Lone Star State Loses Power

Bill Gates, in an interview two years ago, asked how Tokyo would cope with a typhoon if it was fully powered by renewable energy. Compensating for the loss of solar and wind for two to three days would require enormous battery back-up that would sit mostly idle, other than once every few years. He noted the economics would be unworkable.

Texas is a leader in wind energy. It’s tempting to blame the recent blackouts prompted by exceptionally cold weather on the intermittency of wind power. A photo of a helicopter de-icing windmill blades became an iconic reminder of the opportunistic nature of renewables. Widely circulated on social media, it turned out to be from Sweden several years ago.

Texas uniquely has its own power grid, overseen by the Electric Reliability Council Of Texas (ERCOT). Power suppliers compete to provide electricity to the network, and while free markets have much in their favor, reliable power in that market is clearly under-valued. Wholesale electricity prices reached $9,000 per MWh, the limit set by ERCOT. Average U.S. residential prices are 13 cents per KWh, equal to $130 per MWh. Some Texan households will be getting a shockingly high utility bill.

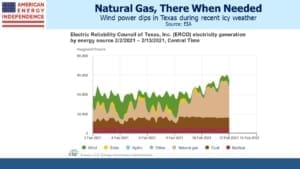

Wind power collapsed leading into the Presidents Day weekend. This wasn’t an unfortunate coincidence, but was a result of icy temperatures that caused power demand to spike. Rolling power cuts extended well beyond Texas, and some natural gas power plants also went offline because cold weather restricted their operations. Nonetheless, natural gas power generation soared when needed. It’s negatively correlated with wind power output, a valuable quality for portfolios of power generation as well as stocks.

The energy sector responded by continuing its strong rally. The American Energy Independence Index, which consists of North America’s biggest pipeline companies, is up 15% YTD, 10% ahead of the S&P500. This could simply be a response to rising oil and gas prices, but it may also reflect a growing awareness that the world will need all sources of energy for the foreseeable future. Solar and wind are prone to go offline during extreme weather events. California’s drive to expunge everything but solar and wind led to rolling blackouts last year during a heatwave (see California Dreamin’ of Reliable Power). Renewables are developing an unfortunate reputation for being there until demand surges, when they’re most needed. Providing back-up adds significant expense.

It’s too early to judge the public response to this failure. Texans are still trying to stay warm. But a cooling dose of realism poured on the single-minded focus on renewables is long overdue.

U.S. foreign policy is now configured to take account of our climate goals, which is a positive development. However, the charge of hypocrisy is easily leveled against both people and countries trying to persuade others to change their ways.

For example, the U.S. plans to halt funding for overseas fossil fuel projects, so as to highlight China’s continued bankrolling of coal projects among poorer countries. China is doing more to warm the planet than any other country – they burn half the world’s coal and are promoting its use among others. With poorer countries less able to cope with rising sea levels, we’re in the odd position of promoting behavior that we find more in their interests than they do. And while reduced coal use is a good objective, the U.S. is forecast to increase its coal consumption this year and next (see Emissions To Rise Under Democrats).

Past years switching from coal to natural gas are being reversed, because natural gas isn’t as cheap as it used to be. Democrat policies are designed to increase energy prices, with sometimes unintended consequences. American leadership would mean phasing out our own use of coal.

Moreover, Joe Biden’s emissary to convince the developing world to use less coal is John Kerry, whose lifetime of private jet travel must make his personal carbon footprint the envy of those he would persuade. Climate change is a serious issue but is not yet receiving a coherent policy response.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Do you remember “Freeze a Yankee”? I guess “Freeze a Texan” would be similarly unkind so will resist the thought! ?

John Kerry is in the top 1/10 of 1% (maybe higher) of carbon footprints in the world. Not really the messenger that thoughtful approaches to polluting less needs.