America’s Still Increasing The Right Energy

/

The US Energy Information Administration (EIA) released its Short Term Energy Outlook (STEO) last week. It confirmed the current trends of increased production, improving mix and declining CO2 emissions.

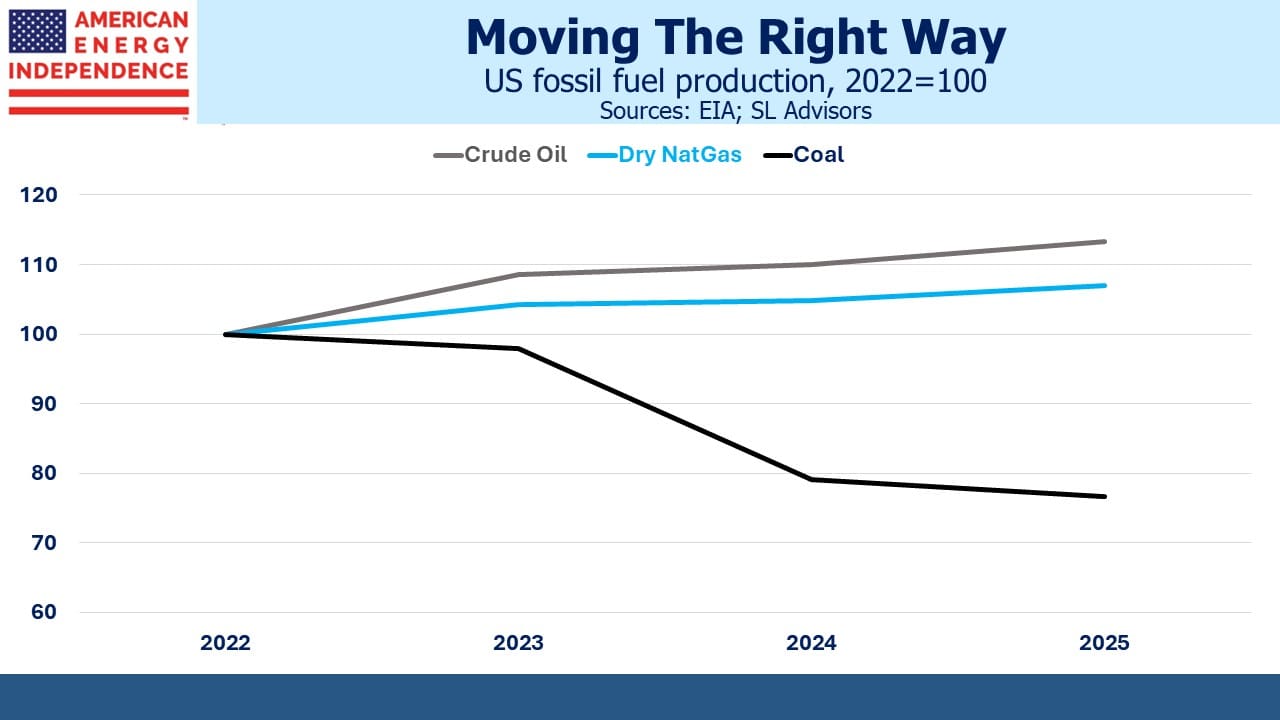

Most notable is that coal production is continuing to fall. This year should see output 20% below 2022, at 470 Million Short Tons (MSTs). We use most of it at home but will still export 94 MSTs this year. Opponents of LNG exports should take note – this is where they should be focusing their attention.

Natural gas and crude oil output are both edging up. We averaged 12.9 Million Barrels per Day (MMB/D) of crude output last year, which the EIA forecasts will increase to 13.1 MMB/D this year and 13.5 MMB/d in 2025.

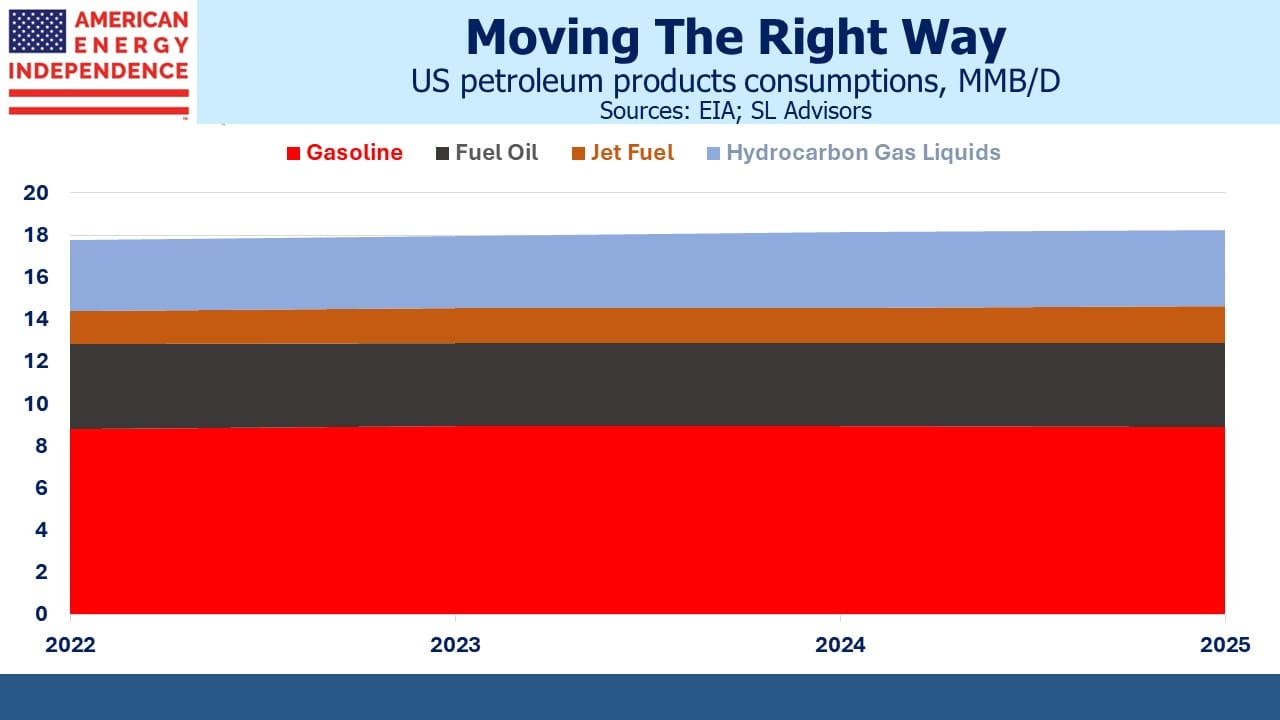

Overall petroleum products consumption is stable at around 18 MMB/D. The link between crude prices and pipeline cashflows continues to weaken (see Pipelines Shed Their Oil Sensitivity) because of stronger balance sheets. But volumes are more stable than prices. US liquids consumption grew at 0.9% per annum in the decade to 2022 according to the Energy Institute’s 2023 Statistical Review of World Energy (formerly published by BP). This stability is an under-appreciated feature of midstream infrastructure.

US gasoline demand is peaking at around 8.9 MMB/D. Increased Electric Vehicle (EV) penetration is a factor, along with improved mileage on conventional cars. EV sales have slowed recently, and the EIA doesn’t disclose its assumptions on future growth. Your blogger remains unconvinced that an EV purchase would meaningfully improve household happiness.

Consumption of aviation fuel is growing, and not just thanks to Taylor Swift. This is especially true in developing countries as a result of rising living standards. Jet fuel consumption was growing at 3% pa until the pandemic struck. Volumes are still recovering.

Use of hydrocarbon gas liquids (also known as Natural Gas Liquids) including propane (heating/cooking) and ethane (plastics and other petrochemical uses) is also growing.

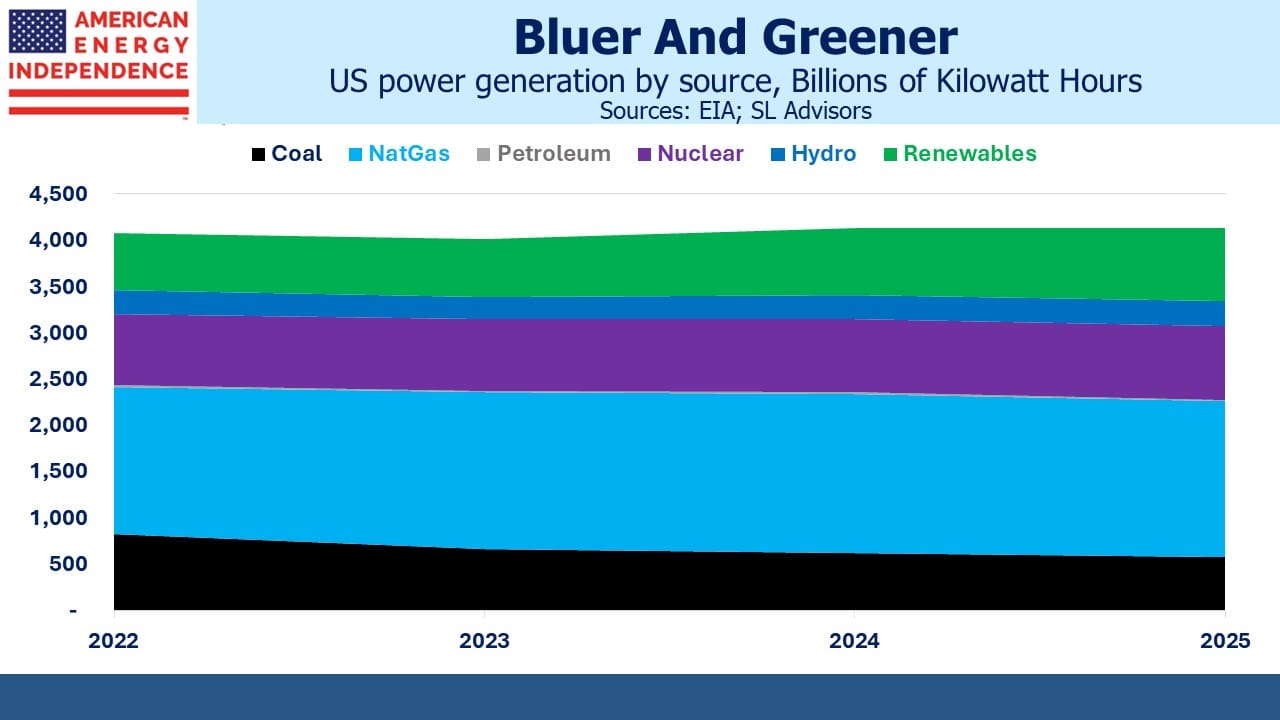

Power generation continues to deliver good news. Coal’s share of electricity generation will drop to 14% by 2025, from 21% in 2022. Natural gas reached 42% last year but is expected to slip to 41% by 2025 as non-hydro renewables grow from 15% to 19%. Our electricity is getting both bluer and greener.

Windpower currently provides almost twice as much electricity as solar. However, from 2022-2025 solar capacity is set to more than double, which will bring them roughly in line. Many will be surprised to learn that windpower output will grow at less than 3% pa 2022-25.

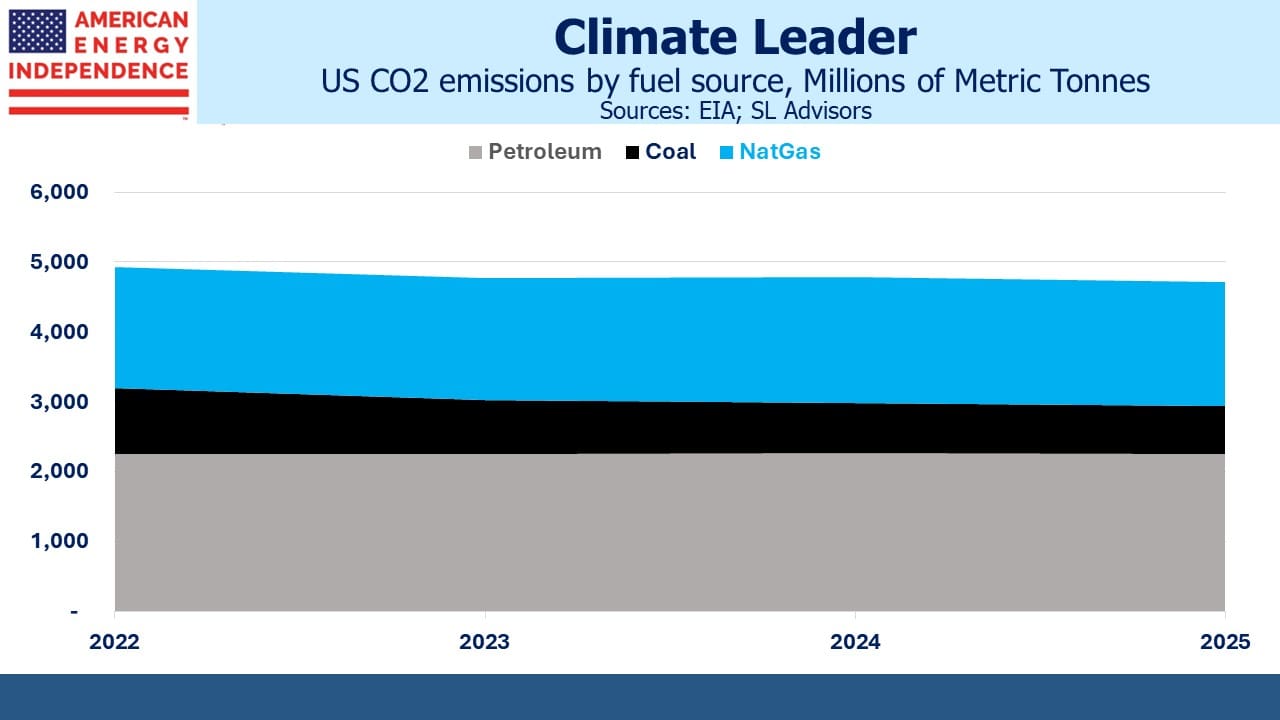

The net result is that we’re becoming better able to export energy security to our trade partners while also reducing our own CO2 emissions, which will fall from 4.9 billion metric tonnes to 4.7 (2022-25).

A pragmatic energy transition is unfolding. Patrick Pouyanné, CEO of France’s TotalEnergies, was interviewed recently in the Financial Times. He rejects the notion that renewables will lead to cheaper electricity, noting that, “renewable intermittency is less efficient.” He feels the prospect of permanently higher prices makes power an interesting sector in which to invest. Total has also been active in signing LNG deals, including with US-based NextDecade, whose planned Rio Grande export terminal is not affected by the recent White House pause on new approvals.

China convinced outgoing climate czar John Kerry that they’re striving hard to reduce their CO2 emissions. They burn over half the world’s coal which is the main source of electricity for their EV market, as this blog often points out. They’re adding coal-burning power plants at more than one a month.

China is also adding substantial solar and wind capacity. It’s often seemed to us that energy security is the driver of China’s choices, rather than the energy transition. If they’re anticipating conflict over Taiwan in the next few years, it makes sense to reduce their need for oil imports as much as possible.

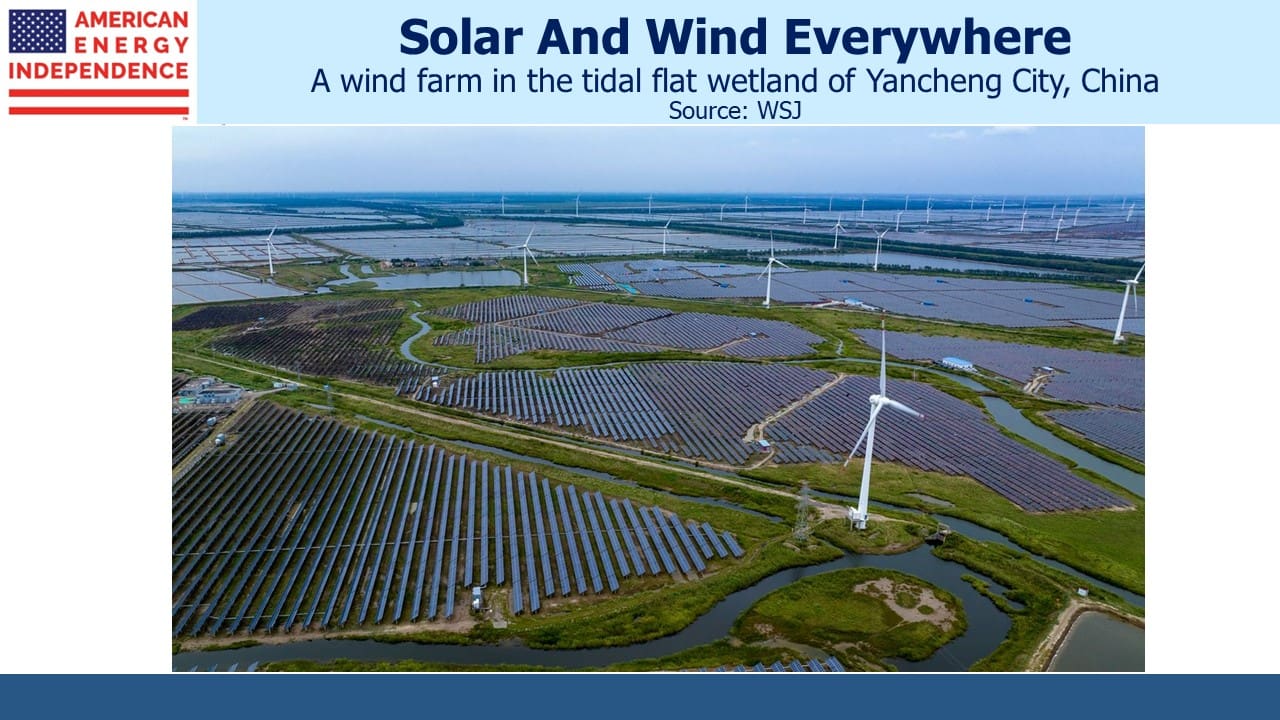

The WSJ recently noted the huge growth in China’s renewables capacity (see China’s Carbon Emissions Are Set to Decline Years Earlier Than Expected). The 300 Gigawatts of solar and wind China added last year is more than total US capacity. China installed over 500 million solar panels.

The photo showing a vast area of solar panels dotted with wind turbines is unlike anything you see in America. Climate Action Tracker now thinks China’s emissions could peak next year but doesn’t expect them to immediately decline.

There are many examples of progress in reducing emissions, and US natural gas production continues to grow because it’s part of the solution.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!