Political and Energy Independence

As we all take a break to celebrate America’s political Independence, it’s worth contemplating how Energy Independence has become attainably within sight over only the past couple of years. In 2015 oil production and energy sector prices were falling as many worried OPEC would bankrupt large swathes of domestic production. In October 2016 the pain of lower prices became too much (see OPEC Blinks). They abandoned their strategy of low prices in favor of production cuts, and altered the future of the U.S. energy sector.

It reminds of past titanic struggles; the 1940 Battle of Britain, when the German Luftwaffe gave up trying to destroy the RAF’s airfields because of persistent aircraft losses. Or even the end of the Cold War when America’s economic might supported military spending beyond the capability of the Soviet Union to keep up, leading to its collapse. Capitalism, technological excellence, relentless productivity improvements and a drive to win are all American strengths that were tested by OPEC and found more than up to the challenge. There may not have been a ticker tape parade down Broadway to mark the victory, but it will turn out to be as consequential for America as some past military exploits. We have much to celebrate, and add the Shale Revolution to that list.

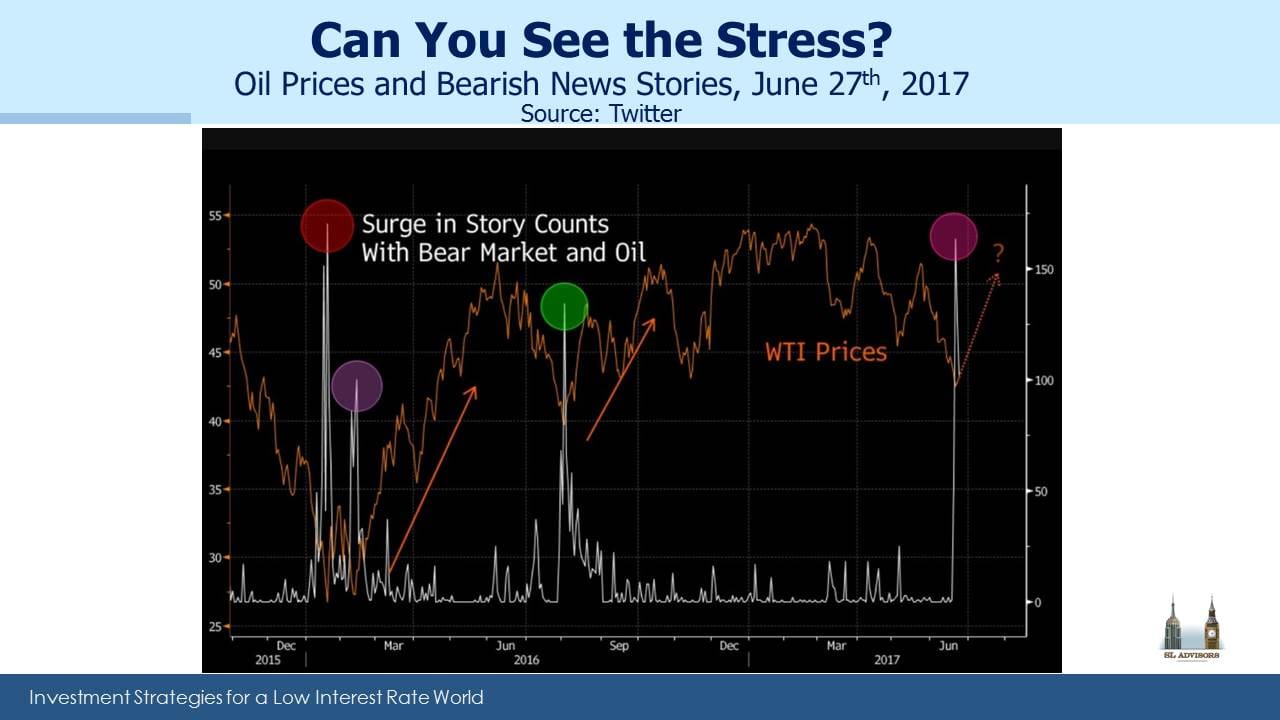

MLPs performed unusually well last week. Our volume of nervous incoming calls peaked with the incidence of bearish crude oil comments in the media. The chart below shows sentiment visually reaching an extreme. No amount of typing by this blogger can shake the solid relationship between crude oil and energy infrastructure. It may be a volume driven, gas-focused industry, but holders of AMLP often think like oil traders which becomes self-fulfilling. Consequently, an over-abundance of bearish stories predictably caused a recovery. MLPs didn’t dissociate from crude, they rebounded with it.

We naturally watch crude movements closely since some client discussions involve tactical thinking, but there were other sources of research and news that were more interesting last week.

John Mauldin’s widely read blog Outside the Box featured an interesting piece on the geopolitical consequence of American energy independence (see Shale Oil: Another Layer of US Power). It includes some startling estimates, such as that the U.S. now has the world’s largest recoverable oil reserves (Rystad Energy), or that 60 percent of all crude reserves that are economically viable at $60 per barrel or less are located in U.S. shale reserves (Wood Mackenzie). Acknowledging the substantial improvements in productivity, the blog notes, “A shale oil driller in the United States, moreover, doesn’t need to be more profitable than Saudi Arabia to drill new wells; the driller just needs to fetch a sufficient return on invested capital. When prices are low, drillers simply forgo exploration and concentrate on the completed wells that produce enough oil to justify their existence.” This last point refers to “short-cycle” projects, which are the essence of shale production. Capital invested is returned within several quarters with output hedged. There’s less focus on Exploration and more on Production.

Saudi Arabia and Russia both require oil prices at least $25 per barrel higher to balance their budgets. It’s unclear how this Math will resolve itself, but it’s likely to highlight America’s strengthening energy position, through higher prices or the benefits of energy security.

Goldman Sachs also produced some thoughtful research. They expect shale production to continue increasing over the next decade before peaking in the late 2020s. They note the benefits of mergers between Exploration and Production (E&P) companies with adjacent fields as such combinations allow for longer laterals that straddle previous separately owned acreage. EQT’s recent acquisition of Rice Energy is an example. There is increasing use of Machine Learning and Artificial Intelligence to optimize drilling techniques. Many private companies unheard of outside the energy industry provide vital services relying on new technology. Biota, a biotechnology start-up founded in 2013, applies DNA sequencing to microbes in the earth’s subsurface. The analysis helps identify sweet spots for drilling. Welldog supplies a fiber optic down-hole monitoring system. Spitfire provides software tools for faster data analysis. EOG has been collecting real time data on every rig and well they control so as to make it available to decision makers in the field. Public policy is solidly behind Energy Independence. On Thursday, the President said, “The golden era of American energy is now underway.”

These are some of the reasons that in Shale, America is the only game in town.

Enjoy Independence Day weekend.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I am hopeful that with articles now appearing which decry the irrational correlation of crude pricing and midstream MLP unit prices, that correlation may dissipate.