AI Boosts US Energy

In recent years the International Energy Agency (IEA) has moved from providing objective forecasts to championing the world’s shift away from fossil fuels. In embracing a liberal political stance they’ve lost relevance to companies and governments making investment decisions to meet future demand. For example, the IEA projects peak oil demand within the next few years, whereas OPEC sees no visible peak. The IEA’s base case for energy consumption sees annual demand growth of less than 1% even though the past decade was 1.4% pa.

One result is that the IEA often revises its near tern forecasts higher. They now see 2024 global crude oil demand at 103.2 Million Barrels per Day (MMB/D), up 1.3 MMB/D from last year. Although the IEA has raised its growth forecast by half since it was first released last year, they’re still behind others such as OPEC which expects 2.2 MMB/D of growth.

Analysts have long warned that underinvestment in new oil production would push prices higher. Russia’s invasion of Ukraine two years ago briefly took prices near $110 per barrel, but a porous sanctions regime has allowed Russian oil to find its way onto the market. However, over the past month oil futures have edged higher as traders digested the upward revisions to demand forecasts.

It’s part of a growing pattern whereby traditional energy consumption is proving more resilient than many forecasts project.

An example is Shell, which has moderated its carbon intensity targets to incorporate the sale of its retail renewable power business. Investors are rewarding companies that prioritize returns, which for companies like Shell come more reliably from oil and gas. In explaining their changed goals Shell cited, “uncertainty in the pace of change in the energy transition.”

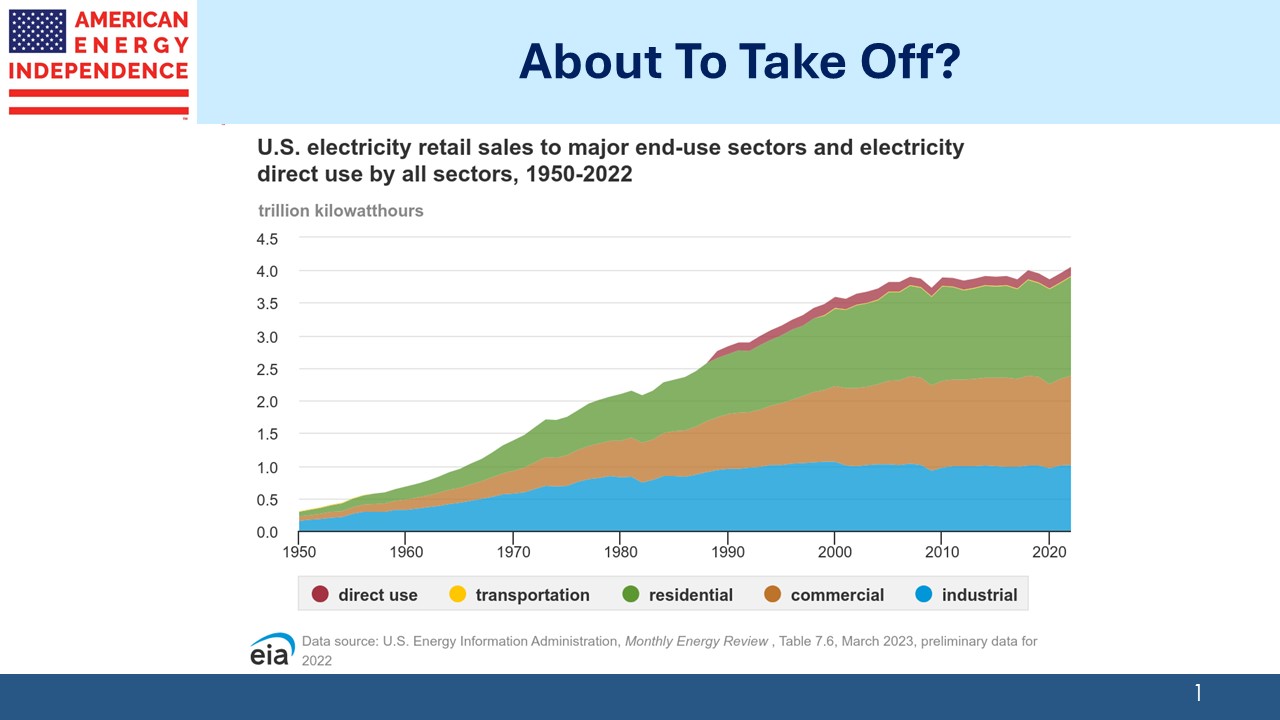

Another area of surprising demand growth is in US power. For over a decade, electricity consumption has hovered just below 4 Trillion Kilowatt Hours. But utilities across the country are preparing for a surge over the next five years. Electric Vehicles (EVs) are only a small part of this. Indeed, Tesla is losing its stature as a growth stock with sales volumes being revised down weekly.

The increased need for US electricity is driven by data centers. Since last year, five year growth in power demand has been revised up by 80%. Virginia has added at least 75 new data centers since 2019. Most regional grids expect increased demand from data centers. California is the exception – the home of computing is a hostile place to build anything.

The Boston Consulting Group expects power demand from data centers to triple by 2030.

In a recent interview, Elon Musk said that AI computing power was increasing at a staggering 10X every six months. Obviously, this isn’t sustainable, but he described it as the fastest growth in a new technology he’s ever seen. Musk has long been optimistic about autonomous driving. He believes Tesla is very close to delivering, although he has said that often over the past several years. He expects self-driving cars using AI to allow much greater utilization of automobiles in the future. While the average car is used for ten hours per week, he expects autonomous cars to move people 50-60 hours a week as they operate like taxis.

Manufacturing is also benefiting from cheap, reliable US energy. New plants to build automobiles and batteries are adding to demand. In the past three years $481BN in new commitments for industrial and manufacturing facilities have been announced. Some of this is the beneficiary of Germany’s slow de-industrialization, caused by years of their disastrous energy policies (see Germany Pays Dearly For Failed Energy Policy).

California, where EVs are popular, expects charging them to consume up to 10% of peak power demand by 2035.

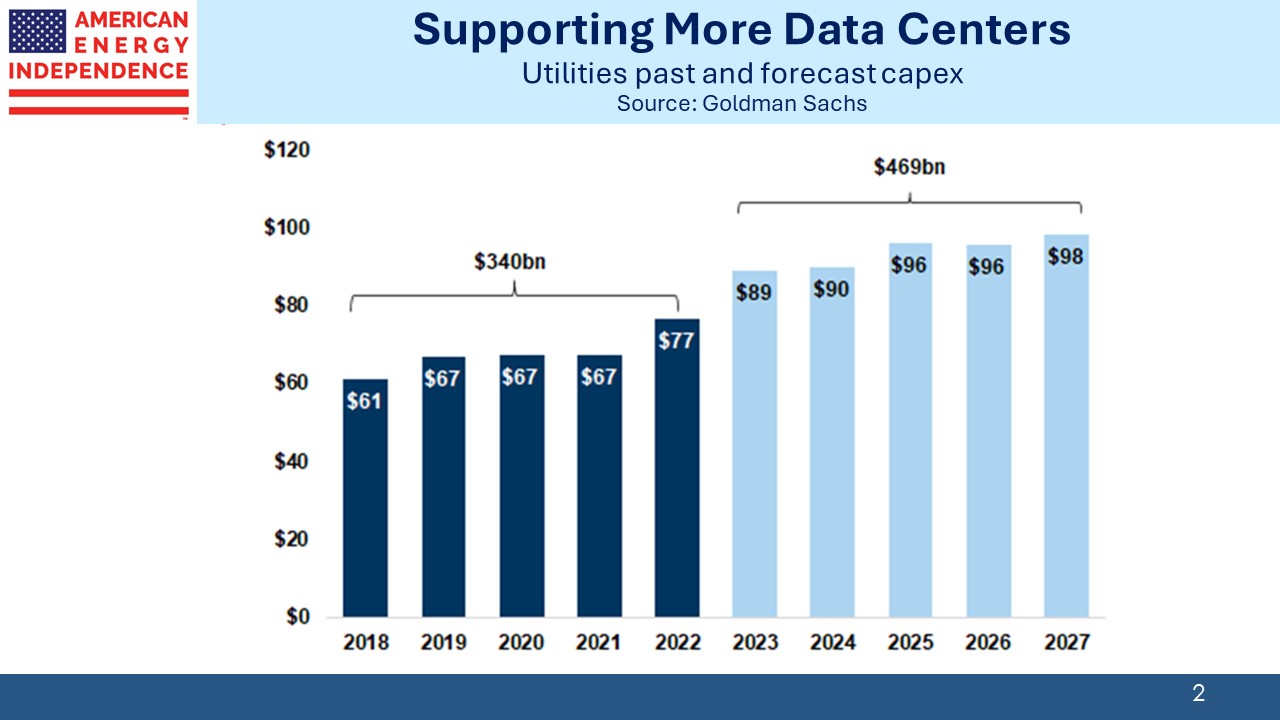

The increased capex among utilities should give investors in that sector pause. But the consequent demand for additional natural gas will further boost utilization of pipelines.

Reducing emissions relies on electrification of activities where it results in a switch to low emission energy. However, renewables are in many cases inadequate to meet this new demand. Georgia, North Carolina, South Carolina, Tennessee and Virginia are planning to add dozens of new natural gas power plants over the next fifteen years.

A challenge to adding renewable power capacity lies in transmission lines. Because solar and wind power require large open spaces, their power must be transmitted often over long distances to population centers. Adding grid capacity is proving difficult. The legal system has been turned into a weapon by climate extremists opposed to traditional energy, but interminable lawsuits are also delaying new power infrastructure.

GridStrategies reports that the U.S. installed 1,700 miles of new high-voltage transmission per year on average in the first half of the 2010s but dropped to only 645 miles per year on average in the second half of the 2010s.

Oil and gas demand remain strong, with many companies finding them the most reliable source of investment returns in the energy sector.

We have three have funds that seek to profit from this environment: