The Magnificent Fab Four

/

Financial advisors need no reminding that performance this year has been heavily influenced by how much you invested in the Magnificent Seven (Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla). Not only have the remaining 493 stocks substantially lagged the S&P500, but the MSCI All-Country World index of nearly 3,000 companies would be down this year if not for the seven.

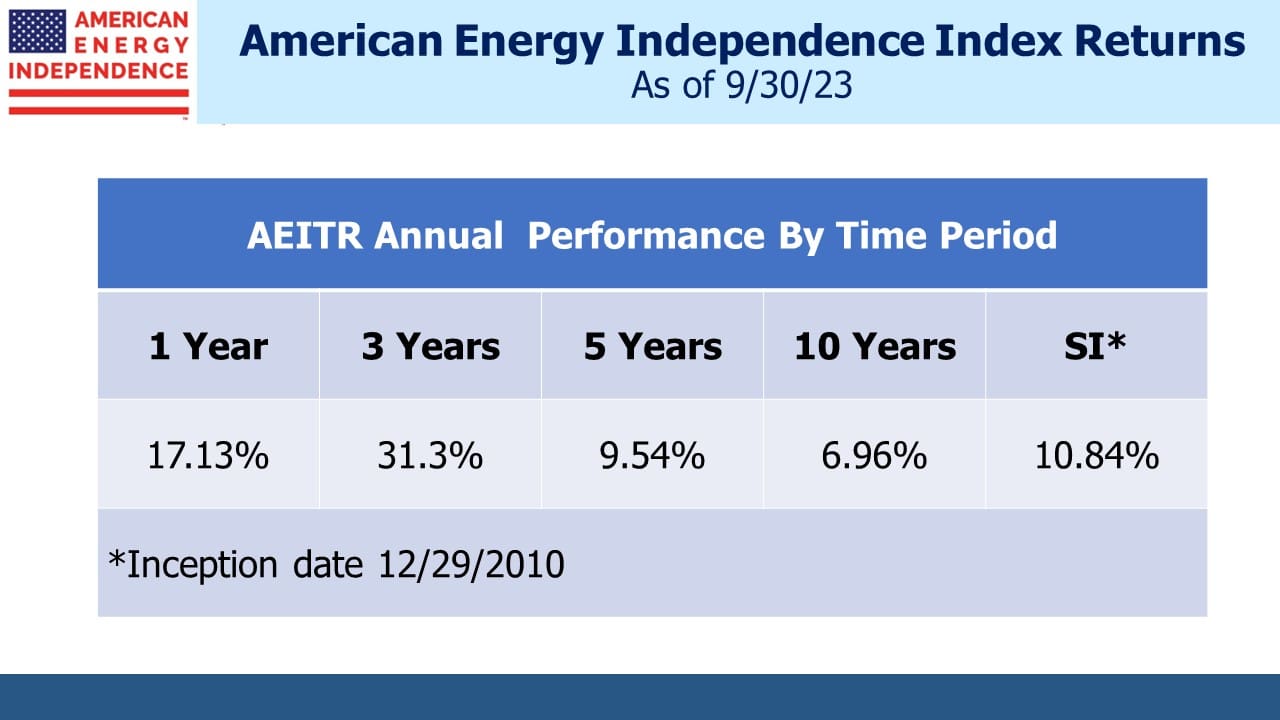

In other words, it’s been hard to beat the S&P500. And yet, midstream energy infrastructure continues to close in on a third successive calendar year of outperformance.

The American Energy Independence Index (AEITR) has its high flyers too. Magellan Midstream was up 45% YTD until it stopped trading following its acquisition by Oneok. We were not happy with the deal (see Oneok Does A Deal Nobody Needs). Nonetheless, we’ll grudgingly accept the profit while remaining dismayed at the recapture of deferred taxes that the transaction creates.

