BP Navigates Politics With Its Outlook

/

BP recently published their 2025 Energy Outlook. When big oil producers make projections about consumption it becomes a political document. Climate extremists are quick to accuse companies of opposing the energy transition and consigning the world to ruinous warming.

Yet capital commitments need to be based on rational expectations, not aspirational ones. Earlier this year BP slashed planned investments in renewables by $5BN because of poor returns. Its stock price has languished, leaving it vulnerable to a takeover from one of its less renewables-focused peers.

Unsurprisingly, BP protects itself from political fallout by saying in the opening paragraph that they’re not making predictions or stating what BP would like to have happen. The Current Trajectory scenario is where we’re likely going.

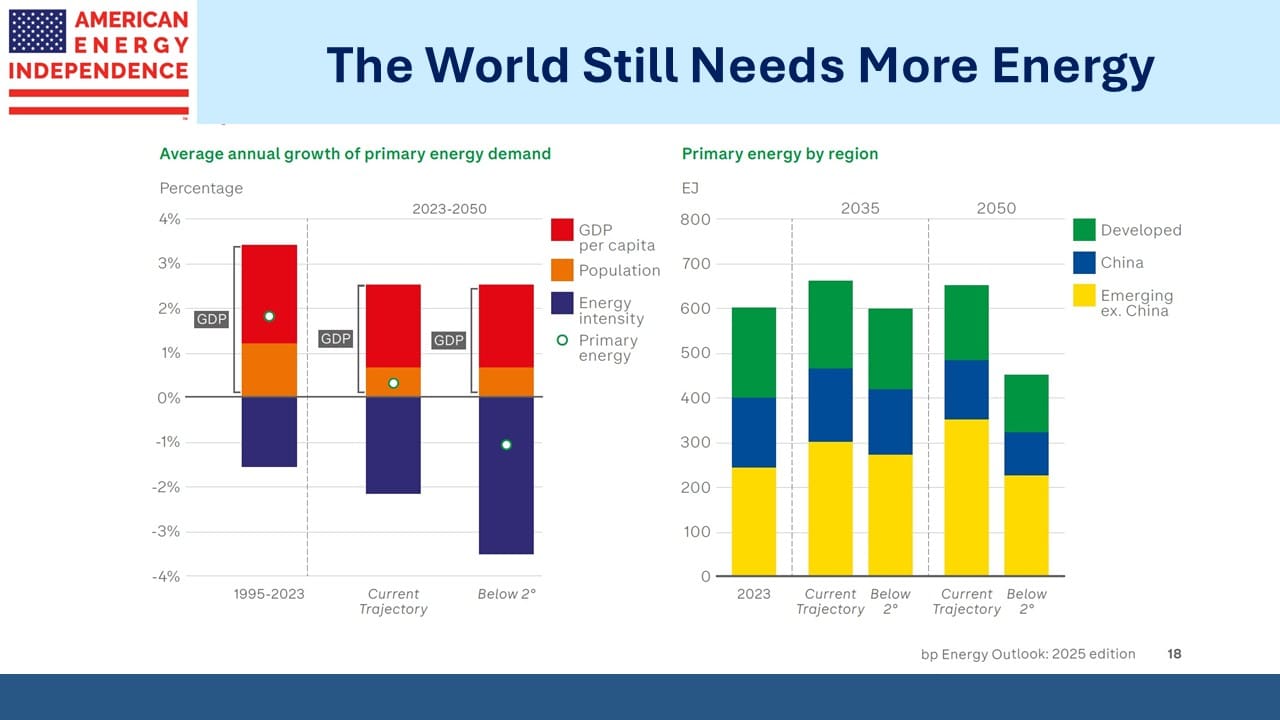

The Below 2 Degrees scenario plots what’s needed to reduce emissions enough to limit global warming by that amount (Celsius) by 2050. Most observers have given up on the original 1.5 degrees target. The main use of the Below 2 Degrees scenario is to show that reducing global energy consumption enough to reach it renders even this goal impractical as well.

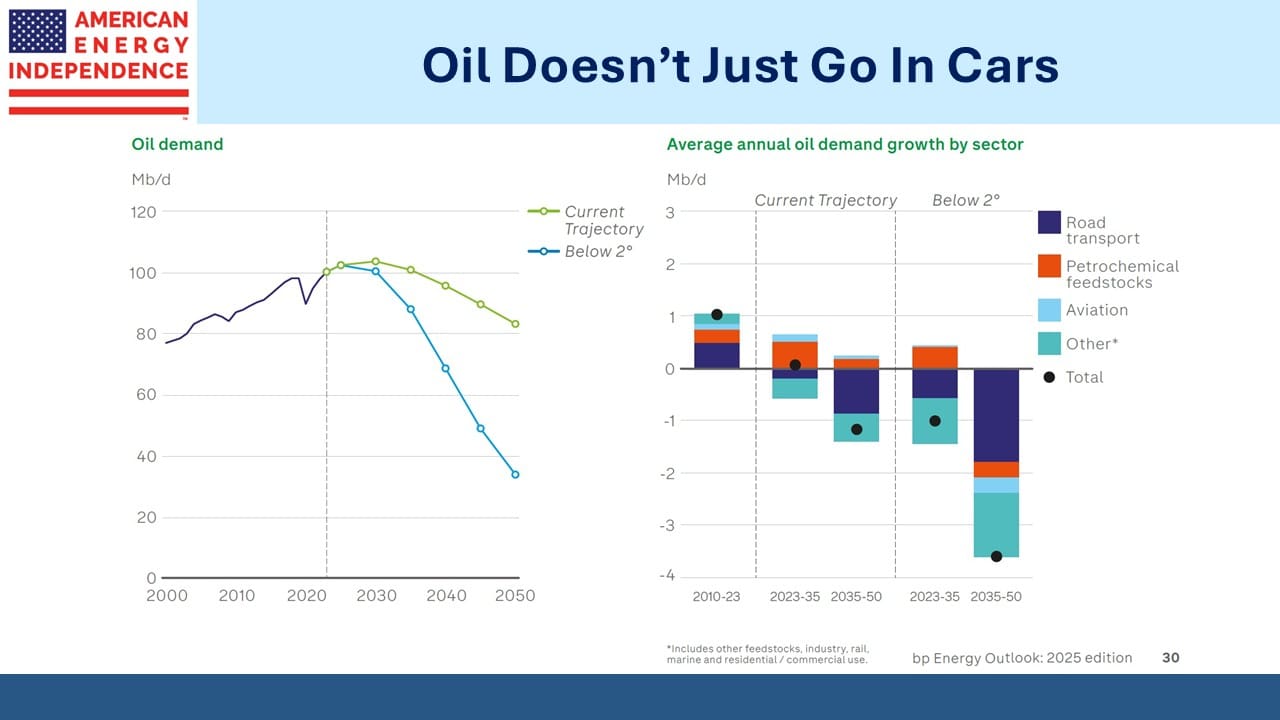

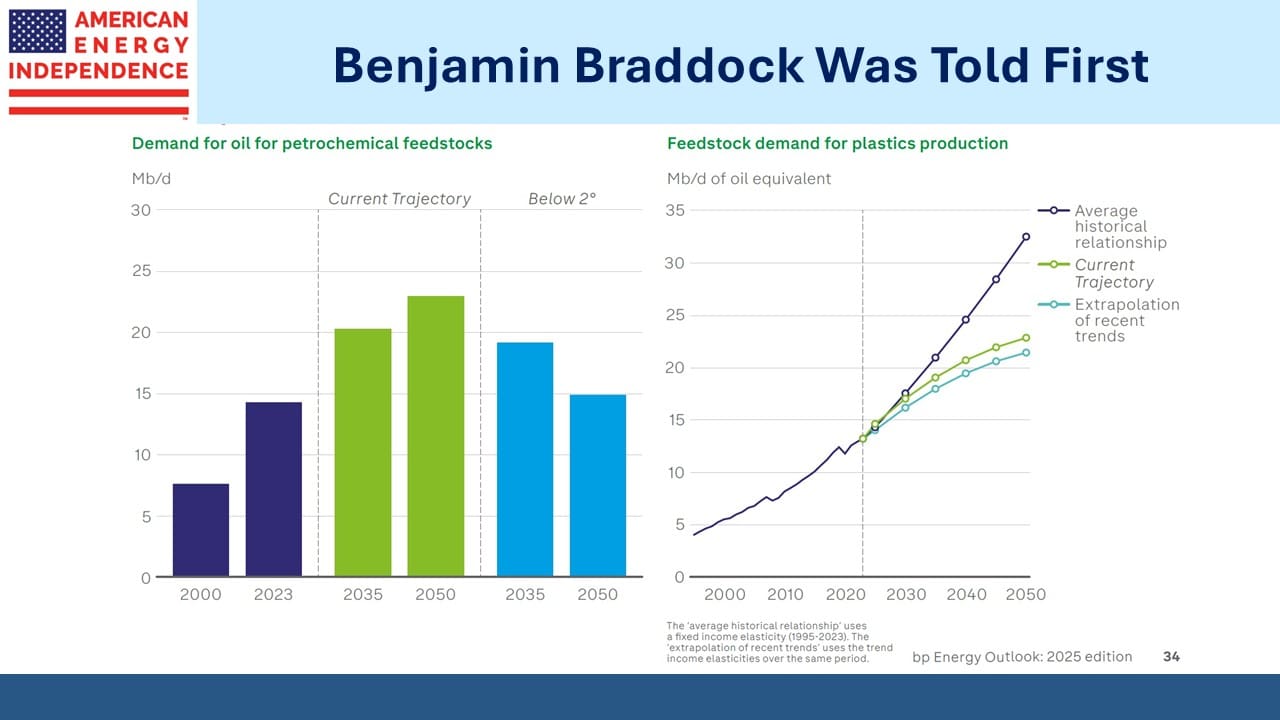

Current Trajectory offers the more interesting slides. Forecasts of peaking oil consumption are built on increasing EV penetration. But the petrochemical industry is the biggest area of growth for oil, for production of plastics as living standards improve across developing economies.

Benjamin Braddock, the recent college graduate played by Dustin Hoffman nervously resisting Anne Bancroft’s attempts to seduce him in the 1967 movie The Graduate was told to dedicate his career to plastics. It’s not a new story.

One of the many implausible outcomes in the Below 2 Degrees scenario shows petrochemical feedstocks roughly flat out to 2050. Rising living standards across non-OECD countries will drive growth for decades. A peak in the global population will probably be required to trim energy consumption including petrochemical feedstocks.

An interesting recent article in The Economist (see Humanity will shrink, far sooner than you think) examined declining birthrates as living standards rise and suggested peak population could occur within a couple of generations by around 2060. That could finally spur a drop in energy consumption, helping drive emissions lower.

