Unsettling The Climate Change Consensus

Do scientists spin the truth in order to explain complex answers simply? That is the suggestion scientist Steven Koonin makes in his new book Unsettled: What Climate Science Tells Us, What It Doesn’t, and Why It Matters.

Koonin speaks with some authority – his career includes being BP’s chief scientist 2004-09 followed by serving in the Obama administration as Under Secretary for Science 2009-11. He has a PhD from MIT in Theoretical Physics. Koonin applies his scientific background to the complex area of climate change.

Koonin is no climate denier. He readily acknowledges that human activity is increasing CO2 emissions, warming the planet. From there, he walks the reader through two huge uncertainties – how much global warming have we caused, and how bad will it be anyway.

The UN’s Intergovernmental Panel on Climate Change (IPCC) has issued a series of reports which led to the 2015 Paris agreement, where countries agreed that limiting global warming to 1.5 degrees Celsius above pre-industrial levels was necessary to avoid irreversible damage to the planet. Humanity’s future hinges on this binary outcome.

In a world of soundbites, “The Paris Accord”, “Zero by 2050” and “Saving the Planet” have all become shorthand rallying cries galvanizing action by governments, corporations and investors worldwide. The implication of certainty grates with Koonin’s scientific mind which accepts degrees of uncertainty around virtually any forecast. Using computers to model the climate (as distinct from weather) taxes the powers of even today’s supercomputers.

Global warming is likely to raise sea levels – but it turns out this has been the case since at least 1900, long before human use of fossil fuels drove CO2 levels higher. While it’s true that the 3mm rate of annual increase over the past twenty years is higher than over the past 100, the 1930s saw a similar rate.

The media often blames extreme weather events on climate change – we’re better at measuring hurricanes, which before satellites were only recorded where they encountered people on land or at sea (assuming they survived). Nonetheless, it’s hard to see any link between the fluctuations in hurricanes and rising CO2 levels.

None of this is intended to eliminate the likelihood that we’re warming the planet – simply to demonstrate that the consequences are hard to isolate.

Moreover, Koonin notes that weather-related catastrophes are killing fewer people, drawing on research from Bjorn Lomborg’s book False Alarm; How Climate Change Panic Costs Us trillions, Hurts the Poor, and Fails to Fix the Planet.

Food production, which we’re warned will collapse with warmer temperatures, has risen with a warmer planet.

The UN reported record world cereal production last year. Inconveniently, rising CO2 levels are improving plant growth. The UN cites a report that satellites show a marked increase in leaf coverage for 25-50% of vegetated areas.

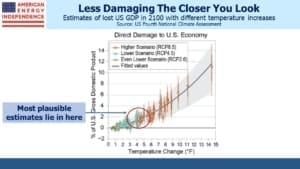

The U.S. Global Change Research Program (USGCRP) is a Federal agency charged with assessing the impact of climate change. Their Fourth National Climate Assessment was published in 2018, and is full of warnings. But the economic consequences, as Koonin notes, seem insignificant.

The Assessment estimates the economic cost of different scenarios. Although the chart extends as far as a 15° F temperature increase by 2100, most serious forecasts of inaction are in the 3-5° range. Assuming 2% real GDP growth, the U.S. economy will grow from $21TN to $102TN by the end of the century. If climate change makes it 2% smaller (i.e. $100TN), that would mean annual growth was 1.97% instead of 2%. The chart looks dramatic, but the plausible economic cost seems inconsequential.

This really gets to Koonin’s point, which combines uncertain climate forecasts with unclear consequences to ask why there isn’t any cost-benefit analysis done on the world’s response to rising CO2. Bjorn Lomberg and Alex Epstein (the latter in The Moral Case for Fossil Fuels) make similar arguments. Increased energy use has improved living standards for billions of people. Koonin notes that the World Health Organization has said that indoor cooking with wood and animal waste is the most serious environmental problem in the world, affecting up to three billion people. This will not be solved with solar panels and windmills in rural areas of emerging countries.

The science is uncertain, and the range of possible outcomes includes some very dire ones too. Prudent risk management of the only planet we have demands some steps towards mitigation. Perhaps some of the scientists who do this work, despairing of the difficulty in communicating complex uncertainty, have resorted to simplifying the message in order to promote changed behavior they sincerely believe is needed.

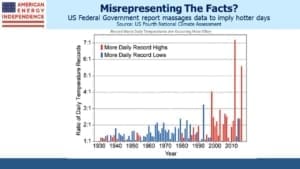

Koonin explores this. In the USGCRP’s Fourth Assessment, they include a dramatic chart that shows more record daily high temperatures. This is why hot days cause the media, and our friends, to blame global warming. But the construction of the chart is odd. It takes the number of new record highs divided by the number of new record lows and plots this ratio. Koonin shows that what’s actually happened is that the average coolest temperature has increased, while the average hottest is about the same as in 1900. Our nights have been getting less cold – our days are not warming. The climate is getting milder.

The chart begins in 1930, so you’d expect a lot of record highs and lows at the beginning of the sample period. This will keep the ratio of the two close to 1.0. As decades pass, the growing prior history will make new records less common, which will also cause the ratio of new highs to new lows to fluctuate more.

Fewer record cold days with unchanged record highs has caused the ratio of the two to rise sharply. But why display the information in this way? Taking the ratio of new highs to new lows from a fixed date in the past is not at all intuitive, and it portrays a very different picture of temperatures than the actual data. At best it’s an example of sloppy work, and at worst it’s an effort to present a biased picture so as to prompt more urgent action.

Because political discourse requires you to be for or against, critics call Koonin a climate denier, That is to ignore his thoughtful embrace of scientific uncertainty, and his advocacy for informed choices that try and balance cost/benefit. Too few climate extremists read the science, and if they truly believed humanity’s existence was threatened they’d quickly embrace natural gas power generation so as to phase out coal, and far greater use of nuclear energy.

The obsession with solar panels and windmills belies lack of serious thought and is why global emissions keep rising – most people care until the energy transition costs them money, which it most assuredly will or we’d have already transitioned. Steven Koonin’s book is a welcome contribution to more informed debate about climate change.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!