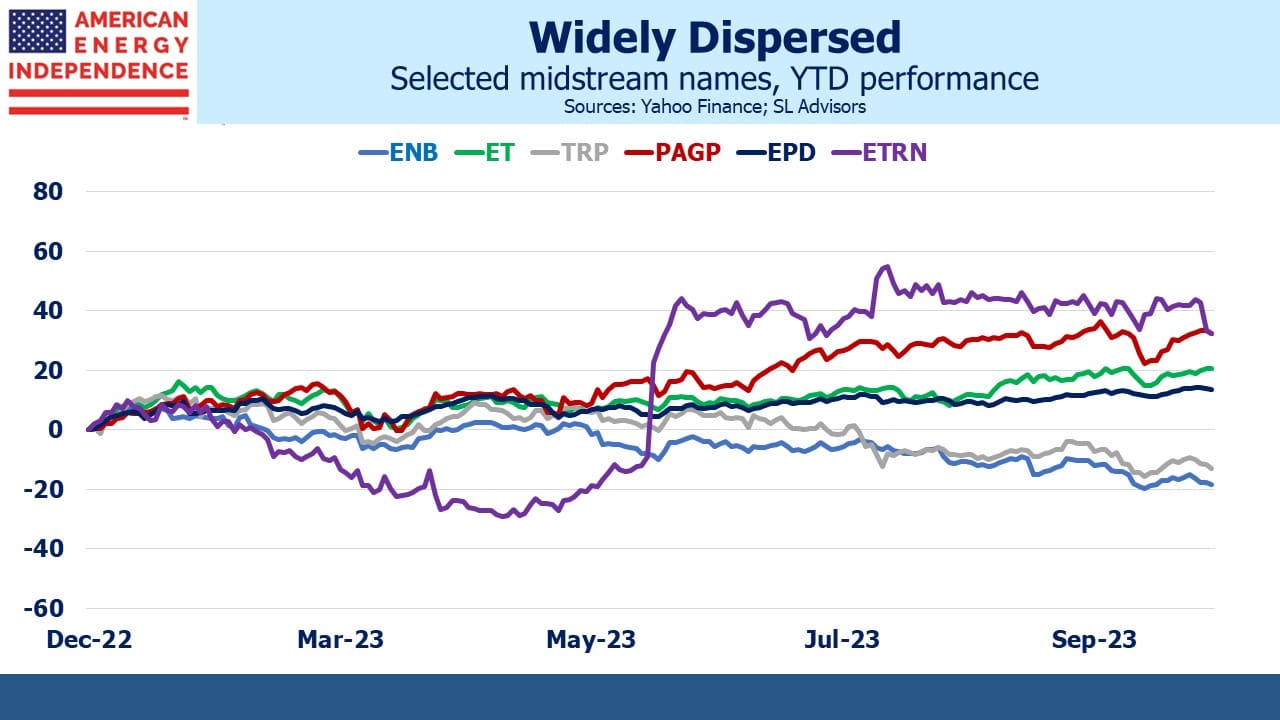

Equitrans (ETRN) is +43% YTD thanks to Joe Manchin insisting on the Mountain Valley Pipeline’s (MVP) inclusion in the recent legislation to raise the debt ceiling. MVP’s completion suffered another delay last week when ETRN disclosed challenges hiring workers to finish the job. It turns out that the constant risk a judge will issue a construction halt in response to one more challenge from an environmental extremist makes those jobs less appealing.

Plains All American (PAGP) is +37%. The M&A activity in energy hasn’t hurt. Exxon’s acquisition of Pioneer (see Exxon Buys More Of What The World Wants) is estimated to increase crude production out of the Permian by 350 thousand barrels per day over the next four years, which is good if, like PAGP, you own and operate crude pipelines there. Chevron’s deal with Hess is another example of capital being allocated on the premise that oil has a bright future ahead of it.

The International Energy Agency expects global crude oil demand to flatten out within the next five years before declining (see The Super Cycle Or Peak Oil?). That’s clearly not what Exxon or Chevron expect. The WSJ cheekily suggested that weakness in electric vehicle sales suggests they could peak first, before crude oil consumption (see Chevron Bets on Peak Green Energy).

Energy Transfer (ET) is +24% YTD. With a 17% 2024E Distributable Cash Flow yield (according to JPMorgan) and 7.1X Enterprise Value/EBITDA, it is the cheapest large business in the sector. It always is. ET is the most commonly owned pipeline name when we talk with financial advisors who pick individual stocks. Years ago management cemented their reputation for abusing their investors when they issued dilutive and very attractive convertible preferreds to management (see Energy Transfer: Cutting Your Payout, Not Mine from 2018 and Is Energy Transfer Quietly Fleecing its Investors? from 2016).

ET’s issuance of these offending securities led to a class action suit in Delaware which the company won. Even though they enjoyed a victory in court, they still didn’t do the right thing. Ever since, the stock has traded at what we’ll call a “Kelcy discount” (Kelcy Warren is Executive Chairman and former CEO) to its peers.

But ET knows how to run a business. Their casual relationship with fiduciary responsibility hides behind well-honed commercial instincts. When Texas suffered widespread power outages during Winter storm Uri in 2021, ET enjoyed $2.4BN in windfall gains by providing natural gas to a market that was short (see Why The Energy Transition Is Hard). Many financial advisors are drawing some satisfaction that this long-time holding is finally rewarding their faith.

The midstream energy infrastructure sector may not have the Magnificent Seven leading the market higher. But we have these Fab Four that have all handily beaten the averages. Since we’re down to three, Enterprise Products Partners (+20% YTD) can take Magellan’s place.

The laggards this year are the Canadians. TC Energy (TRP, -10%), Enbridge (ENB, -13%) and Pembina (-11%) share the stability of utilities, a quality investors don’t value with rising rates. Their Canadian Presbyterian conservatism is being challenged. ENB is leaning against the trend in buying three utility businesses (see a comment on this in Fiscal Policy Moves Center Stage). ENB and TRP are both projected to have leverage above 5X Debt:EBITDA through the end of 2025, meaningfully higher than the 3.0-3.5X that prevails among their investment grade peers. TRP has the more pressing need to shed assets to fund their capex program, but both companies are comfortable that their debt levels are manageable.

Here I’ll switch to briefly indulge in a personal anecdote. My wife and I recently met John Cleese after watching him on stage. Americans are most familiar with Cleese through Monty Python but Fawlty Towers is among the greatest comedies of all time. Cleese plays Basil Fawlty, the irascible hotel owner constantly berating the guests whose presence is often an inconvenience or worse. Quotes from these twelve episodes have featured in our family discourse for decades. Since Cleese has been an enduring source of laughter for us, it was my great pleasure to tell him personally. True to form, he was charming and then told us to “buzz off” as there were others waiting to shake his hand.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!