Oil And Pipelines Less In Sync

/

The relationship between crude oil and pipelines exhibits the qualities of a copula distribution. This was suggested to us last week by a highly numerate financial advisor, commenting on the tendency of the midstream energy infrastructure sector to have its biggest falls when oil is also collapsing.

It is an unfortunate historical truth that a sharp drop in economic activity, such as at the onset of the pandemic, can depress both the price of oil and expectations for volumes of hydrocarbons passing through America’s pipelines. At such times investors recall being told it’s a toll model largely indifferent to commodity prices. This is true, but when commodities fall far enough it can signal a drop in volumes.

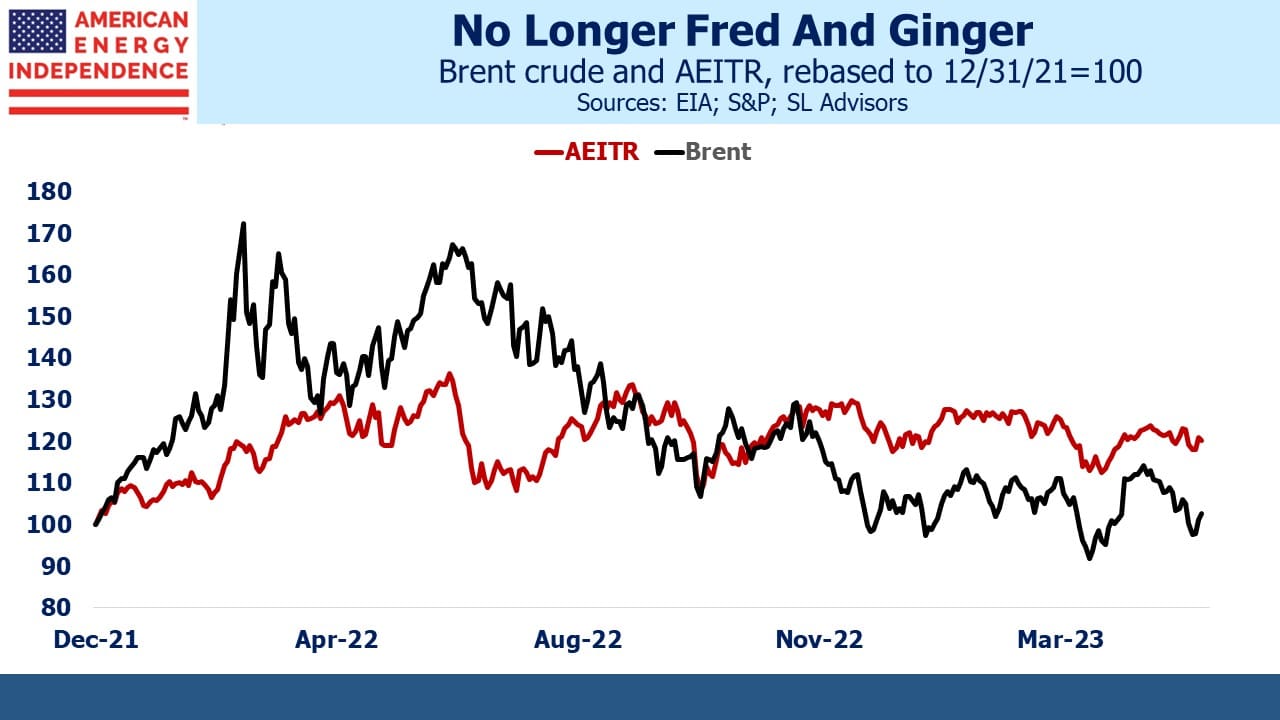

This is why the weakening relationship between the two is so welcome. Since mid-April Brent crude has shed $10 per barrel, while the American Energy Independence Index (AEITR) is close to unchanged. America’s regional banking crisis is one of the causes. Signs of the credit crunch are few, but a bank whose regulator is checking on their liquidity is likely to be trimming its risk appetite.

Construction loans would seem especially vulnerable. 350 California Street in San Francisco is expected to sell at an upcoming auction for 80% less than its $300 million 2019 appraised value. This will provide a useful benchmark for commercial real estate. Hybrid work has hit the Bay area office market especially hard. But the city also shows how much wreckage unchecked liberal policies can inflict. City leaders are considering a slave reparations bill that would award $5million to every eligible black adult, to be funded by the other 94% of the city’s population. A commensurate population shift will likely follow. California is contemplating something similar, at a cost of up to $800BN.

The decoupling of pipelines from crude oil relies in part on stronger balance sheets. The median Debt:EBITDA for investment grade companies is 3.5X. Ten years ago 4-4.5X was common. Most businesses are on a trajectory towards further reduced leverage next year, driven by increasing EBITDA.

Since the beginning of last year, daily returns of oil and the AEITR have a correlation of 0.45. They move together more often than not, but it’s a weak relationship. Following Russia’s invasion of Ukraine crude oil gyrated wildly while pipelines trended up. Crude was up over 50% by midyear, while the AEITR was +13%. During the second half of last year crude fell over 30% while the AEITR was +7%. So far this year they are down 5% and flat respectively.

The AEITR has also been helped by 1Q23 earnings, which followed a familiar pattern whereby companies generally beat expectations by a few percent. Cheniere is usually the exception, once again reporting a huge beat with 1Q23 EBITDA of $3.6BN (versus $2.5BN expected). They also raised full year guidance from $8-8.5BN to $8.2-8.7BN.

The energy sector is sitting on a growing pile of cash. This also acts to shield companies from movements in oil and gas prices. Exxon Mobil finished the quarter with almost $33BN cash on hand. Six big global oil companies have almost $160BN in cash.

Midstream companies tend not to accumulate cash to the same degree but are returning it to stockholders with dividend hikes and buybacks. Capex is creeping up in a few cases, but for the most part financial discipline remains.

The other day an investor asked me why riskless treasury bills yielding 5% weren’t better than energy infrastructure yielding 6% but with equity volatility. The answer is that treasury bills won’t always yield 5%, and interest rate futures imply they’ll be at 3% by the end of next year. Ample dividend coverage with the continued prospect of increases will lead more investors to this sector once the Fed starts cutting rates. Two publications from the Fed on Monday showed that they’re starting to appreciate the risk of regional banks adopting a more cautious attitude towards new exposure.

Bill Gross told Bloomberg TV that he has 30% of his personal portfolio in MLPs. He referred to Energy Transfer as an ETF (he was appearing on ETF IQ) and likes the tax deferred yields. His comments are at the 15 minute mark.

A fixed income investor likes the yield on pipeline stocks. Ten year treasuries at 3.5% are an improvement on the past few years but still inadequate to prevailing inflation.

It’s also interesting to see that NextEra, the most valuable power company in America and a leader in renewables, is planning to invest $20BN in hydrogen. The tax credits in the Inflation Reduction Act (IRA) are an important driver. But solar and wind projects are facing increasing challenges. Danish company Orsted, Spain’s Iberdrola and a JV including Shell are all developing offshore wind projects in New England and have requested a regulatory review of contracts because of sharply higher costs.

Weather-dependent power that requires enormous space and long-distance transmission lines is a miserable future. Hydrogen is expensive, although less so under the IRA. But like natural gas it’s energy dense and dispatchable, meaning it’s there when needed not just when it’s sunny or windy. And it can move by pipeline. Midstream energy infrastructure companies will be ready.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!