The Smart Money Buying Pipelines

/

When a sector has enjoyed a period of good performance, the investor typically has to moderate her feelings of satisfaction at a choice well made with concerns about a crowded trade. When a good idea becomes widely acknowledged as one, prices are likely to overshoot as valuations become stretched.

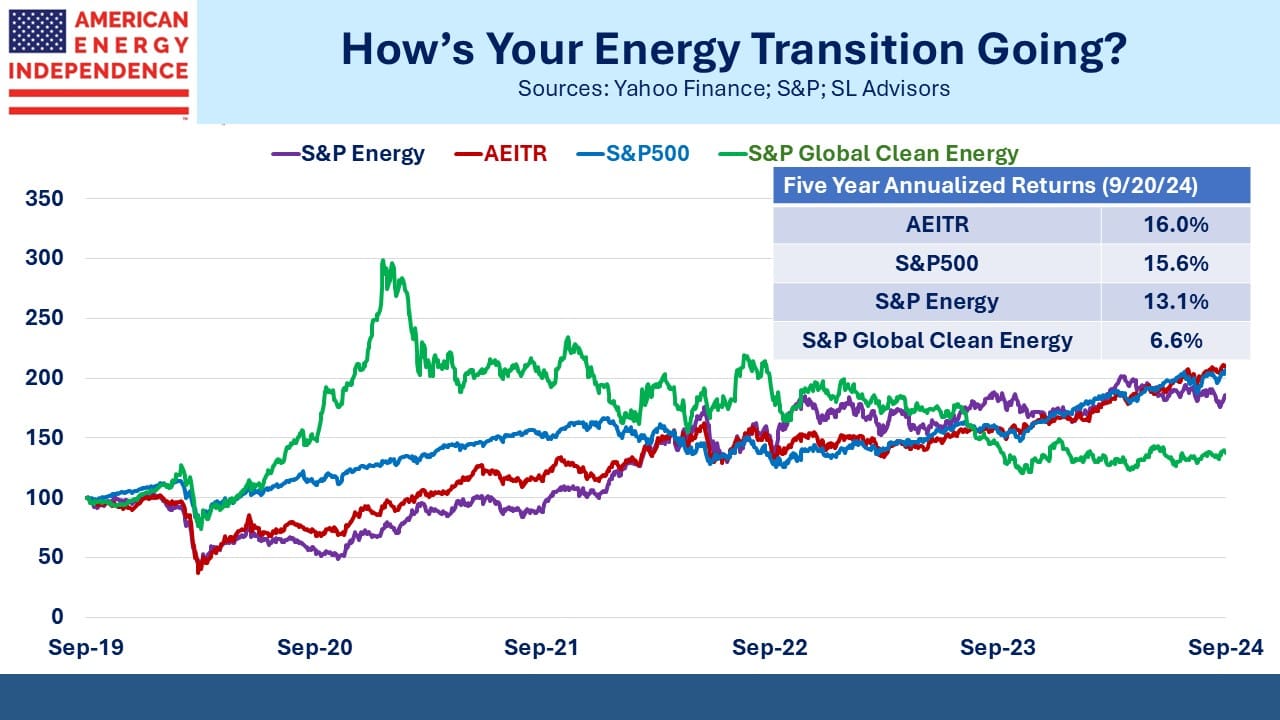

This does not seem to be the case for midstream energy infrastructure, which has returned 16% pa over the last five years. It has generated very satisfactory returns without creating a destabilizing inflow of capital. Pipeline investors have enjoyed a stealth rally – a relentless appreciation that has not caught the attention of social media or most market observers.

We talk to potential investors all the time. Reasons for not investing include fears that lower oil prices could hurt the sector as happened during the pandemic. This overlooks that midstream has delivered several years of good performance while oil and gas prices have languished. The S&P Energy ETF offers that type of commodity price exposure, but reduced leverage throughout the pipeline sector has dampened the relationship with oil.

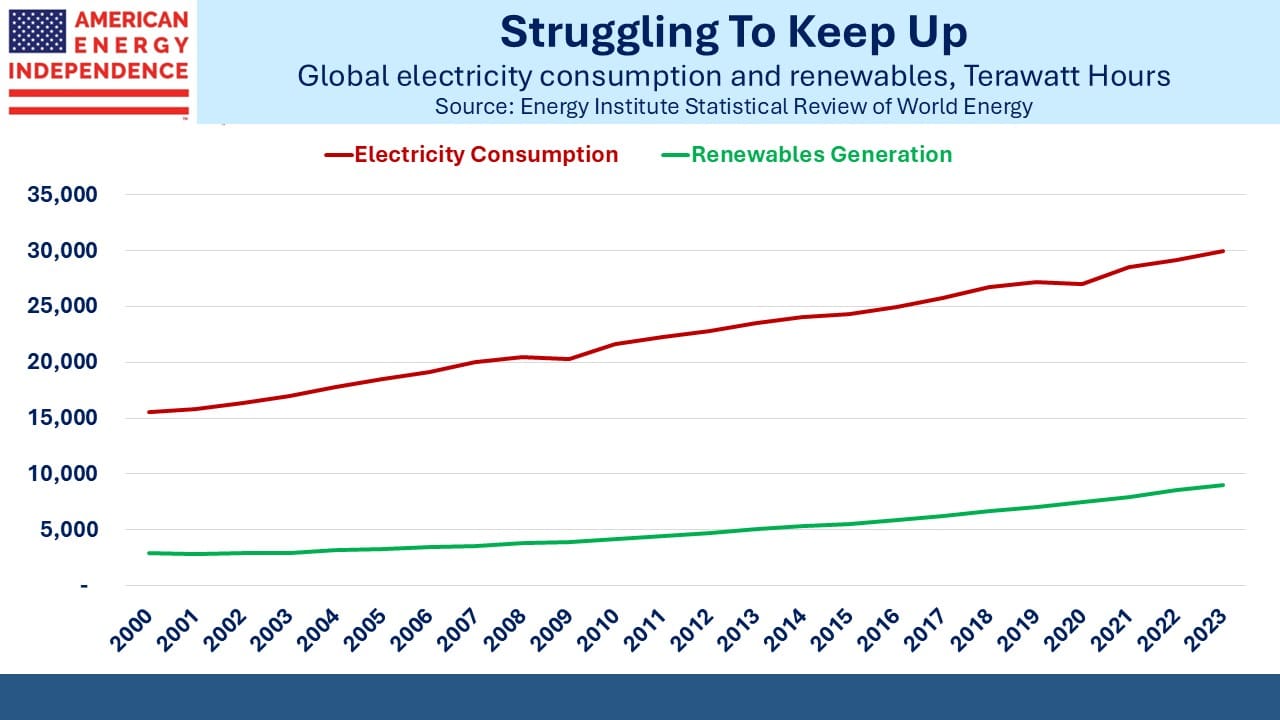

Some still fear that the energy transition will lead to stranded assets as the world moves away from fossil fuels. But the evidence of recent years is that we’re going to use more of every type of energy. Global primary energy derived from renewables is growing only half as much as the demand for electricity. Peak fossil fuel demand is a long way off.

We also run across investors who just find energy too hard, with numerous policy issues that require analysis. The White House has pursued an ambiguous approach – variously encouraging domestic oil production when rising prices caused electoral concern and flip-flopping on fracking (like John Kerry, Biden/Harris were against it before they were for it), but then pausing new LNG permits when left wing Democrats needed some love.

Joe Biden’s embrace of a renewables-based economy is largely based on substantial tax subsidies such as the Inflation Reduction Act. To paraphrase St Augustine, “Lord, give me chastity (or get America off fossil fuels), just not yet.”

Improbably, this has worked out quite well for the US economy, which continues to attract foreign direct investment from manufacturing powerhouses such as Germany where the “energiewende” is strangling domestic businesses with high prices. The 15% reduction in CO2 emissions we’ve achieved over the past couple of decades is short of what the EU has delivered but hasn’t been that painful either.

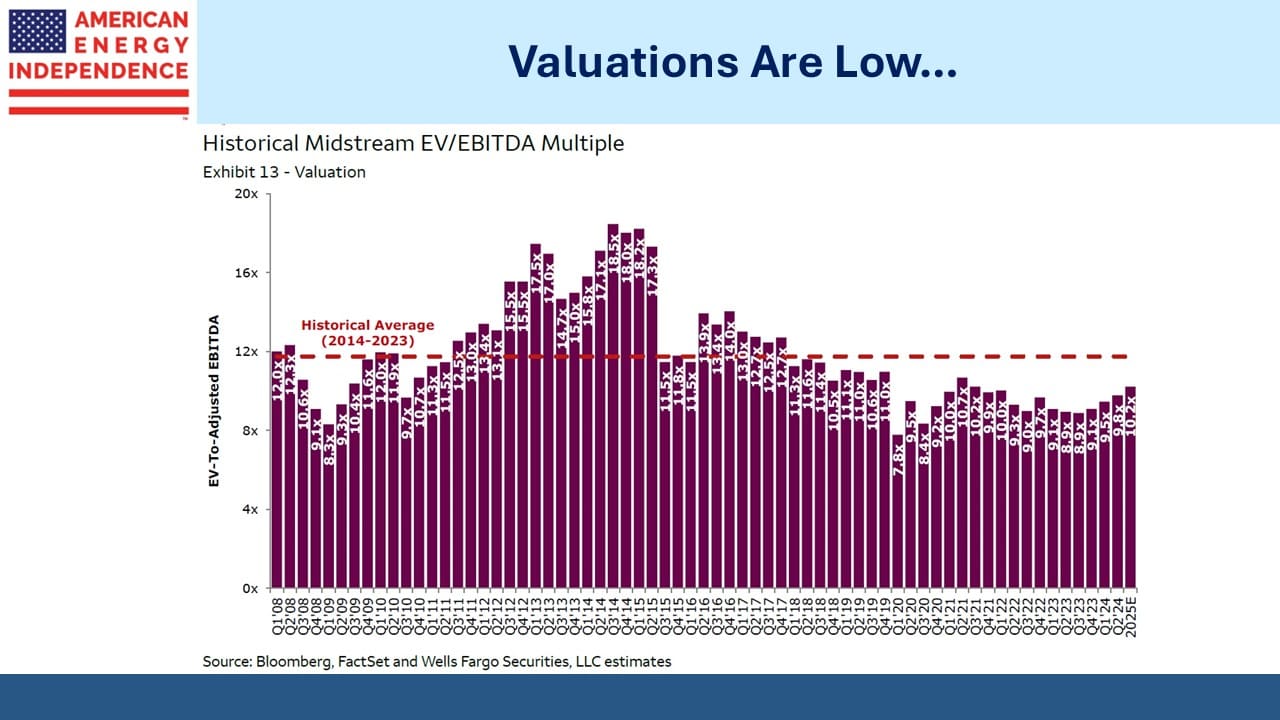

Midstream’s strong performance hasn’t relied on strong fund flows, and as a result valuations have remained attractive. It’s beaten the S&P energy sector and crushed clean energy. To make a small fortune in renewables start with a big one. Midstream has even stayed marginally ahead of the S&P500 without including any high-flying AI stocks. It just keeps moving steadily higher.

Years of outperformance have accrued to comparatively few cognoscenti willing to invest the time required to understand the underlying fundamentals.

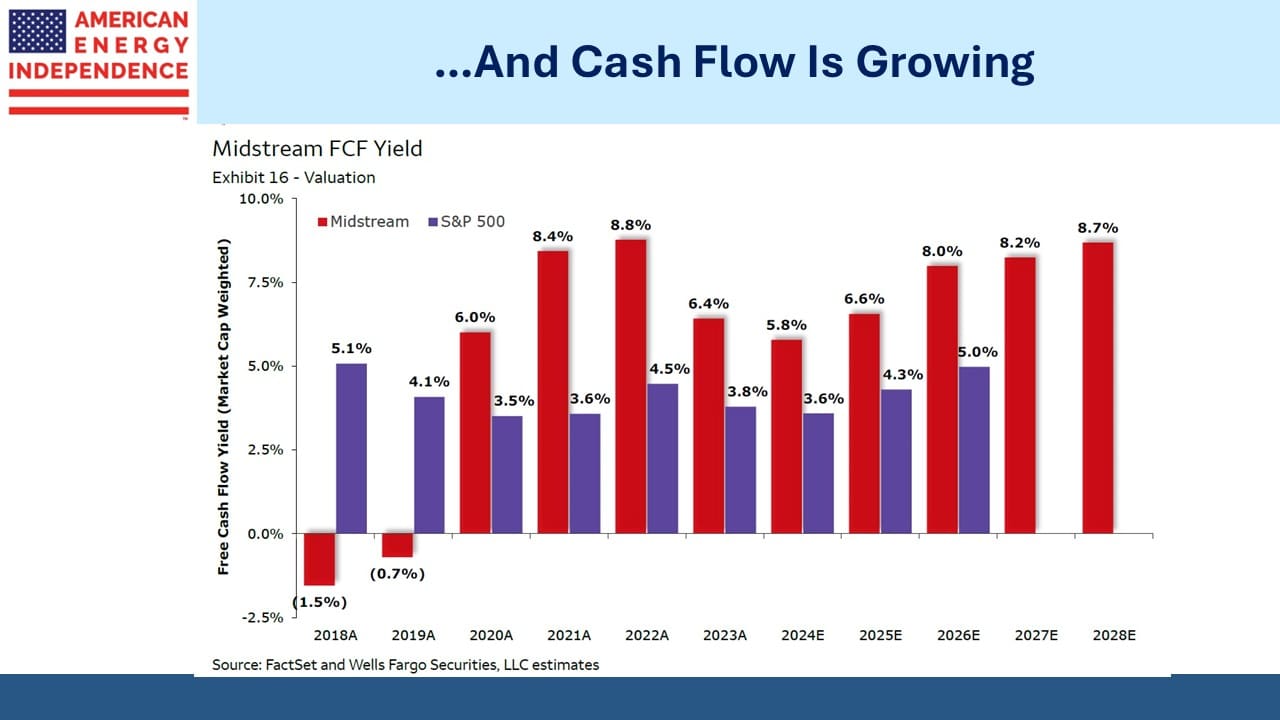

Metrics such as Enterprise Value/EBITDA continue to show the sector as historically cheap. Free Cash Flow (FCF) yields have dipped over the past year as stock prices have climbed, but the growth outlook is such that at current levels yields are set to move higher. Without further appreciation, within a couple of years FCF yields will be headed back towards the high levels of 2021-22.

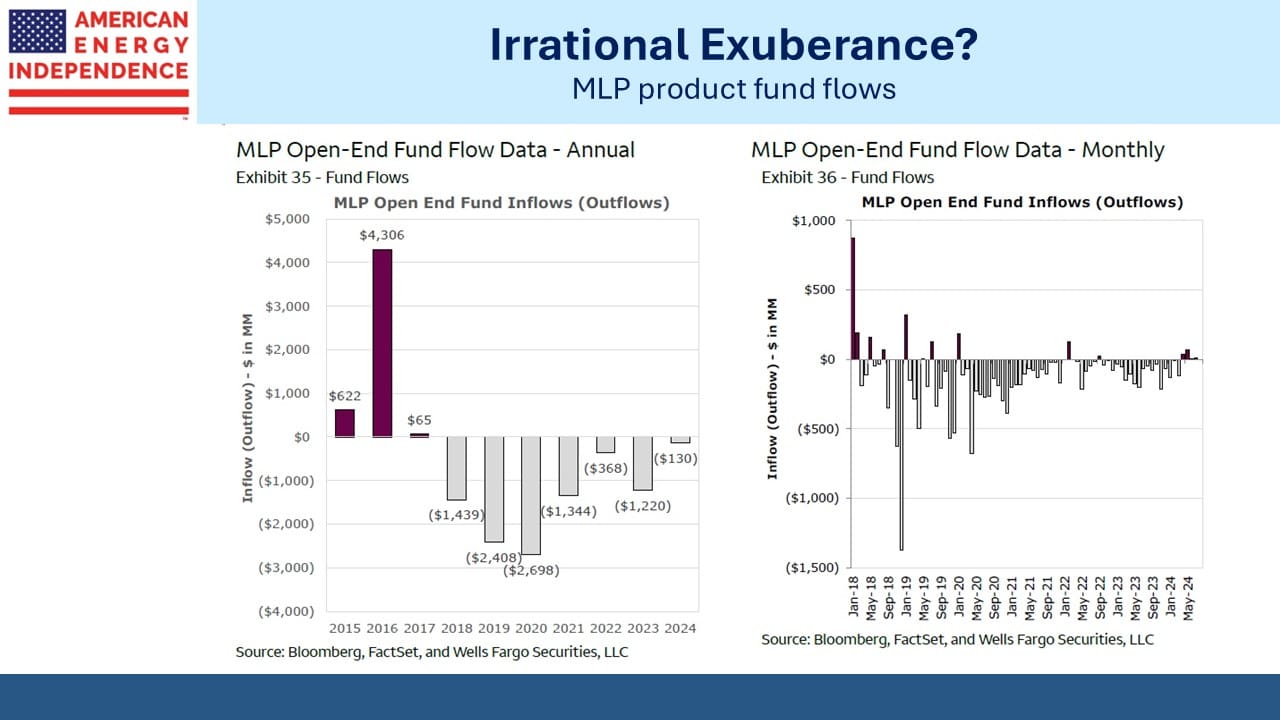

For the past seven years midstream funds have seen net outflows, typically around $1-2BN. Most months are negative, although this summer there were a couple months with small inflows. There is no panic buying in this sector.

