BP Navigates Politics With Its Outlook

BP recently published their 2025 Energy Outlook. When big oil producers make projections about consumption it becomes a political document. Climate extremists are quick to accuse companies of opposing the energy transition and consigning the world to ruinous warming.

Yet capital commitments need to be based on rational expectations, not aspirational ones. Earlier this year BP slashed planned investments in renewables by $5BN because of poor returns. Its stock price has languished, leaving it vulnerable to a takeover from one of its less renewables-focused peers.

Unsurprisingly, BP protects itself from political fallout by saying in the opening paragraph that they’re not making predictions or stating what BP would like to have happen. The Current Trajectory scenario is where we’re likely going.

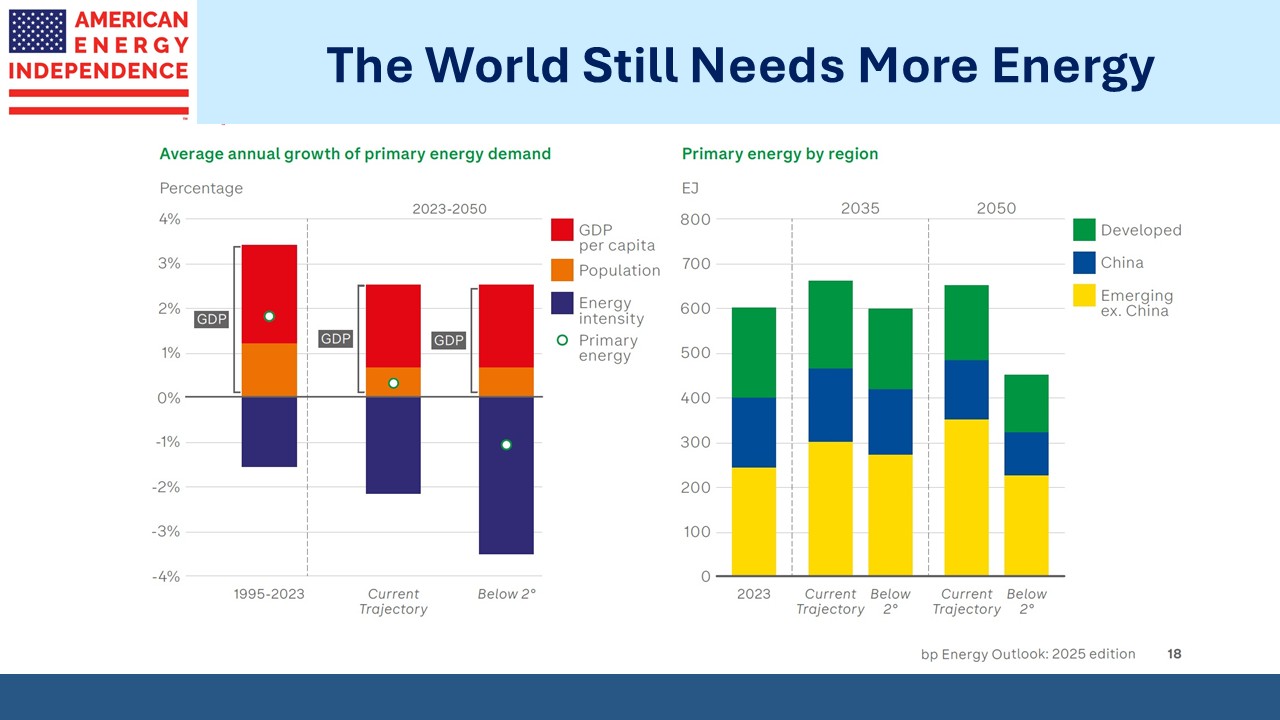

The Below 2 Degrees scenario plots what’s needed to reduce emissions enough to limit global warming by that amount (Celsius) by 2050. Most observers have given up on the original 1.5 degrees target. The main use of the Below 2 Degrees scenario is to show that reducing global energy consumption enough to reach it renders even this goal impractical as well.

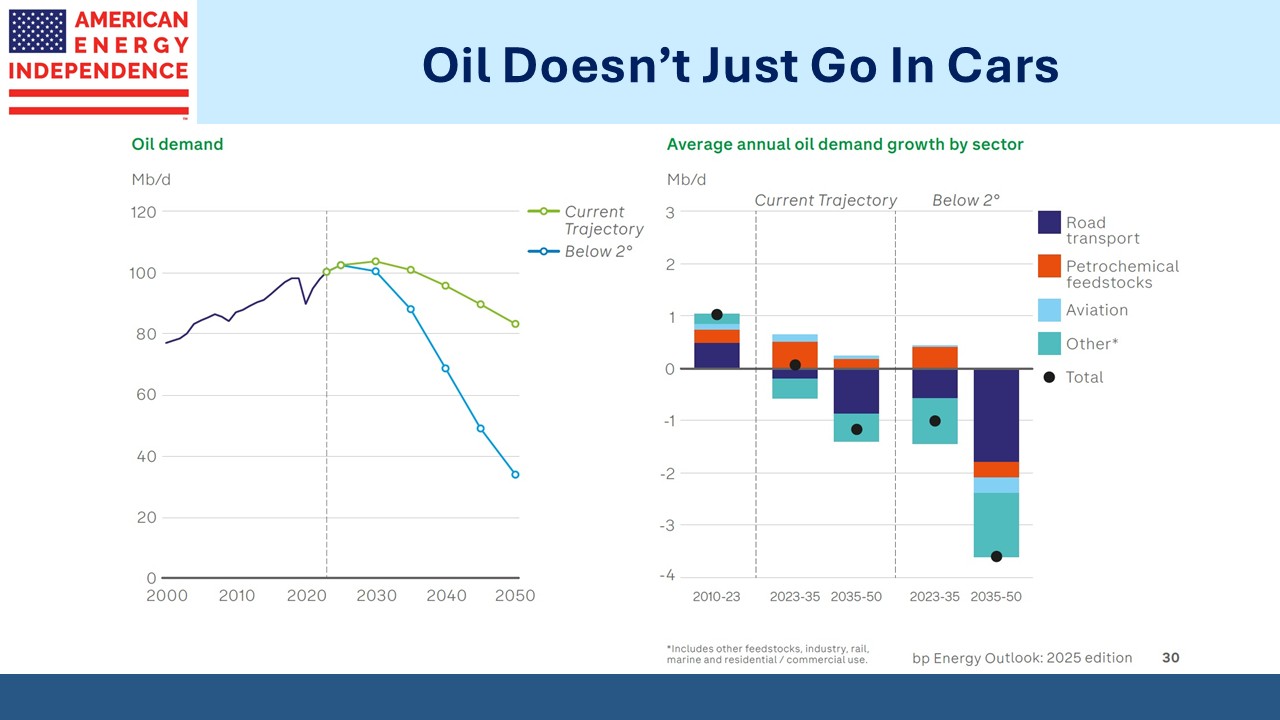

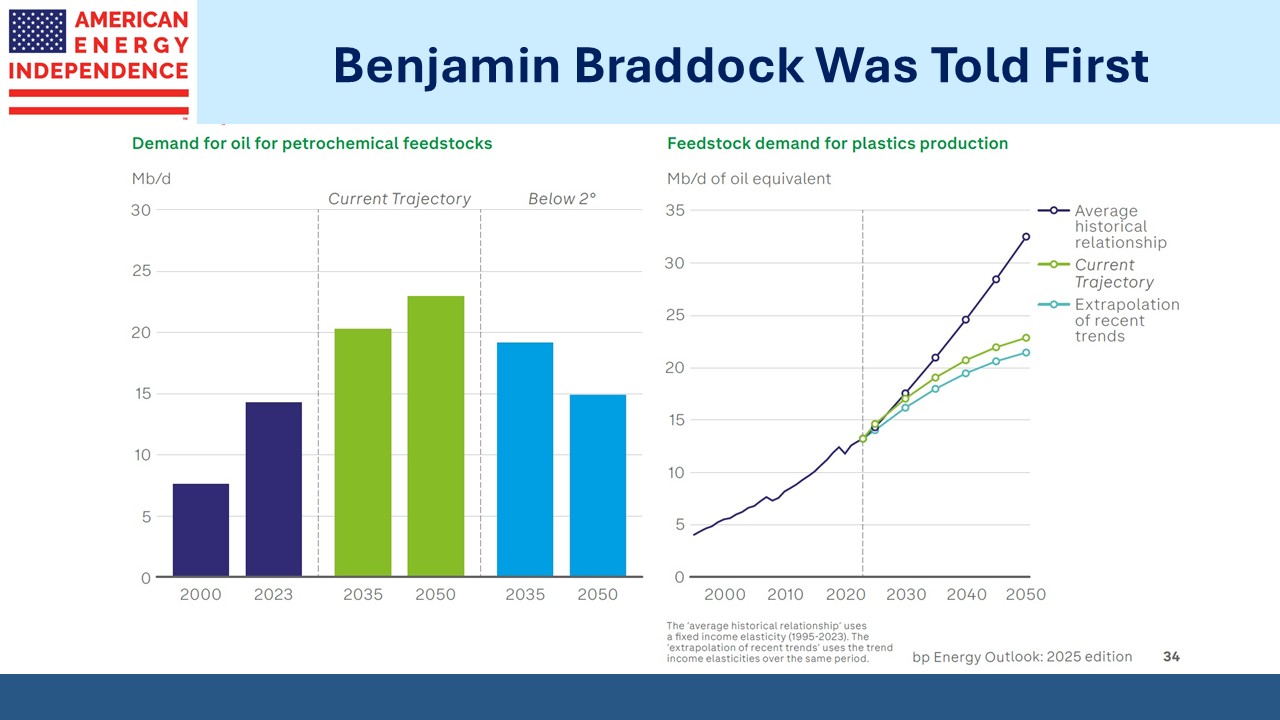

Current Trajectory offers the more interesting slides. Forecasts of peaking oil consumption are built on increasing EV penetration. But the petrochemical industry is the biggest area of growth for oil, for production of plastics as living standards improve across developing economies.

Benjamin Braddock, the recent college graduate played by Dustin Hoffman nervously resisting Anne Bancroft’s attempts to seduce him in the 1967 movie The Graduate was told to dedicate his career to plastics. It’s not a new story.

One of the many implausible outcomes in the Below 2 Degrees scenario shows petrochemical feedstocks roughly flat out to 2050. Rising living standards across non-OECD countries will drive growth for decades. A peak in the global population will probably be required to trim energy consumption including petrochemical feedstocks.

An interesting recent article in The Economist (see Humanity will shrink, far sooner than you think) examined declining birthrates as living standards rise and suggested peak population could occur within a couple of generations by around 2060. That could finally spur a drop in energy consumption, helping drive emissions lower.

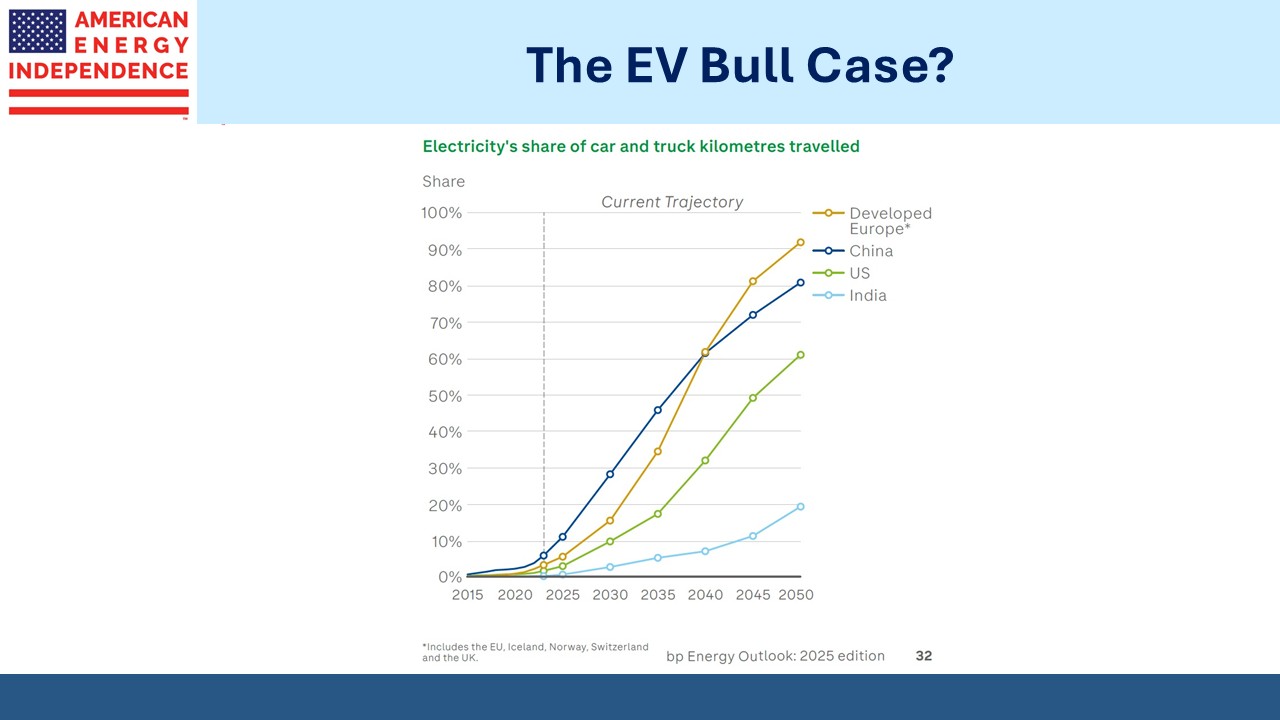

The EV chart assumes a sharp increase in EV penetration throughout the world. China may follow that path, but I’m skeptical that the US will see a tripling of EV usage within five years. 1H25 EV sales in the US were 607K, +1.5% year-on-year. The third quarter saw a big jump but with the Federal tax credit of up to $7,500 now ended we’ll see how much that ate into 4Q sales. GM recently cut EV production, citing weak demand.

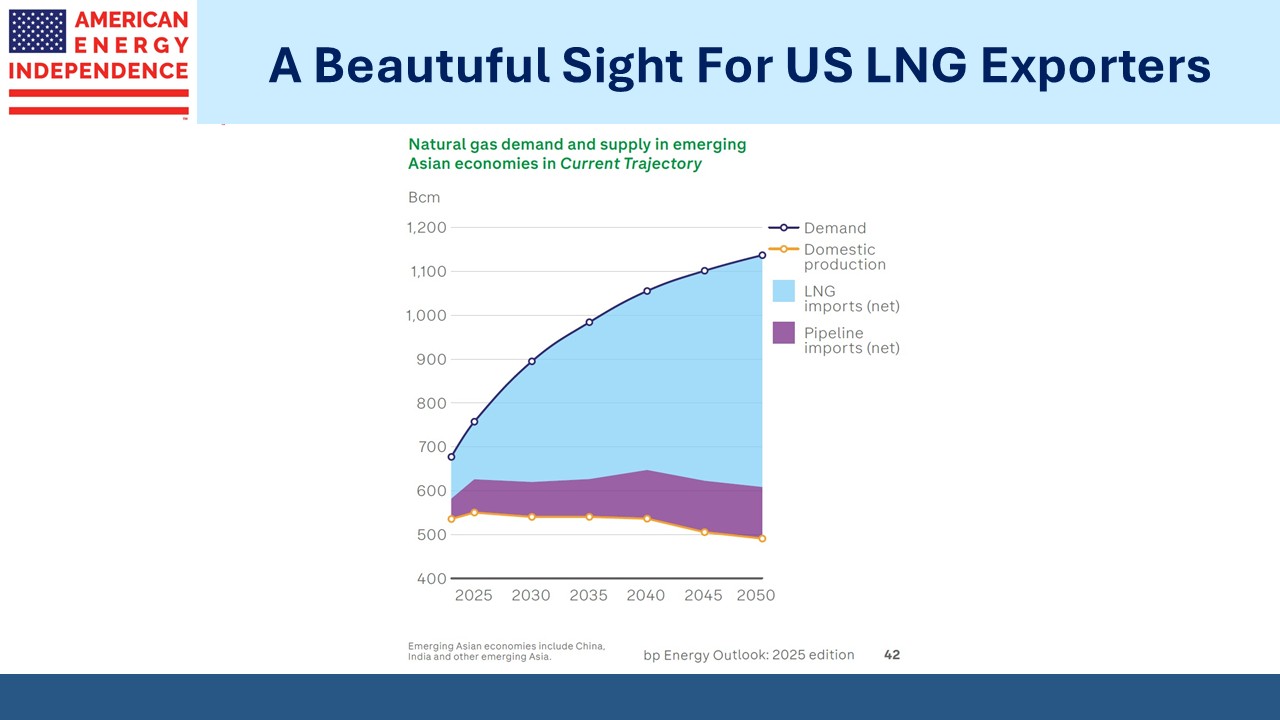

BP expects natural gas demand to keep increasing for the next couple of decades. LNG demand will soar in emerging Asia as regional production falls. As regular readers know, we are optimistic about the long term outlook for US gas exports.

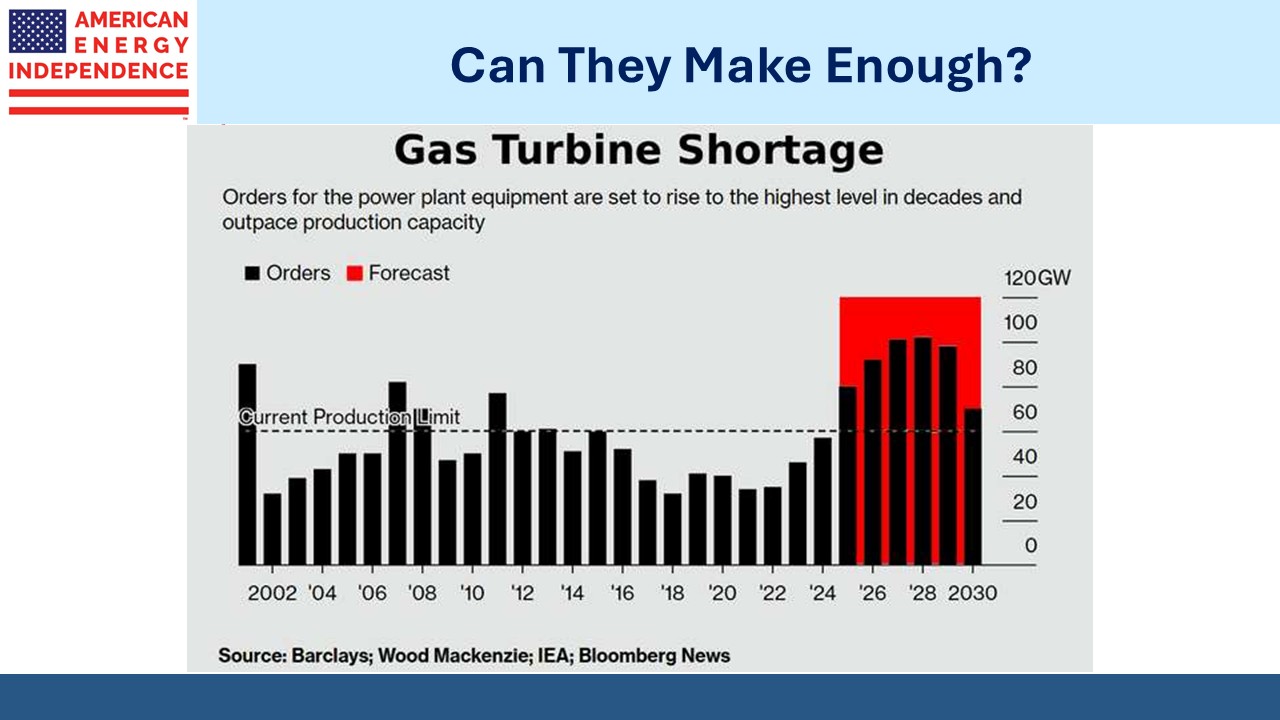

Power demand from data centers is the other growth driver for natural gas. One impediment might be the availability of gas turbines, since demand is outpacing available production capacity.

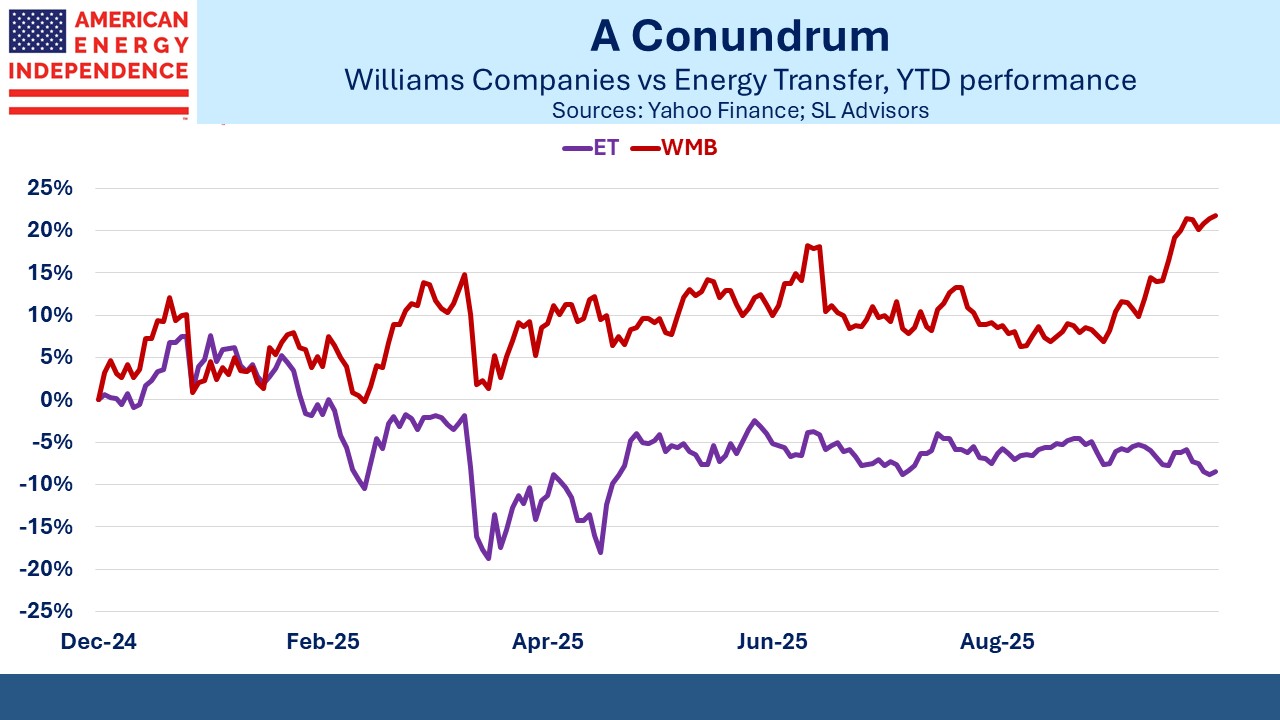

Energy Transfer (ET) is the most owned individual pipeline stock among the investors we talk to. The MLP discount keeps it perennially cheap, but that’s no reason to avoid it. Like Williams Companies (WMB), it is well positioned to provide natural gas to data centers, especially through Behind The Meter (BTM) arrangements.

BTM takes gas directly to a power plant that’s dedicated to the data center. Avoiding the highly regulated grid speeds implementation. Both companies have reported dozens of such discussions are under way.

ET’s weak performance this year surprises us. Their 7.6% dividend yield is more than 2X WMB’s 3.1%. ET’s Distributable Cash Flow (DCF) yield is a whopping 14.5% vs WMB’s 6.4%. And yet YTD WMB is beating ET by 31%.

Moreover, ET’s exposure to Permian gas in west Texas is probably better than WMB’s in Appalachia, because adding takeaway pipeline capacity within the energy-friendly Lone Star state is a lot easier than building in blue states like Virginia to reach the world’s data center capital, for now anyway. The interminable delays and huge additional cost in building Mountain Valley Pipeline from West Virginia to Virginia will dampen enthusiasm for new pipelines in that region for years to come.

For ET to be down on the year shows investor preference for bubble stocks. Cash flow and valuation will return to fashion at some point. We like both ET and WMB but have roughly double the exposure to ET that we have to WMB reflecting the former’s superior prospects and valuation.

We have two have funds that seek to profit from this environment: