Why Texas Lost Power

Debate continues over the cause of the extended power cuts in Texas last week. Predictably, party affiliation colors views. Republican Governor Greg Abbott said, ““the Green New Deal would be a deadly deal for the United States of America.” Two former Energy Secretaries, Rick Perry and Dan Brouillette blamed frozen wind turbines, and over-investment in renewables at the expense of ensuring more robust infrastructure.

It’s true that the extreme cold curtailed output from coal and gas power plants and even one nuclear facility. It’s also true that windpower works in cold northern latitudes. The state’s energy infrastructure just wasn’t prepared for such low temperatures. And the Texan power market, overseen by ERCOT, is a free-wheeling bazaar with hundreds of power providers all vying for business. Households routinely switch from one provider to another. As a result, the average retail price of electricity in Texas is 82% of the national average. But the market structure clearly doesn’t value 100% reliability.

Both of these problems – winterizing equipment and altering market incentives for power providers, can be fixed.

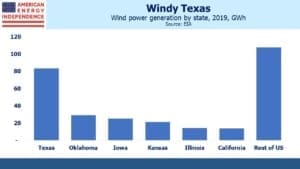

Texas generated 17% of its electricity from wind in 2019 (most recent figures available). They are easily the leading state. At 83 Gigawatt Hours (GWh), they are 28% of the U.S. total and well ahead of #2, Oklahoma at 29 GWh. Wind power in Texas has been widely regarded as a success.

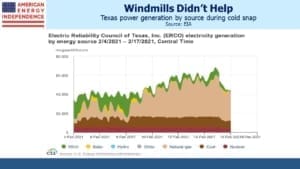

Was over-reliance on windpower to blame, as Republican politicians claim? Or did the cold weather show no favorites, with natural gas, coal and nuclear plants all going offline as well?

Perhaps the chart showing power generation by source can be interpreted to favor either side, but an objective view would surely conclude that natural gas generation soared when needed, uniquely among all power sources albeit not by enough to avoid power cuts. Wind power became negligible. It’s hard to argue that more wind power would have solved this problem.

Climate extremists will argue that more extreme weather is an early warning of the adverse effects of global warming. This alone adds urgency to the energy transition. But if Texas had already converted their power generation to be 100% emission-free, that would remove around 200 million metric tonnes of CO2 emissions, 0.5% of the total emitted worldwide annually. The weather in Texas wouldn’t change. Advocates would argue that such leadership might induce behavior elsewhere. It would need to be in China and other emerging countries to make a difference.

In How to Avoid a Climate Disaster, Bill Gates offers a pragmatic view loaded with useful facts. We’ll be writing a review soon, but he notes the low power density of wind, which produces 1-2 watts of power per square meter. Solar is 5-10, while fossil fuels are 500-10,000. Wind takes up a lot of room.

It may simply be coincidence, but following California’s heatwave-induced blackouts last year (see California Dreamin’ of Reliable Power), two big states with a heavy reliance on renewables have suffered power outages. Since it’s not always sunny and windy, solar and wind have their place but are unwise beyond a certain threshold.

Both states could have redirected capital outlays from renewables to making their existing power supply and grid more reliable. In this way, environmental extremists’ obsession with growing unreliable sources of energy contributed to the blackouts. Gates argues that intermittency limits their ability to provide a significant portion of our power.

Texas is 26% renewables and California 29%. Few states should want to emulate them.

The deception of climate extremists is that renewables are cheaper and will create jobs. If that was true, the oil and gas industry wouldn’t exist. Energy today is cheap, perhaps unsustainably so. Technologies already exist to capture CO2 emitted from the manufacture of steel and cement, as well as from electricity generation. Implementing them will cost money and raise prices, but that should be no surprise.

A serious effort to reduce emissions will impose regulations or additional costs on fossil fuel emissions, which will create the necessary incentives to install equipment that curbs emissions, just as coal plants are required to do for the sulfur they emit. Natural gas will fare well, since it’s cheap, not intermittent and relatively clean burning. That’s why long term forecasts of energy use show natural gas enjoying continued growth.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

A well analyzed and well written article.

Balanced with solid data points…

Thanks