Climate Policies Confront Reality

/

Casually following news of the energy transition can create the impression that the world is a few years away from running on solar power and windmills. The reality is that climate extremists have propagated two impractical beliefs that are impeding policies based on pragmatism. One is that solar and wind are the complete solution. The other is that emerging economies are similarly committed to reducing emissions.

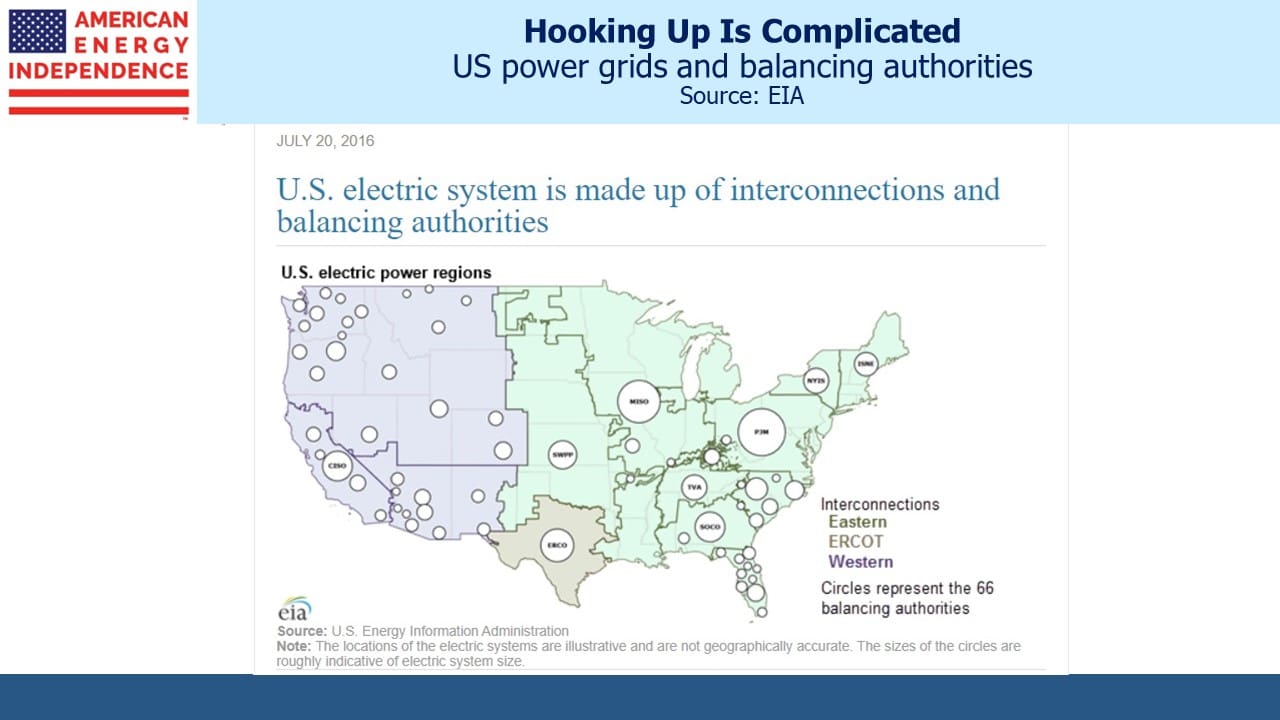

Starting with electrification – the NYTimes recently acknowledged the growing delay in connecting solar and wind projects to the grid. The US has three grids — Eastern, Western and ERCOT which is approximately Texas, along with 66 balancing authorities. New sources of power supply have to negotiate access to this system, which often requires adding power infrastructure.

PJM Interconnection, a regional grid running from Illinois to New Jersey, has frozen new applications to add power until 2026 while they process the backlog. Developers often have to pay for grid upgrades. A wind farm in North Dakota was asked to pay millions of dollars to upgrade transmission lines hundreds of miles away in Nebraska and Missouri.

