Pipeline Rally Exposes Lagging MLP Sector

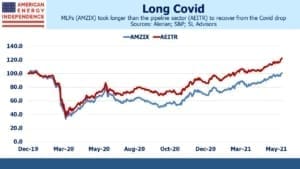

Last week the Alerian MLP and Infrastructure Total Return Index (AMZIX) finally recouped its Covid losses. MLPs have returned to where they were at the end of 2019, when few knew what a coronavirus or N95 mask was. MLP investors have had a miserable decade. The Shale revolution turned out to be an investment bust through overinvestment; the energy transition cast a growing shadow over terminal values; finally, Covid hit demand. As if this wasn’t bad enough, MLP closed end funds endured what leverage and a big market drop inflict (see MLP Closed End Funds – Masters Of Value Destruction).

Although MLP investors can celebrate finally recouping their Covid losses, North American pipelines (which are mostly corporations, not MLPs) reached this threshold three months earlier. Energy is experiencing one of the least celebrated rallies of any sector in recent memory. Few investors will forget the breathtaking drop of March 2020, which at one point registered down almost 60% for the year. Although no pipeline company ever looked remotely close to bankruptcy, it seemed as if a recovery would take years.

The rebound has turned out to be more rapid than many expected. It’s taken a year, but fund flows have now turned positive. These are still not meme stocks so caution prevails. But the growing free cash flow story is drawing more interest. The energy transition is driving oil and gas prices higher as well as limiting growth capex. Several firms are exploring opportunities in Carbon Capture and Sequestration (CCS). Gathering the CO2 where it’s produced by power plants or the manufacture of steel and cement may offer new opportunities. The tax code will soon pay $50 per ton for CO2 permanently buried underground. Pipeline operators possess many of the required skills and some useful infrastructure.

Moreover, green policies are helping (see Profiting From The Efforts Of Climate Extremists). While Exxon Mobil, Chevron and Royal Dutch Shell all received clear direction to further curb emissions, Tellurian (TELL) showed that global demand for U.S. Liquified Natural Gas (LNG) is vibrant, and probably stronger with the biggest oil and gas companies set to invest less in future supply. TELL has recently signed 10-year agreements to provide LNG to Gunvor and Vitol, two commodities firms that see a benefit in securing supplies now for customers in Asia and elsewhere.

Investors are slowly warming to the positive fundamentals. MLPs long ago stopped being the dominant corporate form in the pipeline sector. Beyond the three big ones, Enterprise Products Partners, Energy Transfer and Magellan Midstream, MLPs offer a selection of mostly non-investment companies. The AMZIX has to limit the biggest names because there are too few to create a diverse portfolio.