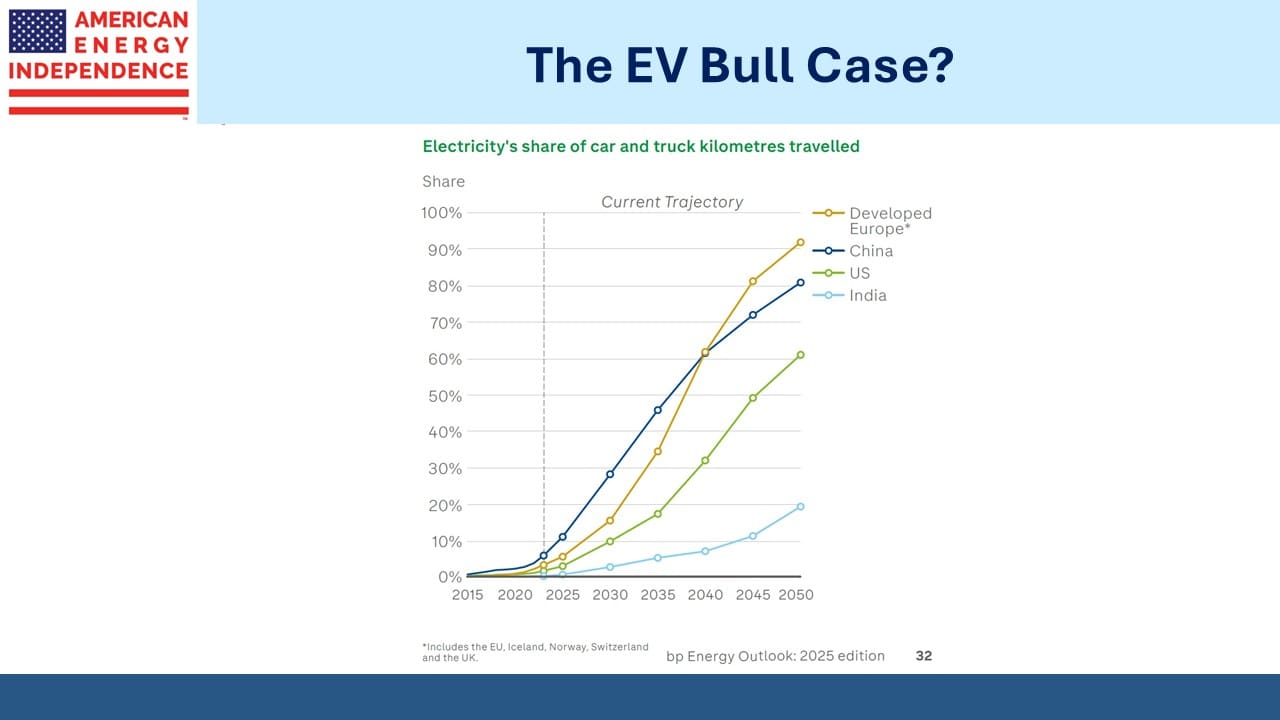

The EV chart assumes a sharp increase in EV penetration throughout the world. China may follow that path, but I’m skeptical that the US will see a tripling of EV usage within five years. 1H25 EV sales in the US were 607K, +1.5% year-on-year. The third quarter saw a big jump but with the Federal tax credit of up to $7,500 now ended we’ll see how much that ate into 4Q sales. GM recently cut EV production, citing weak demand.

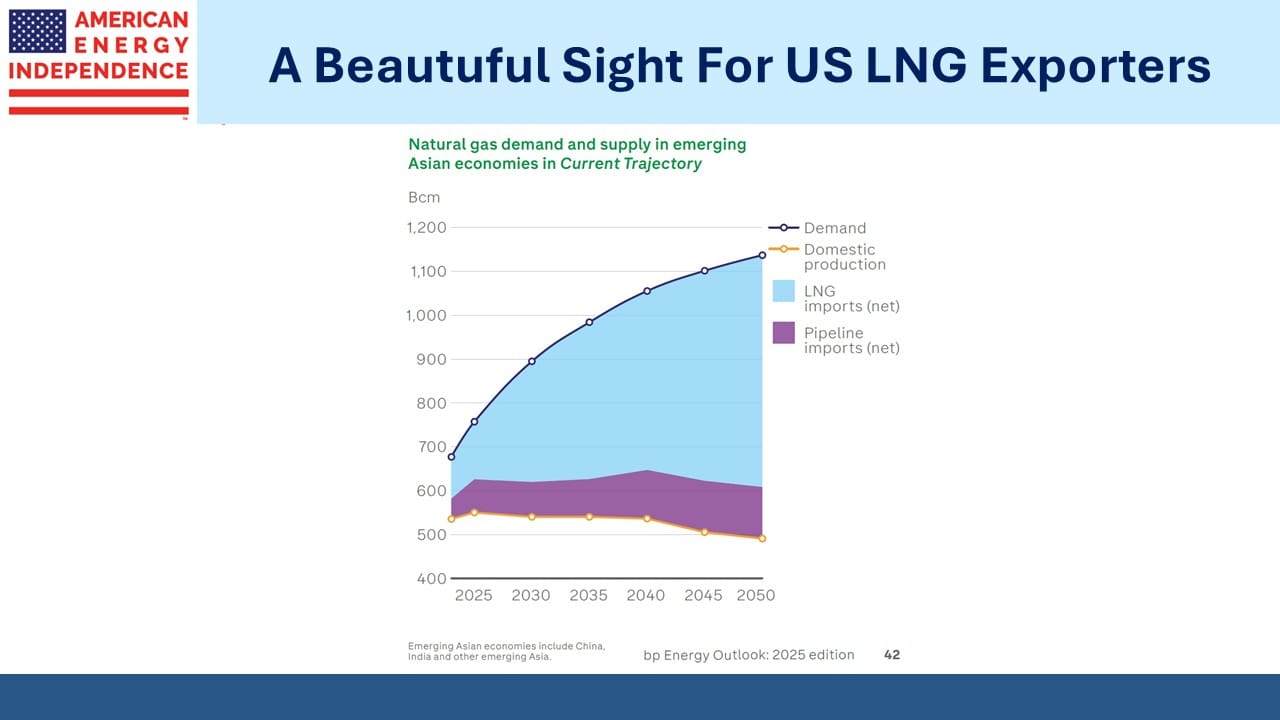

BP expects natural gas demand to keep increasing for the next couple of decades. LNG demand will soar in emerging Asia as regional production falls. As regular readers know, we are optimistic about the long term outlook for US gas exports.

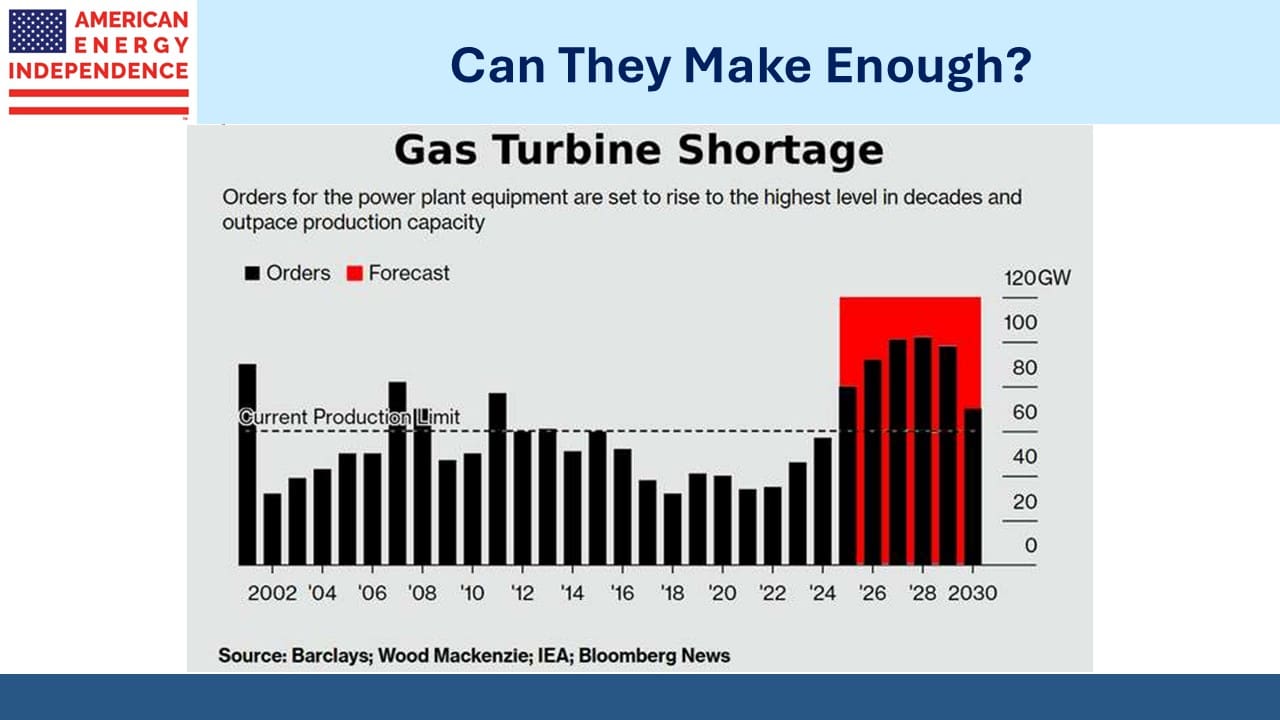

Power demand from data centers is the other growth driver for natural gas. One impediment might be the availability of gas turbines, since demand is outpacing available production capacity.

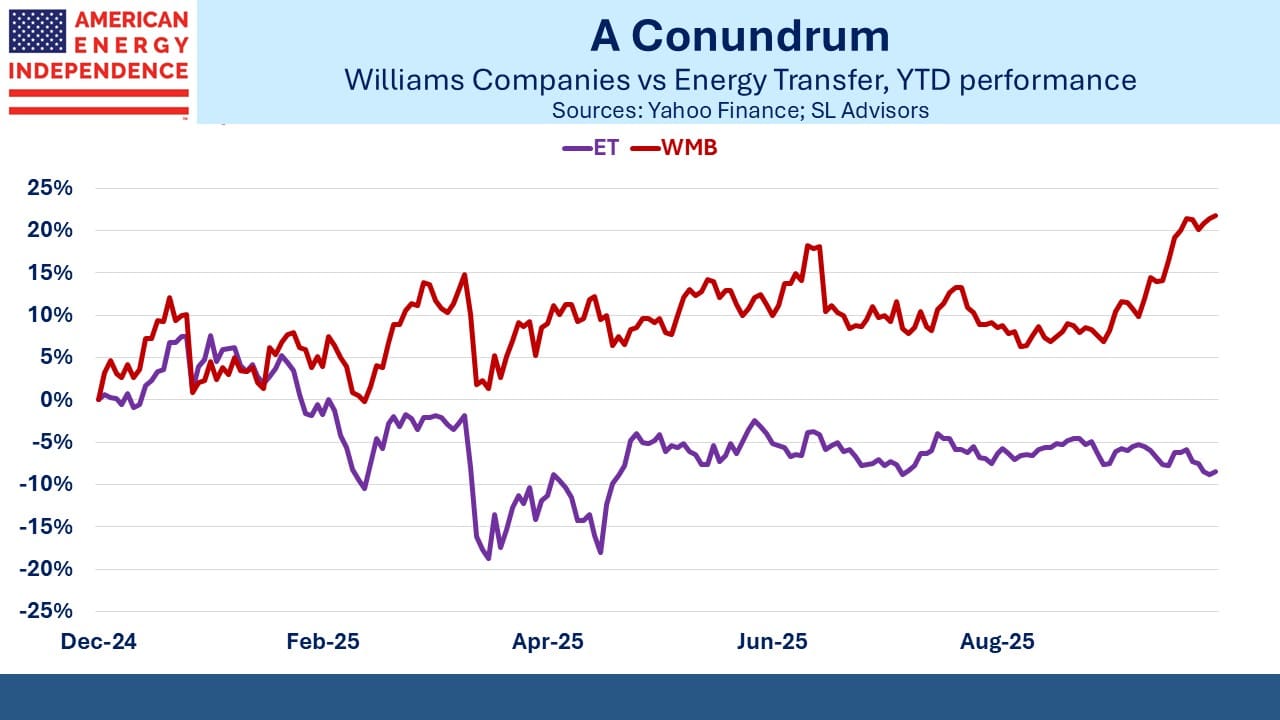

Energy Transfer (ET) is the most owned individual pipeline stock among the investors we talk to. The MLP discount keeps it perennially cheap, but that’s no reason to avoid it. Like Williams Companies (WMB), it is well positioned to provide natural gas to data centers, especially through Behind The Meter (BTM) arrangements.

BTM takes gas directly to a power plant that’s dedicated to the data center. Avoiding the highly regulated grid speeds implementation. Both companies have reported dozens of such discussions are under way.

ET’s weak performance this year surprises us. Their 7.6% dividend yield is more than 2X WMB’s 3.1%. ET’s Distributable Cash Flow (DCF) yield is a whopping 14.5% vs WMB’s 6.4%. And yet YTD WMB is beating ET by 31%.

Moreover, ET’s exposure to Permian gas in west Texas is probably better than WMB’s in Appalachia, because adding takeaway pipeline capacity within the energy-friendly Lone Star state is a lot easier than building in blue states like Virginia to reach the world’s data center capital, for now anyway. The interminable delays and huge additional cost in building Mountain Valley Pipeline from West Virginia to Virginia will dampen enthusiasm for new pipelines in that region for years to come.

For ET to be down on the year shows investor preference for bubble stocks. Cash flow and valuation will return to fashion at some point. We like both ET and WMB but have roughly double the exposure to ET that we have to WMB reflecting the former’s superior prospects and valuation.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

One reason for the market’s valuation of ET is Kelcy Warren.

This article is a real hoot, full of believe, expect, and potential statements that make me wonder if the authors have ever tried actually investing! One minute theyre super bullish on pipeline stocks like ET, the next theyre lamenting how investors prefer bubble stocks – talk about your conflicting signals! The detailed analysis of data center gas demand and Permian vs. Appalachia pipeline politics is fascinating, but did anyone stop to think that maybe building pipelines through green states is just…harder? Overall, a great read for a chuckle about the rollercoaster world of energy investing!act 2 ia