America’s Still Increasing The Right Energy

The US Energy Information Administration (EIA) released its Short Term Energy Outlook (STEO) last week. It confirmed the current trends of increased production, improving mix and declining CO2 emissions.

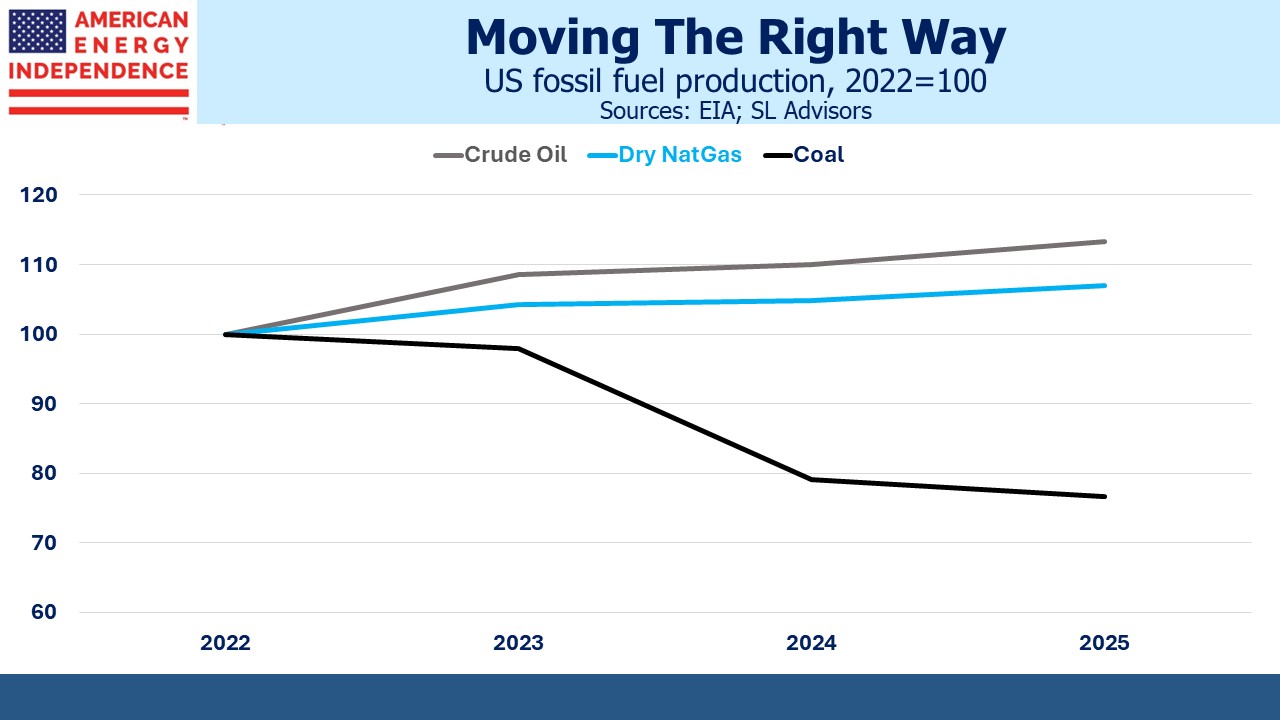

Most notable is that coal production is continuing to fall. This year should see output 20% below 2022, at 470 Million Short Tons (MSTs). We use most of it at home but will still export 94 MSTs this year. Opponents of LNG exports should take note – this is where they should be focusing their attention.

Natural gas and crude oil output are both edging up. We averaged 12.9 Million Barrels per Day (MMB/D) of crude output last year, which the EIA forecasts will increase to 13.1 MMB/D this year and 13.5 MMB/d in 2025.

