It’s Lonely At The Fed

A series of recent client meetings in south east Florida was good news in two respects – both as evidence that in-person meetings are slowly returning, and because people want an update on the new momentum sector, pipelines. Although in truth all these clients would have extended friendship at any and all times in the past.

Focused as we are on the cheapest sector in the market, one financial advisor revealed that many of his clients are nervous. Stocks look expensive, and bonds more so. Very little seems to offer an attractive long-term return versus risk, although plenty of quick trades are there for the opportunistic.

The message of rising free cash flow and increasing global energy demand resonated (see Pipeline Cashflows Continue Higher). Democrat policies impede pipeline construction and promote higher energy prices, creating a happy alignment of interests between the country’s leaders and energy investors (see Is Biden Bullish For Pipelines?). Dividend yields of 7% suggest stress, although dividends are stable and, in some cases, rising. Buybacks equal to around 2% the sector’s market cap provide further support.

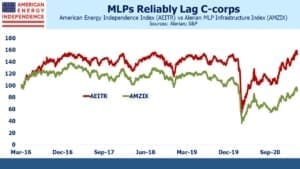

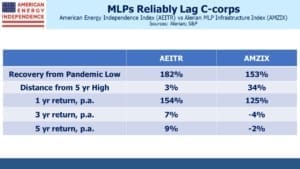

It’s a year since the American Energy Independence Index (AEITR) and other MLP indices made their low. At least closed end funds, one of the causes, destroyed enough capital to lose any future potency (see MLP Closed End Funds – Masters Of Value Destruction). The rebound since then has been breathtaking, with the AEITR returning 182% since March 18, 2020.

Even the perennially lagging Alerian MLP Infrastructure Index (AMZIX), tracked by the much-maligned Alerian MLP ETF, has rebounded 153% from its low. The superior return from c-corps versus MLPs is increasingly apparent, since the AEITR (80% c-corps/20% MLPs) is ahead of AMZIX (100% MLPs) over the past one, three and five years. Investors have spoken.

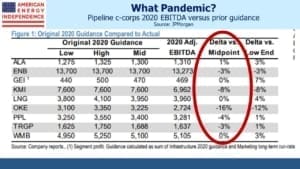

It’s increasingly clear that the March 2020 collapse was an aberration. Most of the biggest pipeline corporations reported 2020 full year EBITDA close to guidance they provided before the pandemic. These businesses are more stable than last year’s sellers.

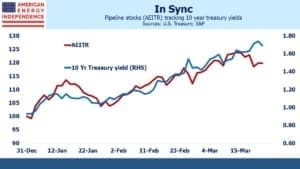

Some clients are feeling concerned about inflation, although not yet making wholesale portfolio changes. Investments that offer protection are few – on this score, pipelines that are tracking the ten-year year yield higher are one of the better ones. For now it’s the reflation trade, but it may transpose into the inflation trade later this year.

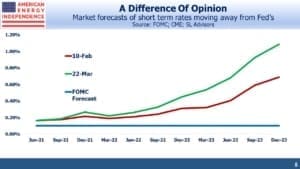

Fed chair Jay Powell is increasingly alone with his equanimity about the inflation outlook. On Monday the National Association for Business Economics (NABE) released their Economic Policy Survey which revealed that almost half the NABE panelists expect the Fed to hike rates next year. A majority sees elevated inflation risk.

Eurodollar futures are more reflective of the NABE outlook than the Fed’s, demonstrating investors’ scant regard for the Fed’s forecasting ability. Jay Powell’s repeated assertions that higher inflation will be temporary and not of concern reflect growing frustration with the market’s dismissive response.

The Fed is simply one more forecaster, and not a good one. But their power over monetary policy is absolute. They can determine whether December 2022 eurodollar futures incorrectly suggest a hike late next next year by holding short term rates steady indefinitely. However, a graceful exit from $120BN of monthly bond purchases becomes harder to envisage as yields move steadily higher.

The ECB has responded to rising yields by increasing its bond purchases. The Fed may yet do the same if they feel financial conditions are becoming too restrictive. This starts to look like a central bank defending a currency peg – usually doomed to failure, except that in this case the analogous effort is to prevent the currency going too high.

A central bank trying to cap its currency should always win – after all, they can provide an unlimited supply of it. Similarly, there’s no theoretical cap on the Fed’s capacity to buy bonds. As Modern Monetary Theory (MMT) teaches, a central bank’s balance sheet to finance its own sovereign’s debt is unlimited (see Modern Monetary Theory Goes Mainstream).

It therefore seems unwise to expect interest rates to move higher than the Fed wants (although they may). It’s more sensible to bet on inflation staying higher than they would like. The Fed can’t control inflation, and their efforts to buy the bond market’s silence mean inflation will go higher than it otherwise would.

Right on cue, news leaked of the White House plan to launch a $4 trillion infrastructure/climate change/jobs initiative. This should dispel any lingering doubts that MMT is government policy. If you need further convincing, check out Stephanie Kelton’s The Deficit Myth, the playbook on current fiscal policy. We reviewed it here.

With fiscal and monetary policy synchronized to produce inflation, this is the path of least resistance. Inflation-sensitive assets, of which energy pipelines are a good example, are becoming indispensable to everyone’s portfolio.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In fairness, an appropriate comparison would be the total returns on midstream C corporations and MLPs on an after current taxation basis, taking into account the tax deferral attributable to partnership distributions being treated as a return of capital and the 20% deduction on partnership earnings and profits under Code section 199A.