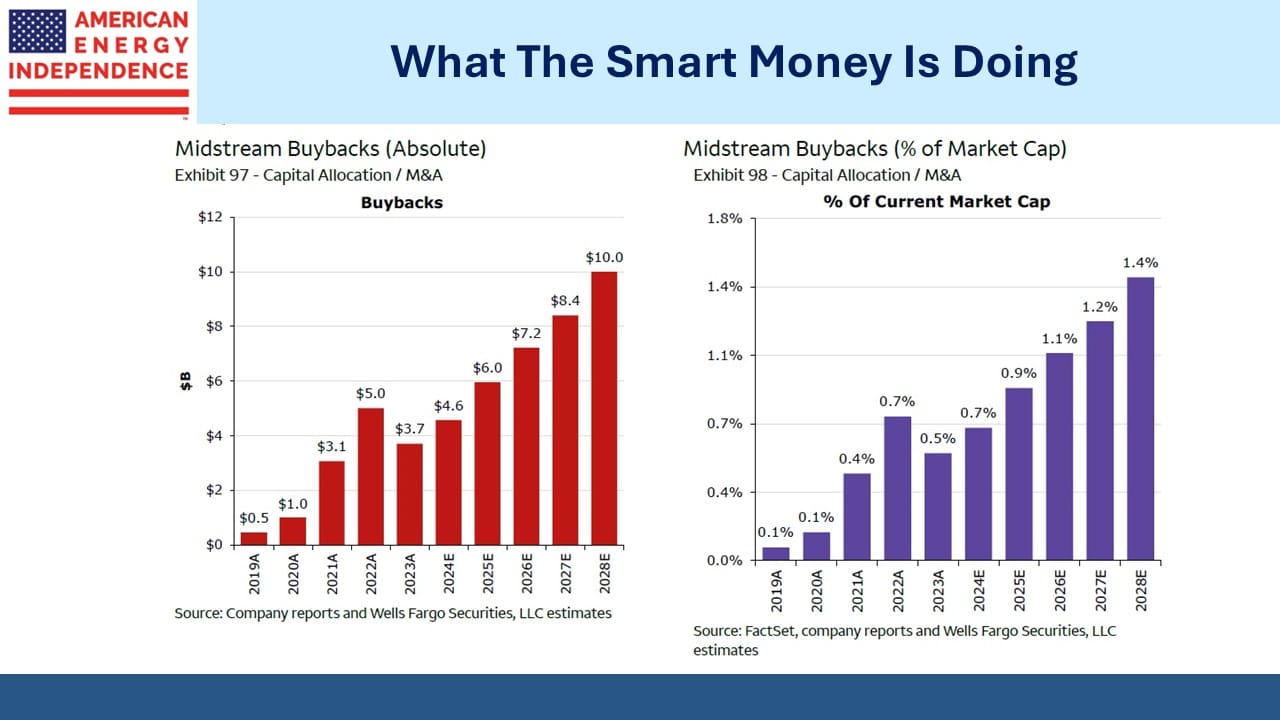

When midstream companies were organized as MLPs buybacks were rare. More common was the regular trickle of secondary offerings to finance “drop-down” purchases from their controlling general partner.

The MLP structure has lost favor to the single entity c-corp with its simplified tax reporting (1099 vs K1). This has coincided with reduced capex and improved financial discipline as companies have concluded that we mostly have the pipeline network we need, and climate extremists have made new construction torturous.

The consequent growth in cashflows has enabled the midstream sector to start repurchasing stock. In recent years these purchases have exceeded the net fund outflows. This year’s stock purchases are over $4BN ahead of fund redemptions. The most informed are buying from the less informed, and the imbalance is growing.

Wells Fargo is forecasting that increasing cash generation by midstream companies will fuel further buybacks. This has helped the American Energy Independence Index (AEITR) to a 27% YTD return.

Imagine what might happen if fund flows turn positive.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!