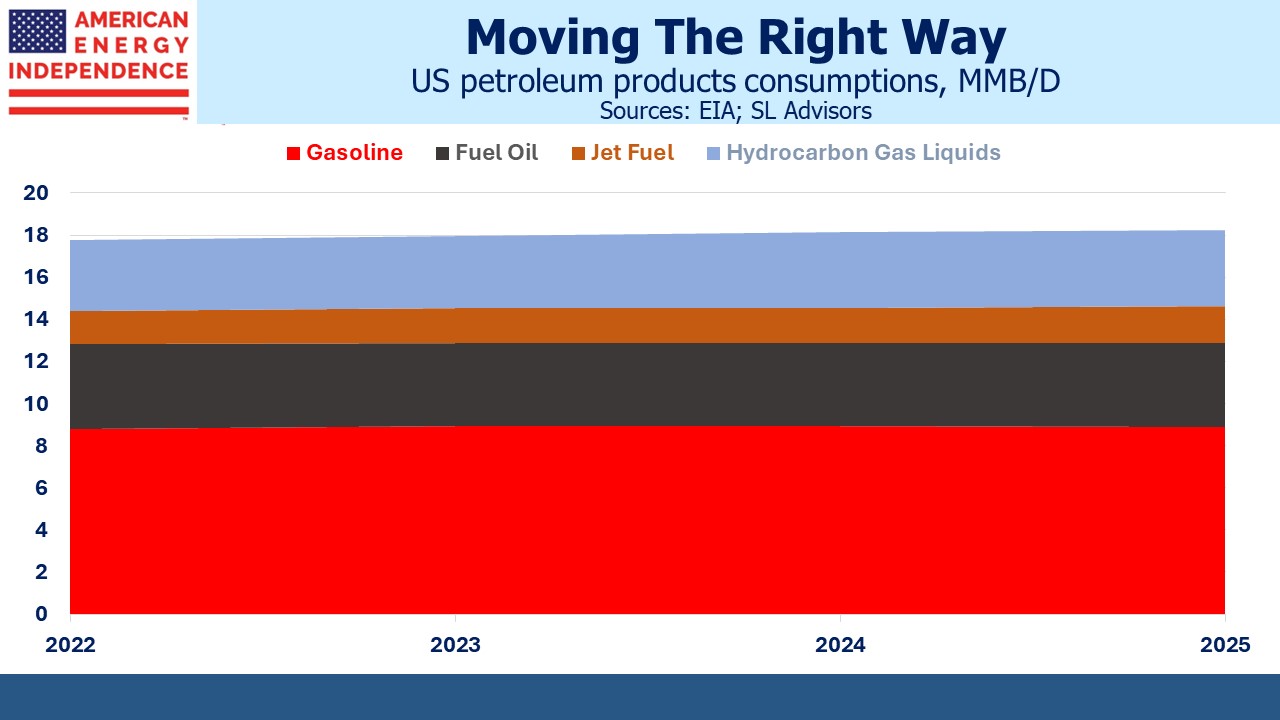

Overall petroleum products consumption is stable at around 18 MMB/D. The link between crude prices and pipeline cashflows continues to weaken (see Pipelines Shed Their Oil Sensitivity) because of stronger balance sheets. But volumes are more stable than prices. US liquids consumption grew at 0.9% per annum in the decade to 2022 according to the Energy Institute’s 2023 Statistical Review of World Energy (formerly published by BP). This stability is an under-appreciated feature of midstream infrastructure.

US gasoline demand is peaking at around 8.9 MMB/D. Increased Electric Vehicle (EV) penetration is a factor, along with improved mileage on conventional cars. EV sales have slowed recently, and the EIA doesn’t disclose its assumptions on future growth. Your blogger remains unconvinced that an EV purchase would meaningfully improve household happiness.

Consumption of aviation fuel is growing, and not just thanks to Taylor Swift. This is especially true in developing countries as a result of rising living standards. Jet fuel consumption was growing at 3% pa until the pandemic struck. Volumes are still recovering.

Use of hydrocarbon gas liquids (also known as Natural Gas Liquids) including propane (heating/cooking) and ethane (plastics and other petrochemical uses) is also growing.

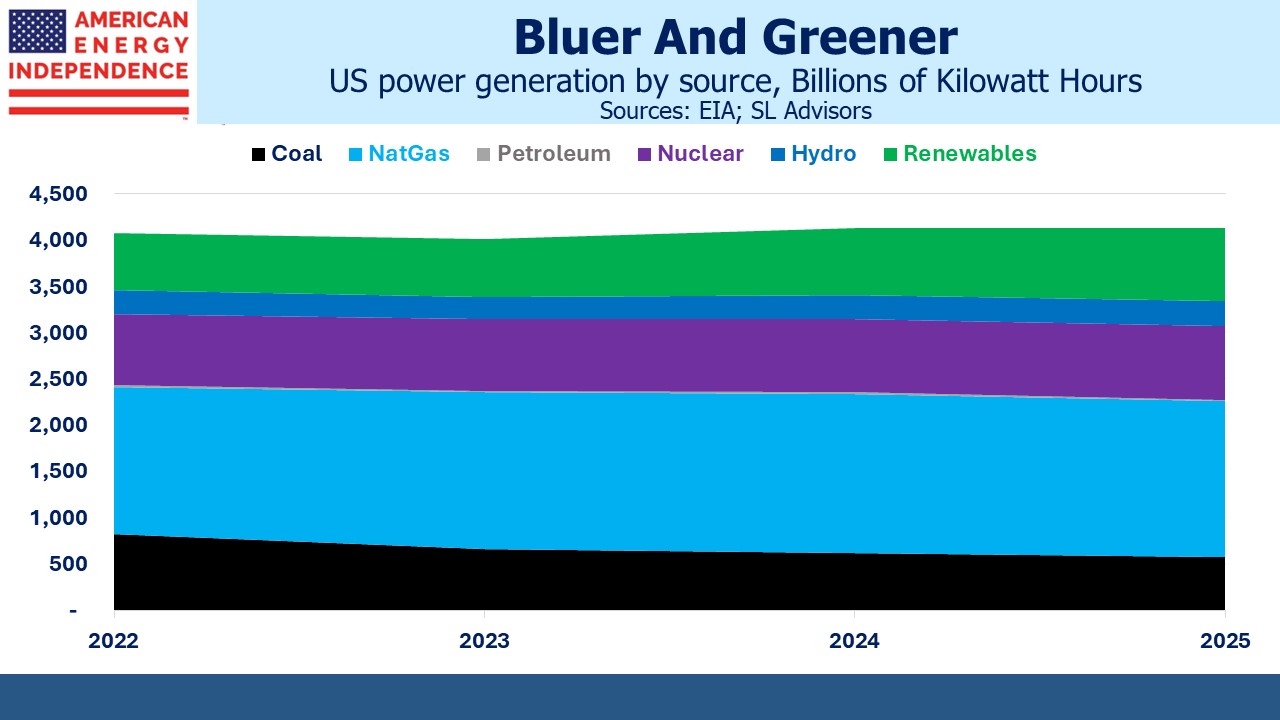

Power generation continues to deliver good news. Coal’s share of electricity generation will drop to 14% by 2025, from 21% in 2022. Natural gas reached 42% last year but is expected to slip to 41% by 2025 as non-hydro renewables grow from 15% to 19%. Our electricity is getting both bluer and greener.

Windpower currently provides almost twice as much electricity as solar. However, from 2022-2025 solar capacity is set to more than double, which will bring them roughly in line. Many will be surprised to learn that windpower output will grow at less than 3% pa 2022-25.

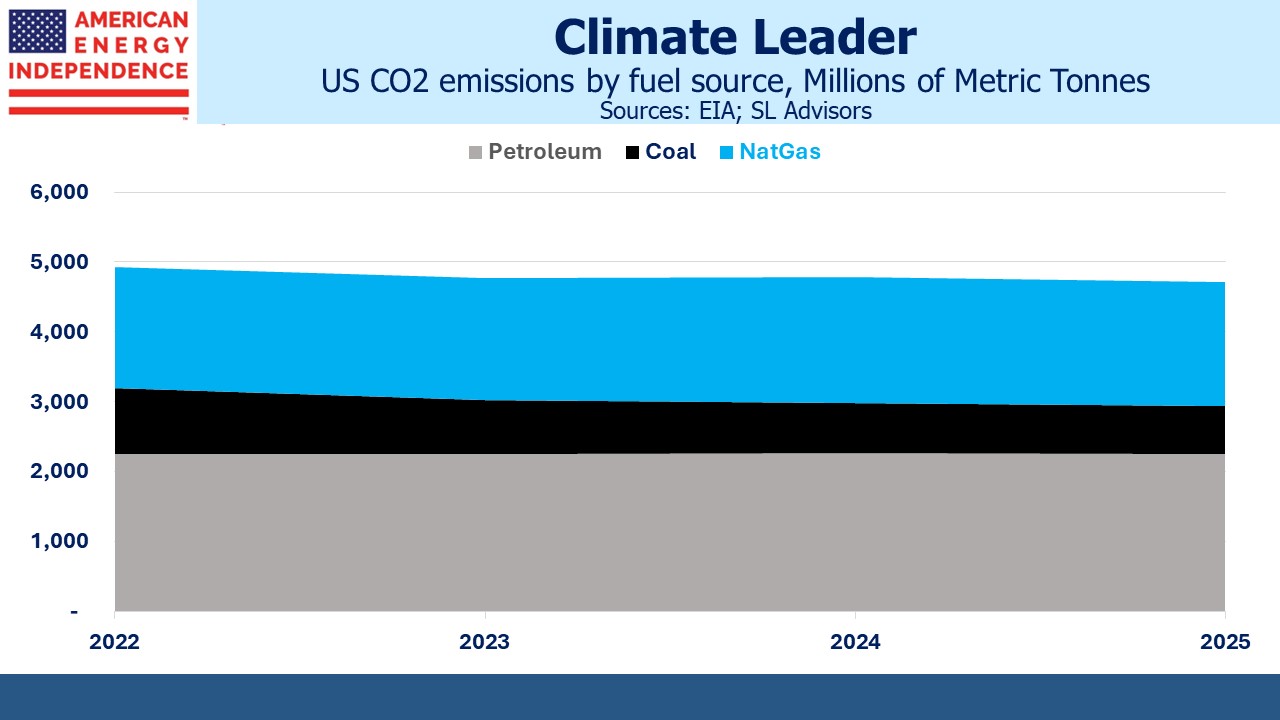

The net result is that we’re becoming better able to export energy security to our trade partners while also reducing our own CO2 emissions, which will fall from 4.9 billion metric tonnes to 4.7 (2022-25).

A pragmatic energy transition is unfolding. Patrick Pouyanné, CEO of France’s TotalEnergies, was interviewed recently in the Financial Times. He rejects the notion that renewables will lead to cheaper electricity, noting that, “renewable intermittency is less efficient.” He feels the prospect of permanently higher prices makes power an interesting sector in which to invest. Total has also been active in signing LNG deals, including with US-based NextDecade, whose planned Rio Grande export terminal is not affected by the recent White House pause on new approvals.

China convinced outgoing climate czar John Kerry that they’re striving hard to reduce their CO2 emissions. They burn over half the world’s coal which is the main source of electricity for their EV market, as this blog often points out. They’re adding coal-burning power plants at more than one a month.

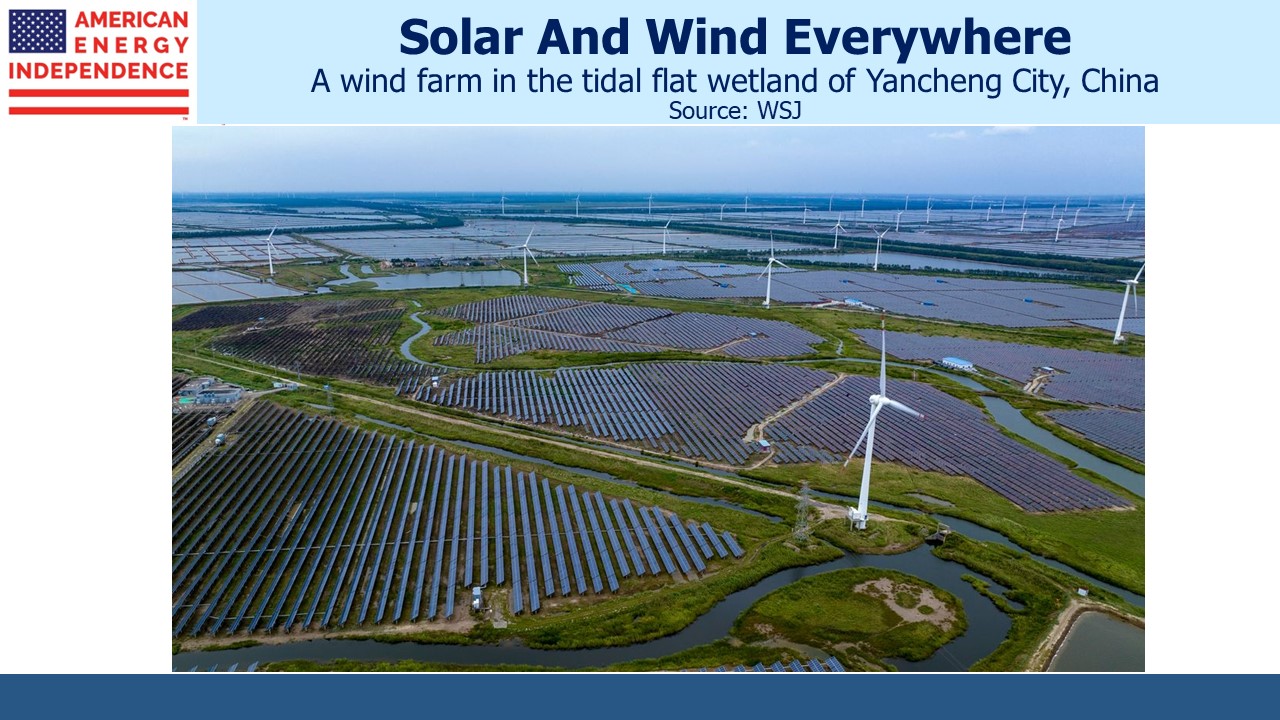

China is also adding substantial solar and wind capacity. It’s often seemed to us that energy security is the driver of China’s choices, rather than the energy transition. If they’re anticipating conflict over Taiwan in the next few years, it makes sense to reduce their need for oil imports as much as possible.

The WSJ recently noted the huge growth in China’s renewables capacity (see China’s Carbon Emissions Are Set to Decline Years Earlier Than Expected). The 300 Gigawatts of solar and wind China added last year is more than total US capacity. China installed over 500 million solar panels.

The photo showing a vast area of solar panels dotted with wind turbines is unlike anything you see in America. Climate Action Tracker now thinks China’s emissions could peak next year but doesn’t expect them to immediately decline.

There are many examples of progress in reducing emissions, and US natural gas production continues to grow because it’s part of the solution.

We have three have funds that seek to profit from this environment: