The Alerian Problem

What do you do if your fund’s index is shrinking? This is the dilemma that many retail investors in MLP-dedicated mutual funds and ETFs will be confronting in the months ahead.

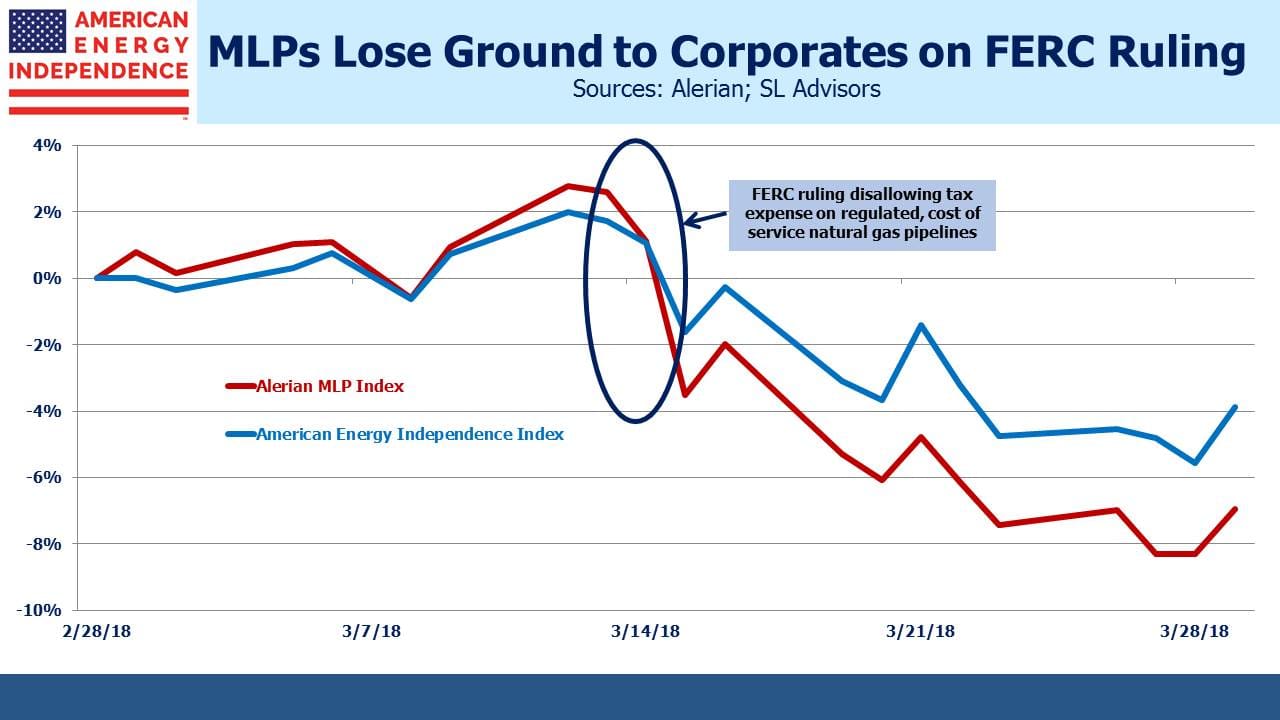

The trend for MLPs to simplify by combining with their corporate General Partner (GP) is well established. The recent Federal Energy Regulatory Commission (FERC) ruling (see FERC Ruling Pushes Pipelines Out of MLPs) prompted us and other observers to conclude that this trend is likely to continue, if not accelerate (see Are MLP Going Away?). Last week Tallgrass Energy Partners (TEP) combined with its GP Tallgrass Energy GP (TEGP), the first such announcement since the FERC ruling on taxes and one of the few simplifications to result in a bounce in the stock price. TEP will drop out of the Alerian Index, reducing the number of constituents to 41. At the end of 2015 it stood at 50.

