Corporations Lead the Way to American Energy Independence

In 2005, when I was providing seed capital to emerging hedge funds at JPMorgan, we met with Alerian’s founder Gabriel Hammond. “Gabe” knew a great deal about Master Limited Partnerships, and he was convinced that the sector needed an index in order to grow. He was right, and Alerian’s index became the most widely used benchmark for MLPs. We seeded Alerian Capital Management’s offshore hedge fund.

Back then, MLPs were synonymous with energy infrastructure. To invest in one was to invest in the other. But as regular readers know, much has changed since then. MLPs are now a shrinking subset of energy infrastructure. The Shale Revolution created the need for growth capital to build new pipelines, because crude oil hadn’t previously been sourced in North Dakota, nor natural gas in Pennsylvania. The MLP’s promise to pay investors 90% of Distributable Cash Flow (DCF) came into conflict with their desire to invest in new projects. The older, wealthy Americans who owned MLPs were there for the regular income. Foregoing some of today’s distributions in exchange for the promise of higher future returns wasn’t appealing, and MLPs turned out to be a poor source of growth capital. MLPs began “simplifying”, in many cases becoming regular corporations where payout ratios are far less than 90% and investors are global. In short, the older, wealthy American turned out to be the wrong type of investor for midstream energy infrastructure’s response to the Shale Revolution. MLPs were no longer equivalent to energy infrastructure.

We’ve watched and participated in this evolution as investors. It’s an ongoing source of considerable frustration to many that the energy sector has performed so poorly when the fundamentals appear so promising. The price of oil peaked along with sentiment in 2014, since when the S&P Energy ETF (XLE) has dropped 18% while the broader S&P500 is up 52%. Volumes continue to grow, with crude oil, natural gas and its related liquids (such as ethane and propane) all reaching new records this year.

The higher volumes will ultimately drive higher profits for the midstream infrastructure businesses that gather, process, transport and store them, although the alignment of production and stock returns is becoming an interminable wait. In the meantime, the vast majority of funds that specialize in energy infrastructure are dedicated MLP funds. They face a tax drag (see AMLP’s Tax Bondage), and a shrinking pool of names (see The Alerian Problem).

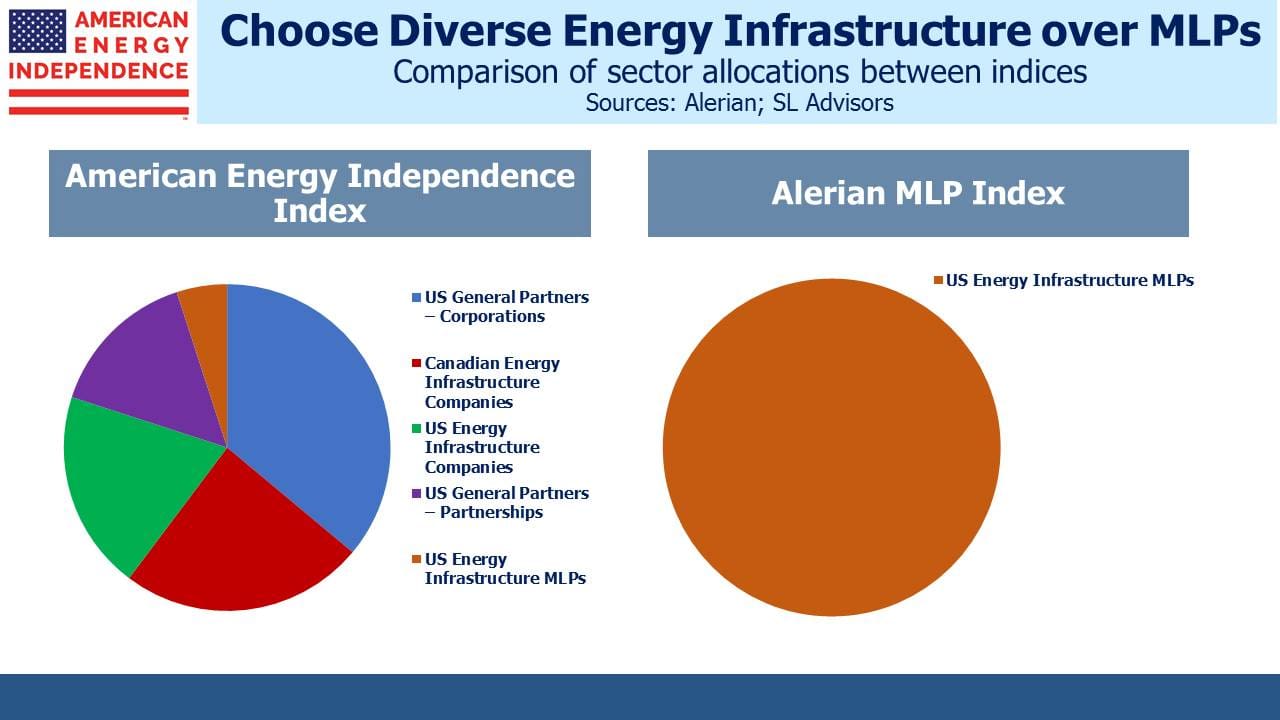

Corporations, not MLPs, control U.S. energy infrastructure. And yet, some of the biggest operators such Kinder Morgan (KMI, market cap $34BN), Oneok Inc (OKE, market cap $24BN), Williams Companies (WMB, market cap $21BN) or Cheniere Inc (LNG, market cap $13BN) don’t appear in the MLP-dedicated funds that, as a result, no longer represent a broad investment in energy infrastructure.

The American Energy Independence Index (AEITR) constituents have a market cap of more than twice that of the Alerian Index. The AEITR also includes General Partners (GPs), whose control of many MLPs provides them with preferential rights as well as being the investment of choice for most management teams (see MLPs and Hedge Funds Are More Alike Than You Think). The AEITR includes some Canadian names, since North America’s pipeline network crosses the border in numerous places and some significant elements of U.S. infrastructure are connected to their northern neighbor’s network.

The result is a far more complete representation of midstream infrastructure. The American Energy Independence Index represents the future, which increasingly is corporate ownership of assets, versus the outdated model limited to MLP ownership. For investors seeking to follow the Shale Revolution’s drive towards American Energy Independence, we believe it offers a superior way to participate.

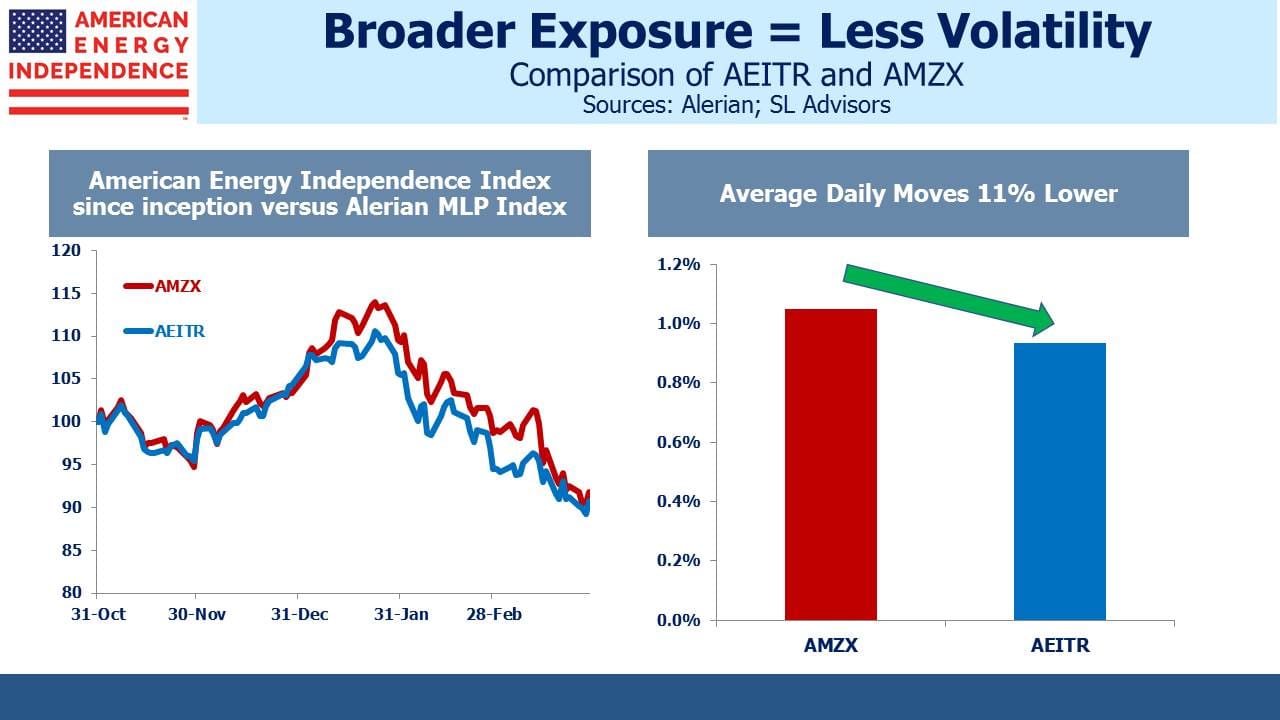

We launched the index in November, and its associated ETF in December. We think because AEITR is more diversified, it has demonstrated 11% smaller average daily moves than the Alerian Index. Given Alerian’s shrinking pool of eligible MLP names and more concentrated sector exposure, we expect the American Energy Independence Index to continue exhibiting lower volatility.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!