We Need Much Cheaper EVs

93% of car trips are less than 25 miles, according to data from the Bureau of Transportation Statistics. The problem with EVs in America is with the other 7%. That’s where the range anxiety and charging infrastructure become an issue.

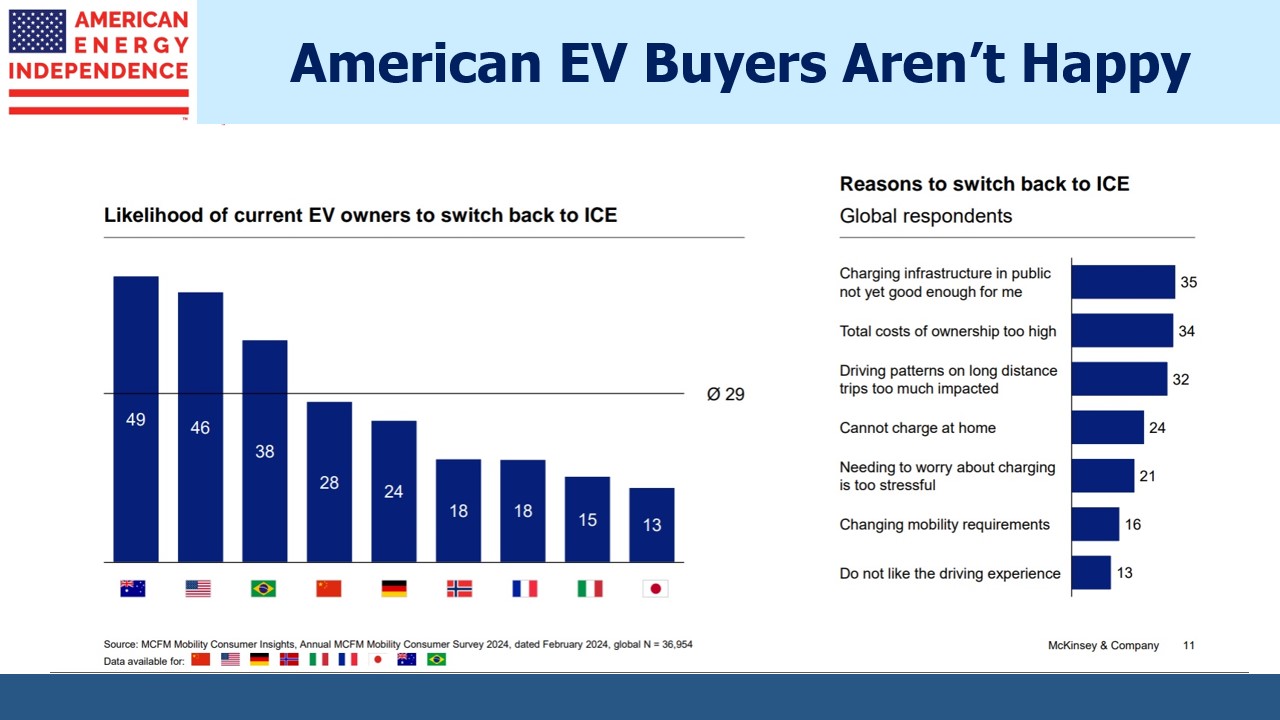

According to a recent survey from McKinsey, the US has among the least satisfied EV owners, with 46% intending to switch back to an Internal Combustion Engine (ICE) with their next purchase. Only Australia, another big country with high average mileage, reports more dissatisfied EV owners at 49%.

It’s a failure of the EV industry that almost half their customers are unhappy with their purchase. Along with poor charging options, cost is another factor. US sales rely heavily on altruistic choices by customers who are virtue-signaling. Research has shown that blue-leaning regions are far more likely to buy EVs than red. It’s why California dominates EV registrations. This is a problem for future sales, similar to subscription churn. If half of your subscribers don’t renew, it’s hard to grow your customer base.

Hybrid plug-in electric vehicles (HPEVs) are thought to be a good compromise. You can always rely on filling up with gas, but by keeping the battery charged you can minimize use of the conventional engine. The problem is that HPEV owners tend to not bother recharging, because (shockingly) it’s so convenient to stop by a gas station. So owners often fail to achieve the EPA mileage estimates that are advertised.

We’re running out of buyers who are willing to pay more for faster acceleration or to show they care about climate change. Like solar and wind power, reducing greenhouse gas emissions costs more than business as usual.

Except with EVs it could be different. Almost half of US households own two or more cars. The EV industry is selling expensive vehicles intended to replace one of the two ICEs a household owns.

There’s a market for very cheap EVs, perhaps souped-up golf carts, for the 93% of journeys that are local and don’t rely on charging infrastructure. As a policy matter, this could induce consumers to add a car that covers most of their driving needs while keeping the ICE for longer trips. The EV would be a compliment to the ICE, rather than trying to be a substitute.

These cheap EVs would need to be bigger than a golf cart – half of US auto sales are light trucks and minivans. But cheap EVs would compensate for the range anxiety. Even if we carpet the country with charging stations and speed them up, Americans are just not going to spend twenty minutes recharging.

BYB’s Seagull sells in China for around $12K. They’d sell millions at that price in the US. They could, except for the tariffs imposed on them, because the White House has a flexible concern about climate change. Red state energy workers aren’t much use to this White House. Blue state auto workers may be. So the latter are protected with tariffs, at the expense of higher US GHG emissions.

Joe Biden told everyone the energy transition will be painless. So far it’s not.

More coherent energy policies are looking more likely since the debate. Guy Caruso served as administrator of the U.S. Energy Information Administration (EIA) from July 2002 to September 2008. In a recent WSJ op-ed he argued that US LNG exports provide energy security to our allies and lower GHG emissions by displacing coal. We’re betting that the LNG permit pause will be lifted by next year, part of a more pragmatic policy approach to climate change.

If President Biden could struggle out of bed in time for an abbreviated day to consider the issue carefully (see Biden Tells Governors He Needs More Sleep and Less Work at Night) he would never have imposed the pause.

Midstream continues to perform well, with the American Energy Independence Index +18.6% for the first half of the year. Wells Fargo points out that the sector’s correlation with the S&P500 has been falling and is only 0.33 in 2024 versus 0.51 over the past five years.

Part of the reason is in the inflation protection that pipelines offer. Because tariffs are so often regulated with an inflation price escalator built in, cash flows responded positively when inflation surged in 2022. Investors have started to take note, which has underpinned performance.

Midstream has also closed most of its valuation gap with utilities, with EV/EBITDA of 9.3X compared to utilities of 9.6X. But leverage is lower (Debt:EBITDA 3.4X vs 5.2X) and dividend yields higher (5% vs 3.8%).

In our opinion, there remains plenty of upside.

We have three have funds that seek to profit from this environment: