Last Year’s Most Popular Blog Posts

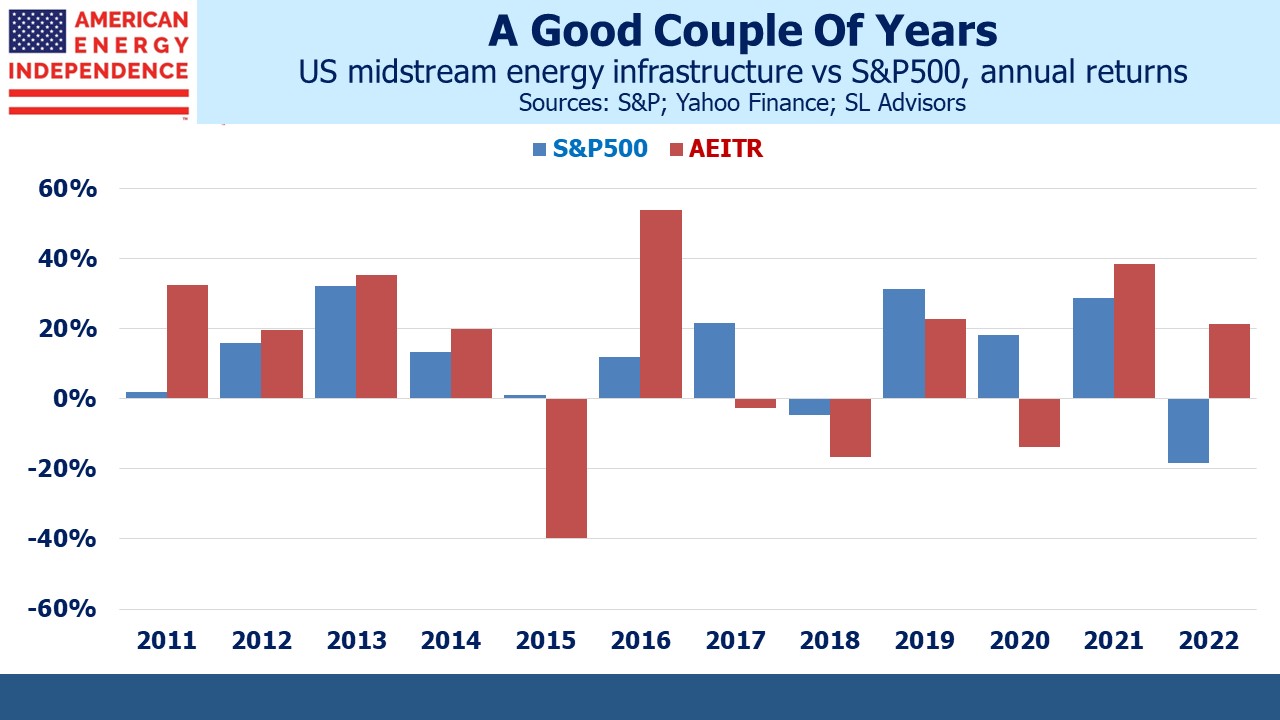

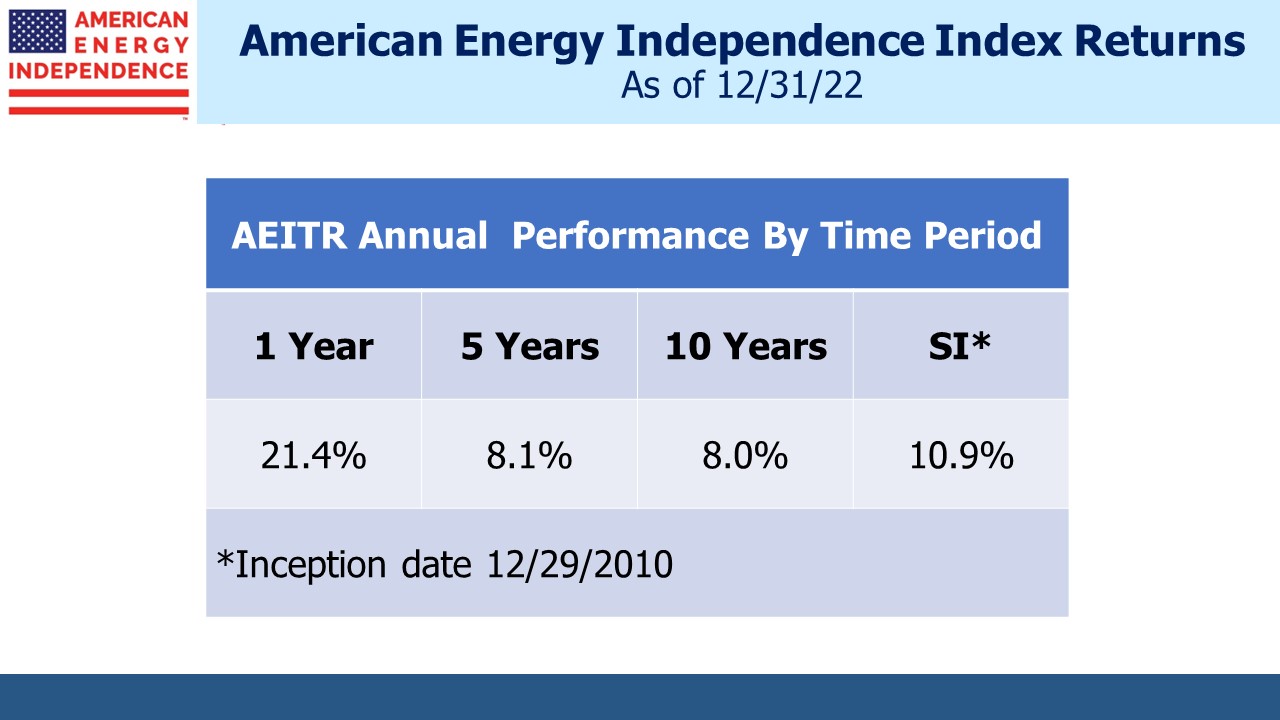

You might think last year’s 39.5% outperformance of the S&P500 by the pipeline sector was a record but in 2016 the margin was 42.0%. This followed a harrowing 41.0% underperformance the prior year. However, the past two years have been the best on record, with the American Energy Independence Index (AEITR) beating the S&P500 by 27.0% pa.

Our most popular blog posts of 2022 were those that covered the positive fundamentals underlying midstream energy infrastructure. Yields are historically tight to the ten-year treasury according to research from JPMorgan, which might make the sector appear rich to some. However, payout coverage is much healthier than in the past, with free cash flow yields almost 2X dividends. In Even After A 30% One Year Return, Pipelines Remain Cheap we highlighted this, as well as the higher incidence of distribution cuts among MLPs than their c-corp cousins.

Renewables receive so much media coverage that it’s tempting to believe they’ll solve all our energy problems. In Hydrocarbons Support The Four Pillars Of Civilization we reviewed Vaclav Smil’s latest book How the World Really Works which explains why global demand for steel, cement, plastic and fertilizer will drive continued growth for reliable energy. Solar panels and windmills are little use in manufacturing any of these vital inputs to modern society.

Russia’s invasion of Ukraine exposed western Europe’s strategic blunder on energy security, led by Germany. The loss of Russian natural gas led to a scramble for LNG not more windmills. In Energy Realism Is Spreading we examined the bullish long-term prospects for US exports of LNG.

The Hard Math Of The Energy Transition looked at the economics behind carbon capture, which received a boost from the Inflation Reduction Act passed in the summer. US climate change policy relies on subsidies aimed at rewarding emissions reduction instead of carbon taxes, and it’s creating business opportunities for midstream to sequester carbon underground, invest in hydrogen and produce emission-free LNG.

Natural gas continues to be our most important source of energy. On December 23 US demand set a new high of 155.7 Billion Cubic Feet per Day (BCF/D) according to S&P Platts, above the prior daily high of 150.2 BCF/D on January 30, 2019. Last year the US tied Qatar for top LNG exporter at 81.2 million tonnes, with Australia just behind at 80.5. The US was ahead during 1H22 until the Freeport terminal shut down because of a fire. Its resumption is likely to make the US the biggest exporter this year.

