The Smart Money Buying Pipelines

When a sector has enjoyed a period of good performance, the investor typically has to moderate her feelings of satisfaction at a choice well made with concerns about a crowded trade. When a good idea becomes widely acknowledged as one, prices are likely to overshoot as valuations become stretched.

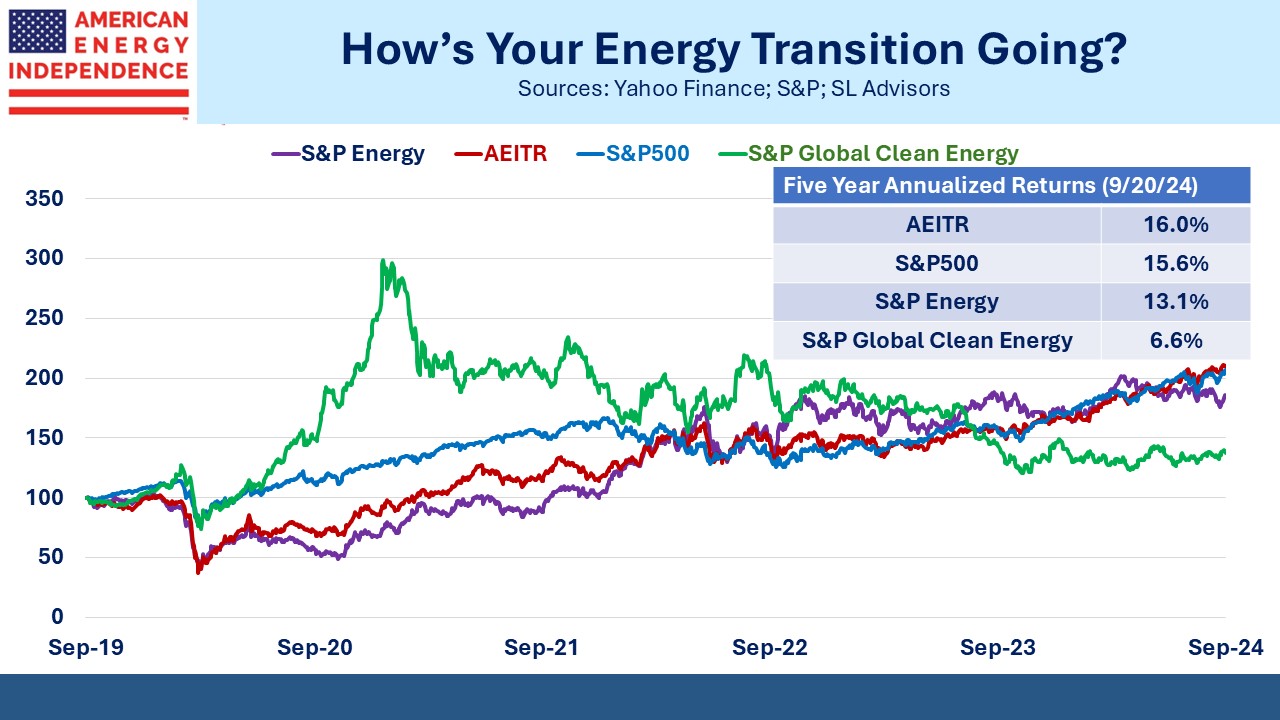

This does not seem to be the case for midstream energy infrastructure, which has returned 16% pa over the last five years. It has generated very satisfactory returns without creating a destabilizing inflow of capital. Pipeline investors have enjoyed a stealth rally – a relentless appreciation that has not caught the attention of social media or most market observers.

We talk to potential investors all the time. Reasons for not investing include fears that lower oil prices could hurt the sector as happened during the pandemic. This overlooks that midstream has delivered several years of good performance while oil and gas prices have languished. The S&P Energy ETF offers that type of commodity price exposure, but reduced leverage throughout the pipeline sector has dampened the relationship with oil.

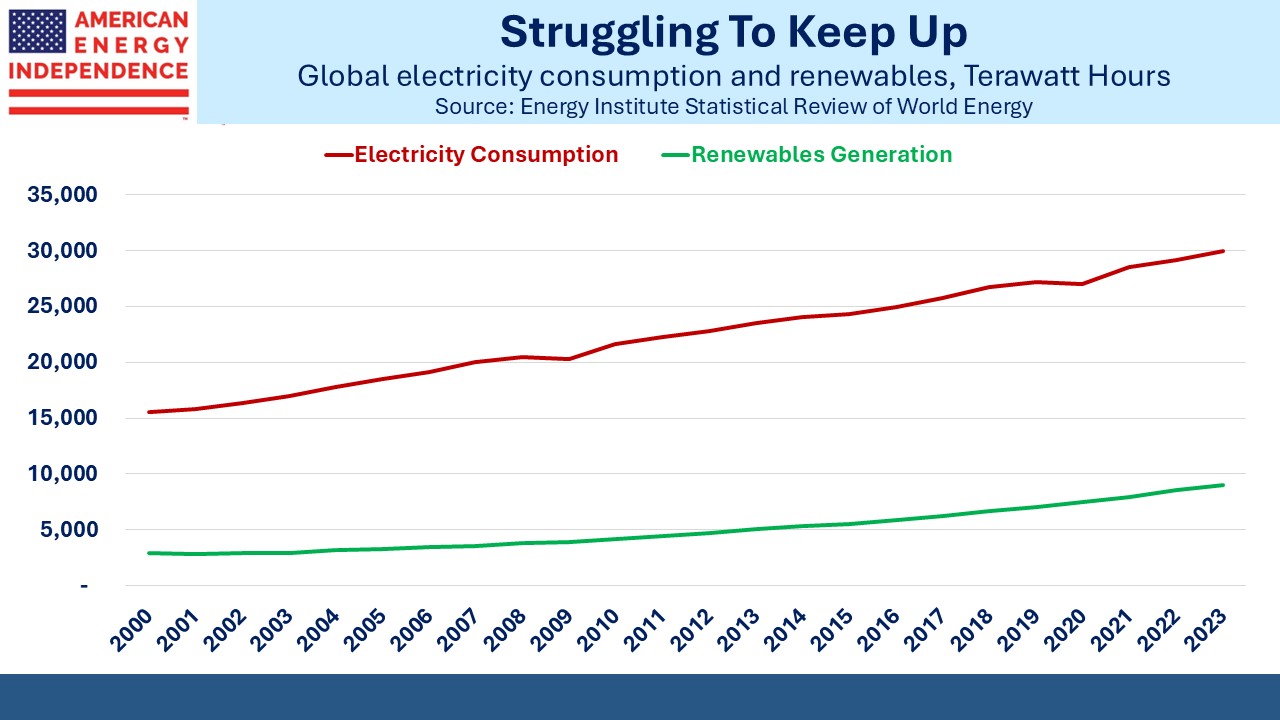

Some still fear that the energy transition will lead to stranded assets as the world moves away from fossil fuels. But the evidence of recent years is that we’re going to use more of every type of energy. Global primary energy derived from renewables is growing only half as much as the demand for electricity. Peak fossil fuel demand is a long way off.

We also run across investors who just find energy too hard, with numerous policy issues that require analysis. The White House has pursued an ambiguous approach – variously encouraging domestic oil production when rising prices caused electoral concern and flip-flopping on fracking (like John Kerry, Biden/Harris were against it before they were for it), but then pausing new LNG permits when left wing Democrats needed some love.

Joe Biden’s embrace of a renewables-based economy is largely based on substantial tax subsidies such as the Inflation Reduction Act. To paraphrase St Augustine, “Lord, give me chastity (or get America off fossil fuels), just not yet.”

Improbably, this has worked out quite well for the US economy, which continues to attract foreign direct investment from manufacturing powerhouses such as Germany where the “energiewende” is strangling domestic businesses with high prices. The 15% reduction in CO2 emissions we’ve achieved over the past couple of decades is short of what the EU has delivered but hasn’t been that painful either.

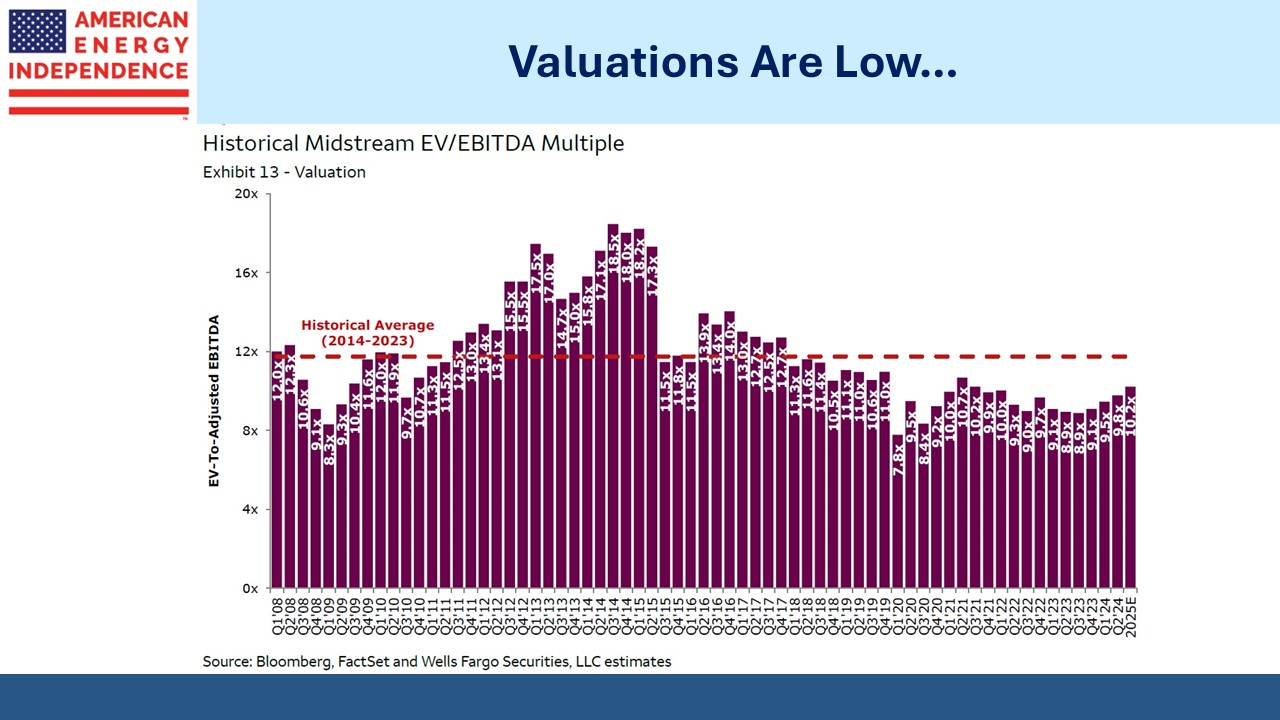

Midstream’s strong performance hasn’t relied on strong fund flows, and as a result valuations have remained attractive. It’s beaten the S&P energy sector and crushed clean energy. To make a small fortune in renewables start with a big one. Midstream has even stayed marginally ahead of the S&P500 without including any high-flying AI stocks. It just keeps moving steadily higher.

Years of outperformance have accrued to comparatively few cognoscenti willing to invest the time required to understand the underlying fundamentals.

