The Emergence Of Omicron Covid

For the past few months the eurodollar futures market has steadily priced in the FOMC’s abandonment of “transitory” in its assessment of inflation. More often than not the Fed follows the market. The typical absence of public comments that precedes FOMC meetings was extended while Biden contemplated renewing Powell’s term. In short order, Powell’s reappointment was announced, several Fed governors publicly contemplated faster tapering and the release of minutes revealed a lively debate. “Transitory” has become a derogatory adjective in finance betraying cognitive dissonance. As in, “The hedge fund manager described his losses from shorting meme stocks as transitory.” Something is transitory, until its permanence becomes painfully obvious.

President Biden and Fed chair Powell had their discussion during which no doubt Biden hoped for a lethargic policy response to inflation while Powell demurred. With Powell’s reappointment secure, all that was left was for the next FOMC meeting to make the taper briefer, in preparation for three to four rate hikes beginning next spring.

B.1.1.529, the new Covid mutation identified in South Africa, has scrambled everything. The World Health Organization has assigned it the Greek letter “Omicron” since that’s the next one in the alphabet. The $8 drop in crude oil will be welcomed by the Administration which will likely claim partial credit since it so closely followed the release from the Strategic Petroleum Reserve. Eurodollar futures removed one projected tightening from next year.

The energy sector modestly outpaced the S&P 500’s 2.2% fall, dropping 2.6% (defined as the American Energy Independence Index).

Last year when investors asked for our outlook on midstream energy infrastructure, we’d often note that the path of Covid would be an important factor. We all became amateur virologists in attempting to project investment returns. The vaccine ushered in economic growth powered by an excessive fiscal response, with the removal of monetary accommodation (albeit very late).

How much has changed?

As before, the near-term direction depends on the virus. If existing vaccines prove ineffective, economic activity will slow until a new one is created and distributed. Some fear the new mutation may require a new vaccine. It’s a science question not an economic one.

The pipeline sector has just reported solid 3Q21 earnings. Cash flows continue to grow, buoyed by recovering volumes and continued financial discipline. Progressive energy policies have been more constructive than expected – impeding sufficient supply of oil and natural gas has improved prices and sentiment. COP26 revealed the gulf that exists between the climate goals of OECD countries and the growth objectives of emerging countries. Unilateral policies to accelerate the energy transition increase prices for consumers and mostly serve to accommodate increased emissions from China, India and others.

Given the uncertain near-term direction, it can be helpful to remember the long-term growth outlook for US energy consumption. Although renewables command excessive media attention, the chart shows that the big energy story of the past decade was the huge drop in coal consumption which was mostly offset by increased natural gas.

The Energy Information Administration expects the US to increase consumption of renewables, natural gas and even petroleum products over the next three decades. “Other renewables”, which is mostly solar and wind, is forecast to grow from 7.5 quadrillion BTUs to 17.5 by 2050. Even then it’ll still provide less than half the energy of natural gas.

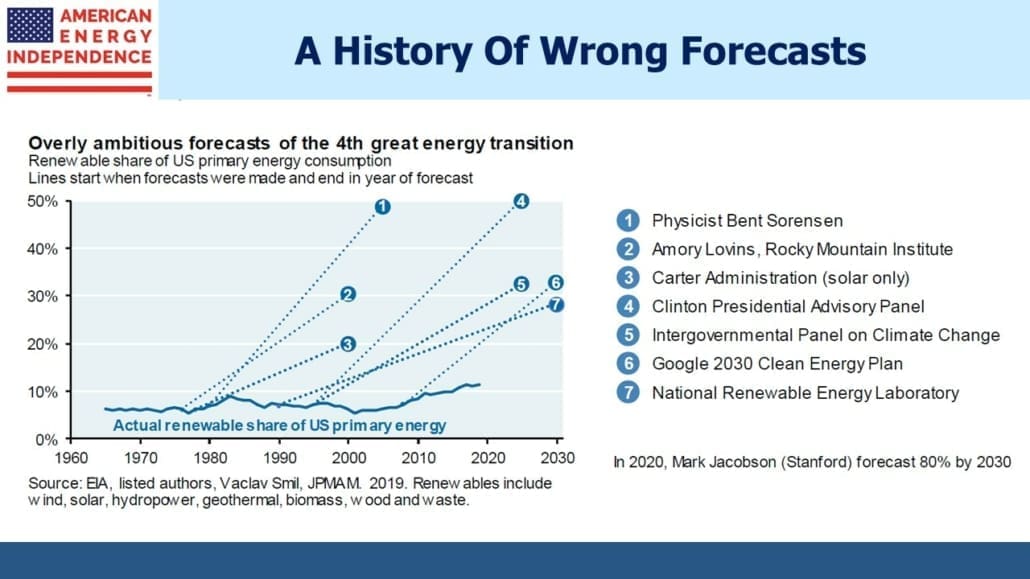

Energy transitions are slow, and forecasters have a long history of overestimating the speed of change. Just over four years ago we noted Tony Seba’s forecast (see A Futurist’s Vision of Energy) that by 2030 US consumers would only be buying Electric Vehicles (EVs). Their share is currently around 4%, with Tesla dominating. Although we expect EVs to grow like most forecasters, reaching one third market share (defined to include hybrids) as expected by LMC Automotive seems more realistic. Electricity produced from natural gas will still be the dominant source of power generation. Incidentally, Exxon Mobil’s 2030 EV market share forecast back in 2017 was 10% — likely to be low. Forecasting adoption rates for new technology is hard.

Near term market direction will depend on the Omicron variant. Over a year or more, we still expect the constructive fundamentals of the US energy sector, especially natural gas, to drive cash flows and stock prices higher.

Join us on Thursday, December 16th at 12 noon Eastern for a webinar where we’ll provide an update on the midstream sector during rising inflation.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

“since that’s the next one in the alphabet”

This isn’t true… Look at the alphabet and then you can figure out why they went to Omicron.

Omicron was not the next letter in the Greek alphabet. I think it was Xi, but since it is the name of the Chinese dictator, the WHO was told not to use it by the Chinese, who have an outsize influence at WHO.