Why Is Oil Still Cheap?

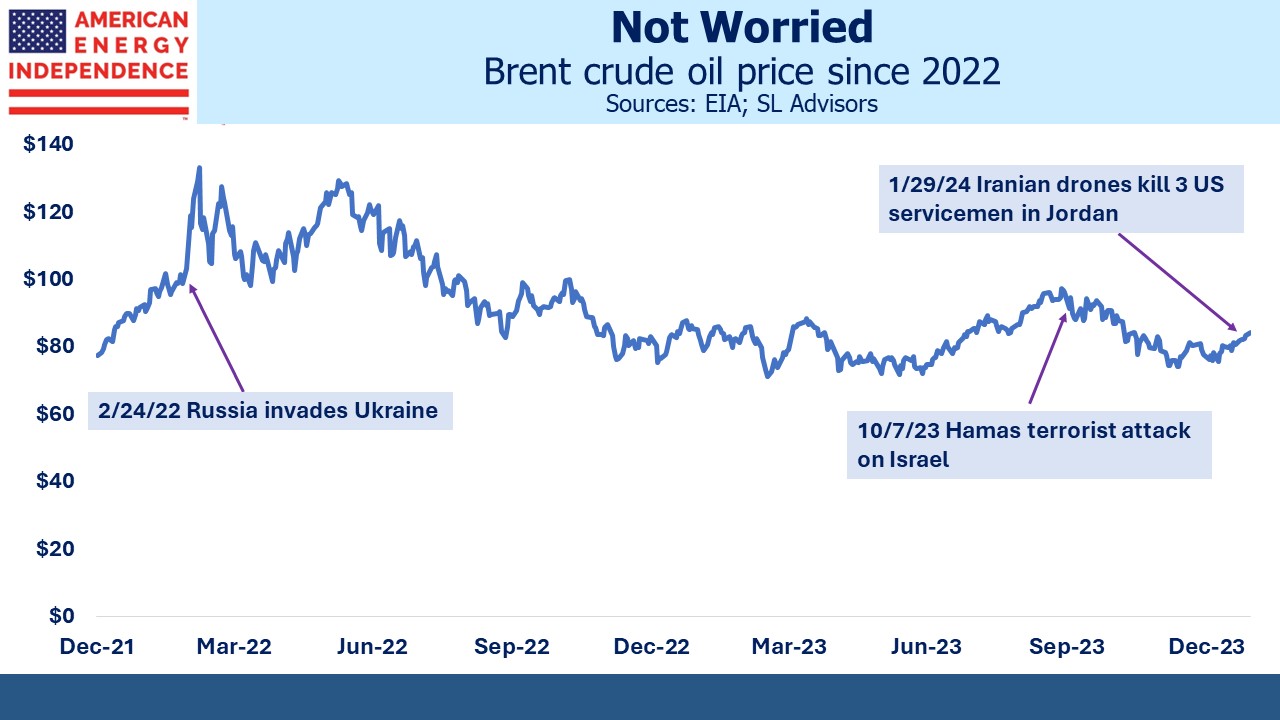

Investors often ask us why crude oil prices aren’t higher. The industry has maintained capex on new production too low to sustain current production for years, without any apparent impact on prices. More recently, the Middle East has generated a plethora of incidents which might be expected to cause consternation about the reliability of supplies from the region. Oil tankers are avoiding the Red Sea, taking the long route around southern Africa. One of Iran’s terrorist proxies just killed three US servicemen. And yet, there’s little discernible risk premium.

One reason is US supply has surprised to the upside, reaching 13.4 Million Barrels per Day (MMB/D) at the end of last year. US E&P firms have remained cautious about spending on production growth but have still managed to raise productivity with longer laterals in their horizontal drilling.

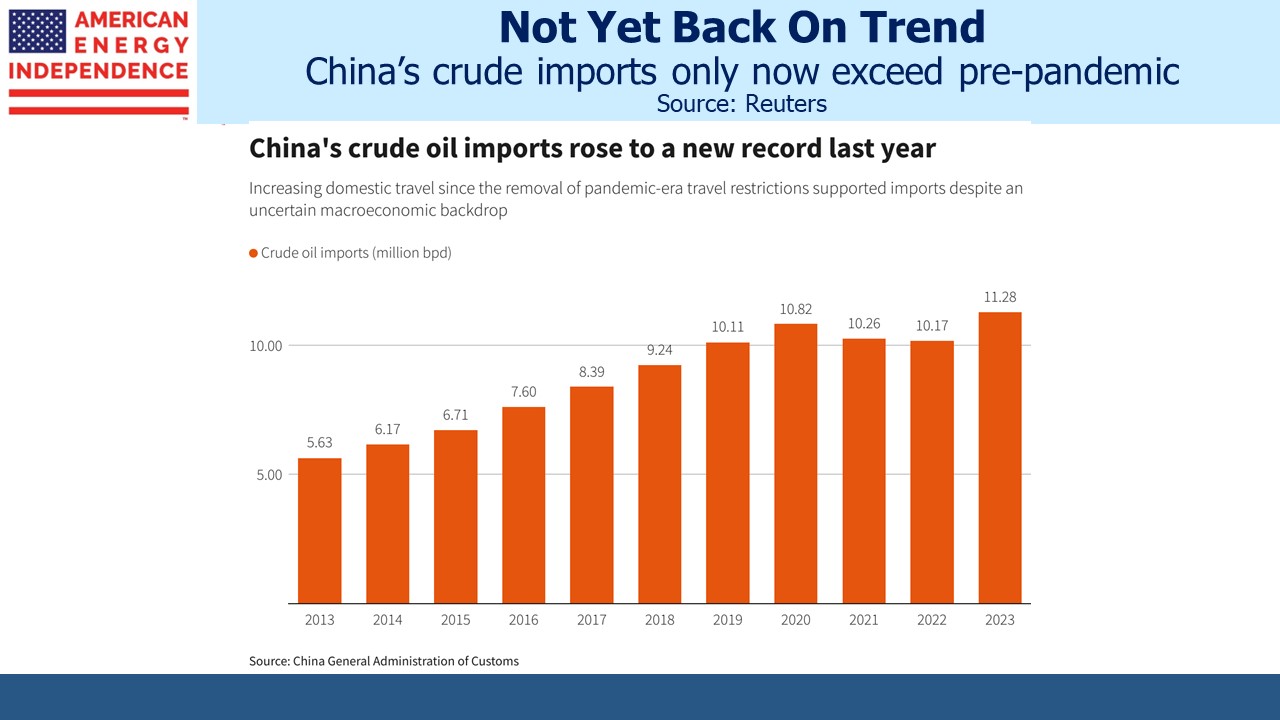

Another is that China’s recovery has been slow. Although they imported record volumes of oil last year, the rebound from the pandemic has been slow. The prevailing trend to 2019 would put them probably 3 MMB/D higher if not for Covid.

Sanctions imposed on Russia by the US and EU have been ineffective. Virtually all of their crude exports have been redirected to China and India, who are happy to buy oil at a discount to global prices. This has enabled Russia to maintain its earnings from the energy sector.

The IMF recently upgraded its 2024 GDP forecast for Russia, to 2.6%. This follows 3% last year and is double the IMF’s prior 2024 forecast. War expenditures are part of the reason, along with robust oil exports.

Russia has found other new buyers. Brazilian imports of diesel from Russia last year soared 4,600 per cent while purchases of fuel oil rose by almost 400 per cent.

Even NATO member Turkey is helping. Their Dörtyol terminal on the southern coast has seen a huge jump in shipments of Russian refined products which are then rerouted to Europe, in spite of EU sanctions. Some Russian fuel is reported to be in US warships operating in the region.

This has led some to argue that oil prices will never exceed $100 again. The FT notes that adjusted for inflation crude prices are roughly in the middle of the range that’s prevailed for over two decades.

The Biden Administration has pursued an ambiguous policy on crude prices. High oil enhances the competitiveness of EVs and should be welcomed by climate extremists. However, the White House also knows that millions of voters have more prosaic concerns such as the cost of their daily commute in a traditional car. Few dislike cheap gasoline.

One consequence is that Saudi Arabia directed Aramco to shelve plans to add 1 MMB/D to capacity, opting instead to keep output at 12 MMB/D. Almost a decade ago, when growing US shale production ate into Saudi market share, they responded by flooding the market in a desire to bankrupt the US E&P firms that were fracking. The Saudis were a year or two late, and although the US energy sector turned down, a renewed focus on innovation and capital discipline turned things around.

Today much of that US production is from bigger, well capitalized US majors following years of M&A. The Saudis don’t have the same option to harm them with lower prices. Their government deficit ballooned to $9.5BN in the most recent quarter. They need higher prices to balance the books.

Last week the CFA Society Naples held its annual forecast dinner. SL Advisors was a sponsor, and we invited some guests. The highlight of the evening was a panel discussion involving Tom Lee, Managing Partner of Fundstrat Global Advisors and Meghan Shue, Head of Investment Strategy at Wilmington Trust. It was ably moderated by CFA Naples board member Tyler Hardt.

An interesting discussion followed, with some useful points of disagreement. Tom Lee spent many years at JPMorgan and chatting with him afterwards we know some of the same people (I left in 2009).

During the Q&A, I asked how the panelists thought about climate change. Climate extremists rarely consider this issue, but equity markets don’t seem as worried as the more extreme progressives think they should be. Lee and Shue both felt that the impacts are too far away and uncertain to be a consideration in constructing portfolios. More relevant are government policies on taxes and spending related to the energy transition.

Another attendee asked where the panelists thought AI would have its biggest impact. Tom Lee offered health care as a sector likely to be significantly impacted. It’s occurred to me and no doubt many others that a doctor’s diagnosis, itself the result of a professional lifetime’s experience, can be supplemented by AI’s ability to analyze all the relevant data for an individual patient’s condition. Insurance companies may in time favor the AI diagnosis over the human professional. Lee suggested that over ten years or more, the AI impact on reducing healthcare spending may turn out to be an important factor in resolving our dire fiscal outlook, given the growing portion of government spending dedicated to Medicare.

I thought this was an intriguing perspective.

We have three have funds that seek to profit from this environment: