Energy Strengthens U.S. Foreign Policy

“Let us set as our national goal, in the spirit of Apollo, with the determination of the Manhattan Project, that by the end of this decade we will have developed the potential to meet our own energy needs without depending on any foreign energy sources.”

Over 47 years ago, President Nixon set out this vision. Securing oil supplies from a region of the world that often seems hostile to the U.S. has driven foreign policy ever since.

Four years later, President Carter warned in a speech to the nation that, “We can’t substantially increase our domestic production, so we would need to import twice as much oil as we do now. Supplies will be uncertain. The cost will keep going up. Six years ago, we paid $3.7 billion for imported oil. Last year we spent $37 billion — nearly ten times as much — and this year we may spend over $45 billion.”

Last week, following Iran’s deliberate miss of U.S. forces in Iraq, President Trump said, “…our economy is stronger than ever before and America has achieved energy independence (emphasis added). These historic accomplishments changed our strategic priorities…We are now the number-one producer of oil and natural gas anywhere in the world. We are independent, and we do not need Middle East oil.”

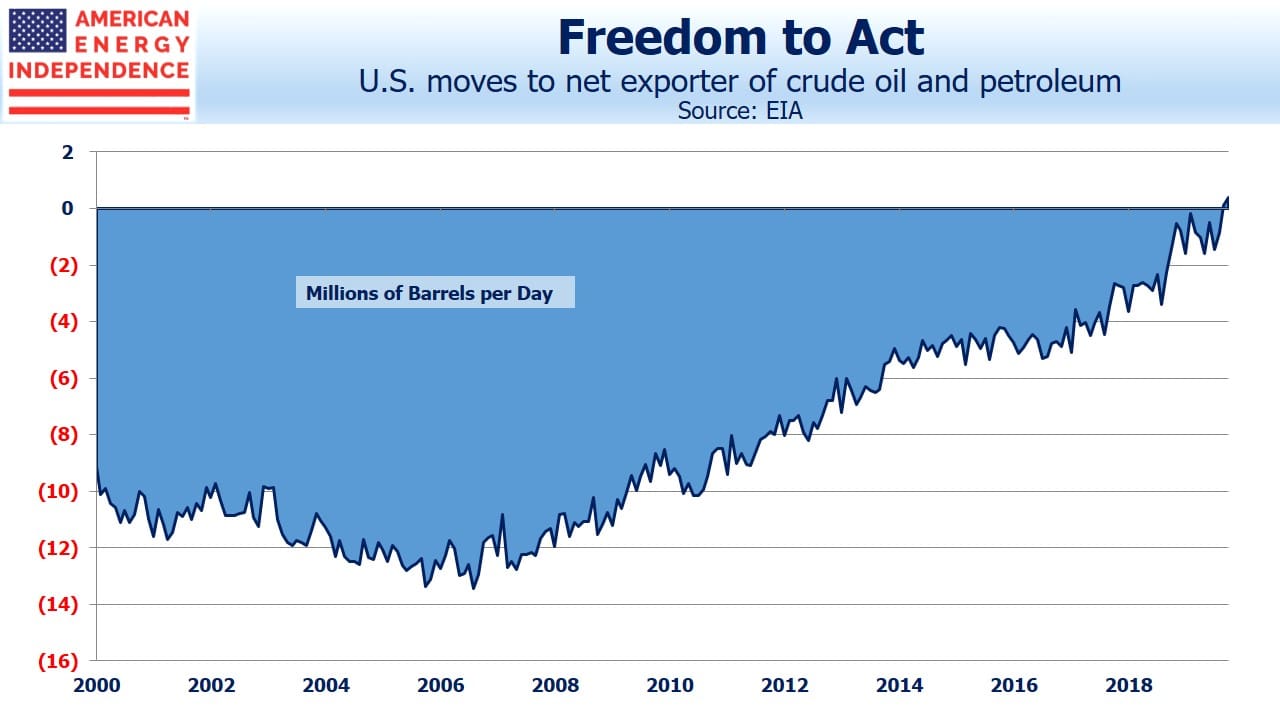

In November, the U.S. was a net exporter of crude oil and petroleum products for the first time in decades, a development made possible by the Shale Revolution. Increased freedom of action is one of the many benefits, as Iran is finding out.

Some have noted that the figures don’t show that the U.S. is a net oil exporter, which is true (see America Is Not Yet A Net Crude Oil Exporter). Domestic production is currently 12.9 Million Barrels per Day (MMB/D), and consumption of refined products is around 20 MMB/D. The difference is made up by 5 MMB/D of Natural Gas Liquids (NGLs), of which 3 MMB/D is consumed domestically, much of it as inputs into the petrochemical industry; 1.0 MMB/D of ethanol; and 1.1 MMB/D of net refinery processing gains. Net imports of crude oil make up the difference.

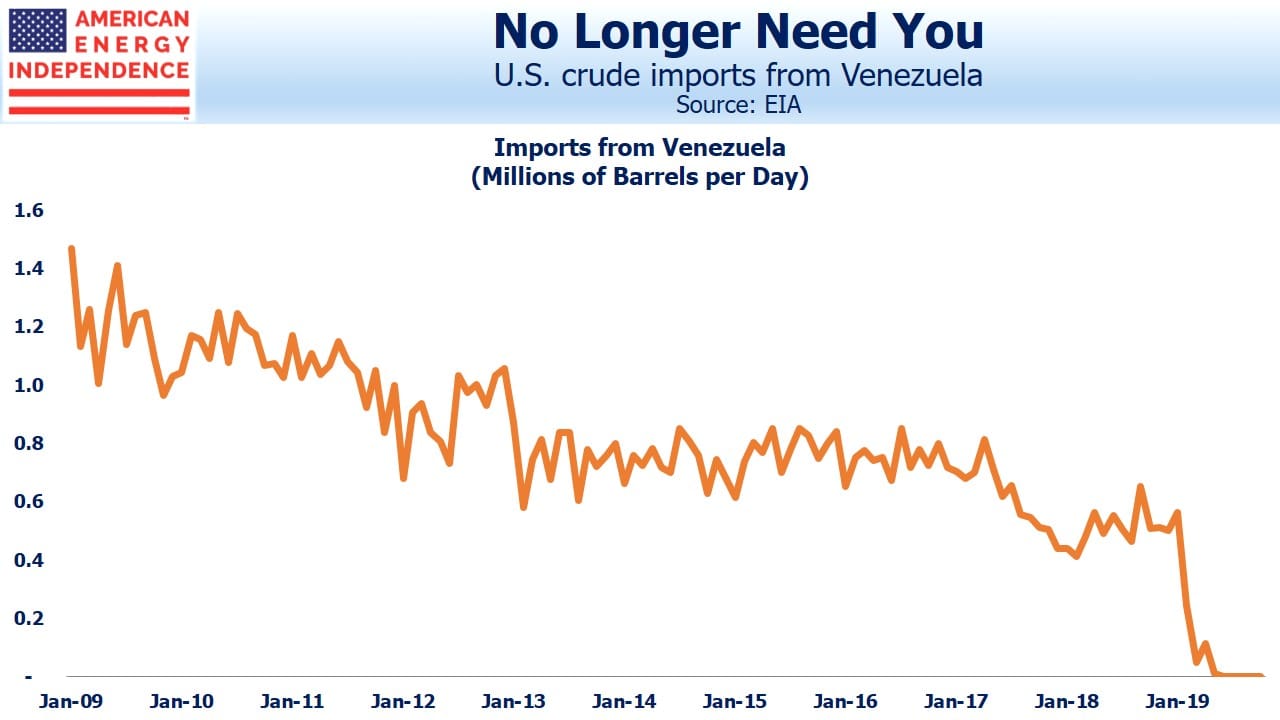

Crude oil comes in hundreds of grades, and it’s often reported that U.S. refineries are better equipped to process the heavy crude that Venezuela and Canada produce, with limited capacity to handle the light crudes that come from the Permian in west Texas. So we trade with other countries to achieve the desired mix of blends.

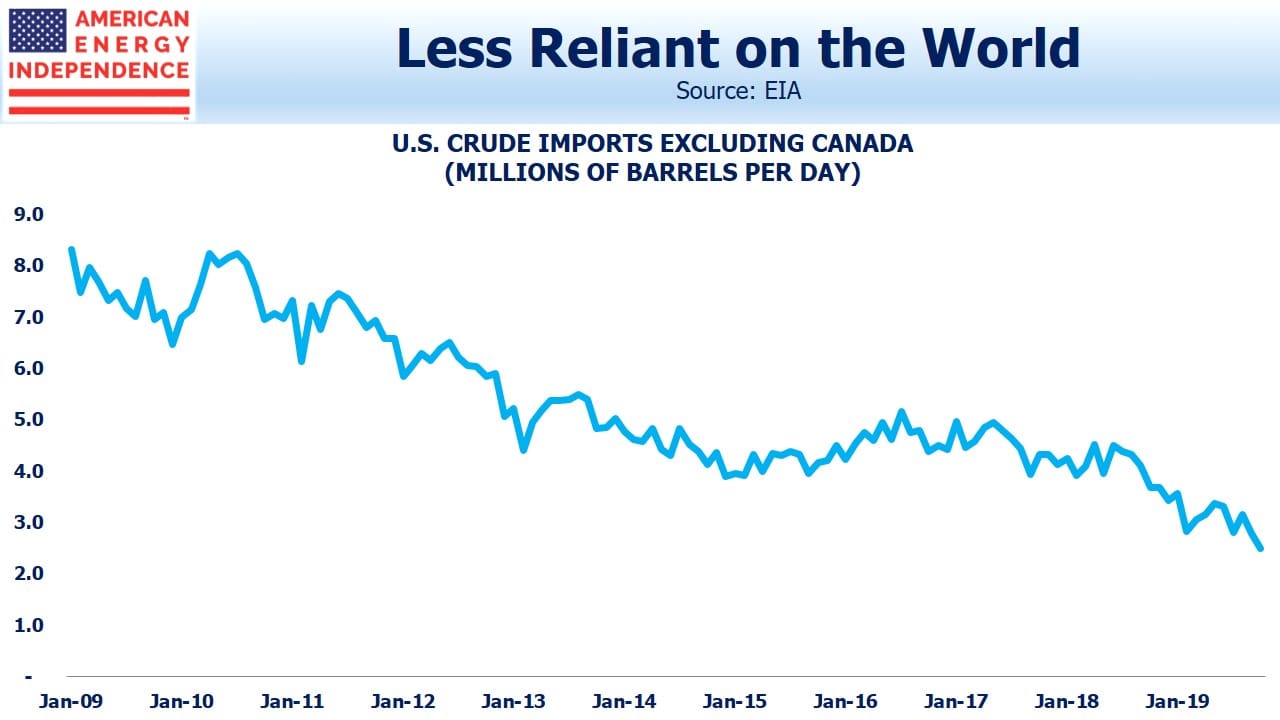

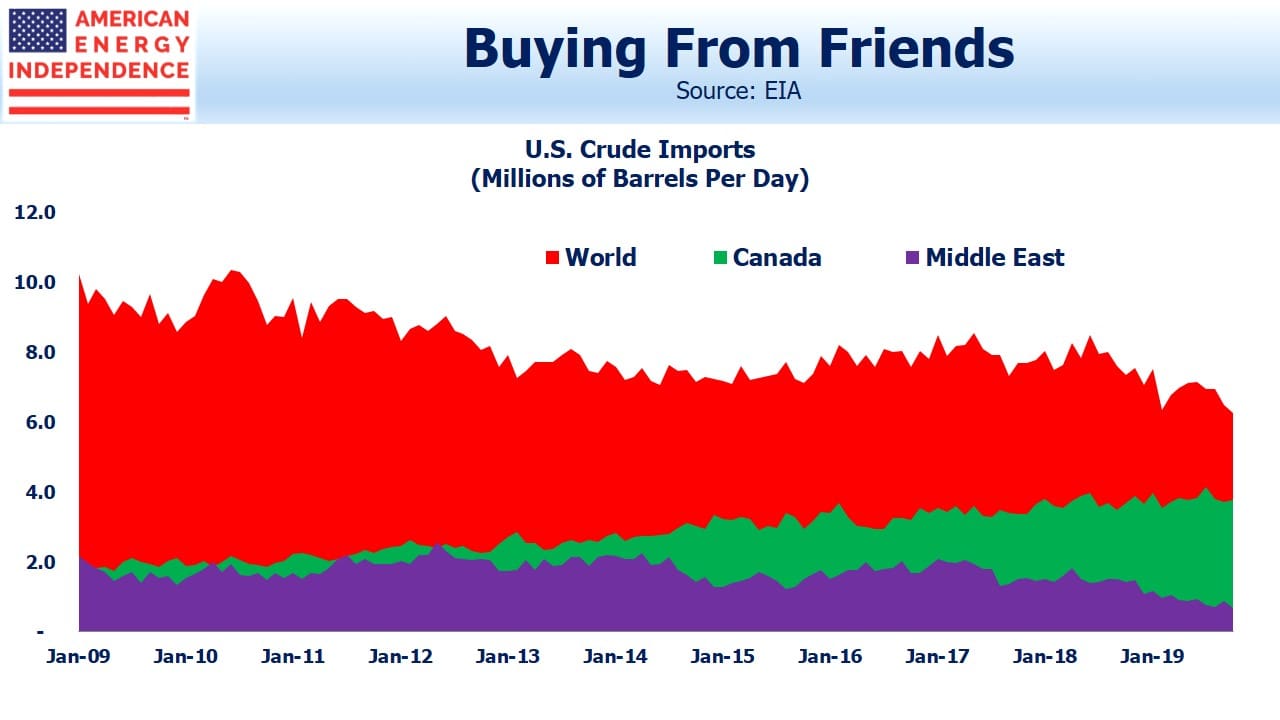

Imports from Venezuela have collapsed to almost zero from 1.2 MMB/D a decade ago. Imports from the Middle East have fallen to 0.7 MMB/D, so it wouldn’t be hard to get by with no Middle East imports at all. Meanwhile, Canada’s continue to grow.

From an energy independence perspective, Canada’s oil imports are hardly at risk. Its oil is produced in Alberta and runs south through pipelines to refineries in the Midwest, and even all the way to the U.S. Gulf coast. Two thirds of Canadian production is the heavy blends suited to U.S. refineries, and we buy 80% of their production. Canada has little choice other than exporting to the U.S. Domestic politics has prevented the construction of additional pipeline capacity from Alberta to Pacific coast ports in British Columbia (see Canada’s Failing Energy Strategy).

So even though there’s two-way trade in crude oil to achieve the blends needed for U.S. refineries, our imports are increasingly coming from friendlier countries.

The net result is that the U.S. is not only net independent in crude based products, but our imports of the blends of crude we prefer are coming from friendly countries. It’s a truly incredible outcome, and midstream energy infrastructure is vital to this success.

For a list of the most important companies in this sector, look at the American Energy Independence Index.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!