Across the US approvals now take on average four years. It’s estimated that less than a fifth of new solar and wind projects get connected. Climate extremists have become adept at using court challenges to vacate environmental permits issued to pipeline projects. But the same approach can also delay infrastructure to support renewables, because NIMBYs are not a coordinated political force. Permitting reform is sorely needed.

The Energy Information Administration reports that renewables were almost two thirds of investment in new power output in 2021, with natural gas 22%. There were no new coal plants. Natural gas often enables renewables by compensating for their intermittency.

Owners of Electric Vehicles (EVs) often struggle with charging. In my experience everyone loves their Tesla, but I recently took an Uber ride in Pennsylvania where the driver reported a daily one hour wait to recharge her (Uber-owned) EV. She wasn’t willing to spend the $6K required to install an EV charging outlet in her home. Most EV owners I know have a second car for long trips.

EVs will continue to gain market share, and the US is a relative laggard. Cheap gasoline, a preference for big cars and high annual mileage have slowed EV penetration outside California. Like many people, I’m going to wait until improved charging speed and availability makes buying an EV an upgrade to quality of life.

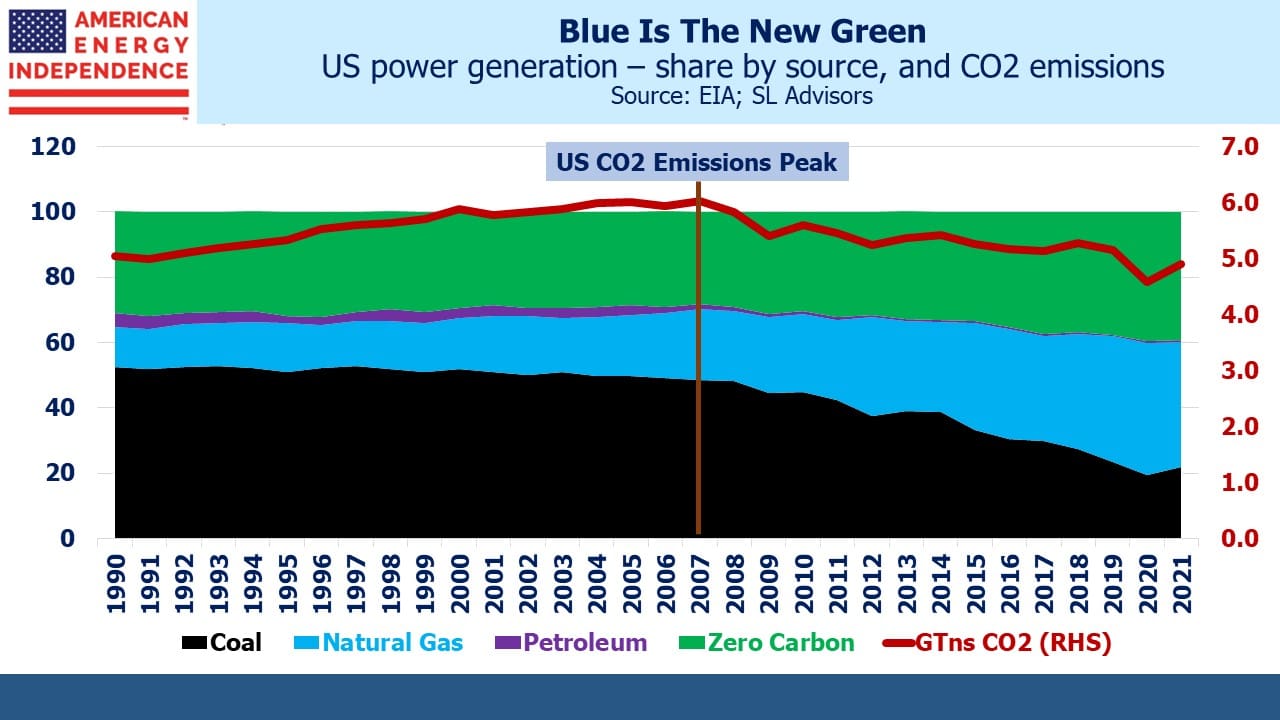

It’s also easy to think that our efforts on climate change here in America are critical to solving the global challenge of reducing CO2 emissions. We have had a lot of success over almost two decades. US CO2 energy-related emissions peaked in 2007 at 6 Billion Metric Tonnes (Gigatonnes, or GTns), and are now 18% lower. This has come about in part because coal dropped from 48% to 22% of power generation. Natural gas rose from 22% to 38%, compared with zero-carbon (which includes reliable nuclear and hydro as well as intermittent solar and wind) which rose from 28% to 39%.

This is why a sensible strategy to reduce emissions would eliminate what remaining coal we use and replace it with natural gas and nuclear. Climate extremists are purists if not practical.

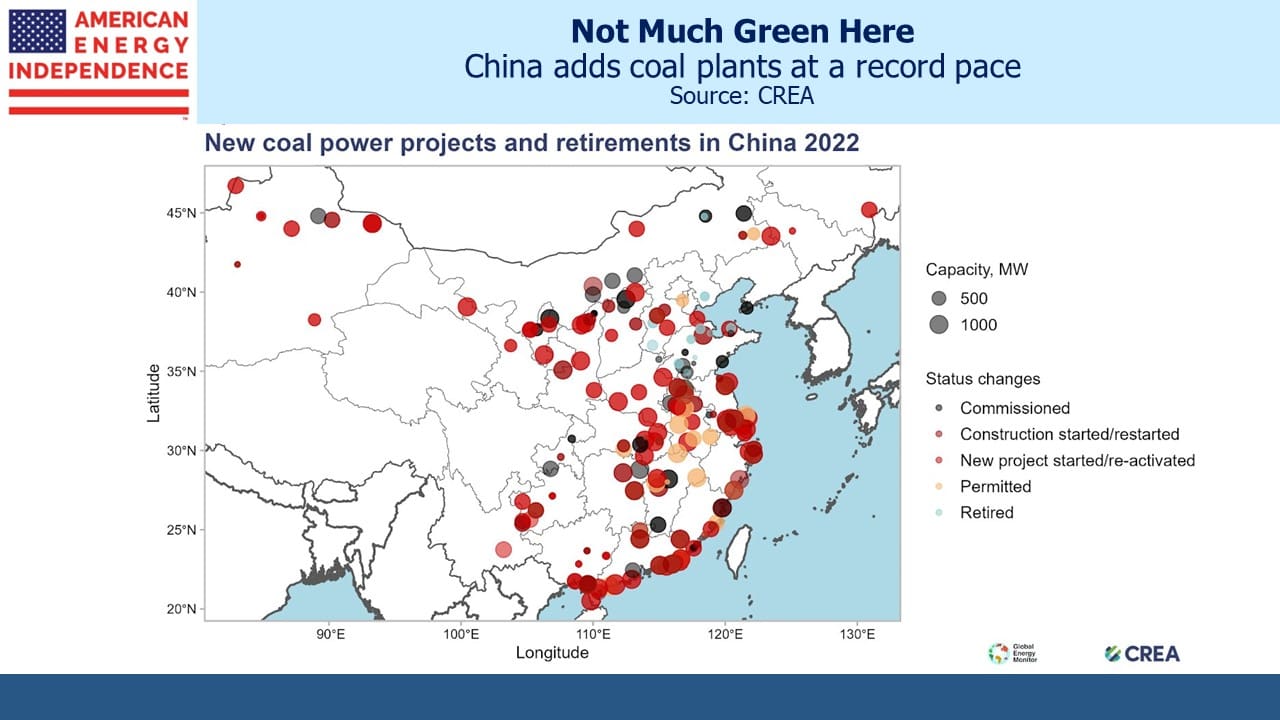

Emerging countries are defining the world’s CO2 emissions, and they continue to invest in coal burning power plants. At the COP21 in Glasgow India promised to “phase down” coal, which practically speaking means its use will grow more slowly than other sources of energy. Old coal mines are being reopened, and coal executives expect their output to be required for at least another quarter century. Its fastest growing coal mine is scheduled to triple in size.

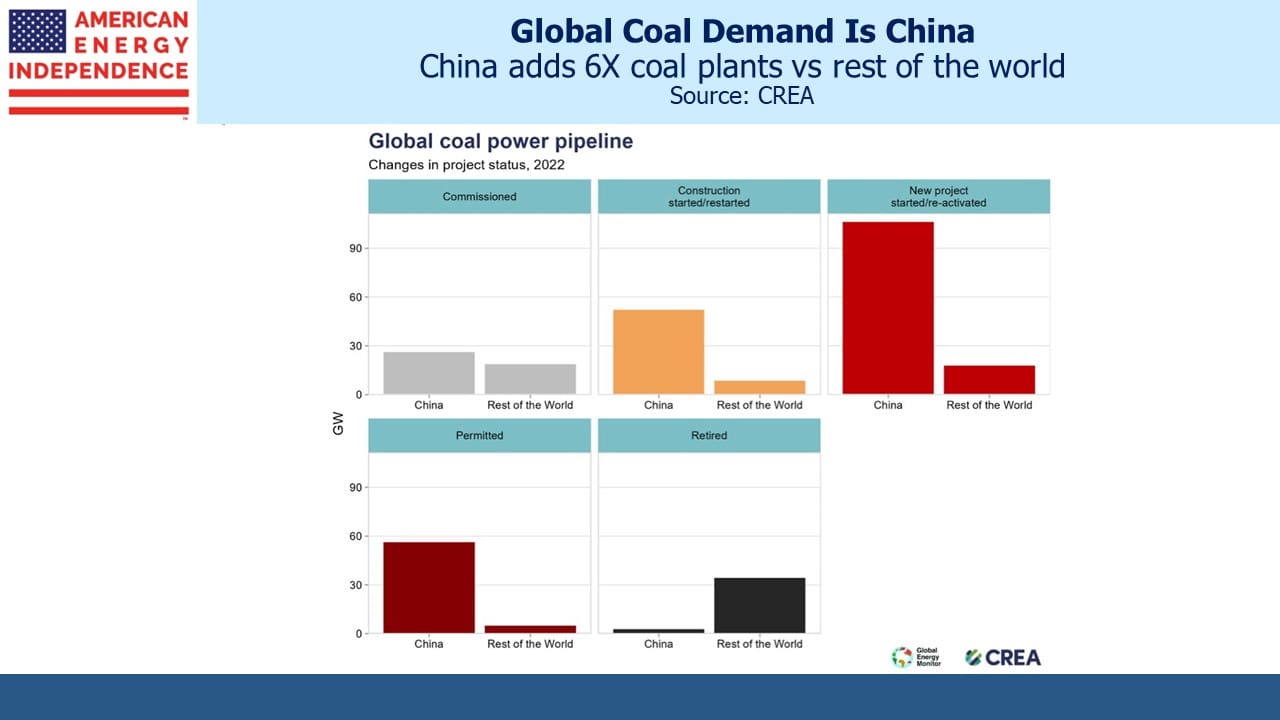

China’s coal use dwarfs the rest of the world. The Centre for Research on Energy and Clean Air (CREA) calculates that 85% of the planet’s planned new coal projects are in China. Living standards can’t improve without increased energy use, but China’s policies render other countries’ efforts irrelevant. Or our efforts allow China to do less, depending on your perspective.

No review of climate policies would be complete without reference to that obnoxious little girl Greta Thunberg, who once preached to the rest of us from the UN (“How dare you”). Betraying her discombobulated understanding of the world’s energy needs, she recently accused Norway of “green colonialism” because of plans to build an onshore wind farm in the middle of an area where reindeer graze.

Natural gas remains the world’s best hope for serious emissions reduction, as it has been in the US in spite of sometimes incoherent opposition from climate extremists.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!