On Monday, oil driller Legacy Reserves LP (LGCY) announced they were converting from an MLP to a corporation, causing their stock to jump 11%. CEO Paul Horne clearly will not miss running an MLP. In the press release, he noted that, “…we look forward to stepping out from the dark cloud we have been under as an upstream MLP.” On Friday, Viper Energy Partners LP (VNOM) jumped 10% after electing to be taxed as a corporation. Simply by agreeing to be a taxpayer, thereby issuing 1099s instead of K-1s, they became more valuable. Their presentation noted, “VNOM will be uniquely positioned as a first-mover and leading public minerals yield vehicle without the limitations of an MLP.” These moves reflect the disdain investors have developed for the MLP structure, and the bigger ones contemplating their own conversion will have taken note.

The reduced corporate tax rate makes MLPs relatively less attractive. FERC’s elimination of imputed tax expense, although inconsequential in the near term, will affect cashflows for some interstate natural gas pipelines and, in a couple of years some liquids pipelines too. Moreover, MLP yields remain stubbornly high. They are attractively valued, but as such they represent an expensive source of equity capital for issuers. The older, wealthy American who is the typical MLP investor wants steady income. The shifting of cashflows to fund new infrastructure projects demanded by the Shale Revolution has alienated him (see Will MLP Distributions Pay Off?). All these factors are reducing the value of putting eligible assets in an MLP.

As a result, MLPs are less than half of the midstream energy infrastructure sector, and each MLP simplification further reduces their number. This need not matter much for a holder of individual MLPs. As your MLPs convert to corporations, your portfolio’s composition shifts as well. TEP investors will still own the same assets via Tallgrass Energy, LP (TGE), a corporation for tax purposes.

But if you’re invested in an MLP-dedicated fund, you and your fund manager face a problem. A shrinking Alerian MLP Index (AMZ) creates a dilemma for funds that are benchmarked to it. If they do nothing, the index (and therefore, the fund) will become steadily less representative of the sector, with fewer names and a smaller median market cap. Today, the median market cap of AMZ’s constituents is only $1.8BN, compared with $15BN for the broader American Energy Independence Index (AEITR). Not coincidentally, since the FERC announcement broader, corporate exposure to infrastructure has outperformed the MLP-dedicated Alerian index.

To put this in perspective, the Alerian MLP ETF (AMLP), various tax-impaired mutual funds offered by Oppenheimer Steelpath, Goldman Sachs, Center Coast and Cushing, along with the JPMorgan Alerian MLP Index ETN hold a combined $24BN in MLPs linked to AMZ. This is 14% of AMZ’s float-adjusted market cap. If these funds do nothing, tracking their index will shift them into more concentrated portfolios, or smaller names, or both.

Rather than fight against this tide, it might make sense for them to consider switching to a more representative index that better reflects energy infrastructure. However, like watching elephants dance, it’s unlikely to be elegant. If AMLP announced that it was substituting a different, broader index, that would immediately depress the prices of those MLPs that it would need to sell, hurting performance immediately. Actively managed mutual funds could implement portfolio shifts to a broader index over weeks or months, and although this might lessen the immediate market impact, it would introduce tracking error against both old and new benchmarks. It would likely be disruptive to their performance.

If all these funds sold 75% of their MLPs they could even claim to be RIC-compliant and no longer subject to the drag of corporate taxes. Unfortunately, that would require selling $BNs of MLPs, and the reason MLPs are converting to corporations is because MLP prices are depressed.

MLP-dedicated funds face an unenviable business decision, and they’re clearly best served by the status quo. Their best outcome is to delay changing their benchmark indefinitely, and hope to convince their retail investors that MLP-only funds remain a viable proposition. The risk for current and future holders is that the shrinking Alerian Index eventually forces them to change, which could be tumultuous. It might be one reason why net inflows to MLP-dedicated funds are flat since last Summer. In addition to the headwinds of corporate taxes (see AMLP’s Tax Bondage), you can add index uncertainty. It’s The Alerian Problem.

We are short AMLP

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!