West Texas Leads a New Oil Boom

In our recent blog post America Is Great!, we described the success of America’s shale producers in the face of OPEC’s intention back in 2014 to bankrupt them with lower oil prices. The recent agreement on reductions in output was a concession that this strategy had failed (see OPEC Blinks). America’s private sector had bested countries representing more than a third of global oil production.

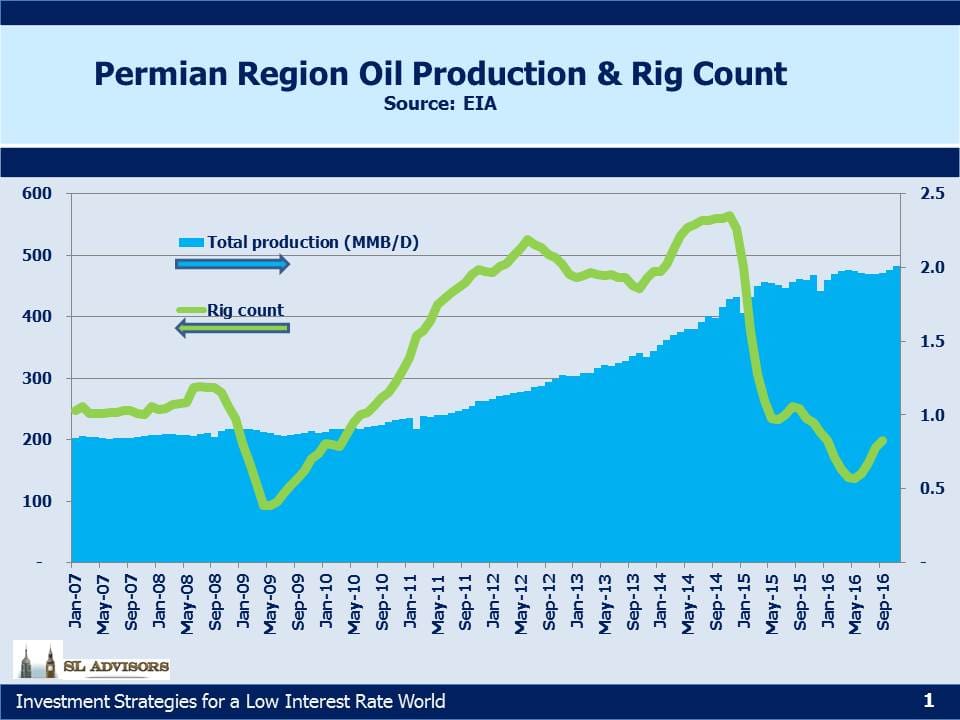

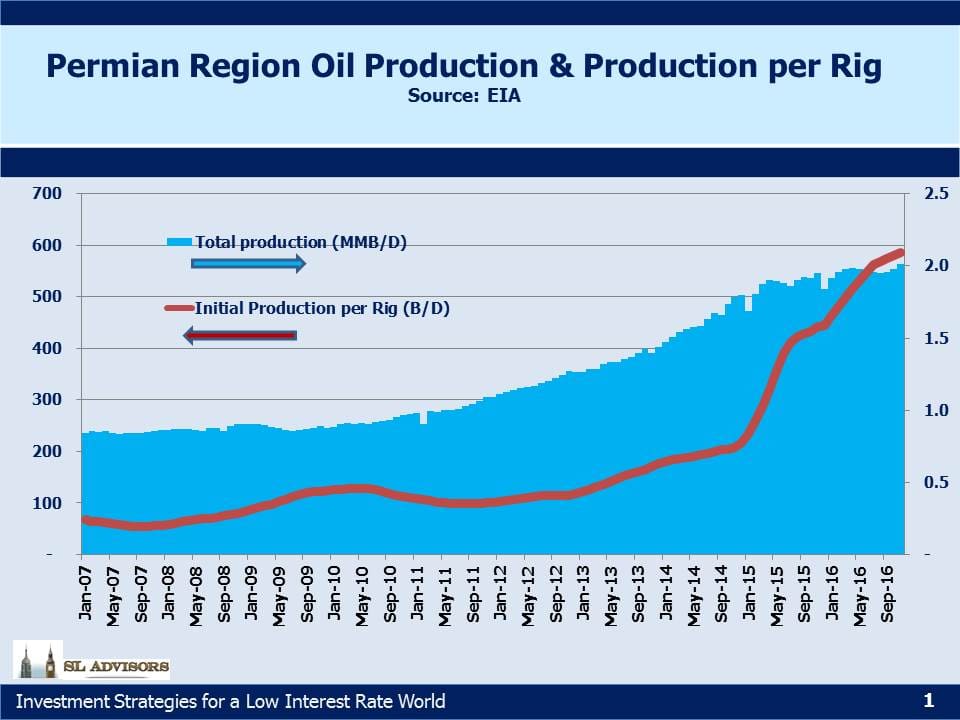

The Permian Basin in West Texas represents this success more clearly than just about any other region in the U.S. It chiefly consists of two areas, the Delaware Basin and the Midland Basin, with several plays within each region. The Permian has been a source of crude oil production in the U.S. for decades. The first commercial oil well was completed there in 1921. As the Shale Revolution took hold over the last ten years, Permian output rose along with other plays. But such is the opportunity, combined with continued technological improvements in drilling, that output barely dipped in 2015 even while other shale regions saw cutbacks. Today, almost half the active drilling rigs in the U.S. are in the Permian Basin. This is driven by the productivity of Permian wells, where production from new wells has more than tripled over the past three years.

The Energy Information Administration’s (EIA) recent Annual Energy Outlook 2017 forecasts Permian crude production to increase by around 40% over the next five years based on current futures prices. If crude oil trends higher, the Permian holds the potential for significantly greater output than that.

The irony of this is not lost on an investor in Master Limited Partnerships (MLPs). We were originally led to expect stable income that grew steadily each year. The Shale Revolution added excitement and substantial upside to this originally rather pedestrian story, but also exposed the frailty of the more recent investor base. The bear market of 2015 was so clearly a problem of MLPs confronting growth opportunities whose capex needs exceeded their current cashflow (see The 2015 Crash; Why and What’s Next).

The collapse in MLP prices led energy infrastructure businesses to achieve greater alignment between their funding and investment opportunities. Energy Independence, never previously attainable, came into view as a realistic goal within less than a generation. Adapting our existing energy infrastructure network to support this vision is creating substantial opportunities for today’s leaders. Being an MLP investor today inevitably requires studying the markets for oil, Natural Gas Liquids (NGLs) and natural gas. Sales made by investors in late 2015/early 2016 will rank up there among the biggest missed opportunities of all time.

The Permian is now the target of a veritable land rush as some of the world’s biggest oil companies seek to increase their presence. Exxon Mobil (XOM) just agreed to pay $6.6BN for 275,000 acres. Noble Energy bought acreage for $2.7BN. The region has seen over $25BN in acquisition activity since June.

Memories of the global glut caused by North American production are still fresh. Now that U.S. production is increasing again, there are fears of a repeat. The world needs 6 million barrels a day of new supply each year to replace depletion from existing wells and new demand. We don’t think a second collapse is likely, but in any event U.S. shale producers have shown that they’re better able to withstand such an outcome than others. Meanwhile, in China for example, oil output has entered long term decline, creating one new source of extra demand for imports.

Growing Permian output will use up some of the extra take-away capacity, including for Plains All American (PAGP) who estimate they could see up to $600M in increased EBITDA as output grows.

We are invested in PAGP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

“Meanwhile, in China for example, oil output has entered long term decline, creating one new source of extra demand for imports.” Will the use of advanced technologies turn this around, as it did with U.S. production?

Nick de Peyster

http://undervaluedstocks.info/

It’s hard to say. The Chinese presumably incorporate some assumptions around that already in their forecasts.