How Tightening Impacts Our Fiscal Outlook

/

For anyone in finance, the US budget deficit has always been a looming disaster but rarely a current problem. It hasn’t been a political issue since Clinton ran for office and Jim Carville quipped that the bond market intimidated everybody. For a few brief years we had a budget surplus (1998-2001), but fiscal prudence long ago lost its appeal with voters because the current costs of profligacy are inadequate to impact elections.

But tomorrow is approaching, and according to the Congressional Budget Office (CBO) sooner than we thought a year ago.

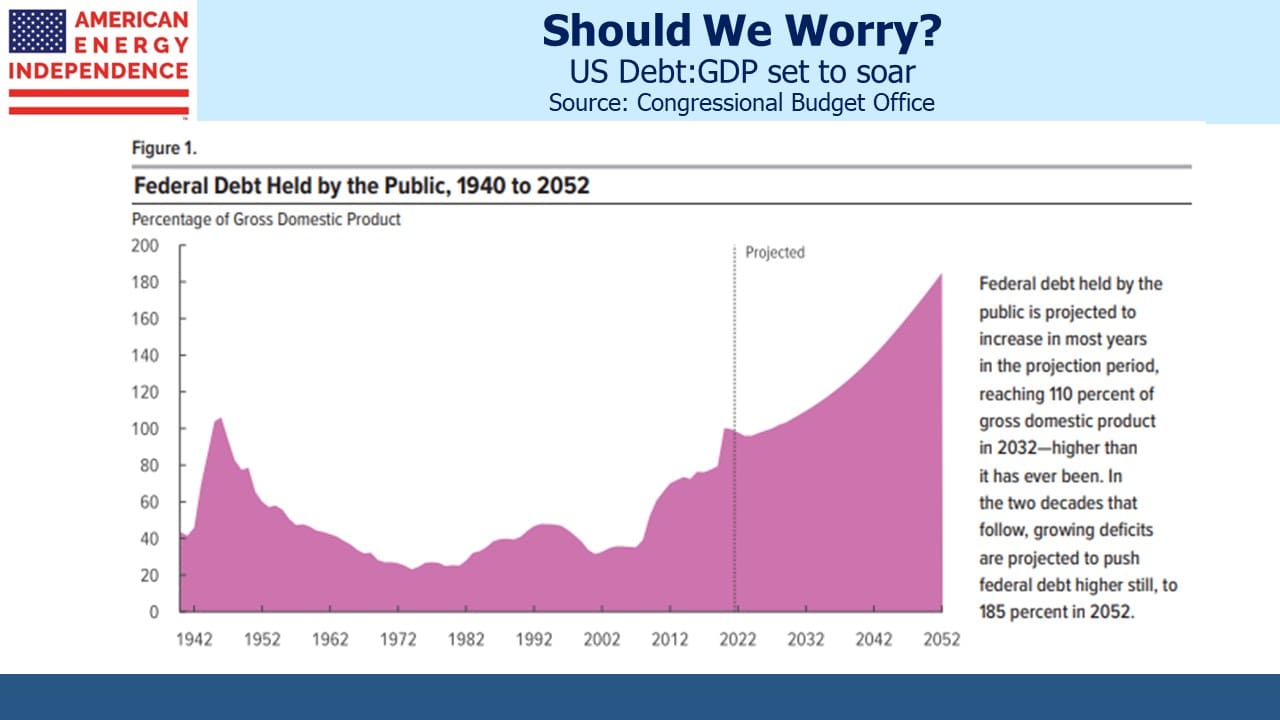

Last week the CBO updated their 10-year budget projections, with disappointing revisions compared with the prior release last May. Our Debt:GDP is at levels last seen towards the end of World War II. Back then following the end of hostilities spending fell, and artificially depressed government bond yields helped lower the country’s debt burden.

This time around, ballooning Medicare and social security spending will take us into uncharted territory.

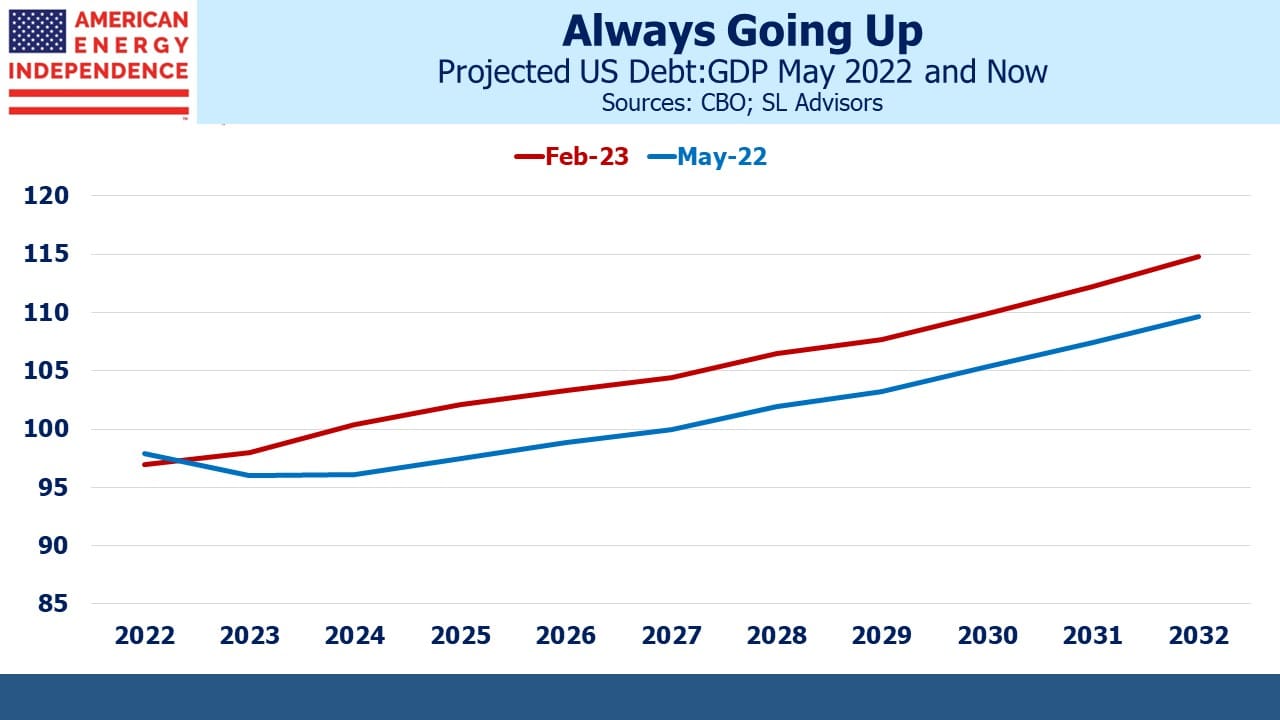

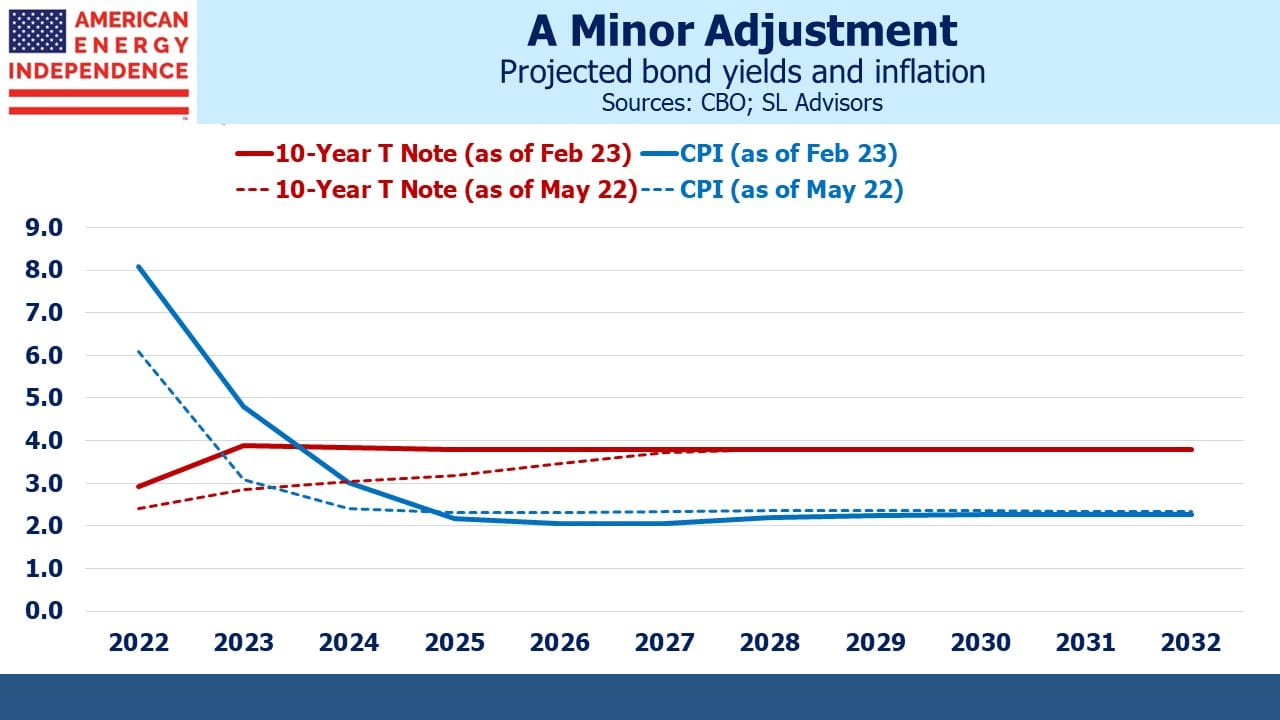

Rising debt has increased our interest rate sensitivity. The CBO’s outlook for inflation and bond yields hasn’t shifted apart from reflecting today’s higher inflation. Compared with last year’s forecast, inflation is expected to return to the Fed’s 2% target a year later.

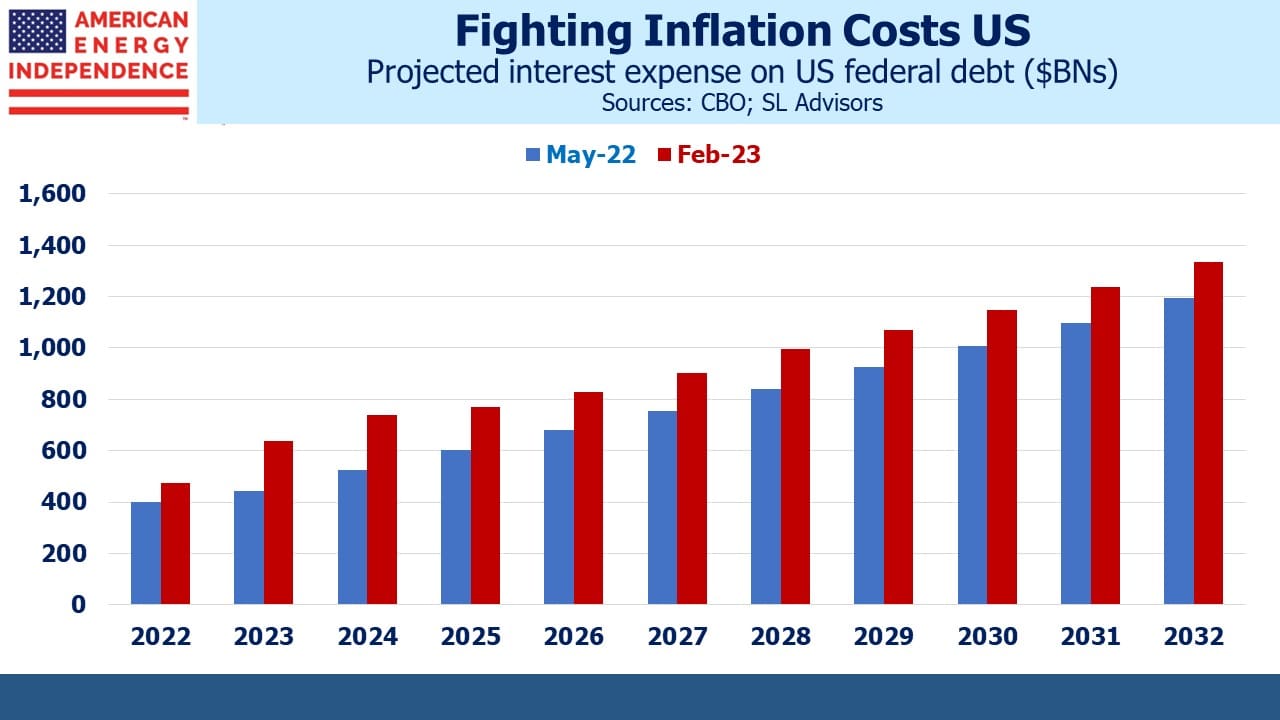

The impact on our finances has been dramatic. Debt will now exceed GDP next year, four years earlier than before. Interest expense over the next decade will be $159BN higher annually, bringing forward by approximately two years milestones such as $500BN, $1TN or $1.25TN in annual debt servicing cost.

The White House is unlikely to dwell on this, but the change in circumstances between the two CBO publications might represent the most rapid deterioration in America’s finances in history. The bigger the problem gets the harder it is to solve.

It would be worse without Quantitative Easing (QE). The Fed still holds $5.4TN in government bonds and another $2.6TN in MBS. Without return-insensitive buyers such as central banks (see More Than A Fiscal Agent) and others with inflexible investment mandates financing our debt would be even more costly.

The Fed follows its dual mandate by focusing on whichever of the two variables (employment or inflation) is farthest from its desired level. In the summer of 2019 at Jackson Hole, they concluded that we could tolerate a little more inflation over short periods to boost employment (see The Fed’s Balance Sheet Has One Way To Go). The timing was unfortunate, and within a couple of years a modest overshoot demanded their attention.

The Fed’s Congressional mandate doesn’t include concern about the fiscal impact of their actions, but they are becoming more impactful. QE has emasculated debt hawks by hiding the apparent cost of fiscal excess. QE’s slothful removal has impeded the Fed’s efforts to slow the economy, as seen in recent strong data such as employment and retail sales.

The current tightening cycle hasn’t been enough to raise unemployment, but it’s had a meaningful impact on our debt outlook. The Fed’s interpretation of its dual mandate now has a fiscal dimension.

The logical response is to tolerate higher inflation. There’s nothing magic about 2% – stability is more important than its level (see El-Erian, Rogoff Say It’s Too Late to Fix Too-Low Inflation Target). The numbers suggest that tolerance of 3% inflation leaves us better able to service our debt than 2%. There are few tangible benefits from the current effort to stick to the old inflation target.

Last year interest expense alone was 1.90% of GDP. Within a decade it is expected to reach 3.52%, up from a 3.254% projection in May.

The Fed’s Summary of Economic Projections has the Fed Funds rate ending this year at 5.1% and next year at 4.1%. The CBO expects Fed Funds to average 3.6% in 2024 (last year they were projecting 2.6% for 2024). If the Fed is right, the CBO’s 2024 interest rate forecast will be around 1% too low, which will result in further adverse updates to our fiscal outlook.

The CBO aligns with where interest rate futures were when they prepared their budget outlook. Since then, strong data has caused the market to shift towards the Fed’s projections.

Fed chair Powell has been clear that bringing inflation back to 2% is in everyone’s interests. While this is consistent with their Congressional mandate, it’s no longer the most desirable public policy. Our vast debt, poor fiscal outlook and heightened interest rate sensitivity make increased inflation tolerance preferable.

For now, investors should take the Fed at its word that they’ll do what it takes. But the impact on our finances of returning inflation to its 2% target is eventually going to make this a consideration. It means defining price stability as 2% inflation is becoming more costly. Maintaining the purchasing power of your assets means assuming inflation settles in higher than this target.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!