US States Choose Reliable Power

On Monday the Energy Information Administration (EIA) announced that 27.3 Gigawatts (GW) of natural gas power plants will be added to the US fleet over the next three years, representing a 6% increase from current capacity. The US is blessed with abundant supplies of natural gas, sufficient to power the country for many decades.

Many US states are pursuing sensible energy policies designed to maintain reliability and affordability, as well as diminish our reliance on coal. The map below shows where these power plants are being added – generally close to existing natural gas supplies. New York state is conspicuously not taking advantage of this opportunity, since its energy agenda has been hijacked by progressives.

The COP26 in Glasglow revealed the divide we’ve often chronicled between OECD countries who want lower CO2 emissions and emerging economies that are focused on raising living standards, which requires more energy. The inability of COP26 to produce anything meaningful exposed the ambivalence of countries like the US to an overly rapid energy transition. Higher crude oil has brought solicitations to OPEC to increase supply and now sales from the Strategic Petroleum Reserve (SPR).

The first failure of climate extremists is their inability to convince consumers that they should give up reliable fossil fuels and opt for higher-priced intermittency.

The most important development this year in US power generation is the resurgence of coal demand at the expense of natural gas. After several years of losing market share, domestic demand for coal has rebounded because of improved relative pricing.

US natural gas for January ‘22 delivery touched $6.50 per Million BTUs (MMBTU) a month ago, before retreating to its current level of around $5. US consumers are not immune to the policy errors in other countries (see Why The Energy Crisis Will Force More Realism) but are thankfully being spared from the type of Greta-inspired outcomes endured in the UK (see U.K. Power Prices Soar Above £2,000 on Low Winds). The new natural gas power plants noted by the EIA are an example.

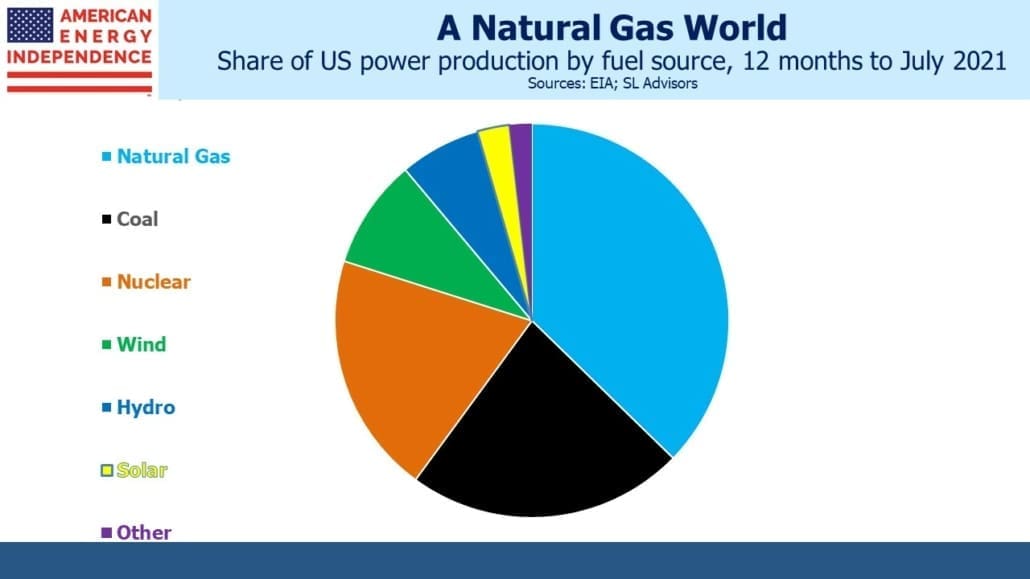

By contrast, nothing newsworthy is happening with US solar and wind. They continue to grow — since January 2018 solar’s market share of US power generation has increased from 1.2% to 2.2%, and windmills have gone from 6.0% to 7.5%.

It’s possible to create some impressive numbers from this – solar output has a Compound Annual Growth Rate (CAGR) of 20% since January 2018, and wind has 9%. But as the charts show, if both disappeared tomorrow, we mostly wouldn’t notice. Coal use is up 12% in the past year, and currently generates almost twice the power of solar and wind combined. Vaclav Smil has shown that energy transitions play out over decades. Renewables will be small with a high CAGR for many years to come.

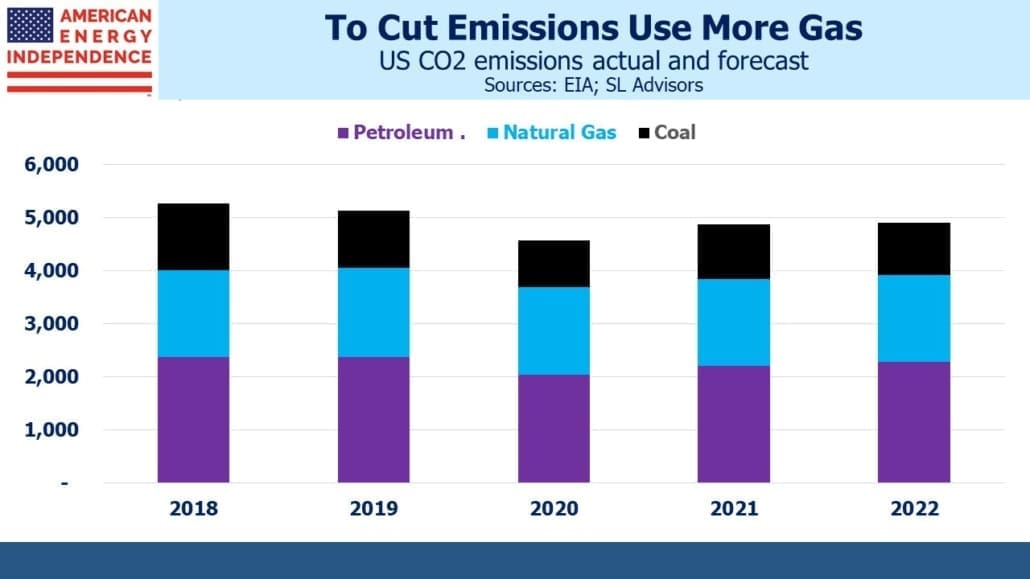

US energy-related CO2 emissions are forecast to be +7% this year – not just because energy consumption is rebounding from covid-depressed levels, but also because of this adverse fuel mix. Next year is forecast to be +1%, in part due to a shift back towards natural gas by utilities.

This leads to the second failure of climate extremists – their refusal to differentiate among fossil fuels has impeded their effectiveness. Had they pushed public policies that encouraged utilities to switch from coal to natural gas, perhaps with a carbon tax, the trend towards natgas would have continued this year and CO2 emissions wouldn’t have jumped as much. Instead, their purist approach has left market forces through cheap natural gas to drive most of the reduction in CO2 emissions the US has achieved.

The US even declined to join 40 other countries in pledging to phase out coal within two decades. This puts us alongside China, the world’s biggest emitter and consumer of half the world’s coal.

American voters want to reduce emissions as long as it doesn’t lead to higher energy prices. Administration efforts to jawbone crude oil prices lower reflect that reality. High gasoline prices should incentivize switching to electric vehicles (which are more likely to rely on natural gas power plants than any other fuel). Instead, the White House is trying to diminish this incentive with sales from the SPR. Foregoing the coal pledge is another example of pragmatism over-ruling progressives.

Pragmatic policies in many states and the White House’s incoherent energy strategy are helping us avoid the poor planning of the UK, Germany and California. Many states such as Florida are adding natural gas capacity in order to preserve reliability. It’s one more reason why migrants from New York state with its poorly conceived energy policies will continue to move to the sunshine state.

Join us on Thursday, December 16th at 12 noon Eastern for a webinar where we’ll provide an update on the midstream sector during rising inflation.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!