Was That A Delta Head Fake?

Crude oil fell sharply on Monday, hit by the long-awaited confirmation of increased production from OPEC and growing concerns about the Delta Covid variant. Pipeline stocks dropped along with the energy sector. Financial markets’ concern coincided with the dropping of all remaining Covid restrictions in the UK (although visitors still face mandatory testing and/or self-quarantine, depending on where they’re coming from). After a strong rally for most of the year, some investors were clearly caught out by the market’s sudden concern with the Delta variant. Although infections are rising, there are far fewer hospitalizations than before in developed nations because of widespread vaccinations and acquired immunity.

Lockdowns and other measures that seek to protect populations continue to inflict much damage. Deaths from drug overdoses in the US rose by 30% in the past year, a jump at least partially blamed on Covid lockdowns. Moreover, CDC data shows that 87% of all deaths among all age cohorts above 40, even including those 85 and older, didn’t involve Covid. All those people who died since January 2020 endured a lousy last year of life trying to avoid Covid, but the vast majority succumbed to something else.

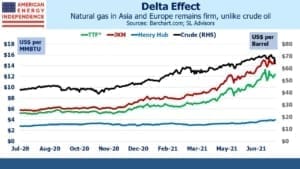

Although oil garners most attention, natural gas is at least as important to North American midstream, energy infrastructure. Global prices have been rising, even recently when oil prices have weakened. The JKM benchmark for Japan and South Korea continues to trend higher, as does the TTF European benchmark. This has improved the economics for exports of US Liquified Natural Gas (LNG), and volumes continue to grow.

Even last year, global LNG volumes were flat, contrasting with crude oil where global demand was down 7%. The US saw the biggest growth in LNG exports, +1.5 Billion Cubic Feet per Day (BCF/D) to 6.5BN. Following a fall last summer as the world endured its brief Covid recession, volumes rebounded in October.

The outlook for LNG exports looks very strong. The International Energy Agency (IEA) recently forecast that global power demand would rise 5% this year following a drop of just 1% in 2020. This is driven by emerging economies, particularly in Asia. Just under half of the increase relies on fossil fuels, especially coal. The continued importance of the dirtiest of fossil fuels in Asian power generation represents a huge opportunity for natural gas. Switching from coal to natural gas would lower emissions, emulating the success the US has had doing just that. Global use of natural gas for power generation is expected to rise 1% this year and almost 2% next, following a 2% drop in 2020.

Over the past five months US exports of LNG plus pipeline exports to Mexico have averaged over 17 BCF/D. After a slow start, Mexican demand is picking up and looks set to grow at 10% pa over the next four years. Even though US power sector demand for natural gas is moderating as higher prices cause switching back to coal, export demand is more than making up the difference.

Recent floods in Germany have become an election issue, with all the major parties attributing this extreme weather event to changing climate. Germany is about 2% of global emissions, so even if voters demanded a swift move towards carbon neutrality, German weather wouldn’t change perceptibly as a result. However, a sensible result of increased German concern about climate could be pressure on China and other emerging countries in Asia to lower their use of coal. Natural gas would stand to benefit.

It’s only a couple of years since the TTF benchmark was under $4 per Million BTUs (MMBTUs), less than a third of today’s price. This is drawing more long-term buyers of US LNG, which has in turn caused leading LNG exporter Cheniere to sign a 15-year purchase agreement from Tourmaline, Canada’s biggest producer of natural gas. Tellurian’s CEO Charif Souki has said he expects to announce additional LNG offtake agreements to add to the two recent ones they signed (see Pipeline Rally Exposes Lagging MLP Sector).

The volatility of crude oil and its consequent impact on energy sentiment distracts attention from the long term commitments being made for natural gas.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!