Deciding When To Sell

Investors sometimes ask us what induces us to sell a security. It’s usually because relative valuation has made one stock more attractive than another. Williams Companies (WMB) is an example. The company holds a unique position in natural gas pipelines with its Transco network running along the eastern US. They have a heavily fee-based business, regularly meet or beat earnings expectations and have paid a dividend for half a century. They handle roughly a third of US natural gas.

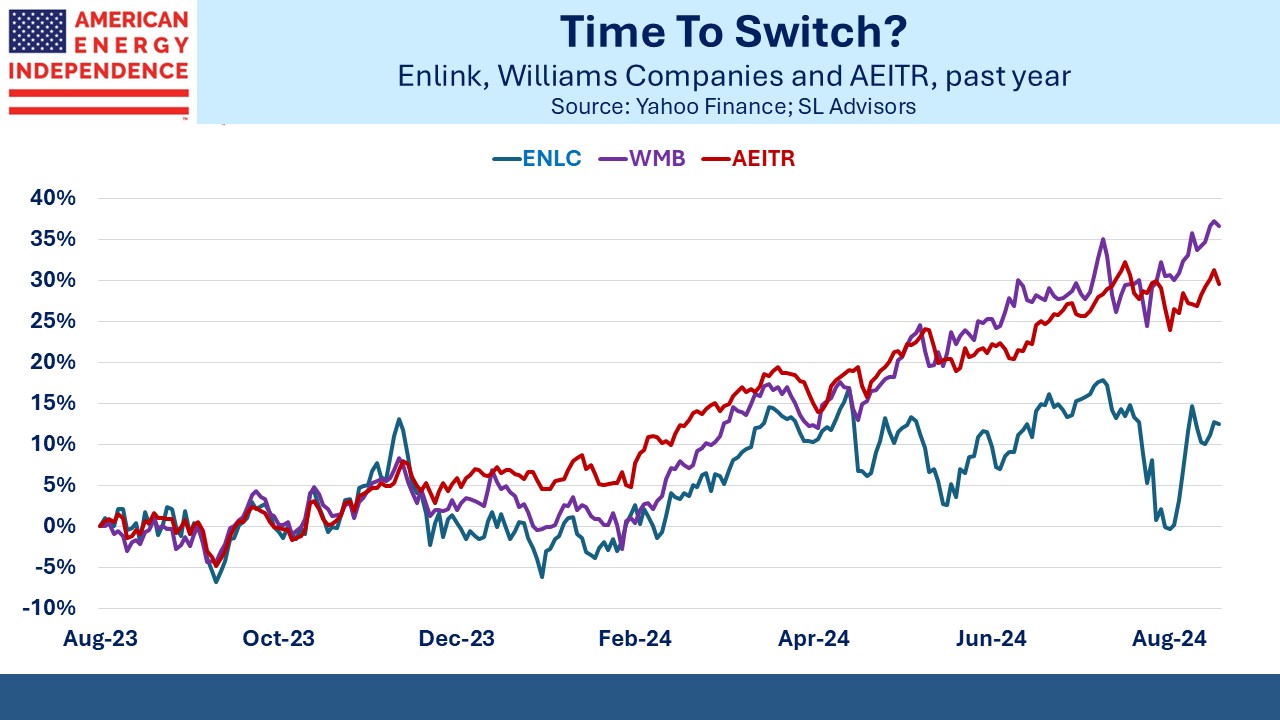

However, their 2024 Distributable Cash Flow (DCF) yield is below 8%, the lowest of any of their peers. Over the past year they’ve returned 37%, roughly 7% ahead of the American Energy Independence Index (AEITR). WMB is a stable company, in our opinion richly priced.

So we’ve cut our position back and purchased more Enlink Midstream (ENLC). They’re not perfect substitutes – ENLC’s $6BN market cap is much smaller than WMB’s $55BN. But we like their exposure to natural gas and NGLs in Texas and Louisiana. Their leverage is a comfortable 3.3X Debt:EBITDA giving them an investment grade rating.

Over the past five years ENLC has repurchased 10% of their stock. They have an interesting opportunity in Carbon Capture and Sequestration (CCS) since they serve many industrial companies throughout Louisiana’s industrial corridor. Their existing pipeline network allows them the opportunity to send CO2 generated by their customers back to the geological formations from where the natural gas was extracted.

There’s an elegant symmetry in taking carbon atoms originally sourced as CH4 (natural gas, methane) being returned home as CO2. Federal CCS tax credits under the misnamed Inflation Reduction Act help.

A further appeal is ENLC’s 15% DCF yield, among the highest in the sector and with potential upside from repricing of NGL contracts (see Long Term Energy Investors Are Happy).

ENLC has trailed the AEITR index with a 12% one year return. We concluded the valuation difference between WMB and ENLC was sufficient to switch some capital.

Sometimes less is more when it comes to regulatory approvals. Following a court ruling that partially suspended NextDecade’s (NEXT) permit for their LNG export facility (see Sierra Club Shoots Itself In The Foot) their stock fell sharply. Investors reassessed the odds of completing the Rio Grande terminal, even though construction continued after the ruling.

The Federal Energy Regulatory Commission (FERC) now has to revise their previously completed Environmental Impact Statement (EIS). NEXT was planning to include a CCS capability at Rio Grande. Now in an ironic twist, NEXT has withdrawn its CCS application from FERC, because they believe this will simplify regaining the permits they already had to build the LNG terminal.

The stock staged a modest recovery but will likely return to its pre-ruling levels only once the permit issue is resolved.

Climate extremists have been effective at constraining capex which in turn has helped drive up midstream free cash flow. But they’re opening themselves up to financial exposure along the way. Greenpeace was active in opposing Energy Transfer’s Dakota Access pipeline project, which substantially raised its cost.

Kelcy Warren’s company isn’t known for avoiding conflict. So they’re suing Greenpeace for $300 million, a sum the environmental group has said represents an existential threat. This is the group whose protesters illegally board ships and oil rigs to promote their dystopian views. They oppose natural gas, the biggest source of reduced CO2 emissions in the US.

If ET does prevail in court and a life-ending settlement is imposed on Greenpeace, they won’t be missed.

In another triumph for common sense, New Zealand is tempering its reliance on renewables (see New Zealand to push through law to reverse ban on oil and gas exploration). Electricity prices recently spiked to some of the highest among developed economies.

New Zealand’s previous center-left government imposed regulatory hurdles on LNG imports, something the current center-right government also wants to reverse.

Energy Minister Simeon Brown lamented that, “The lakes are low, the sun hasn’t been shining, the wind hasn’t been blowing, and we have an inadequate supply of natural gas to meet demand.” In other words, intermittent power supply that depends on co-operative weather has been, well, intermittent.

The climate extremists who speak loudest on policy promised New Zealand cheap, carbon-free energy. New Zealanders have received the opposite, with coal use for power generation increasing to meet the shortfall. New Zealanders each generate on average around 6 metric tonnes of CO2 annually, less than Germany which styles itself a leader on climate change.

Once the permit issue for NEXT is cleared up, they might have a new customer for their LNG.

We have three have funds that seek to profit from this environment: