Jay Powell’s Victory Lap

Criticizing the Fed is a self-indulgence afforded the rest of us unburdened with the need to actually set monetary policy. The FOMC usually provides a target-rich environment. The last couple of years have offered a sumptuous feast of mis-steps.

Start with synchronization of accommodative monetary policy with Biden’s uber-stimulus following his inauguration in early 2021. Quantitative Easing (QE) was promoted from a one-off solution to the 2008 great financial crisis to just another part of the Fed’s toolkit. Over the past fifteen years their balance sheet has taken a series of steps higher, from $1TN to $8TN, with only brief episodes of contraction. They don’t seem to know how to shrink it, so the partial monetization of our debt continues.

Monetary policy has adopted its own vocabulary, repurposing words such as hawk and dove. Transitory has become a pejorative word since it more accurately described the seeming permanence of high inflation. One imagines a freshman Economics class at Harvard where a self-appointed member of the monetary policy cognoscenti derides a fellow student’s poor grades as transitory.

Your blogger has taken regular shots at the Fed with irrational exuberance (see Time For Powell To Go). It’s just so easy.

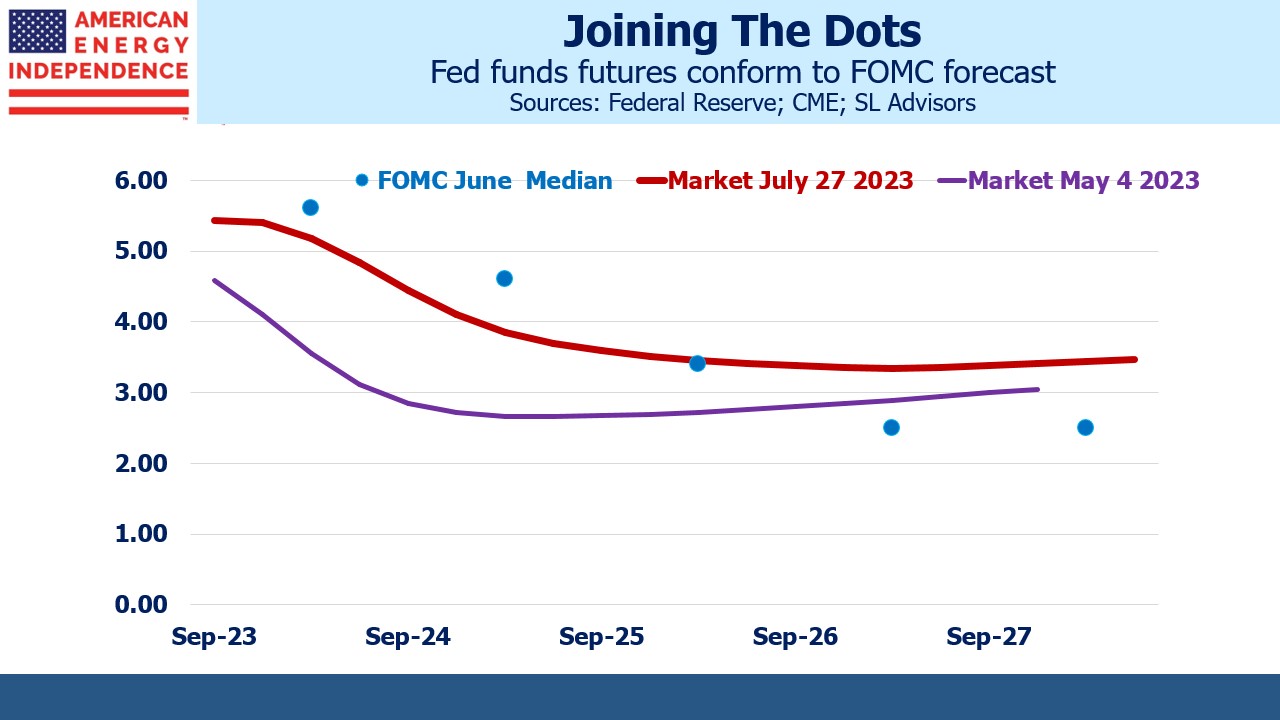

So Fed chair Jay Powell might have permitted himself a small victory lap in the green room last Wednesday out of sight of the cameras following his press conference. He’d just announced another hike in the Fed Funds target range, to 5.25-5.5%. As recently as May SOFR futures had been priced for a summer’s end rate of 4.7% with imminent easing. Since then, the June ‘24 futures yield has risen almost 2%, conceding to the Fed. Powell said it’s unlikely they’ll cut rates this year.

Inflation has been falling – not yet to the Fed’s 2% target but heading that way. JPMorgan is forecasting CPI inflation of 2.4% by next spring. The FOMC is projecting their preferred inflation measure using the Personal Consumption Expenditures (PCE) deflator to average 2.5% next year. PCE tends to be 0.2-0.4% below CPI because its weights adjust dynamically (CPI weights are updated biennially). So the FOMC inflation forecast is more conservative than JPMorgan’s. They expect PCE inflation to reach 2.1% by 2025.

For months economists have been warning of a recession. JPMorgan projects that 4Q23 and 1Q24 GDP will each be –0.5%, meeting the technical definition of a recession which is two consecutive quarters of GDP contraction. But the day after the Fed raised rates second quarter GDP came in at 2.4%, ahead of expectations as consumption remained strong. Powell has maintained for months that a recession could be avoided, and he reiterated that view at his Wednesday press conference.

One way to think about the Fed’s dual mandate of seeking maximum employment consistent with stable prices is that they focus on whichever of these two metrics is most off target. Hence in 2020 with inflation stubbornly low they said they’d tolerate higher inflation than in the past in order to achieve higher employment. That reinterpretation of their goals was as transitory as the higher inflation that followed.

Older readers will remember Ronald Reagan citing the “Misery Index” (Inflation + Unemployment Rate) under President Jimmy Carter as reason to vote him out. If FOMC policymakers ran for office rather than being political appointees, Powell would be running ads proclaiming the Utopian Index (think of it as the Misery Index when it’s low) was looking as good as ever on his watch.

Full employment is probably still somewhere above 4%, since the time it’s been below 4% has coincided with inflationary wage growth. Both JPMorgan and the FOMC are projecting unemployment next year of around 4.5% and inflation of around 2.5%. If things turn out that way, it will represent a deft monetary policy navigation that seemed implausible just a few months ago.

Even hyper-active Jim Cramer, ever sensitive to the market’s zeitgeist, asserted on Thursday morning that he had always been a supporter of Fed chair Powell. He proclaimed himself a “Jay fan” — and even a “Jay Hawk.”

Therefore, we must be at Peak Powell. The Fed’s critics have been relentlessly disarmed by empirical data that suited the Fed’s narrative more than theirs. Recession fears are receding. Inflation has not resisted downward pressure too stubbornly. Partial debt monetization via QE has not led to a collapse of the dollar or hyperinflation. The stock market has remained buoyant, unbowed by the improving returns offered by fixed income. Events have hewed more closely to what Powell told us to expect than the naysayers.

Jay Powell should gratefully accept whatever accolades come his way. Popularity for a Fed chair is ephemeral. The economy is a fickle mistress. He is, for now, on top.

We have three funds that seek to profit from this environment: