Federal Reserve Housing Support Has Run Its Course

The red-hot housing market is a topic of cocktail conversations, at least among those comfortable to take that step back to normalcy. The S&P/Case-Shiller U.S. National Home Price Index (C-S) sports a 14.6% year-on-year increase through April. Residential real estate benefits from numerous sources of government support. Property taxes are tax-deductible up to $10K (although in NY and NJ the benefit is derisory because taxes can be 2-3% of a home’s value). Mortgage interest is also tax deductible, and the Federal government underwrites the credit risk of conforming mortgages which lowers their interest rate. Add to that the $40BN in monthly MBS purchases, part of the $120BN in long term bonds the Fed is buying which acts to further depress rates. So on top of the various tax subsidies and guarantees, the Federal government is lending almost half a trillion dollars a year to home buyers. It’s no wonder home prices are rising.

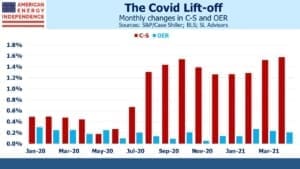

The Fed measures housing inflation by relying on a survey by the Bureau of Labor Statistics on what monthly rent homeowners think their home could command if rented. It’s safe to say that Owners Equivalent Rent (OER) is not the subject of the abovementioned excited cocktail chatter because it’s a theoretical concept – the only element of the inflation statistics not derived from actual transactions. Its weaknesses are well documented and we won’t belabor them here (for more detail, see Why You Can’t Trust Reported Inflation Numbers). Suffice it to say that OER doesn’t reflect the cost of housing for the two thirds of households who choose to own their home. The S&P/Case-Shiller U.S. National Home Price Index has risen at an annual rate of 4.4% over the past two decades, versus 2.6% for OER. The Fed’s use of OER means it has persistently ignored inflation in the biggest expense households face.

Although the FOMC is more in thrall to progressives than bond vigilantes nowadays, their full-on spiking of the punch bowl is making some increasingly uneasy. Boston Federal Reserve Bank president Eric Rosengren is worried that a housing “boom and bust cycle” will threaten financial stability. It’s hard to find any serious support for the Fed’s continued buying of MBS in the financial community. Even the liberal wing of the Democrat party must conclude that few beneficiaries of housing inflation are likely to be found among their core supporters.

The continued strong housing market speaks to the imminent conclusion of at least this element of the Fed’s $120BN monthly bond buying. Expect the FOMC to curtail it during the third quarter, as a growing chorus of economists and investors warns of another housing bubble. Eurodollar futures priced in earlier monetary tightening following Powell’s press conference a couple of weeks ago, so that the yield curve now more closely resembles the forecasts from St. Louis Fed president James Bullard than Jay Powell (see The Fed, Thinking Fast Or Slow). But there’s still more downside price risk than upside for futures.

Switching to energy markets, those of us outside California will appreciate this priceless headline: California Asks Residents to Avoid Charging Electric Cars Amid Power Grid Strain. The Golden state is pursuing altruistic energy policies – swearing off everything but solar and wind, yet unable to provide reliable power. One problem is they’re ahead of most of the world in shifting as quickly as possible to largely renewable power (2018 was 34%). Global greenhouse gas emissions continue to rise, mostly due to rising living standards and energy consumption in developing countries. To the extent that climate change is responsible for the heatwave across western states, Californians are enduring both the results of global warming and the costs of mitigation without any visible benefit.

Of course renewables aren’t directly responsible for California’s power shortages, although had they redirected solar and wind investments to modernizing their existing grid and boosting conventional power sources they’d be in a better place.

The energy transition is a multi-generational marathon. It’s not an endeavor that lends itself to a declaration of victory, although defeat will be recognizable. This will be a problem for politicians, but it’ll be interesting to see how enduring popular support is to phase out fossil fuels in California and elsewhere. The effort will need to last decades while the connection with changing weather will remain tenuous. Few other states will see much to emulate in their approach.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!