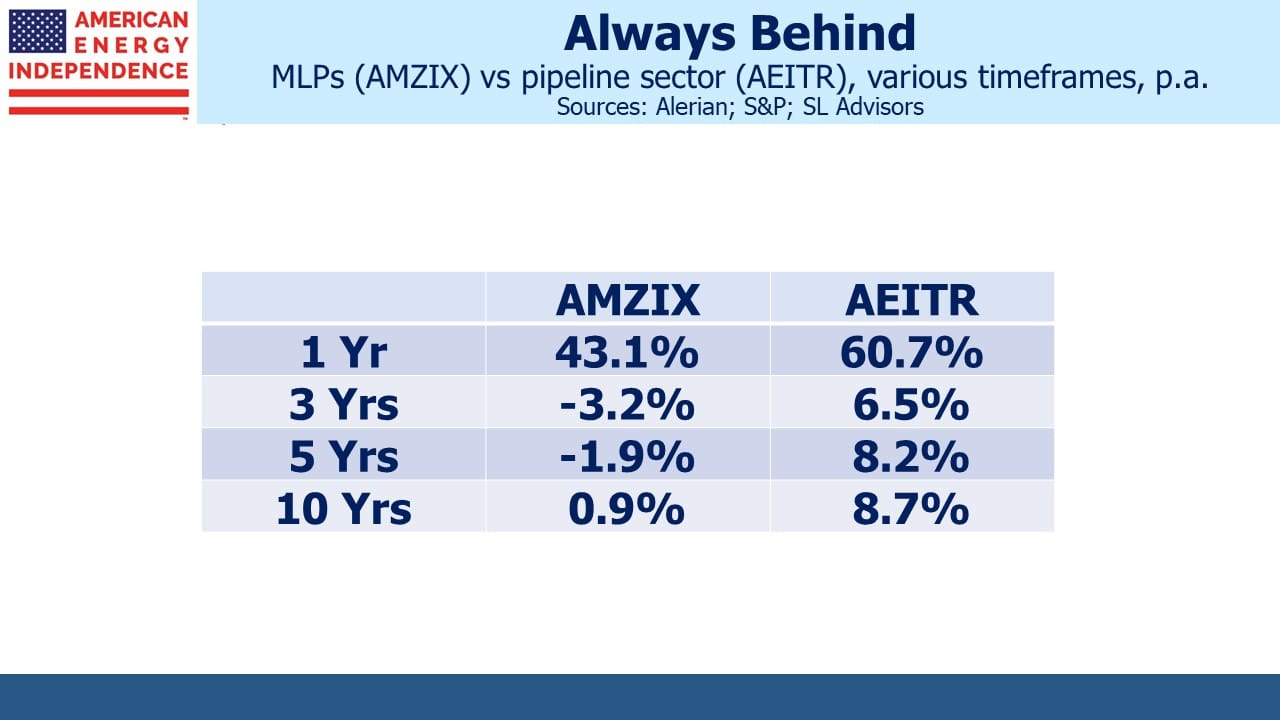

MLPs are now around a third of the North American midstream infrastructure business (as defined by the American Energy Independence Index, AEITR), and performance has lagged over numerous timeframes. MLP distributions on the Alerian MLP ETF (AMLP), which invests in AMZIX, have been cut by more than half over the past five years. The K-1 tolerant high net worth U.S. taxable investor has for the most part abandoned MLPs, although some remain because of the tax-deferred nature of the distributions. Corporations have handily outperformed MLPs because of the broader investor base.

For years, AMLP’s status as a tax-paying corporation caused it to lag its index. At times this creates asymmetry – when it has unrealized gains its upside is held back by taxes, but when it has unrealized losses it falls with the market. Shorting AMLP around this inflection point can be an interesting trade, one your blogger has done in the past (see Uncle Sam Helps You Short AMLP).

In recent years MLPs have performed so poorly that AMLP has been a long way from having to carry a deferred tax liability. But if the sector’s current trend continues, it will once again become a taxpayer and fail to track its index. And if Democrat proposals to raise the corporate tax rate are enacted, the tax drag will be even more expensive.

We’ve started to see investors once again switch out of AMLP and into more tax-efficient, RIC-compliant vehicles. They recognize that the pipeline sector is attractive, but they’re in the wrong product.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon is talking his book a bit much here. My own midstream investments are not in funds. I’ve made about as much on MLP names over the past 18 months as I have on C-corp midstreams. There were great buying opportunities across the entire space during 2020. Notable items in the MLP space: MPLX has a bigger market cap than ET, far more stability, and less debt. What CEQP just did to improve their corporate governance is amazing. What DCP has done operationally is outstanding.

Here are some contrary thoughts.

1. Low MLP unit prices have been a buying opportunity to achieve irrationally exorbitant yields. On the one hand, I have owned EPD for more than ten years and with intermittent buying my yield is still 11.53%.On the other hand, when MLP unit prices were in single digits due to panic selling last year I bought DCP which now provides me with a yield of 16.5%. On Crestwood, which I have owned for about five years with intermittent purchases my yield is 12.65%. USA Compression Partners provides me with a yield of 13.7%. More recently, I bought MPLX with a yield of 10.33% and Oasis Midstream Partners with a yield of 10.19%.

2. And of course, the current tax law defers tax on the entire portion of the distribution which is a return of capital, and as to that portion of partnership earnings and profits allocated to the limited partners, Code section 199A provides a 20% deduction. Some tax benefits may be eliminated if the Democrats can get the repeal past Congress, but in the meantime MLPs have provided me with excellent tax benefits which corporations could not.

3. During my recent Zoom conferences with MLP managements during the EIC conference I asked about their prospective investments in emerging energy trends such as carbon capture and hydrogen. The universal–and very prudent–response was that they are finding that currently there are inadequate returns on capital but that those trends will continue to be carefully analyzed and undertaken when the returns are adequate.

It’s no secret that a lot of MLP investors are more concerned with the size and reliability of distributions than in unit (or share) prices, or even total returns (in the case of those who plan to never cash out). For those investors, 2020 produced some great MLP investment opportunities.