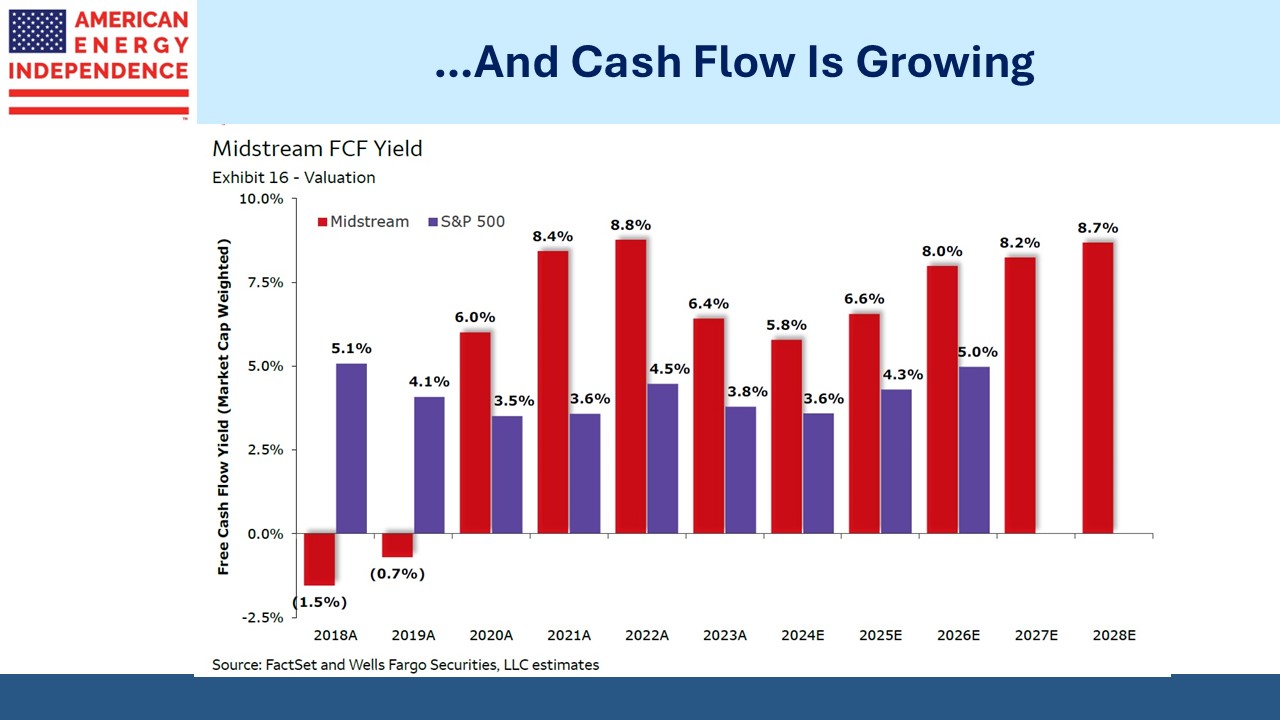

Metrics such as Enterprise Value/EBITDA continue to show the sector as historically cheap. Free Cash Flow (FCF) yields have dipped over the past year as stock prices have climbed, but the growth outlook is such that at current levels yields are set to move higher. Without further appreciation, within a couple of years FCF yields will be headed back towards the high levels of 2021-22.

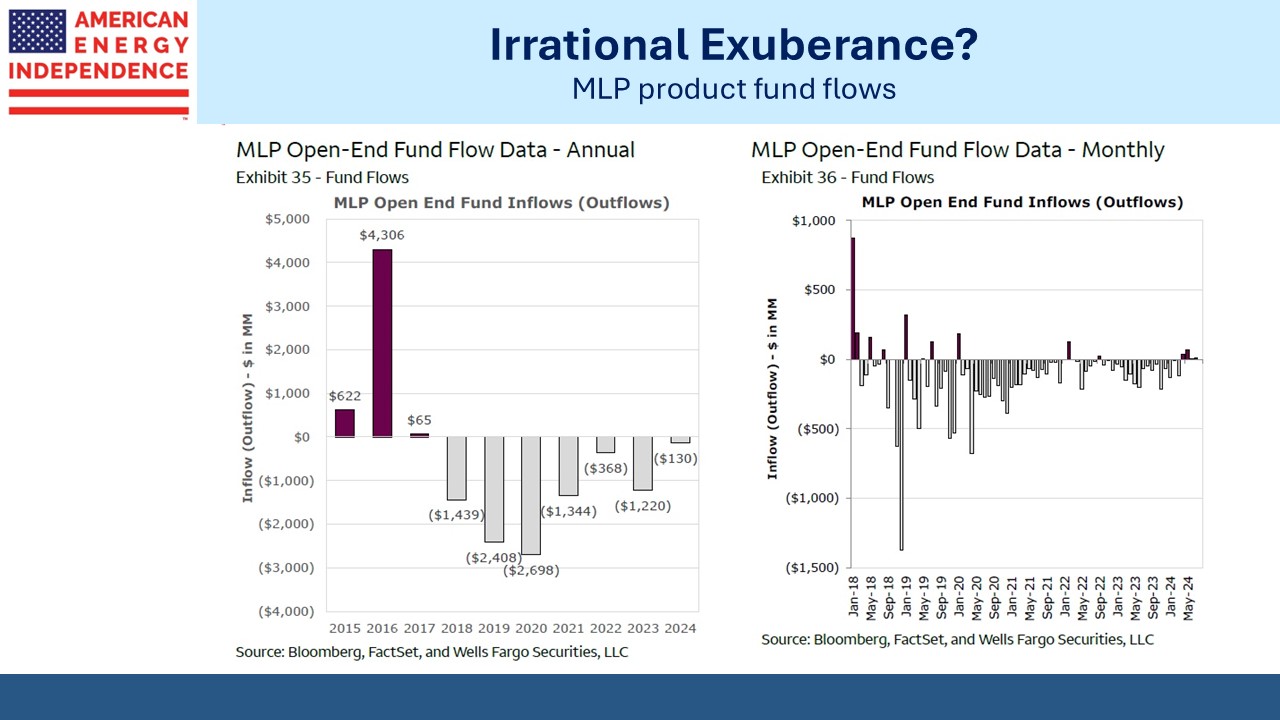

For the past seven years midstream funds have seen net outflows, typically around $1-2BN. Most months are negative, although this summer there were a couple months with small inflows. There is no panic buying in this sector.

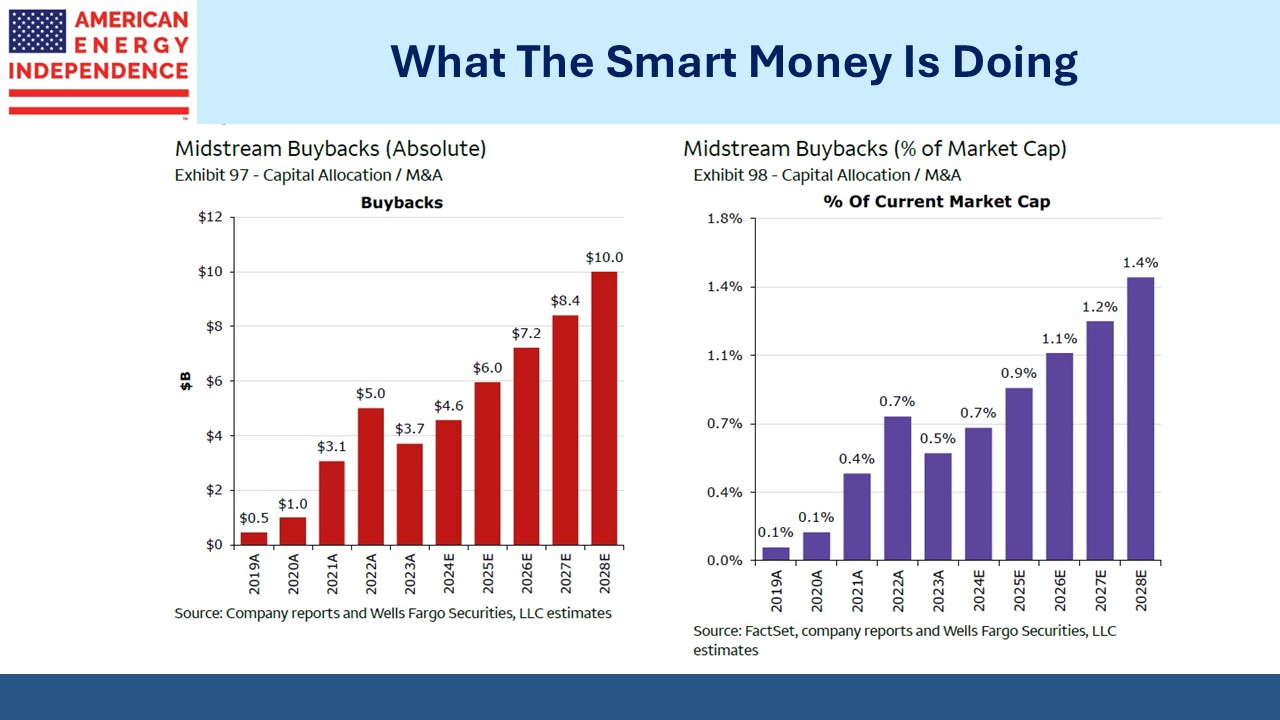

When midstream companies were organized as MLPs buybacks were rare. More common was the regular trickle of secondary offerings to finance “drop-down” purchases from their controlling general partner.

The MLP structure has lost favor to the single entity c-corp with its simplified tax reporting (1099 vs K1). This has coincided with reduced capex and improved financial discipline as companies have concluded that we mostly have the pipeline network we need, and climate extremists have made new construction torturous.

The consequent growth in cashflows has enabled the midstream sector to start repurchasing stock. In recent years these purchases have exceeded the net fund outflows. This year’s stock purchases are over $4BN ahead of fund redemptions. The most informed are buying from the less informed, and the imbalance is growing.

Wells Fargo is forecasting that increasing cash generation by midstream companies will fuel further buybacks. This has helped the American Energy Independence Index (AEITR) to a 27% YTD return.

Imagine what might happen if fund flows turn positive.

We have three have funds that seek to profit from this environment: