Is Biden Bullish For Pipelines?

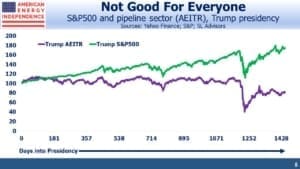

The Trump presidency was unequivocally good for investors. The S&P500 returned 14.9% p.a. during his four-year term. There will be strong opinions on either side, and we’ll leave that debate for others. But it’s fair to say that this beat the expectations held by many when he was elected.

Energy executives cheered the loudest when Trump won in 2016. This is an industry where Republican views dominate. Few energy investors were expecting such a miserable subsequent four years. Even before Covid decimated crude oil demand, the American Energy Independence Index (AEITR) had returned 3% p.a., versus 16% for the S&P50 through 2019. On the day voters elected Biden, the numbers for Trump’s term were –4.9% and +14.9% respectively.

Trump’s policies were energy-friendly – he eased regulations, pulled out of the Paris climate agreement and promoted American “energy dominance”. The problem was energy executives. They over-invested, over-produced and, in the case of some pipeline companies, overbuilt. The lesson for energy investors is that when management teams get what they want, look out!

It’s still early to assess the Biden impact on pipelines, but the signs are encouraging. Democrats are naturally anti-fossil fuels, but the ones in power recognize that keeping the lights on is important to staying in office. The energy transition is a long one. We’re not yet fully reliant on intermittent solar and windmills and should hope we never are. Democrat policies are oriented towards constraining the supply of what they dislike, not demand.

This is turning out to be investor-friendly. Every energy company has a few ESG slides in their presentation. They all discuss the energy transition. Some are even investing in solar and wind, although wouldn’t unless the IRR on such investments was supplemented by the benefits of a greener image. On their recent earnings call, Energy Transfer (ET) co-CEO Mackie McCrea revealed that, “… we’re struggling with wind quite honestly, it’s hard for us to figure out how to make that work. And we’re not going to do anything that doesn’t make good economic sense for unitholders.” He then added, “I don’t know if we’ll ever get involved as far as investing in a solar project because the returns are …so much less than what we can achieve with other opportunities we have.”

Financial discipline is acting as a constraint against boldly leaping into renewables. At the same time, traditional pipeline projects on a large scale are becoming too risky to contemplate. When Biden canceled the Keystone XL, he reversed a prior executive order approving it and gave scant attention to our ally Canada’s need to find export routes for its crude. TC Energy (TRP) had already brought in the province of Alberta as a partner in case a Democrat president canceled the project. Alberta’s CS1.5BN investment is likely to be lost.

Kinder Morgan (KMI) similarly offloaded the Trans Mountain Pipeline project to the Canadian federal government in 2018 when they tired of navigating Alberta and British Columbia’s conflicting views on its completion (see Canada’s Failing Energy Strategy). Enbridge’s Line 3 Replacement is also at risk from U.S. government opposition, although most expect it to be completed.

Pipeline construction risk has become almost unquantifiable, because Democrat leaders are willing to over-turn previous approvals. Court challenges from environmental extremists can add substantial delays. Renewables projects advance PR objectives, but low IRRs limit their scope. The result is pipeline companies’ assessment of new investments reflect economic and political realites. Democrats have achieved something that long eluded investors, which is to limit growth capex. Smaller projects are still being done. The Energy Information Administration (EIA) yesterday noted new gas pipelines with 4.4 billion cubic feet per day of capacity entered service between November and January.

Reduced capex among upstream companies is constraining oil and gas supply, which is contributing to rising prices. Although pipeline companies have limited direct economic exposure to commodity prices, they reflect sentiment and overall economic activity. High energy prices are good for energy investors.

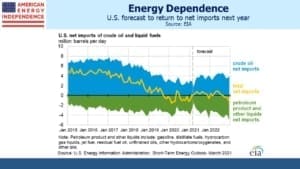

Gasoline prices are well above the $2.57 per gallon average of the Trump presidency and are on the verge of exceeding the range of his four-year term. Since the Administration felt compelled to provide a $1.9TN fiscal boost to the economy, it’s likely that gasoline prices are headed higher. The EIA expects domestic oil production to recover slowly, and for the U.S. to revert to being a net importer of crude next year.

The pandemic dominated energy prices last year and has permanently impacted production. Maybe U.S. output would be on the same modest growth path if Trump had won re-election.

Nonetheless, Democrat policies are oriented towards less spending and higher energy prices, both very pro-investor policies. With the emphasis on impacting supply not demand (i.e. no carbon tax), these trends are likely to continue. They’re consistent with efforts to combat climate change. They’re also good for the energy sector. The Biden administration has become an unwitting friend of pipeline investors.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

To some extent at least, the interests of upstream and midstream are in contrast. When commodities are in reduced supply and demand stays the same, prices rise, and that’s good for upstream, but reduced upstream activity is disadvantageous for midstream. When there is more supply than demand prices decline, which is a disadvantage for upstream but the increased activity is beneficial for midstream. Amazingly, the market completely misses this point and treats “energy” as a single, unified sector..