Green Growth Projects Are Losing Fans

/

On Sunday my daughter lamented the fact that she didn’t have a ticket for the Chiefs-Jets game that evening. Not that she’s an NFL fan – she was blissfully unaware of the injury that Aaron Rodgers sustained three weeks ago and has no experience of the perpetual heartache Jets fans stoically endure. She just wanted to see Taylor Swift waving at Travis Kelce from the VIP section. The Chiefs provided plenty to wave at.

Even the Bills 48-20 demolition of the Dolphins, coming a week after the Dolphins mauled the Broncos 70-20, couldn’t beat Taylor Swift as the opening paragraph in the WSJ’s Jason Gay NFL column on Monday. We’re simply following the trend.

Almost as important was the rebalancing of the Alerian index now that it’s lost Magellan Midstream to Oneok and will soon cede Crestwood to Energy Transfer. Vettafi, owner of the indices, opted to move beyond pipelines in its quest for more MLPs. Among the additions is USA Compression Partners which provides compression services that keep oil and gas moving through pipelines. They’re in the equipment services business, without the visible cashflows that characterize the pipeline toll model. USAC’s business is cyclical and competitive. They don’t enjoy the regulated monopolies of pipelines with PPI-linked tariff increases. High profits at USAC will draw new providers of such services. The MLP fund managers whose indices will now include USAC must choose to underweight it or accept more energy cycle risk. Investors in the Alerian MLP ETF, AMLP, will have no choice.

I remember meeting USAC’s CEO several years ago at a conference and asking him why they were still pursuing growth strategies that didn’t cover their cost of capital. He responded that if Chevron asks you whether you’ll be there for them in a new oil or gas play, you have to say yes. That’s the attitude that caused poor capital allocation at the height of the shale revolution.

Mizuno’s Gabriel Moreen, who covers the midstream sector, just downgraded USAC to underperform, saying the company, “does not possess the balance sheet flexibility to lean into growth” even if such opportunities present themselves.

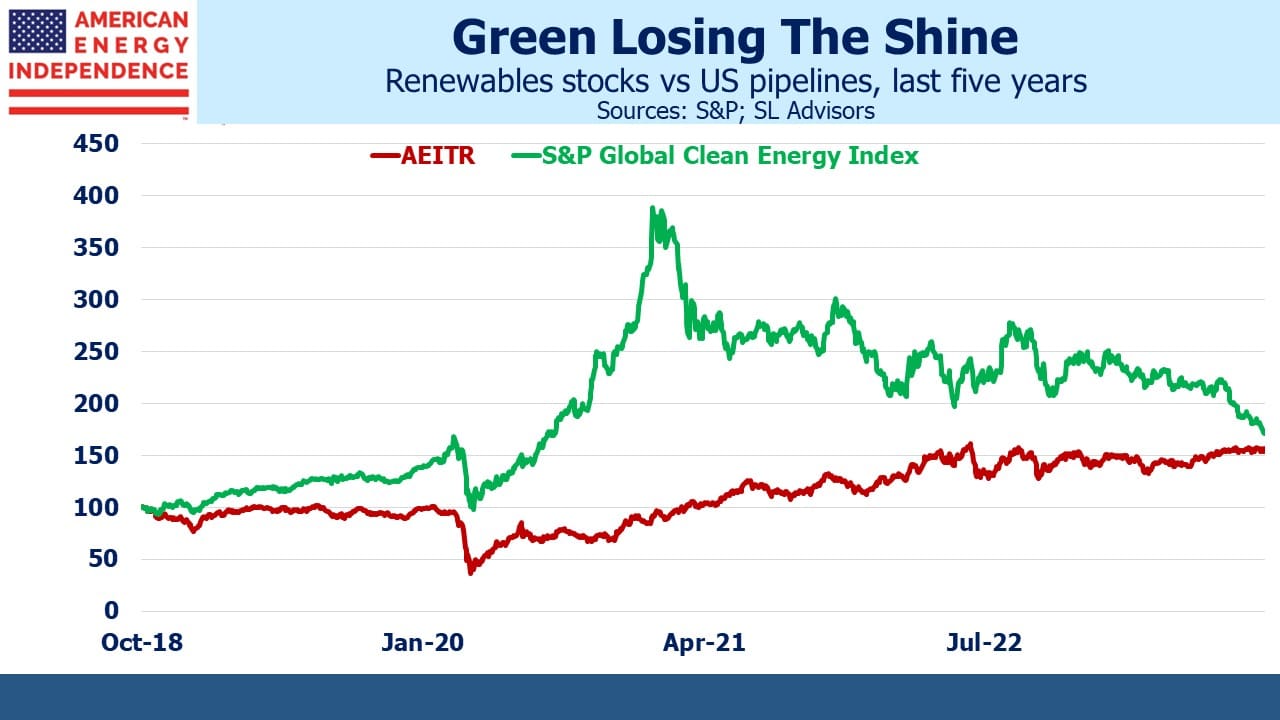

Five years ago and before the pandemic, renewables stocks were starting their ascent on the belief that a fast energy transition was beginning and oil and gas assets would be stranded. Covid represented a brief setback, but the rally soon resumed. Early 2021 marked the peak in sentiment, and the deflating bubble has spread misery ever since.

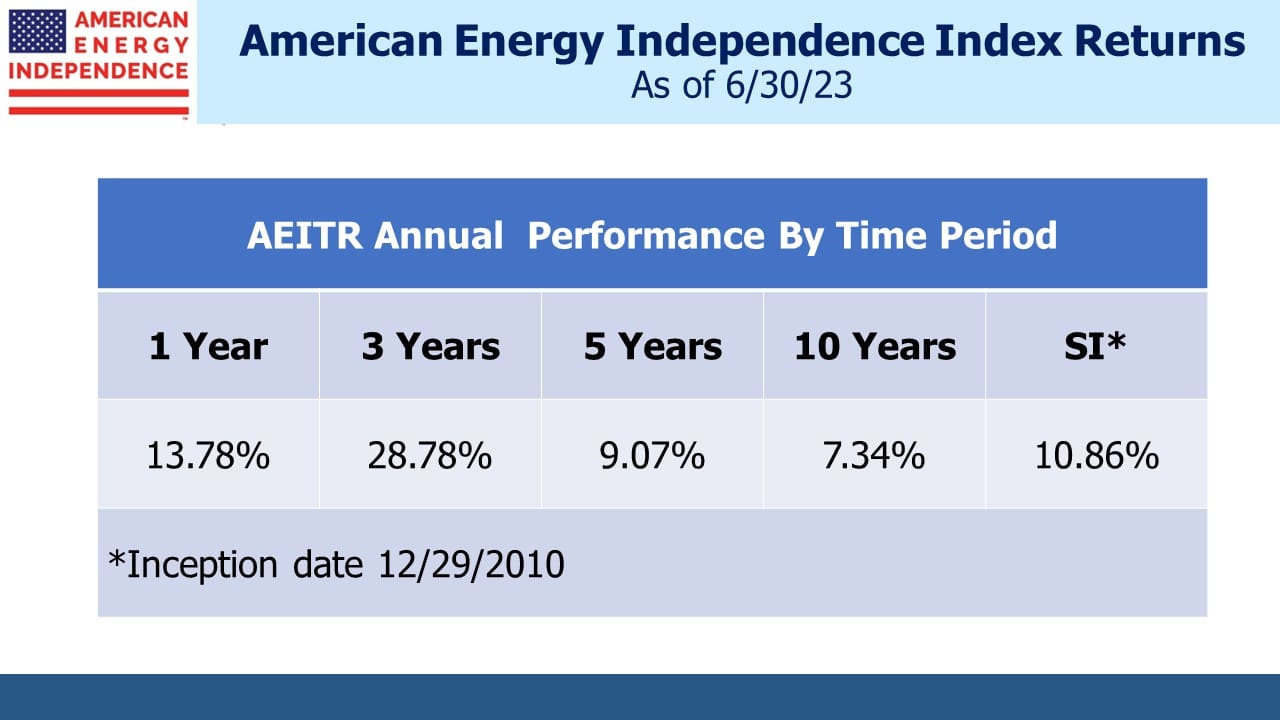

Midstream energy infrastructure looks like the tortoise gaining on the clean energy hare. Five year returns are converging and on present trends it shouldn’t be too long before investors in green energy are forced to conclude pipelines were better. The enthusiasm of management teams for deploying new capital is not shared by the market.

NextEra Partners, LP (NEP), has lost almost half its value following last week’s revised guidance on distribution growth, down from a range of 12-15% to 5-8%. The market’s reaction was as if they’d slashed their payout instead of simply reducing its projected growth rate, although the current 12% yield suggests many think it will be cut anyway.

Rising interest rates have hurt companies promising high growth, including renewables. Meanwhile traditional energy companies remain content with parsimonious capex growth and high current returns.

NEP is an old-style MLP with an external General Partner (GP) in parent NextEra Energy Inc (NEE). As with the pipeline GP/MLP combinations that have disappeared, NEE sells assets to NEP who issues equity to pay for them. Pricing is supposed to be arms’ length but historically the GP has done better than the MLP, just as hedge fund managers have done better than hedge fund investors (see The Hedge Fund Mirage).

NEP tried to soften the bad news by promising no need for additional growth equity (ie secondary offerings) until 2027. However, investors were apparently unexcited about plans to “repower the majority of its wind portfolio in the coming years” which means upgrade old equipment, or the “excellent growth opportunities” from acquiring assets from the parent.

MLPs have a narrow investor base, mostly income-seeking US taxpayers willing to tolerate a K1 (ie old rich Americans) and a few energy funds. Mistreating this investor base depresses the stock price, rendering it a prohibitively expensive source of capital which in turn makes it hard for the parent to drop down assets. Former investors in Kinder Morgan Partners know what comes next (see Kinder Shows The MLP Model is Changing). The MLP gets rolled up into the parent at a low price, delivering LPs an unwelcome tax bill for deferred income recapture.

NEP CEO John Ketchum has arranged his own investments accordingly. His holdings of NEE, where he is also CEO, are more than 10X his holdings of NEP. He’s seen this movie before.

We three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!