Why Is Oil Still Cheap?

/

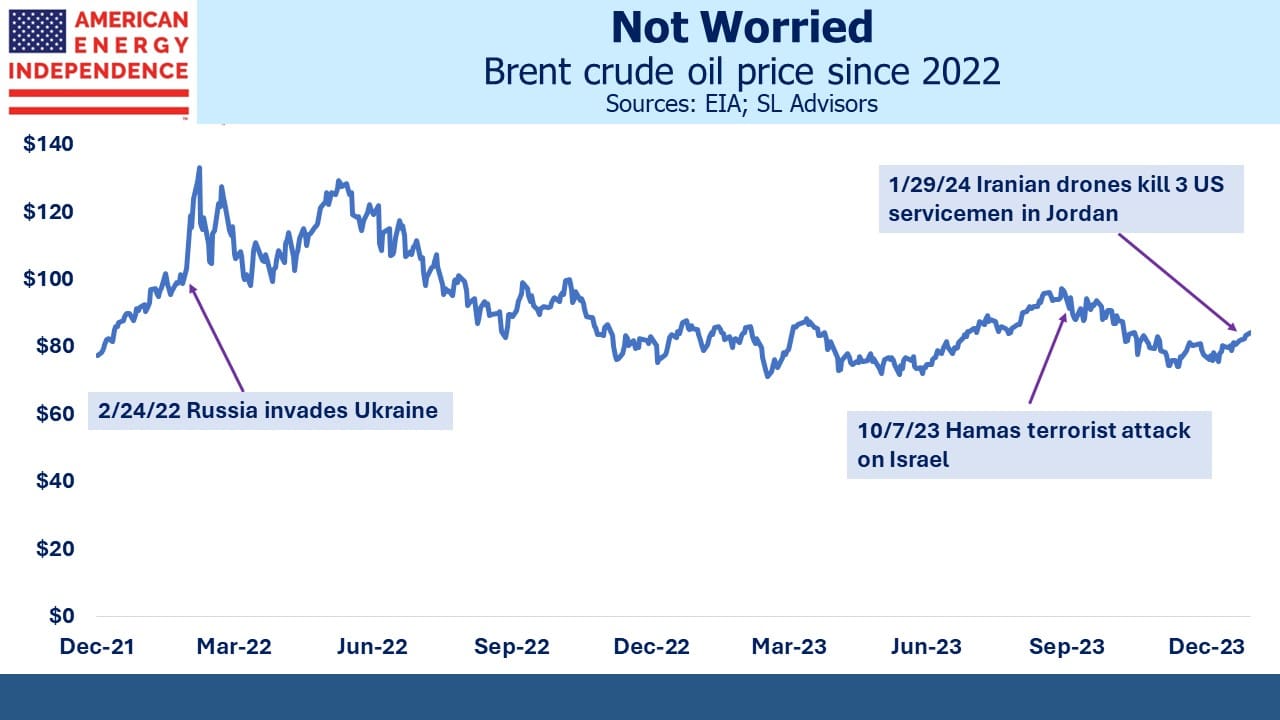

Investors often ask us why crude oil prices aren’t higher. The industry has maintained capex on new production too low to sustain current production for years, without any apparent impact on prices. More recently, the Middle East has generated a plethora of incidents which might be expected to cause consternation about the reliability of supplies from the region. Oil tankers are avoiding the Red Sea, taking the long route around southern Africa. One of Iran’s terrorist proxies just killed three US servicemen. And yet, there’s little discernible risk premium.

One reason is US supply has surprised to the upside, reaching 13.4 Million Barrels per Day (MMB/D) at the end of last year. US E&P firms have remained cautious about spending on production growth but have still managed to raise productivity with longer laterals in their horizontal drilling.

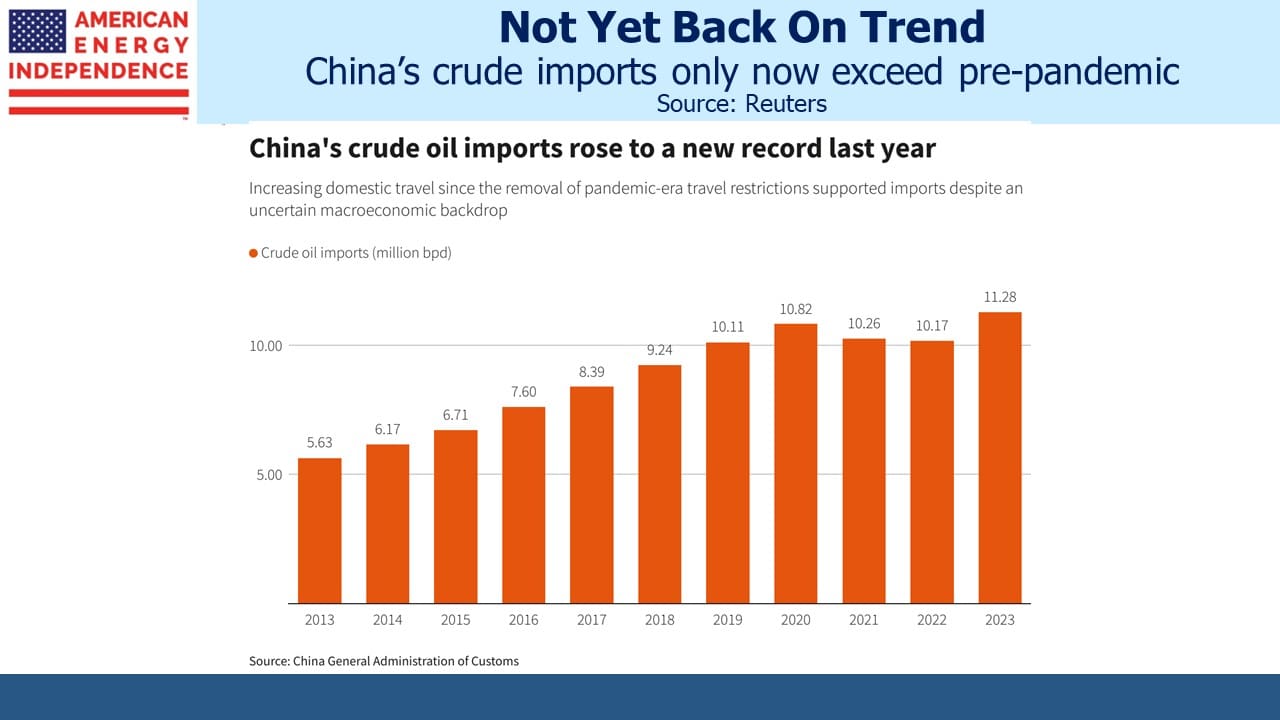

Another is that China’s recovery has been slow. Although they imported record volumes of oil last year, the rebound from the pandemic has been slow. The prevailing trend to 2019 would put them probably 3 MMB/D higher if not for Covid.

Sanctions imposed on Russia by the US and EU have been ineffective. Virtually all of their crude exports have been redirected to China and India, who are happy to buy oil at a discount to global prices. This has enabled Russia to maintain its earnings from the energy sector.

The IMF recently upgraded its 2024 GDP forecast for Russia, to 2.6%. This follows 3% last year and is double the IMF’s prior 2024 forecast. War expenditures are part of the reason, along with robust oil exports.

Russia has found other new buyers. Brazilian imports of diesel from Russia last year soared 4,600 per cent while purchases of fuel oil rose by almost 400 per cent.

Even NATO member Turkey is helping. Their Dörtyol terminal on the southern coast has seen a huge jump in shipments of Russian refined products which are then rerouted to Europe, in spite of EU sanctions. Some Russian fuel is reported to be in US warships operating in the region.

This has led some to argue that oil prices will never exceed $100 again. The FT notes that adjusted for inflation crude prices are roughly in the middle of the range that’s prevailed for over two decades.

The Biden Administration has pursued an ambiguous policy on crude prices. High oil enhances the competitiveness of EVs and should be welcomed by climate extremists. However, the White House also knows that millions of voters have more prosaic concerns such as the cost of their daily commute in a traditional car. Few dislike cheap gasoline.

One consequence is that Saudi Arabia directed Aramco to shelve plans to add 1 MMB/D to capacity, opting instead to keep output at 12 MMB/D. Almost a decade ago, when growing US shale production ate into Saudi market share, they responded by flooding the market in a desire to bankrupt the US E&P firms that were fracking. The Saudis were a year or two late, and although the US energy sector turned down, a renewed focus on innovation and capital discipline turned things around.

Today much of that US production is from bigger, well capitalized US majors following years of M&A. The Saudis don’t have the same option to harm them with lower prices. Their government deficit ballooned to $9.5BN in the most recent quarter. They need higher prices to balance the books.

Last week the CFA Society Naples held its annual forecast dinner. SL Advisors was a sponsor, and we invited some guests. The highlight of the evening was a panel discussion involving Tom Lee, Managing Partner of Fundstrat Global Advisors and Meghan Shue, Head of Investment Strategy at Wilmington Trust. It was ably moderated by CFA Naples board member Tyler Hardt.

An interesting discussion followed, with some useful points of disagreement. Tom Lee spent many years at JPMorgan and chatting with him afterwards we know some of the same people (I left in 2009).

During the Q&A, I asked how the panelists thought about climate change. Climate extremists rarely consider this issue, but equity markets don’t seem as worried as the more extreme progressives think they should be. Lee and Shue both felt that the impacts are too far away and uncertain to be a consideration in constructing portfolios. More relevant are government policies on taxes and spending related to the energy transition.

Another attendee asked where the panelists thought AI would have its biggest impact. Tom Lee offered health care as a sector likely to be significantly impacted. It’s occurred to me and no doubt many others that a doctor’s diagnosis, itself the result of a professional lifetime’s experience, can be supplemented by AI’s ability to analyze all the relevant data for an individual patient’s condition. Insurance companies may in time favor the AI diagnosis over the human professional. Lee suggested that over ten years or more, the AI impact on reducing healthcare spending may turn out to be an important factor in resolving our dire fiscal outlook, given the growing portion of government spending dedicated to Medicare.

I thought this was an intriguing perspective.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!