Midstream Earnings Wrap

/

Midstream earnings are in, and generally met expectations as has been the case for the past several quarters. Williams Companies (WMB) enjoyed record natural gas gathering volumes of 18 Billion Cubic Feet per Day (BCF/D). This drove 2Q23 adjusted EBITDA of $1,611MM, versus analyst expectations of $1,568MM.

Liquefied Natural Gas (LNG) exporter Cheniere continued a run of positive surprises with a 13% beat of sell-side expectations and once more raised full year EBITDA guidance. Their success contrasts poignantly with the declining fortunes of founder and former CEO Charif Souki, forced out by activist Carl Icahn in 2015. The following year Cheniere began shipping LNG, and today their 6 BCF/D in volumes represents around half of US LNG exports.

Souki went on to found Tellurian (TELL), best described as a “Cheniere wannabe”. Tellurian has been trying for years to sign up customers and raise the capital required to build Driftwood LNG, an export terminal along Louisiana’s Calcasieu River. Souki is either a visionary who was early to recognize the export potential of US natural gas, or an entrepreneur with excessive risk tolerance always looking to enrich himself first. He’s probably a bit of both. When you invest with Souki, you know he’ll make money; you just don’t know if you will. Some have speculated that TELL would have more success raising capital with a new CEO.

We noted Souki’s proclivity for excessive upfront compensation early this year when he negotiated $20 million in annual compensation even though Tellurian is years away from shipping any LNG (see Tellurian Pays For Performance in Advance). Developing Driftwood still looks like a long shot.

Souki routinely borrows against his own stock holdings. In early 2020 when TELL was plunging along with the rest of the energy sector, a margin call forced him to dump shares he owned. More recently, weakness in TELL led UBS to seize Souki’s 30-meter carbon fiber hull yacht Tango, pledged as security.

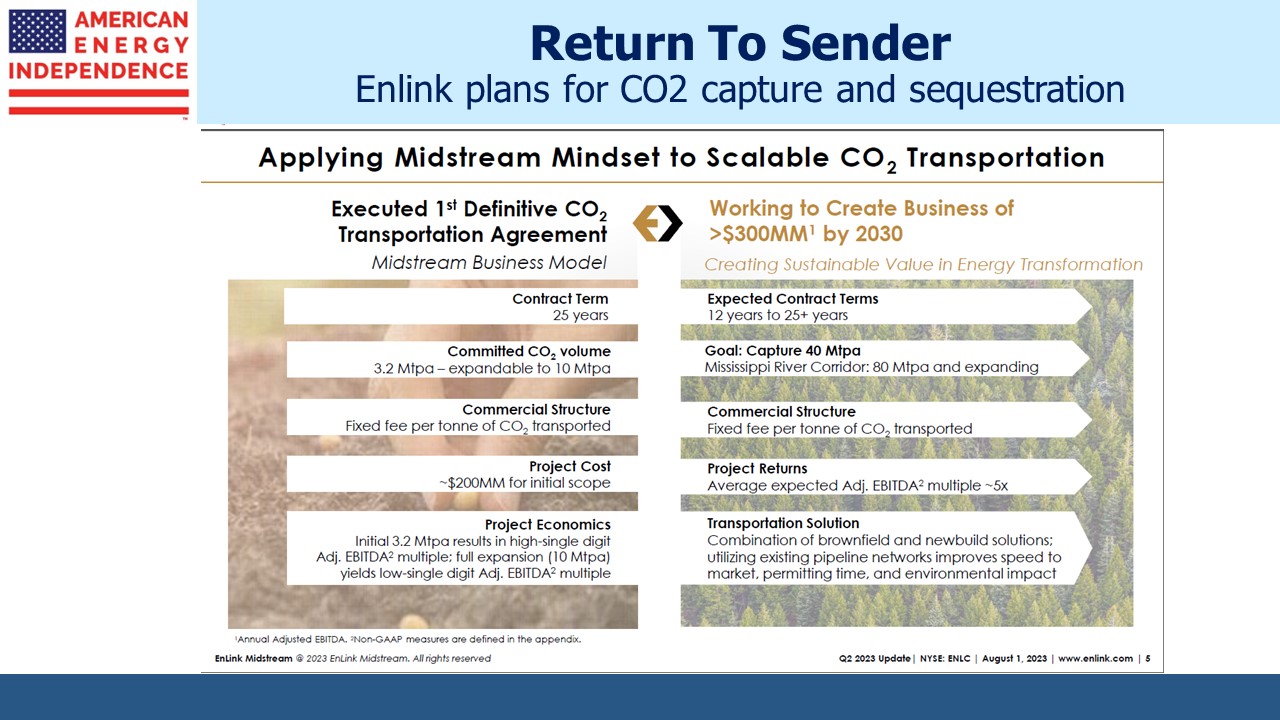

Every midstream company has something to say about their energy transition opportunities. Last year’s Inflation Reduction Act (IRA) increased the tax credits available for Carbon Capture and Sequestration (CCS). At its most generous, the Federal government will pay $180 per metric tonne for CO2 that is extracted out of the ambient air and permanently buried underground.

Even though a generation of young people is growing up mortally afraid that rising CO2 levels represent an existential threat, at around 412 parts per million (0.04%) it’s thinly dispersed in the air around us, and therefore expensive to extract. Nonetheless, Occidental (OXY) is building the world’s biggest CCS facility in Texas. In a few years expect to read that IRA tax credits are offsetting OXY’s tax liability on its conventional oil and gas business.

Sometimes the right geologic formation to permanently hold CO2 is the same one from which natural gas (CH4) was originally extracted. There’s an appealing symmetry in sending the carbon atoms back home after they’ve been separated from the four hydrogen atoms they arrived with while generating a useful chemical reaction that’s left them bonded with two oxygen atoms instead.

EnLink (ENLC) is better positioned than most to do this, since they provide natural gas to a number of petrochemical facilities along the Mississippi River corridor. The emissions from these facilities have far higher concentrations of CO2. 50% or more isn’t uncommon. ENLC is exploring opportunities to capture some of this CO2 and send it in dedicated CO2 pipelines back towards the region that provided the natural gas whose combustion created it. They estimate that they can earn an EBITDA return of around 20% on invested capital. Midstream energy infrastructure long since stopped being threatened by the energy transition and is instead becoming vital to it.

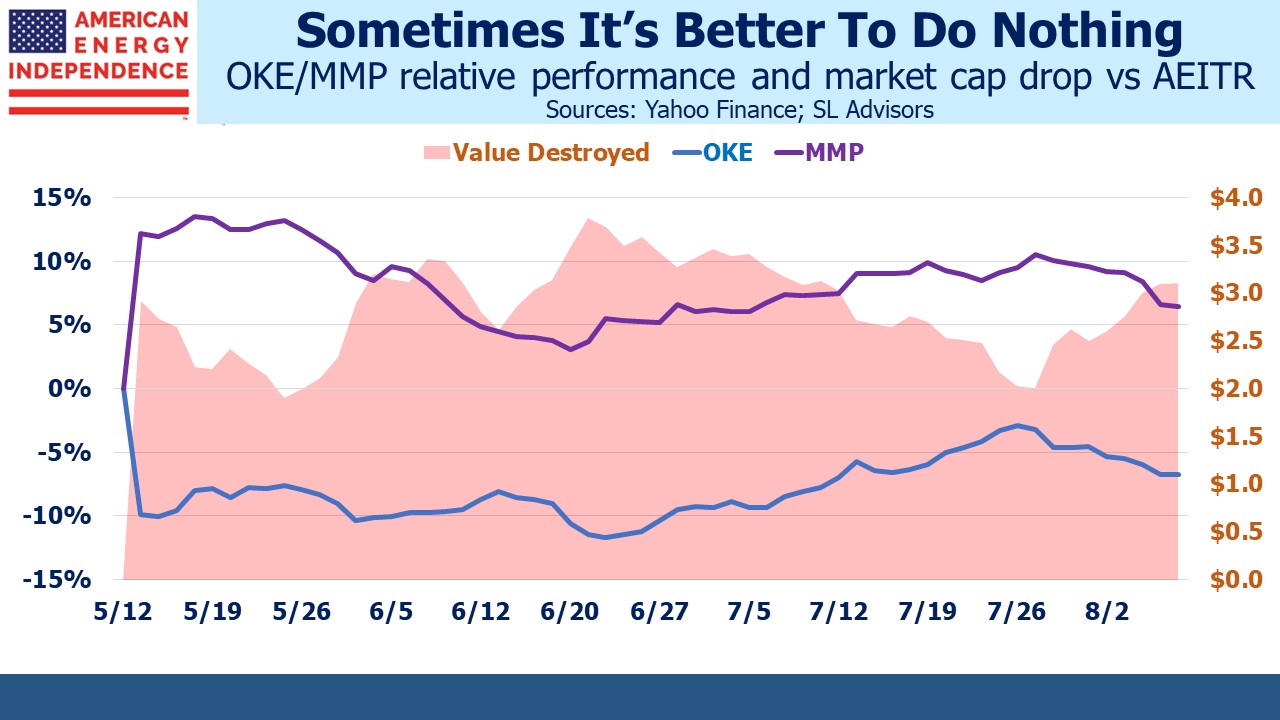

Magellan Midstream (MMP) and Oneok (OKE) reported good earnings as investors in both companies vote on their proposed merger. MMP’s adjusted EBITDA was 8% ahead of expectations and they raised their standalone EBITDA guidance for this year by 2%. OKE 2Q EBITDA beat expectations by just under 4%, and matched MMP’s full year increase in EBITDA guidance of 2%. One might ask why they need to combine when business seems to be going so well.

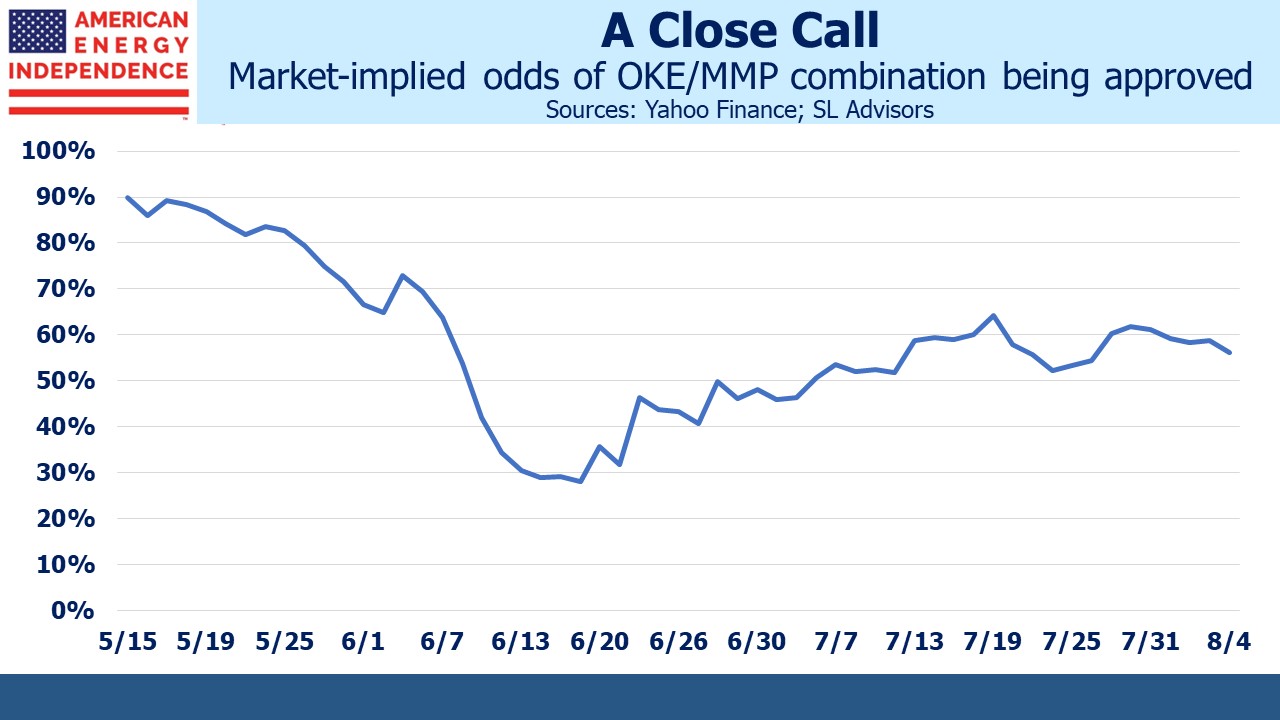

Votes on the merger are being counted this week, and the market-implied odds of its passage remain finely balanced. We estimate that $3.1BN in value has been destroyed since the announcement in May. Both companies have scheduled a special meeting of shareholders for September 21, at which point the result will be announced. It looks like being a nailbiter.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I would not at all be surprised if the results of the MMP/OKE merger vote leak out before the official September date, either directly or through high unit transactions by insiders or leakees..