Last Year’s Most Popular Blog Posts

/

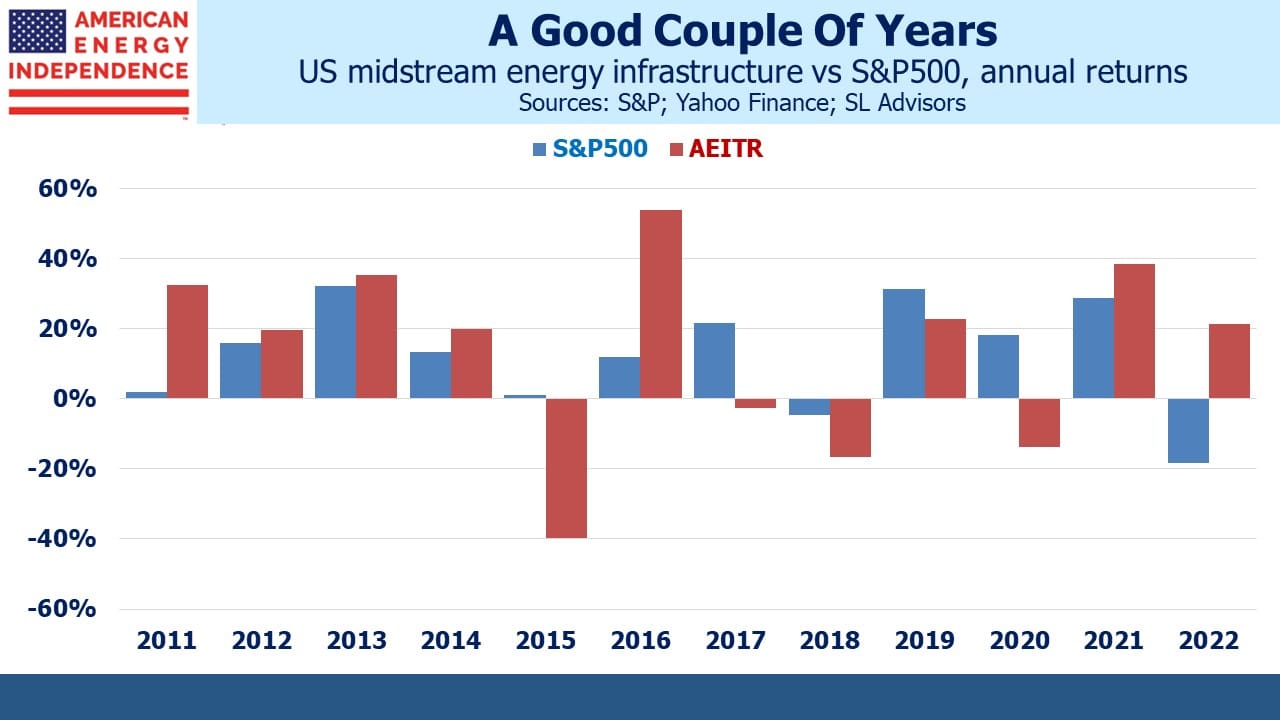

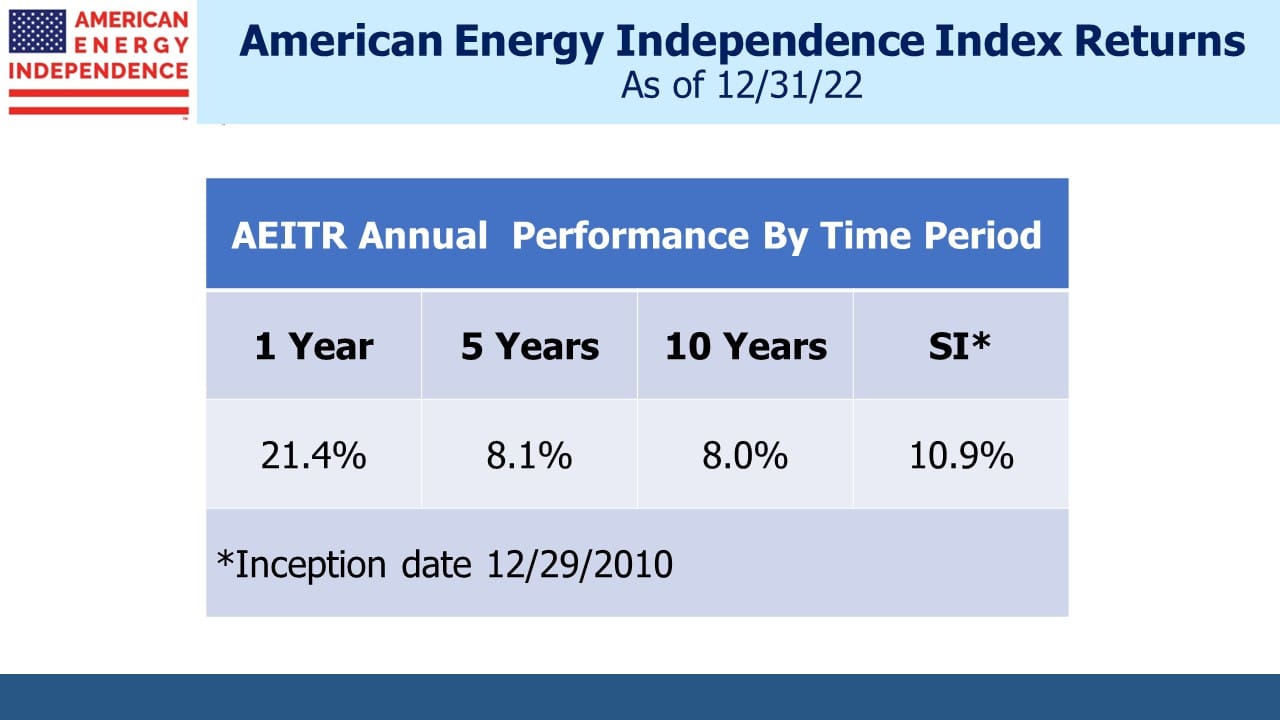

You might think last year’s 39.5% outperformance of the S&P500 by the pipeline sector was a record but in 2016 the margin was 42.0%. This followed a harrowing 41.0% underperformance the prior year. However, the past two years have been the best on record, with the American Energy Independence Index (AEITR) beating the S&P500 by 27.0% pa.

Our most popular blog posts of 2022 were those that covered the positive fundamentals underlying midstream energy infrastructure. Yields are historically tight to the ten-year treasury according to research from JPMorgan, which might make the sector appear rich to some. However, payout coverage is much healthier than in the past, with free cash flow yields almost 2X dividends. In Even After A 30% One Year Return, Pipelines Remain Cheap we highlighted this, as well as the higher incidence of distribution cuts among MLPs than their c-corp cousins.

Renewables receive so much media coverage that it’s tempting to believe they’ll solve all our energy problems. In Hydrocarbons Support The Four Pillars Of Civilization we reviewed Vaclav Smil’s latest book How the World Really Works which explains why global demand for steel, cement, plastic and fertilizer will drive continued growth for reliable energy. Solar panels and windmills are little use in manufacturing any of these vital inputs to modern society.

Russia’s invasion of Ukraine exposed western Europe’s strategic blunder on energy security, led by Germany. The loss of Russian natural gas led to a scramble for LNG not more windmills. In Energy Realism Is Spreading we examined the bullish long-term prospects for US exports of LNG.

The Hard Math Of The Energy Transition looked at the economics behind carbon capture, which received a boost from the Inflation Reduction Act passed in the summer. US climate change policy relies on subsidies aimed at rewarding emissions reduction instead of carbon taxes, and it’s creating business opportunities for midstream to sequester carbon underground, invest in hydrogen and produce emission-free LNG.

Natural gas continues to be our most important source of energy. On December 23 US demand set a new high of 155.7 Billion Cubic Feet per Day (BCF/D) according to S&P Platts, above the prior daily high of 150.2 BCF/D on January 30, 2019. Last year the US tied Qatar for top LNG exporter at 81.2 million tonnes, with Australia just behind at 80.5. The US was ahead during 1H22 until the Freeport terminal shut down because of a fire. Its resumption is likely to make the US the biggest exporter this year.

High energy prices have been a drag on growth in much of the world. Although American motorists felt some pain from rising gasoline prices early last year, in America Dodges The Energy Crisis we explained how abundant natural gas has insulated most of America from the experience of western Europe. Massachusetts continues to import LNG at high global prices from foreign countries because of ill-considered opposition to natural gas pipelines.

Tellurian’s Charif Souki has failed to create a second Cheniere. Souki’s compensation is among the highest in the industry in spite of Tellurian’s slumping stock price and diminishing odds of completing its Driftwood LNG facility. His compliant board has embraced pay for performance in advance. We asked What’s Next For Tellurian?

We started posting regular videos last year too. ESG Is A Scam was especially popular.

ESG has become an easy target. The three components (Environmental, Social and Governance) are not bad objectives, and every investor must favor stronger governance. But ranking companies based on “ESG-ness” is a scam perpetuated by companies like S&P creating metrics for corporate qualities. Every company can obtain a good ESG rating because no common standard prevails. The Dow Jones Sustainability Index looks past Lockheed Martin’s business of delivering products that blow up things and people, deeming them worthy of index inclusion year after year.

Our most watched video, What’s the deal with natural gas? explained why it represents the world’s best opportunity to reduce emissions, by phasing out coal. Natural gas investors own the most important element of a successful energy transition. The only way global emissions will fall is if emerging economies led by China reduce their reliance on coal. Natural gas is the clear winner.

We don’t always stick to energy and interest rates. A year ago we calculated that ARKK’s Investors Have In Aggregate Lost Money, because unfortunately the inflows to Cathie Wood’s fund came mostly at high prices. Since then ARKK has lost an additional 60%.

In December we asked Is BREIT Marked To Market? because valuations on its portfolio are both more stable and immune to the travails impacting publicly traded real estate. Perhaps mindful of the incongruity of such stability, their most recent monthly NAV was –1.2%.

Our engagement with you through blog posts and videos is the highest in our history. Continue to post comments, either publicly or directly to me, anytime you’re so moved. We welcome all constructive feedback.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

This is my favorite blog… Keep up the good work! Thinking this will be another good year for MLPs. I am truly amazed at how undervalued they are compared to other sectors. As a result, I would love to see more buybacks as opposed to more capital being allocated to

growth projects.

Rodney thanks for your comment.