Natural Gas Demand Remains Firm

/

Midstream energy infrastructure lagged the market sharply following last week’s FOMC meeting with its revised dot plot. The odds of a recession have increased. Although infrastructure businesses have very visible cashflows, enough holders operate on a hair trigger that requires little inducement to sell. It’s doubtful you’ll see any revision to guidance as a result of the last few days.

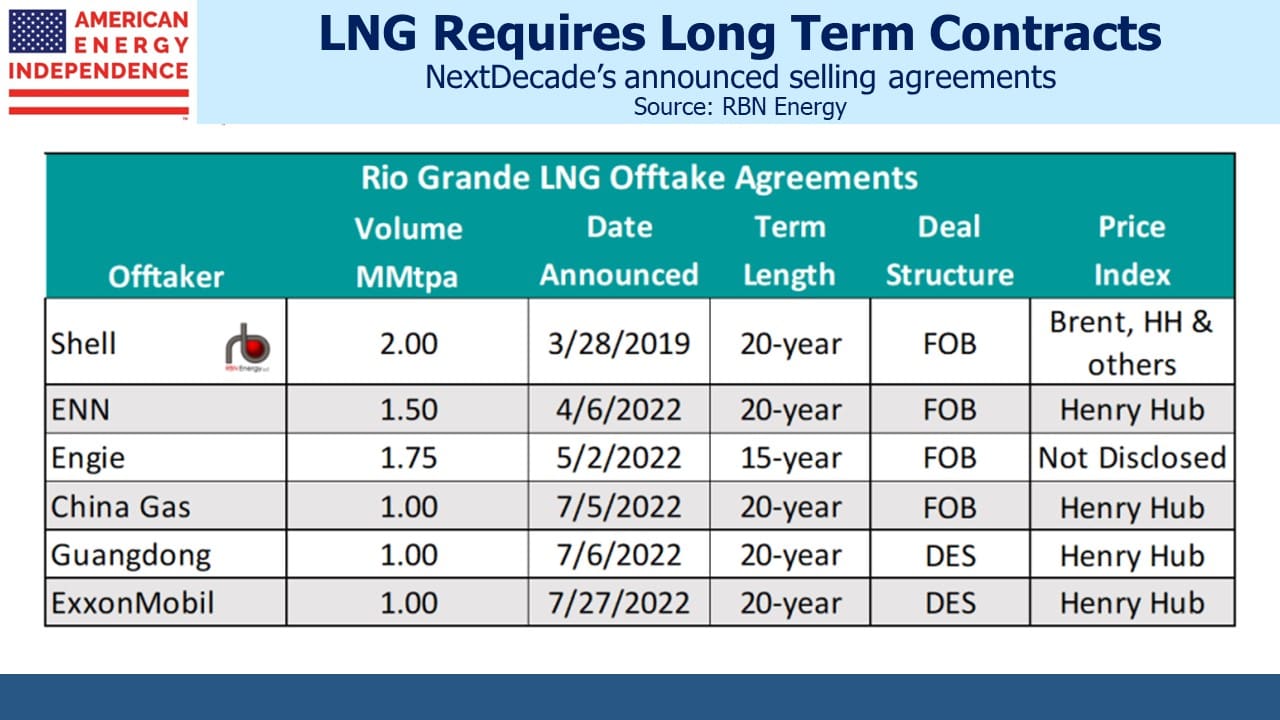

Increasing demand for US natural gas provides a strong underpinning. NextDecade was the subject of a positive article by RBN Energy (see Jump In The Line, Part 4 – NextDecade Eyes FID On Rio Grande LNG Project With Carbon Capture). They have signed commitments for 75% of the capacity of their first two Liquefied Natural Gas (LNG) trains – the name given to the structures that chill and condense methane before its loaded onto specialized LNG tankers.

A Final Investment Decision (FID) to move ahead with construction of the Rio Grande LNG facility in Brownsville, TX is expected before year’s end. Further selling agreements may result in FID on three trains. At its full capacity of five trains, NextDecade’s Rio Grande LNG terminal will ship 3.6 Billion Cubic Feet per Day (BCF/D) of natural gas. Cheniere, the leader, currently ships 5-6 BCF/D. NextDecade also promises to capture 90% of the CO2 expended at Rio Grande, a feature likely to appeal to climate-conscious European buyers.

US LNG exports will increase, but the results will take several years to show up given the complexity of construction. LNG contracts are typically designed with a liquefaction fee and limited price exposure to natural gas for the LNG operator.

NextDecade’s success contrasts with Tellurian’s struggles to obtain financing for their project. Tellurian’s bullish view on natural gas prices meant they structured agreements such that they retained price risk. Consequently, they have found it hard to attract investors for this riskier business model. Two selling agreements recently lapsed, so Tellurian moved a step farther away from FID.

Meanwhile, some US drillers are prioritizing natural gas production over crude oil. In west Texas, “associated gas” produced along with crude oil, has often been flared – capture and transportation being unprofitable. Today that is reversing, as increased global demand for LNG trickles through the energy sector (see Dregs of US Oil Patch Are More in Demand Than Crude Itself).

