Energy’s Momentum Continues

Last week’s news from Pfizer triggered some big sector moves, as investors sold technology stocks in favor of value like energy and financials (see The Big Rotation Begins). Pfizer CEO Albert Bourla didn’t overstate the case when he said, “It is a great day for humanity when you realize your vaccine has 90% effectiveness. That’s overwhelming,”

Moderna followed up with their own vaccine announcement this week, topping Pfizer with 94.5% efficacy. Even though this news was telegraphed by Anthony Fauci days earlier, the switch into value stocks has continued.

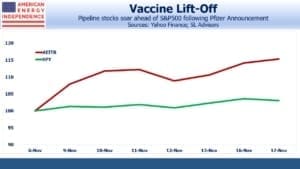

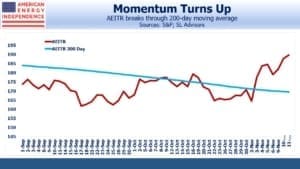

On the day of Pfizer’s announcement, the American Energy Independence Index (AEITR) solidly crossed its 200–day moving average. It has continued to move sharply higher since then, outpacing the S&P500 by 10%. The prospect of a return to normalcy within six months or so has lifted sectors that Covid has hurt, such as energy.

Yesterday showed the energy demand for pipeline stocks, as the sector opened down on the day but traded up from then on, increasing its recent outperformance against the S&P500.

For the past six months, investors have wrestled with the conundrum of the Covid pandemic and rising equity markets. During the spring, the news seemed so relentlessly bad that holding a constructive view on stocks seemed insensitive (see The Stock Market’s Heartless Optimism).

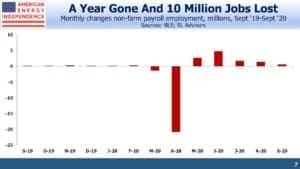

Superlatives were inadequate for the many record statistics that described the global economy shuddering to a sudden halt. Economic distress shows up quickly in the employment statistics. The April non-farm payroll report recorded a stunning loss of 20 million jobs – almost 1 in 7 U.S. workers lost their jobs in one month. Even in the face of this disaster, the S&P500 was up 12% by the end of the month.

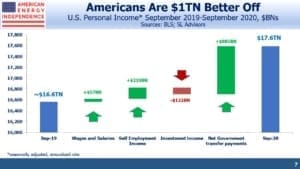

Although the Federal government’s stimulus is widely credited with arresting the economy’s sharp decline, most people assume that personal income has similarly collapsed along with employment. This is not the case.

The chart below shows the personal income “bridge” from September 2019 to September 2020. Disposable Personal Income – that is, including the effects of any government transfer payments such as unemployment insurance, is $1TN higher than a year ago. $800BN of that is due to direct payments by the Federal government. But even Wages and Salaries are $56BN higher over this period.

Meanwhile, the economy has lost ten million jobs. In 2019 we averaged monthly gains of 178K None of us have ever witnessed a period like this, with employment and personal income heading in sharply different directions.

It’s surprised economists for most of the year. The failure of Congress to pass an additional stimulus plan has created fears of more widespread hardship. But the vaccine news from Pfizer and Moderna will likely temper the more extreme stimulus proposals.

Meanwhile, energy is becoming the new momentum sector.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!