EnLink Aims for Positive Free Cash Flow

It’s a sign of the market’s evolving view of pipeline stocks that EnLink Midstream’s (ENLC) distribution cut was followed by a modest bounce in the stock. A cut had been widely expected, and during the conference call with analysts some questioned whether the 34% reduction was big enough. MLP investors are no longer solely focused on distribution yield as a measure of value.

ENLC is technically an LLC rather than a partnership. It has elected to be taxed as a corporation so as to broaden its investor base by issuing 1099s rather than K-1s. But its owner base remains dominated by MLP funds, perhaps because the weaker governance of an LLC dissuades many institutions who might otherwise consider the stock.

One unanswered question remains the influence of Global Infrastructure Partners (GIP) in setting strategy. GIP has taken a beating since investing $3.125BN in July 2018 (see Leverage Wipes Out Investor’s Bet on Enlink). GIP took on $1BN in debt and the subsequent collapse in ENLC’s stock has virtually wiped out the equity. The deteriorating fundamentals of Enlink’s business since GIP’s investment highlight that private equity often brings little to the table besides cash (and additional leverage). Uncertainty about GIP’s intentions remains a negative, and ENLC has offered little information. CEO Barry Davis simply said they exchange information with GIP on what each is seeing in the marketplace, which means either he doesn’t know much useful about GIP’s plans or what he does know isn’t positive. Preserving enough cashflow to GIP from the reduced dividend to service their debt was regarded by most as a factor.

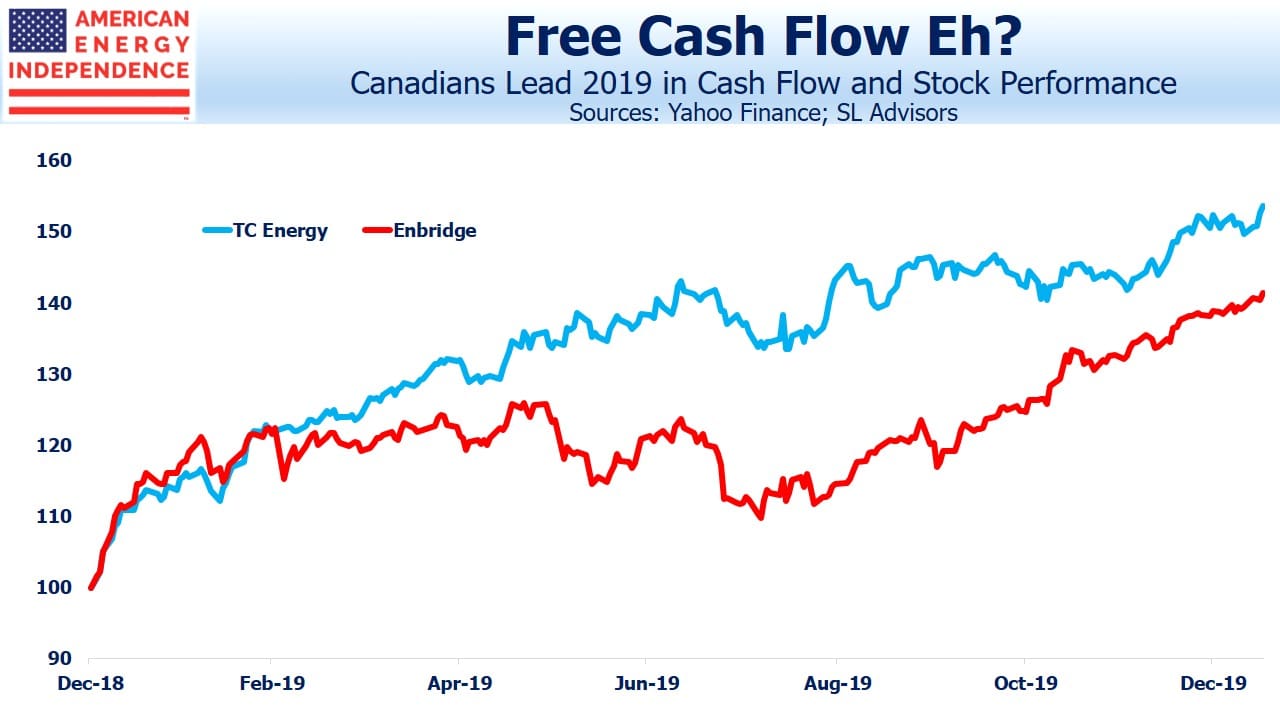

Investors were mildly cheered by the discussion of Free Cash Flow (FCF) and the fact that it’ll be positive in 2020. Midstream energy infrastructure stocks have been rewarded for generating FCF. We estimate that almost half the industry’s 2019 FCF came from two big Canadian companies, TC Energy (TRP) and Enbridge (ENB). Both were star performers last year, returning 58% and 39% respectively including dividends. In The Coming Pipeline Cash Gusher last year we highlighted the industry’s growing FCF. Following 4Q earnings in the next few weeks we’ll update those projections, but they’re likely to be largely on track.

Even after the cut, ENLC now yields 13%, roughly 2X the yield on the American Energy Independence Index. This new dividend is presumably secure, not least because it must align with GIP’s debt servicing needs. Questions remain about long term performance in its assets located in Oklahoma and North Texas. Devon Energy (DVN), once ENLC’s owner and significant customer, triggered the weaker performance by divesting from plays in those regions. ENLC is still struggling to convince investors that their long term future is secure, and as with many pipeline companies the Permian in west Texas looks more attractive.

More clarity around GIP would be helpful. ENLC isn’t the traditional toll model with secure volume-backed contracts extending out many years. Customer drilling activity remains a critical factor in driving their performance. But for now they seem to be operating from the front foot. The dividend is also fully classified as a non-taxed return of capital, an appealing feature for those taxable investors who care about such things. It’s likely to remain that way for at least another three years due to a depreciation shield offsetting taxable income. RW Baird estimates 2021 FCF of $115MM, which on its current market cap of $2.85BN is a 4% FCF yield. However, that’s after the 13% distribution, so represents a high total FCF yield to equity holders. FCF is a recent discovery for many energy companies, and the fact that ENLC can show some ought to provide some support for the stock.

We are invested in ENB, ENLC and TRP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The stack/scoop was heralded as the next Permian. What happened? How vulnerable is enlink to lower volumes in the next 8 years? We own the debt

S-L Advisors specifically mentioned ENLC when discussing the financial future for pipelines. Apparently your posterchild for a more prosperous tomorrow has not had a more prosperous tomorrow. Does it make you reevaluate your basic thesis?

ENLC has been a big disappointment. We do ongoing evaluation of every position, but this one clearly wasn’t a good investment where GIP initially came in.