Was That A Delta Head Fake?

Crude oil fell sharply on Monday, hit by the long-awaited confirmation of increased production from OPEC and growing concerns about the Delta Covid variant. Pipeline stocks dropped along with the energy sector. Financial markets’ concern coincided with the dropping of all remaining Covid restrictions in the UK (although visitors still face mandatory testing and/or self-quarantine, depending on where they’re coming from). After a strong rally for most of the year, some investors were clearly caught out by the market’s sudden concern with the Delta variant. Although infections are rising, there are far fewer hospitalizations than before in developed nations because of widespread vaccinations and acquired immunity.

Lockdowns and other measures that seek to protect populations continue to inflict much damage. Deaths from drug overdoses in the US rose by 30% in the past year, a jump at least partially blamed on Covid lockdowns. Moreover, CDC data shows that 87% of all deaths among all age cohorts above 40, even including those 85 and older, didn’t involve Covid. All those people who died since January 2020 endured a lousy last year of life trying to avoid Covid, but the vast majority succumbed to something else.

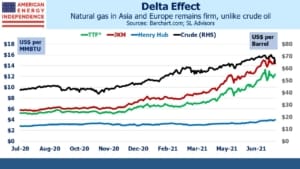

Although oil garners most attention, natural gas is at least as important to North American midstream, energy infrastructure. Global prices have been rising, even recently when oil prices have weakened. The JKM benchmark for Japan and South Korea continues to trend higher, as does the TTF European benchmark. This has improved the economics for exports of US Liquified Natural Gas (LNG), and volumes continue to grow.

Even last year, global LNG volumes were flat, contrasting with crude oil where global demand was down 7%. The US saw the biggest growth in LNG exports, +1.5 Billion Cubic Feet per Day (BCF/D) to 6.5BN. Following a fall last summer as the world endured its brief Covid recession, volumes rebounded in October.

The outlook for LNG exports looks very strong. The International Energy Agency (IEA) recently forecast that global power demand would rise 5% this year following a drop of just 1% in 2020. This is driven by emerging economies, particularly in Asia. Just under half of the increase relies on fossil fuels, especially coal. The continued importance of the dirtiest of fossil fuels in Asian power generation represents a huge opportunity for natural gas. Switching from coal to natural gas would lower emissions, emulating the success the US has had doing just that. Global use of natural gas for power generation is expected to rise 1% this year and almost 2% next, following a 2% drop in 2020.

Over the past five months US exports of LNG plus pipeline exports to Mexico have averaged over 17 BCF/D. After a slow start, Mexican demand is picking up and looks set to grow at 10% pa over the next four years. Even though US power sector demand for natural gas is moderating as higher prices cause switching back to coal, export demand is more than making up the difference.

Recent floods in Germany have become an election issue, with all the major parties attributing this extreme weather event to changing climate. Germany is about 2% of global emissions, so even if voters demanded a swift move towards carbon neutrality, German weather wouldn’t change perceptibly as a result. However, a sensible result of increased German concern about climate could be pressure on China and other emerging countries in Asia to lower their use of coal. Natural gas would stand to benefit.

It’s only a couple of years since the TTF benchmark was under $4 per Million BTUs (MMBTUs), less than a third of today’s price. This is drawing more long-term buyers of US LNG, which has in turn caused leading LNG exporter Cheniere to sign a 15-year purchase agreement from Tourmaline, Canada’s biggest producer of natural gas. Tellurian’s CEO Charif Souki has said he expects to announce additional LNG offtake agreements to add to the two recent ones they signed (see Pipeline Rally Exposes Lagging MLP Sector).

The volatility of crude oil and its consequent impact on energy sentiment distracts attention from the long term commitments being made for natural gas.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.