Critics of the Federal Reserve are finding more ammunition. Former NY Fed president Bill Dudley believes the Fed is underplaying the pain of inflation fighting. He thinks the unemployment rate (currently 3.6%) will need to rise much higher than the FOMC projected peak of 4.4% in order to meaningfully impact inflation. He notes still very benign long term inflation expectations – ten years of 2.4% based on US treasuries. Dudley fears that the Fed will lose support for its policies when it becomes clear rates must move higher than expected.

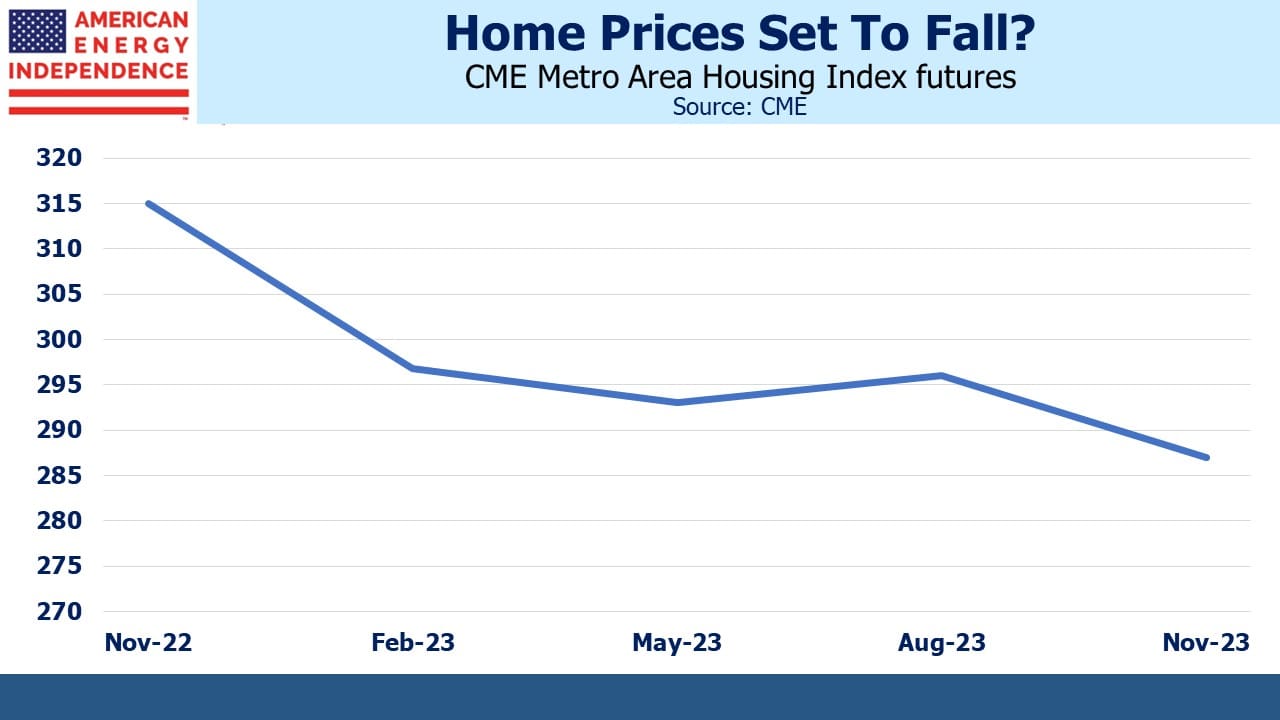

We’ve pointed out the weaknesses in Owners’ Equivalent Rent (OER), the statisticians’ measure of the service (shelter) a home provides (see The Fed Is Misreading Housing Inflation). Yesterday the Case Shiller 10-city composite index of home prices recorded a 14.9% annual increase, down from 17.4% the prior month.

Home price index futures (yes, they do exist) present a gloomy outlook for housing. CME Metro Area Housing Index futures imply a 9% drop over the next year. At the depths of the 2008-09 financial crisis the Case Shiller Metro Area Home Price Index (on which the futures are based) registered a –12.8% annual drop in February 2009.

If the market forecast is correct, we’re in for more than just a little softness. Nonetheless Fed chair Jay Powell said at last week’s press conference that he expects shelter inflation to, “remain pretty high for a while.” He knows OER has little to do with home prices.

We continue to think that over the long term 3% inflation is more likely than 2%. Voters long ago ditched any tolerance for pain to reduce the Federal deficit, the outlook for which steadily worsens. There’s no reason to believe that higher unemployment today in search of lower inflation tomorrow will garner widespread support once the newly unemployed realize they’ve been sacrificed for the greater good.

For evidence of today’s demand for pain-free economics, look no further than the president’s student loan forgiveness program which the nonpartisan Congressional Budget Office (CBO) estimates will cost $400BN. Even the New York Times seems to have lost some enthusiasm. Critics note that the CBO analysis excluded, “a plan to reduce payments for future borrowers who go on to earn low incomes after college, which outside analysts say could cost hundreds of billions of dollars more.”

You might think that, since the student loan problem is caused by young people borrowing to purchase educations inadequate to subsequently deliver sufficient income for repayment, thoughtful policy might seek to dissuade more of the same.

Apparently all this can be achieved through an executive action by the president. A country where such is possible seems likely to find slow debt monetization with 3-4% inflation preferable to fiscal and monetary discipline. We believe midstream energy infrastructure offers attractive upside in such circumstances.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!