Adapting To America’s Low Rate Policy

/

President Trump continues to heap pressure on the FOMC to cut rates, to the alarm of every economist and bond analyst. Central bank independence is the gold standard for western nations, the only way to assure that politicians don’t seek to juice growth synchronized with the election cycle.

Fed chair William McChesney Martin Jr, who served in that position longer than anyone (1951-1970), was credited with describing the Fed as, “…independent within the government, not independent of the government.”

Central bank independence really means immunity from short term political pressure. Few argue that cental banks shouldn’t be politically accountable. The Fed’s twin mandate of maximum employment with stable prices is set by Congress and could be changed by Congress.

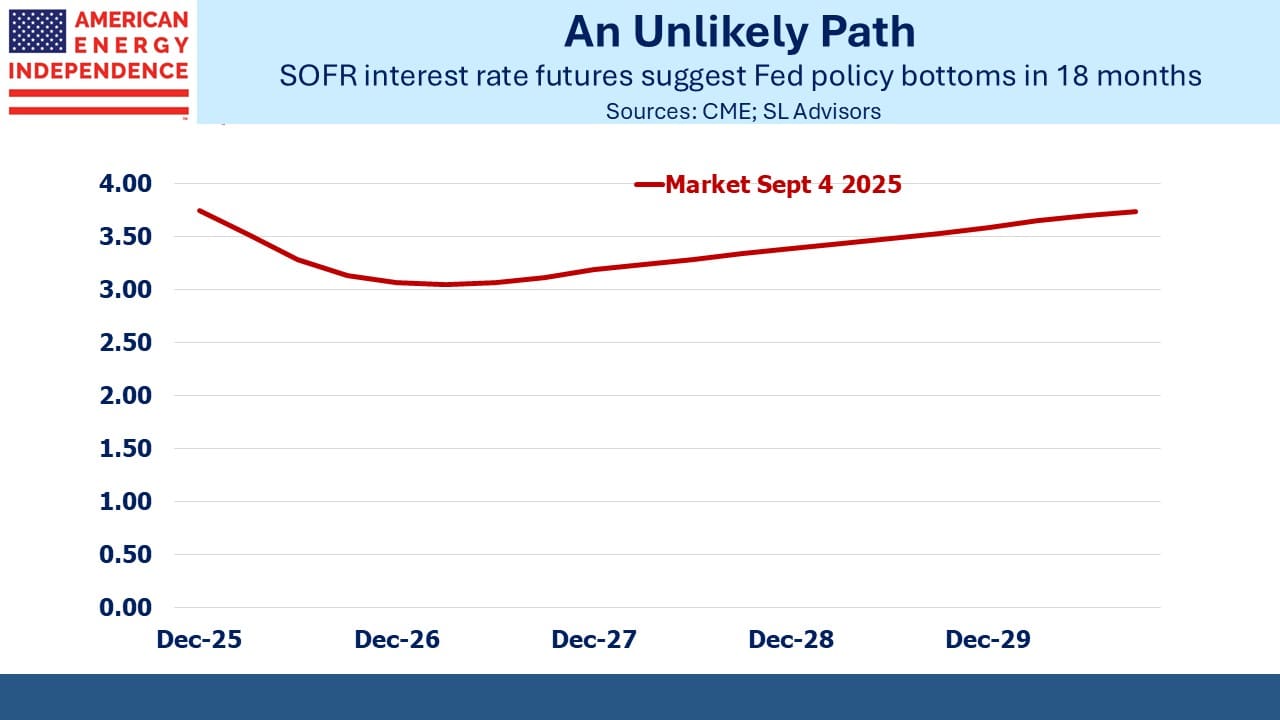

Trump isn’t the first president to call for lower rates, but as with most issues that get him exercised he is a relentless opponent willing to break norms to achieve his goals. The market is beginning to price in a Trump-managed rate cycle. It seems likely to me that his steady pressure on the Fed will tend to force short term rates lower for the rest of his term, as he finds more ways to change some FOMC members and intimidate the rest.

We are heading into a period of increased inflation tolerance. Whether or not actual inflation moves sustainably higher, few would confuse Trump with a hard-money man. If you’re excessively worried about preserving your purchasing power, arrange your investments appropriately into sectors that will respond well to rising prices – such as midstream energy infrastructure. Don’t rely on the president to help.

I increasingly run into people who differentiate between Trump’s policies and their implementation. Tariffs have turned out to be a national sales tax on imports. The Congressional Budget Office estimates they’ll generate $4TN over the next decade. Everyone who wrings their hands over our fiscal outlook and criticized the deficit increase in the One Big Beautiful Bill should welcome this new source of revenue to the Treasury.

Taxes aren’t inflationary. The prices of affected goods undergo a one-time increase. Tighter monetary policy in response would be exacerbating the headwind to consumption. Most states have a sales tax, and you’ve never heard that a monetary policy response was required.

Tariffs may not be that bad. But their implementation has been tactical and capricious.

The conventional wisdom supporting central bank independence is that it promotes low and stable inflation. There’s nothing magic about 2%. The FOMC disclosed their 2% inflation target in 2012 but for years previously had gravitated towards that level without formally adopting it. Many economists have argued that stable inflation is more important than the actual level, since it aids long term capital planning. Stability is more easily achieved around a lower number. Barry Knapp of Ironsides Economics argues that capex has historically been strongest during periods of low inflation volatility, such as from the 1960s-90s.

Our dire fiscal outlook is beginning to intrude. When the Fed raised interest rates in 2022 to combat the inflation caused by the Biden Administration’s fiscally profligate pandemic response, it drove up the cost of financing our Federal debt. With $37TN outstanding, we can no longer be oblivious to interest expense, which will exceed $1TN this year.

Trump has repeatedly accused Fed chair Jay Powell of costing us “hundreds of billions of dollars” by not cutting interest rates. As with much of Trump’s policymaking, his approach is combative and violates conventional norms. But it is reasonable to consider the Fed’s appropriate mandate given our fiscal outlook, the improvement of which both parties have concluded offers no political upside.

Federal debt has an average maturity of around six years and an average rate of 3.3%. If the Fed slashed short term rates to 1% immediately, it would take several years to meaningfully impact our interest expense. But eventually it would. If we targeted stable inflation of 3% and funded ourselves at 2%, a –1% real (i.e. inflation-adjusted) cost of financing would, over time, lower the real value of what we owe.

Mild currency debasement is a time-honored way for governments to repay less than they borrowed when adjusted for purchasing power, as I wrote in Bonds Are Not Forever; The Crisis Facing Fixed Income Investors.

The right way to do this is for Congress to debate the Fed’s dual mandate, to hold hearings and consider whether it should be changed. The world being what it is, the Administration is pursuing a different approach.

It’s easy to criticize the threat to the Fed’s independence. It’s also likely that for the balance of his term Trump will get his way. Because he’s willing to take some risk with inflation, investors should position accordingly. Unsurprisingly, we believe midstream energy infrastructure, with its inflation-linked business model, can be part of the solution.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!