Energy Policies Are Feeding Inflation

The continued ascent in natural gas prices has transfixed the energy sector but hadn’t much impacted broad market commentary, until recently. Europe has an energy crisis to be sure – a combination of over-reliance on windpower, years of policy discouraging natural gas production and strong global demand for natural gas. If sentiment in the pipeline sector was as sensitive to natural gas prices as it is for crude oil, its performance would likely have been even stronger in recent days. The recent jump in crude prices has grabbed more mainstream attention, propelling energy sector stocks up with it.

The Federal Reserve and other central banks will have to grapple with the feedthrough impact on inflation. Policymakers already exclude food and energy from the inflation statistics they target, on the basis that these are volatile and mean-reverting. However, higher utility bills and increased cost of transportation will have a secondary effect on most areas of the economy.

Wage inflation has historically been the trigger for shifts in monetary policy – wage increases beyond what improved productivity justifies. The same test could be applied to commodities though. A thousand cubic feet (MCF) of natural gas delivers the same one million BTUs whether the price is $3 per MMCF as it was a year ago or $6.25 as it is currently. Even at that level it’s a quarter of the price European and Asian buyers are paying for imports of Liquified Natural Gas (LNG).

The only constraint on US prices is the availability of more LNG export terminals capable of chilling methane so it’s 1/600th of its normal volume. As more LNG export capacity becomes operational, domestic natural gas prices will move higher. Interestingly, European prices for carbon credits have been following natural gas prices higher. Even at €70 per metric tonne, they’re no constraint. Natural gas generates 121lbs of CO2 per MCF, so a power plant has to pay around €3.30 per MCF for CO2 credits. The fact that these credits are rising with natural gas prices reveals the strength in demand.

The FOMC continues to believe inflation is transitory, which is why they’re comfortable with a very gradual reduction of bond market support. It looks as if monthly buying of mortgage-backed securities will continue into next spring, a year after it was abundantly clear that the US housing market was hot (see Federal Reserve Housing Support Has Run Its Course).

Because the FOMC relies on the quirky Owners’ Equivalent Rent (OER) survey of homeowners to gauge the cost of shelter, they don’t see housing inflation (see Why You Can’t Trust Reported Inflation Numbers). The followers of OER are probably limited to a few hundred people, consisting of statisticians at the Bureau of Labor statistics, Wall Street economists and the FOMC. The rest of America looks at house prices. So the Fed is once again feeding a housing bubble by not looking at it.

An unusually calm North Sea was the proximate cause of Europe’s energy crisis (see Europe Follows California Into Renewables Oblivion), but the loss of windpower has exposed years of underinvestment in conventional energy such as natural gas. Higher prices are an obvious consequence and are part of the climate extremists’ playbook. Shifting towards renewables was always going to lead to higher prices (see Is The Energy Transition Inflationary?). This provokes two big questions for markets: (1) will the Fed feel compelled to respond to energy-driven inflation as it becomes clear that it’s not transitory, and (2) does the jump in natural gas prices suggest that we need more supply, or will unreliable solar and wind benefit from improved relative pricing?

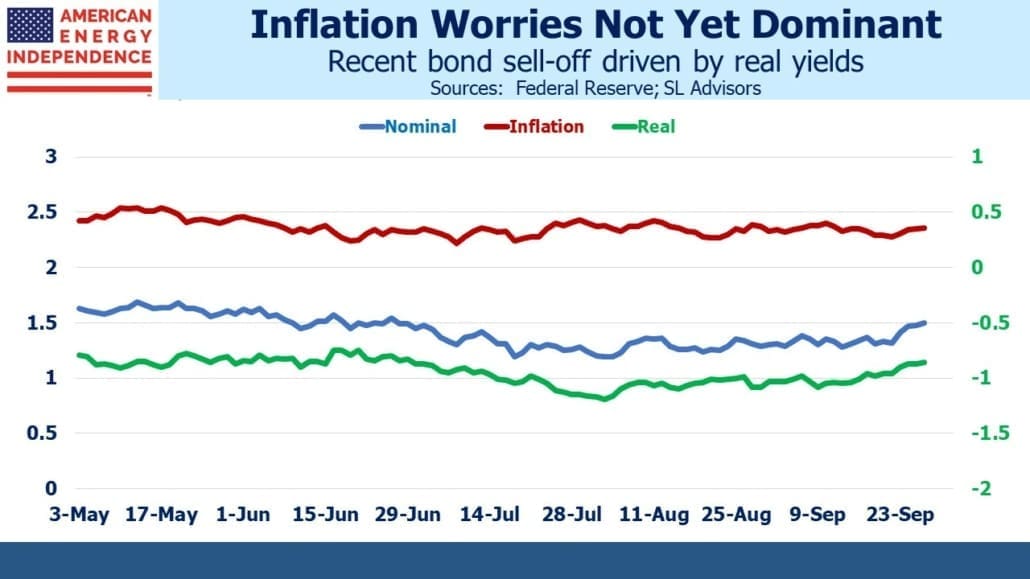

On the first question, we’d bet on the FOMC exploring every alternative explanation before concluding that inflation requires changes in monetary policy. They’ll be relieved to see that the sell-off in bonds is mostly driven by rising real yields. The market is adjusting to approaching cessation of Fed buying. Ten year implied inflation has remained in the 2.3-2.4% range.

The second question is more complicated. Investment in new oil and gas production has been declining for years. Rich world policies that discourage fossil fuels and climate extremists’ efforts have constrained energy sector capex. Today’s high prices are the result. Solar and wind power are incapable of filling the void. As Britain has discovered, intermittency remains a huge problem. Back-up battery storage still isn’t available on economic terms. Power grids require substantial upgrades. So, do policymakers correctly accept the inevitability of continued natural gas use for decades to come while seeking technological solutions to emissions, such as carbon capture? Or do they conclude we need even more renewables? Climeworks is a start-up company that sucks CO2 out of the air. It was profiled in a WSJ story describing OPEC’s expectation to gain market share through 2045, helped by global demand growth led by emerging economies and falling rich world production.

New Jersey is one state heading for poor choices. Earlier this week PennEast dropped plans to build a natural gas pipeline from Pennsylvania to New Jersey because of continued regulatory challenges. As a result, New Jersey customers will in years to come face less reliable power.

Public support for the energy transition is about to be tested by higher prices. Polls show voter support until it hits their wallets. Political leaders sure of their footing will embrace today’s energy prices as an important element of the transition.

Meanwhile, higher energy prices will feed into the broader inflation statistics in the months ahead.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Not only do power grids require substantial upgrades, policymakers do as well.