Natural Gas Demand Remains Firm

Midstream energy infrastructure lagged the market sharply following last week’s FOMC meeting with its revised dot plot. The odds of a recession have increased. Although infrastructure businesses have very visible cashflows, enough holders operate on a hair trigger that requires little inducement to sell. It’s doubtful you’ll see any revision to guidance as a result of the last few days.

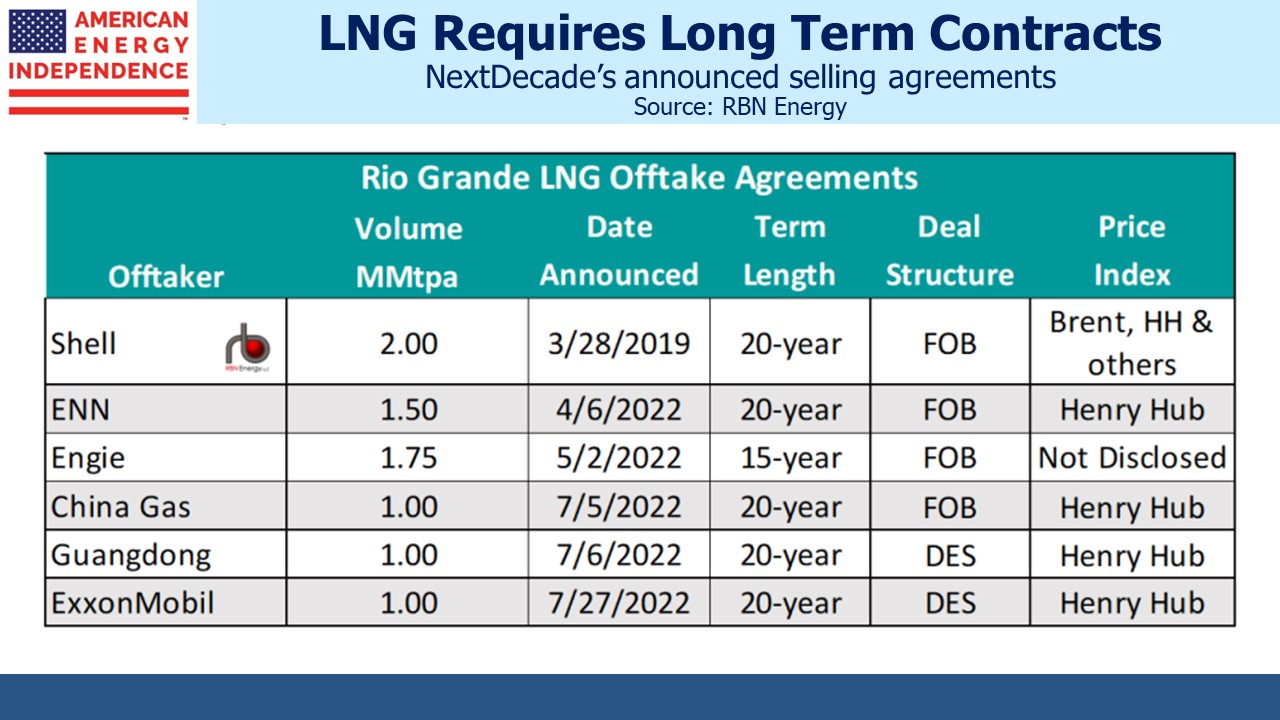

Increasing demand for US natural gas provides a strong underpinning. NextDecade was the subject of a positive article by RBN Energy (see Jump In The Line, Part 4 – NextDecade Eyes FID On Rio Grande LNG Project With Carbon Capture). They have signed commitments for 75% of the capacity of their first two Liquefied Natural Gas (LNG) trains – the name given to the structures that chill and condense methane before its loaded onto specialized LNG tankers.

A Final Investment Decision (FID) to move ahead with construction of the Rio Grande LNG facility in Brownsville, TX is expected before year’s end. Further selling agreements may result in FID on three trains. At its full capacity of five trains, NextDecade’s Rio Grande LNG terminal will ship 3.6 Billion Cubic Feet per Day (BCF/D) of natural gas. Cheniere, the leader, currently ships 5-6 BCF/D. NextDecade also promises to capture 90% of the CO2 expended at Rio Grande, a feature likely to appeal to climate-conscious European buyers.

US LNG exports will increase, but the results will take several years to show up given the complexity of construction. LNG contracts are typically designed with a liquefaction fee and limited price exposure to natural gas for the LNG operator.

NextDecade’s success contrasts with Tellurian’s struggles to obtain financing for their project. Tellurian’s bullish view on natural gas prices meant they structured agreements such that they retained price risk. Consequently, they have found it hard to attract investors for this riskier business model. Two selling agreements recently lapsed, so Tellurian moved a step farther away from FID.

Meanwhile, some US drillers are prioritizing natural gas production over crude oil. In west Texas, “associated gas” produced along with crude oil, has often been flared – capture and transportation being unprofitable. Today that is reversing, as increased global demand for LNG trickles through the energy sector (see Dregs of US Oil Patch Are More in Demand Than Crude Itself).

Critics of the Federal Reserve are finding more ammunition. Former NY Fed president Bill Dudley believes the Fed is underplaying the pain of inflation fighting. He thinks the unemployment rate (currently 3.6%) will need to rise much higher than the FOMC projected peak of 4.4% in order to meaningfully impact inflation. He notes still very benign long term inflation expectations – ten years of 2.4% based on US treasuries. Dudley fears that the Fed will lose support for its policies when it becomes clear rates must move higher than expected.

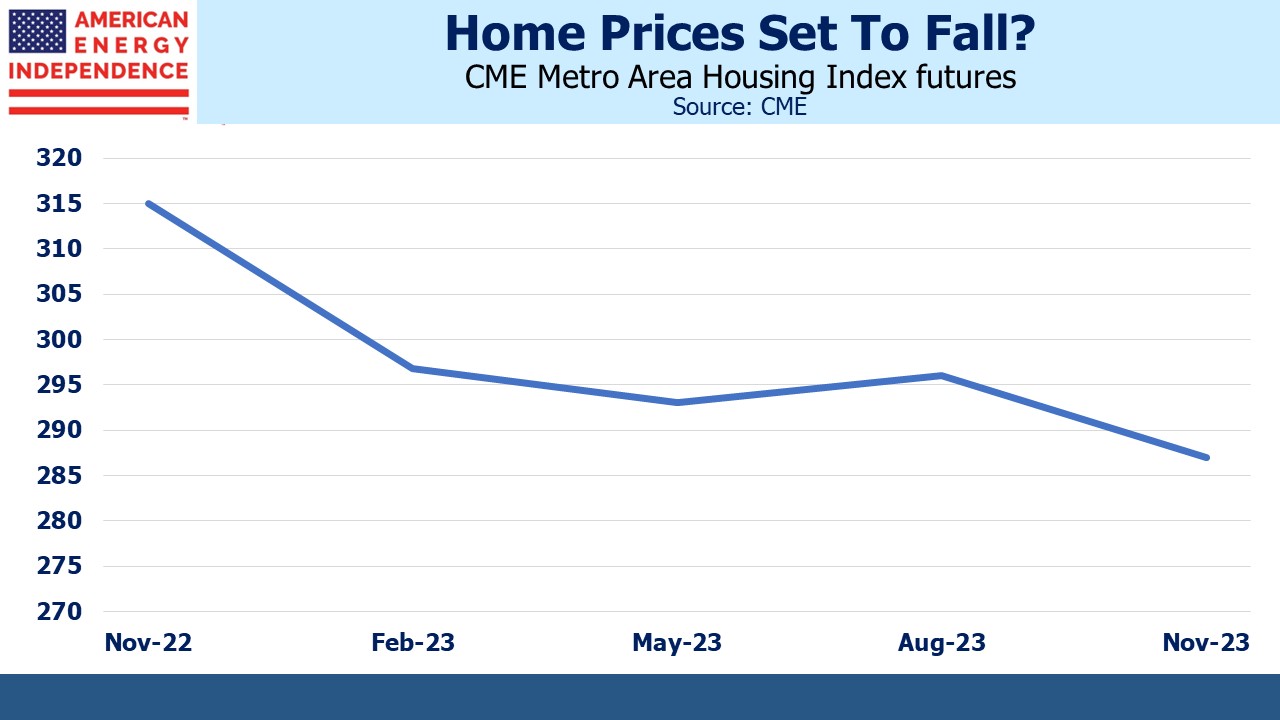

We’ve pointed out the weaknesses in Owners’ Equivalent Rent (OER), the statisticians’ measure of the service (shelter) a home provides (see The Fed Is Misreading Housing Inflation). Yesterday the Case Shiller 10-city composite index of home prices recorded a 14.9% annual increase, down from 17.4% the prior month.

Home price index futures (yes, they do exist) present a gloomy outlook for housing. CME Metro Area Housing Index futures imply a 9% drop over the next year. At the depths of the 2008-09 financial crisis the Case Shiller Metro Area Home Price Index (on which the futures are based) registered a –12.8% annual drop in February 2009.

If the market forecast is correct, we’re in for more than just a little softness. Nonetheless Fed chair Jay Powell said at last week’s press conference that he expects shelter inflation to, “remain pretty high for a while.” He knows OER has little to do with home prices.

We continue to think that over the long term 3% inflation is more likely than 2%. Voters long ago ditched any tolerance for pain to reduce the Federal deficit, the outlook for which steadily worsens. There’s no reason to believe that higher unemployment today in search of lower inflation tomorrow will garner widespread support once the newly unemployed realize they’ve been sacrificed for the greater good.

For evidence of today’s demand for pain-free economics, look no further than the president’s student loan forgiveness program which the nonpartisan Congressional Budget Office (CBO) estimates will cost $400BN. Even the New York Times seems to have lost some enthusiasm. Critics note that the CBO analysis excluded, “a plan to reduce payments for future borrowers who go on to earn low incomes after college, which outside analysts say could cost hundreds of billions of dollars more.”

You might think that, since the student loan problem is caused by young people borrowing to purchase educations inadequate to subsequently deliver sufficient income for repayment, thoughtful policy might seek to dissuade more of the same.

Apparently all this can be achieved through an executive action by the president. A country where such is possible seems likely to find slow debt monetization with 3-4% inflation preferable to fiscal and monetary discipline. We believe midstream energy infrastructure offers attractive upside in such circumstances.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.