In Case it’s Not Clear, Rates Are Going Up

/

“I have approximate answers and possible beliefs in different degrees of certainty about different things, but I’m not absolutely sure of anything.”

Fed chair Jay Powell did not say this at his press conference on Thursday. It is attributed to American physicist Richard Feynman. But had Powell uttered these words they would not have seemed out of place. Having overseen a largely avoidable spike in inflation by maintaining monetary accommodation for at least a year too long, the FOMC has turned their focus on its resolution. Thus are they laying the groundwork for their next mistake.

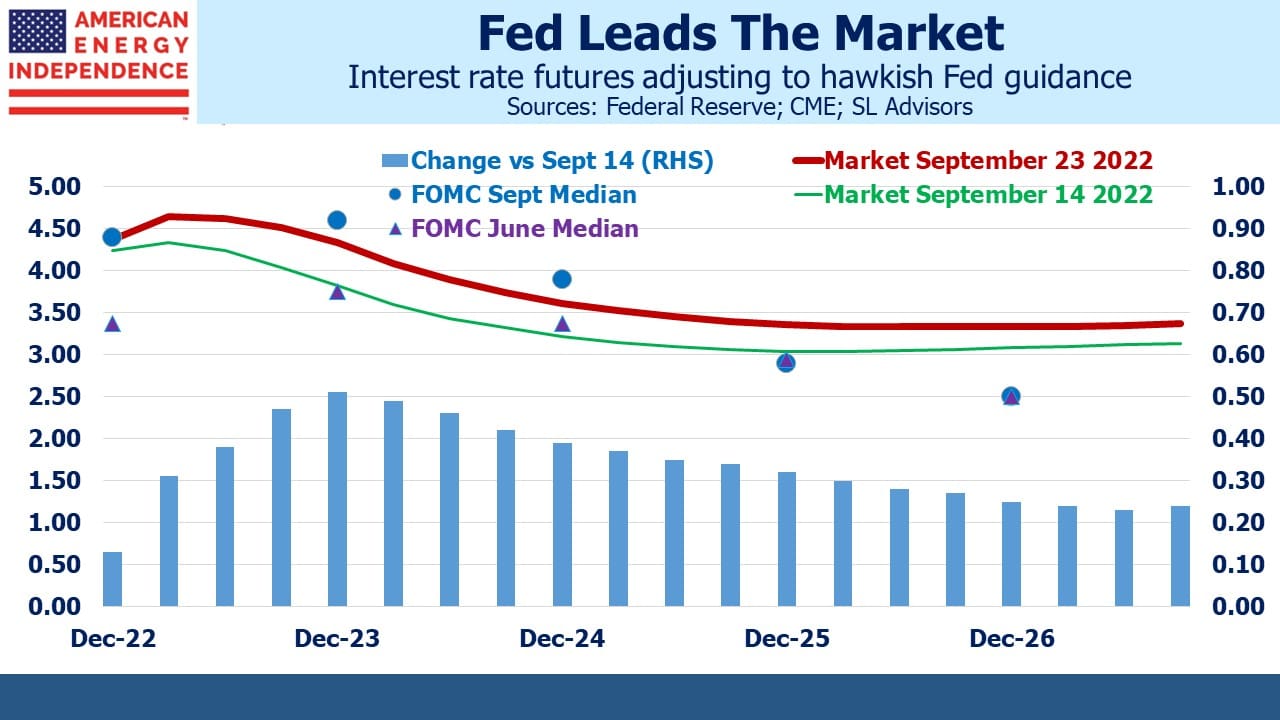

The revised dot plot projects a sharp increase in the Fed funds rate – in fact for now the FOMC is ahead of the market in their assessment of the rate cycle peak. The 2024-25 area of the futures curve is 0.50% lower than the latest Summary of Economic Projections (SEP). Fed policy can best be described not as managing a dual mandate that balances employment with price stability, but as attending to whichever of these two objectives is most out of line. Consequently, the warnings of hardship to come as the Fed drives up unemployment so as to soften wage growth and, in turn, inflation.

The SEP doesn’t portend much hardship. It projects unemployment averaging 4.4% in the fourth quarter of next year and 2024, so presumably peaking around that level. Before the pandemic many held full employment to be around 4.5%, so this hardly looks like a forecast of economic misery. PCE inflation, the Fed’s preferred measure and generally lower than CPI, is forecast to reach 2% by 2025.

Prior to the pandemic, the Fed emphasized full employment and tolerated a modest inflation overshoot. It seems reasonable to assume they’ll swing too far the other way now. Because inflation is the Fed’s focus, it’s likely unemployment will miss to the upside.

There’s little to fault so far in the current tightening cycle other than its tardiness. But the FOMC exhibits the weakness of committees in that they’re slow to reach a consensus and because of this they’re slow to reach a new one. Crisp decision making is not a hallmark of Powell’s FOMC.

Fed critics are increasingly numerous and will become more vocal as rates rise. The actionable conclusion from this analysis is to bet that yields on 2024-25 short term interest rate futures will rise towards the blue dots. This FOMC wants to compensate for their inflation mistake by snuffing it out reasonably quickly. Their SEP says as much. The risk, as in most tightening cycles, is that they’ll overshoot and cause a recession. Achieving the benign combination of modestly rising unemployment with declining inflation remains an inordinately optimistic outcome.

Last Sunday we showed how the inflation stats rely on a lagging measure of home prices to calculate shelter inflation (see The Fed Is Misreading Housing Inflation). Owners’ Equivalent Rent (OER), is a survey that asks what homeowners believe they could rent their home for as a way to measure inflation in the cost of shelter, the service that a home provides. Shelter inflation was an important factor in the recent high CPI report. When asked, Chair Powell said, “I think that shelter inflation is going to remain high for some time. We’re looking for it to come down, but it’s not exactly clear when that will happen… So I think on shelter inflation you’ve just got to assume that it’s going to remain pretty high for a while.” Later he referred to the “red hot housing market” adding that, “we probably in the housing market have to go through a correction.”

This acknowledges the problem in using OER. It’s a non-cash item that lags the housing market but constitutes 31% of the CPI. The PCE deflator also uses OER but assigns a lower weight to shelter than does the CPI. It was interesting that Powell expects shelter inflation to remain high – it would seem an odd view to hold unless he’s also aware that OER lags the actual cost of housing.

There are increasing signs of softness in home prices, with rising mortgage rates being the culprit. Data from Zillow shows prices in San Francisco and Los Angeles both dropped 3.4% in the past month. Just as they missed the booming housing market because OER was slow to react, the Fed is likely to assess higher than actual inflation as OER lags on the way down. Mike Cembalest at JPMorgan recently wrote that “housing is imploding.”

I don’t think the Fed knows how to process information about house prices as it relates to inflation.

Another illuminating comment from Powell on the rate cycle was, “…you want to be at a place where real rates are positive across the entire yield curve.” Presumably a positive yield on ten year TIPs would suffice for the long end, but it’s unclear whether this means the Fed funds rate must be higher than current inflation, or simply above near-term inflation expectations.

At some point we’ll find out. For now monetary policy is being led by a group that, while not conceding one large policy error is nonetheless focused on avoiding a second one.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!