Enterprise Products Keeps On Going

November was a month of records for stocks, including for the energy sector. The American Energy Independence Index (AEITR) was +20.8%. This year has seen the top two months, and it’s still –16.1% YTD.

Crude oil grabs most of the attention, but propane is an under-appreciated area of rising production that’s driving higher exports. It’s generally used for heating by businesses, industry and homes, but is also used for cooking in rural areas that are not reached by natural gas (methane).

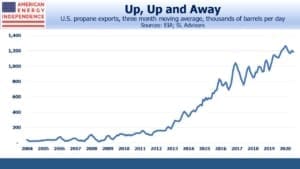

Propane exports have been rising steadily for the past decade, growing at a 26% compound annual rate since 2010. We crossed the 1 million barrels per day threshold in 2017. The Covid pandemic is barely a blip.

One reason for this is increased demand in India. Propane is often produced as a by-product of oil refining, but in the U.S. it’s found naturally in gas wells where it’s separated out from the methane.

Tens of millions of households in India rely on bottled propane for cooking and heating. The drop in gasoline demand earlier this year lowered local refinery runs, depressing propane production. So India turned to the U.S. for imports (see Energy Does More Than Move People).

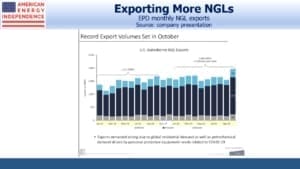

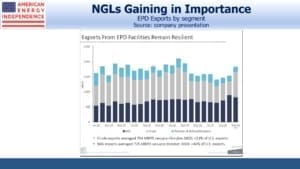

Enterprise Products Partners (EPD), the biggest MLP, is one of the winners from this business. They include propane in their Natural Gas Liquids (NGL) segment, and they’ve participated in this growth as much as any company.

NGL exports volumes are now similar to crude oil, though few outside those following EPD would know that. Propane dominates the segment.

This has driven EPD’s margin from NGL pipelines and services to a 9% compound annual growth rate over the past five years. Based on the first 9 months, 2020 looks set to be another record year for NGLs.

This all highlights the resilience of their business model.

Nonetheless, EPD’s stock price has lost a third of its value this year, even after a 17% gain in November. This reflects continued loss of appetite among investors for the sector. EPD’s $1.78 dividend currently yields almost 9% and looks secure since the company has bought back $225MM in stock this year out of an announced $2BN program.

Investors often ask whether EPD will convert to a c-corp. There can be little doubt that, if accessible to a far broader set of buyers, their stock would rally. However, insiders own 32% of the company, and they have concluded that subjecting their profits to corporate taxes doesn’t justify the potentially higher valuation. Although EPD never had to cut its distribution, unlike most of its MLP peers, it suffers guilt by association with many poorly run brethren. CEO Jim Teague usually runs a colorful quarterly earnings call – regular listeners look out for the Vietnam references (i.e. he’s been in tougher spots than 2020).

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In addition to its uses as described in this article, propane is combined with butane to create liquified petroleum gas or LPG, which is also exported–often through EPD facilities– in material quantities, especially to under developed countries. And of course, propane becomes propylene and then polypropylene, which has major industrial uses here and abroad. EPD is now building still another PDH facility. And of course, ethane, another NGL, becomes ethylene and then polyethylene, and EPD has advanced ethane cracker facilities.

The company may consider acquiring olefin and other basic chemical pipelines and logistical assets from chemical companies and refiners. This could become a much bigger business for Enterprise over the next decade.