Energy Does More Than Move People

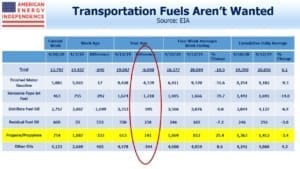

As the world’s economy has stopped moving, demand for transportation fuel has collapsed. The latest weekly report from the U.S. Energy Information Administration (EIA) presents the statistical reality in our country. Gasoline supplies are down 46% from a year ago. Kerosene (jet fuel) is down 72%. Nobody has anywhere to go.

Interestingly, propane supplies are up. Natural gas liquids are part of the hydrocarbon value chain. At one end is methane, the simplest molecule. This is the natural gas that produces electricity, heats homes and runs through your gas stove. It’s known in the industry as “dry gas”. Natural gas liquids (NGLs) are successively more complex molecules of carbon and hydrogen; these include ethane (can be burned but is mostly used as a feedstock for plastics); propane (heating and cooking where methane supply isn’t available), butane and others. The hundreds of blends of crude oil sit at the more complex end.

In today’s energy market, the farther you are from transportation fuel, the better.

Natural gas demand has held up. Power demand has risen compared to a year ago. Residential/Commercial is up because people are spending more time at home. And we’re exporting more. There is almost no evidence of coronavirus in this part of the energy market.

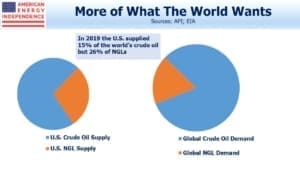

NGLs don’t receive much attention, but there are two reasons investors in midstream energy infrastructure sector care: (1) NGLs require processing when extracted to separate them into their useful products, creating multiple opportunities to “touch” each molecule and charge a fee, and (2) the U.S. produces around 26% of world consumption, far bigger than our share for natural gas or crude oil. NGL exports continue to make new records.

Many Indians cook and heat their homes with Liquid Petroleum Gas (LPG), a combination of propane and butane. Methane requires too much pressure to go in the ubiquitous gas bottles seen all over the world, so LPG meets the needs of consumers without a natural gas hook up. The U.S. exported over 100 thousand barrels per day of NGLs to India in 2019.

Last week Bloomberg ran a story highlighting rising LPG prices (see One Fuel Is Thriving During the World’s Biggest Lockdown). In Asia, LPG is often produced as a byproduct of refining crude oil, and lower gasoline demand means refineries are cutting output. LPG demand in India is up, whereas demand for transportation fuels is down 20% or more. James Mann of the Texas Pipeline Association warned that cutting oil production would have the unintended consequence of also reducing NGLs and gas, potentially leaving some customers short of needed product.

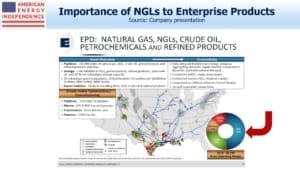

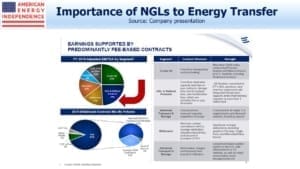

Some big U.S. midstream energy infrastructure companies generate a significant portion of their profits from NGLs. Last Tuesday the Texas Railroad Commission held hearings on a request to curb Texan oil production (called “pro-rationing”). Enterprise Products Partners CEO Jim Teague was invited to give his view. He was against pro-rationing, and went on to note that their LPG export facilities were in high demand.

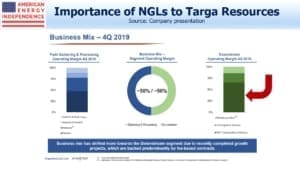

The following slides show the importance of NGLs to some of North America’s biggest pipeline companies.

We are invested in all of the companies mentioned above.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Ethane becomes ethylene which becomes polyethylene. Propane becomes propylene which becomes polypropylene. These end products have a vast multitude of industrial uses.