Emissions To Rise Under Democrats

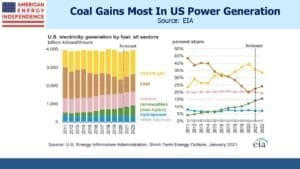

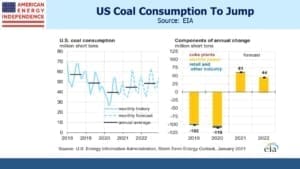

By the end of President Biden’s first year in office, his administration’s report card on climate change will offer some uncomfortable facts. Natural gas, after taking market share from coal for power generation under the Trump administration, will see those gains reversed. In the U.S. Energy Information Administration’s (EIA) most recent Short Term Energy Outlook, they forecast that U.S. coal consumption will increase its share of power generation from 20% last year to 24% by next. The biggest source of falling CO2 emissions in the U.S. has been the reduction in burning coal, a trend that pre-dated the last administration but continued through it.

President Biden will no more accept the blame for this unhappy shift than Trump could claim credit for the positive trend that preceded it. But policy changes are partly the cause.

Natural gas consumption grew over the past several years because it was cheap. Trump’s pro-energy stance stimulated oil and gas production, much to the chagrin of investors who would have benefited from less. Prices have been rising recently, and although there are many global macro factors at play, the chilling effect of Democrat policies on new fossil fuel production is playing a part.

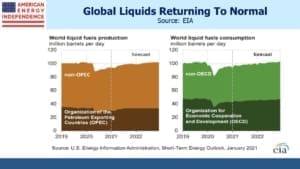

Over the next two years, world liquids fuel consumption is expected to recoup the Covid slump, so that 2022 will look much like 2019. The same is true in the U.S.

Optimists will point to the growth in solar and wind energy, whose share of U.S. electricity production is set to increase, from 12% last year to 16% in 2022. However, nuclear power will lose 2% (from 21% to 19%), as continued opposition which includes climate extremists reduces one source of zero-emission power. Add in a 1% drop in hydropower, and clean energy is set to gain 1% market share over the next two years – hardly dramatic.

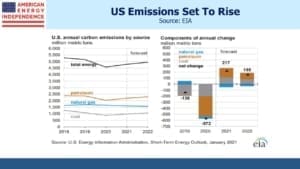

As a result, U.S. CO2 emissions are going to begin rising again. By the middle of Biden’s term, there will be little to point to in terms of actual U.S. results on climate change. The entire story will be one of hope. It’ll be hard to lecture China on the need to curb their emissions, which are forecast to keep rising along with rising living standards.

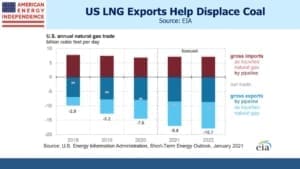

Fortunately, U.S. natural gas exports are expected to keep rising. Over the next couple of years it looks as if America’s biggest contribution to curbing global emissions will be enabling the foreign buyers of our natural gas to use less coal than they otherwise would.

It’s hard to pivot towards cleaner energy. The two places where public policy has been aggressive (Germany and California) have little to emulate. Increased coal consumption to counter renewables’ intermittency (Germany), unreliability (California) and high prices (both) aren’t an appealing destination for the rest of us.

The politics of this will be fascinating. Climate extremists are likely to be frustrated at the lack of results. The Democrats’ razor-thin margin in the Senate make sweeping policy changes unlikely.

Reducing coal consumption is the low hanging fruit of reducing emissions. It not only generates twice the CO2 emissions of natural gas when burned, but also pollutes locally with fine particulate matter and nasty chemicals such as mercury. Executive actions via the Environmental Protection Agency and aggressive enforcement of existing environmental laws could increase the cost of coal, offering the new administration some chance of improved results.

Trump won three of the five biggest coal producing states (Wyoming, West Virginia and Kentucky) with Pennsylvania and Illinois voting for Biden. Democrats might therefore conclude that they have little to lose by taking on the coal industry, a move that would be easily supported by the science. It’ll be a tricky decision though, because they’d risk losing the other two.

The biggest weakness in policies to combat climate change is their reliance on supply constraints. Billions of people use fossil fuels, and we are all contributing to emissions to varying degrees. But rather than raising prices directly on the consumption of energy, policies more often seek to manage sources of supply. Public support to reduce emissions is shallow – if people believed the planet was truly at risk, nuclear energy would be an obvious solution. We’d have a carbon tax in the U.S., but that’s a political non-starter. So policy focuses on supply, because the impact is less visible.

The logical progression is to engineer higher coal prices. The natural winner would be natural gas, the only energy source with the capacity to quickly compensate for, say, a 5% drop in coal production.

Democrats own the U.S. response to climate change for the next four years. Higher energy prices are part of their strategy. It’s what energy investors would like too.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!