High energy prices have been a drag on growth in much of the world. Although American motorists felt some pain from rising gasoline prices early last year, in America Dodges The Energy Crisis we explained how abundant natural gas has insulated most of America from the experience of western Europe. Massachusetts continues to import LNG at high global prices from foreign countries because of ill-considered opposition to natural gas pipelines.

Tellurian’s Charif Souki has failed to create a second Cheniere. Souki’s compensation is among the highest in the industry in spite of Tellurian’s slumping stock price and diminishing odds of completing its Driftwood LNG facility. His compliant board has embraced pay for performance in advance. We asked What’s Next For Tellurian?

We started posting regular videos last year too. ESG Is A Scam was especially popular.

ESG has become an easy target. The three components (Environmental, Social and Governance) are not bad objectives, and every investor must favor stronger governance. But ranking companies based on “ESG-ness” is a scam perpetuated by companies like S&P creating metrics for corporate qualities. Every company can obtain a good ESG rating because no common standard prevails. The Dow Jones Sustainability Index looks past Lockheed Martin’s business of delivering products that blow up things and people, deeming them worthy of index inclusion year after year.

Our most watched video, What’s the deal with natural gas? explained why it represents the world’s best opportunity to reduce emissions, by phasing out coal. Natural gas investors own the most important element of a successful energy transition. The only way global emissions will fall is if emerging economies led by China reduce their reliance on coal. Natural gas is the clear winner.

We don’t always stick to energy and interest rates. A year ago we calculated that ARKK’s Investors Have In Aggregate Lost Money, because unfortunately the inflows to Cathie Wood’s fund came mostly at high prices. Since then ARKK has lost an additional 60%.

In December we asked Is BREIT Marked To Market? because valuations on its portfolio are both more stable and immune to the travails impacting publicly traded real estate. Perhaps mindful of the incongruity of such stability, their most recent monthly NAV was –1.2%.

Our engagement with you through blog posts and videos is the highest in our history. Continue to post comments, either publicly or directly to me, anytime you’re so moved. We welcome all constructive feedback.

We have three funds that seek to profit from this environment: