Market Bows To FOMC Forecast

/

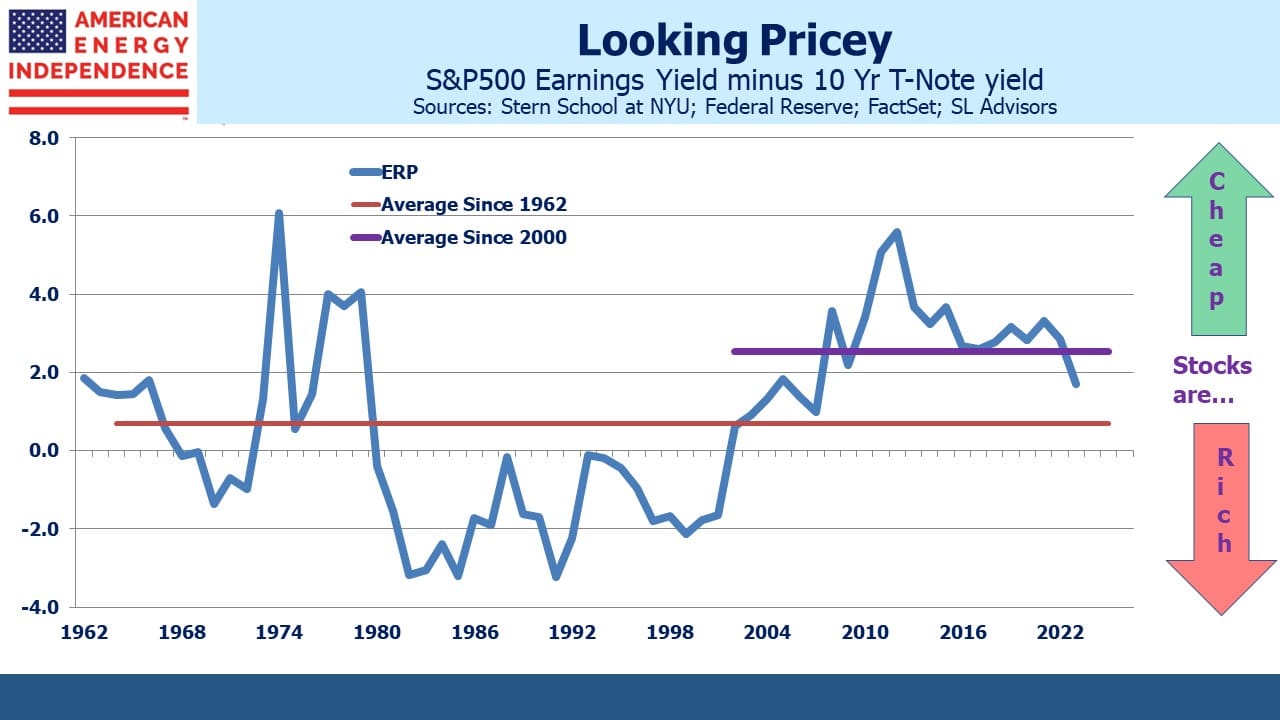

A couple of weeks ago stocks and bonds looked vulnerable to strong data (see Confronting Asymmetric Risks). Since then the narrative of impending recession has been punctured by employment, retail sales and inflation figures that all surprised to the upside. Valuations based on the Equity Risk Premium (ERP) were only moderate. Since then, stocks are slightly lower and ten year yields sharply higher.

The result is that the ERP shows stocks are the least attractively priced in over a decade. Earnings growth could offset this, except that analysts continue to revise them down. Bottom-up S&P500 2023 EPS of $224 is 10% lower than last summer and still trending down. It’s possible the strong jobs and spending figures will translate into upward revisions to earnings forecasts, but unlikely to be enough to change the overall picture.

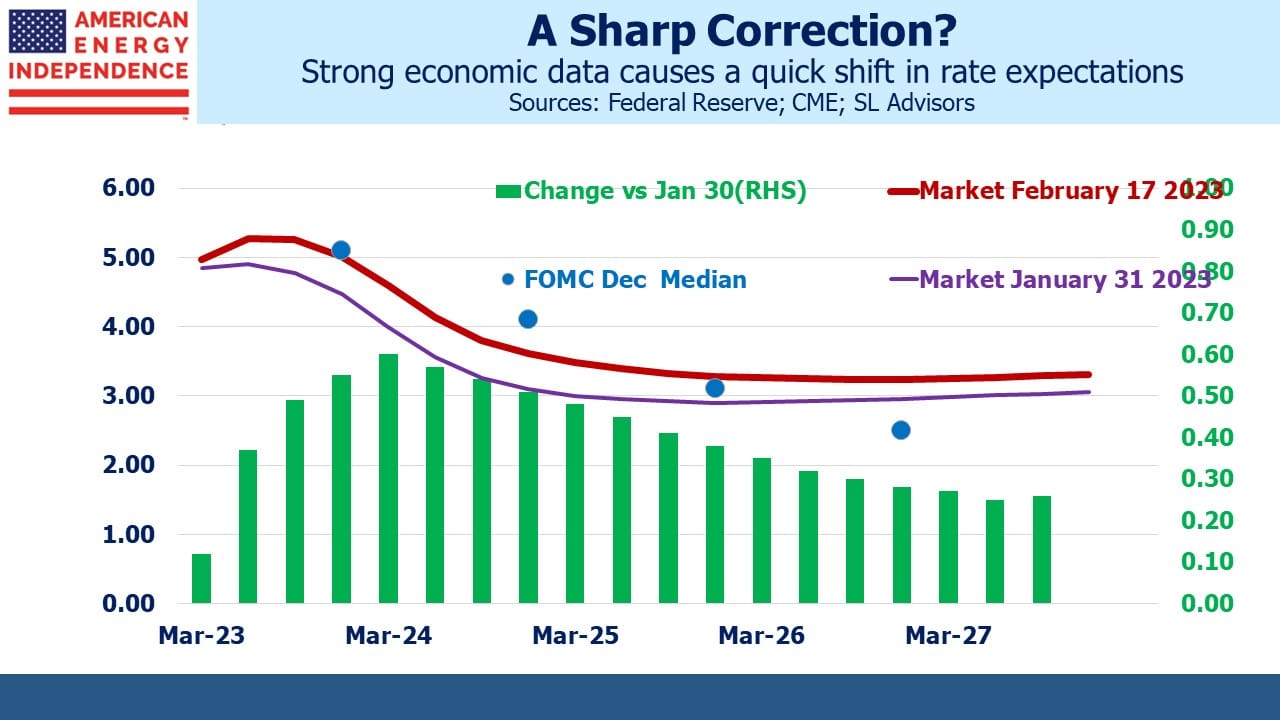

Fed funds futures have also repriced sharply. The brief euphoria when Fed chair Jay Powell mentioned “disinflation” has been replaced by a growing acceptance that the FOMC’s predicted 4% YE 2024 Fed Funds rate might even be too low.

The ten-year treasury yield has risen around 0.30% since the end of January, but the correction in Fed Funds futures has been more severe. The likely path of monetary policy over the next couple of years has adjusted 0.50-0.60% higher in less than three weeks. In the past, large discrepancies between futures and the FOMC’s Summary of Economic Projections have been resolved in a way that confirms the Fed’s poor forecasting record (see Don’t Bet On A Return To 2% Inflation). For once the market has been forced to adjust.

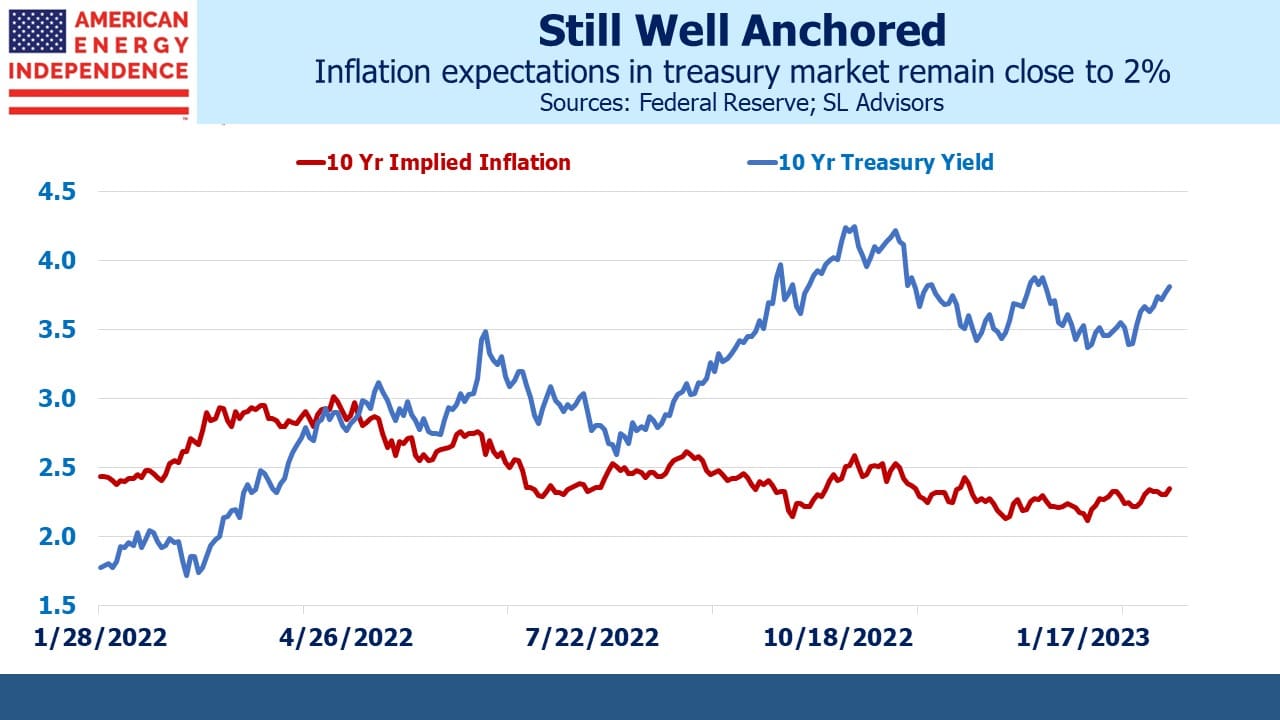

Interestingly, some are beginning to make the case for dropping the 2% inflation target. Mohamed El-Erian argues that, “You need a higher stable inflation rate. Call it 3 to 4%.” Such views are in the minority and there’s no chance the Fed will alter their 2% target. So the risk for short term rates is that they go higher than currently priced in. However, a moderately higher inflation target is better for the US, if not the lost credibility the Fed would endure in getting there. How this plays out will impact investment returns for years. For now, inflation expectations remain well anchored in spite of the recent strong data.

Pipeline earnings continue to come in close to or better than expectations. Energy Transfer (ET) reported 4Q22 EBITDA 4% ahead of analysts’ expectations. On their ensuing earnings call they warned of a delay to their Lake Charles LNG project. Co-CEO Tom Long said that, “The LNG market along the Gulf Coast is currently extremely competitive.” There are several competing projects looking to sign up sufficient buyers to justify Final Investment Decision (FID) so they can start construction. Ultimately there’s little doubt that the US will grow its exports of natural gas, but long-term contracts of twenty years make a good marriage of buyer and seller critical.

An interesting response came when the Barclays analyst asked,”…if you could share your latest thoughts on a potential C-Corp currency.”

In 2014 Kinder Morgan acquired its MLP Kinder Morgan Partners (KMP), leading to a tax bill and reduced dividends for KMP investors. Other simplifications followed, and the MLP sector has never recovered its reputation. Energy Transfer gave up the GP/LP structure, but limited partnerships continue to provide weaker governance. It’s why MLPs are excluded from ESG indices – they score poorly on “G”.

It’s generally thought that the MLP conversions to c-corps have been done. Energy Transfer, Enterprise Products and Magellan Midstream have shown little inclination to adopt a corporate tax burden in exchange for a higher stock price. If you don’t intend to sell your MLP holding, the conversion makes little sense because future earnings and therefore distributions would be lowered by the 21% US corporate tax rate.

However, a business contemplating acquisitions using its equity securities as a currency might conclude the higher price granted a c-corp to be worthwhile. Hence Tom Long’s response was intriguing: “We do have a team that’s working on that. I guess the way I would tell you is that we are spending quite a bit of time in evaluating that. And we feel pretty good about probably 2023.”

This suggests a c-corp conversion is more likely than not and would reflect management’s desire to boost the stock price. ET’s stock price didn’t seem to react to a potential development that might be worth 5-10% to its price, and there were no follow-up questions. Alternatively, perhaps investors are wary of a conversion whose purpose must be to issue more equity so as to buy up assets. The ET management ethos can be characterized as prioritizing increased executive wealth over that of unitholders.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!