U.S. National Debt: The Bond Market Doesn’t Care

For almost my entire 38 year career in Finance, we’ve worried about the U.S. Federal deficit. Someone recently asked me if we should still be worried. You’d think that it should have been a problem by now, but it’s not. Thirty year treasury bonds yielding 3% don’t look enticing, but evidently a lot of investors feel differently. Low as they are, U.S. yields are substantially higher than Germany, whose 30 year bonds yield a paltry 0.73%.

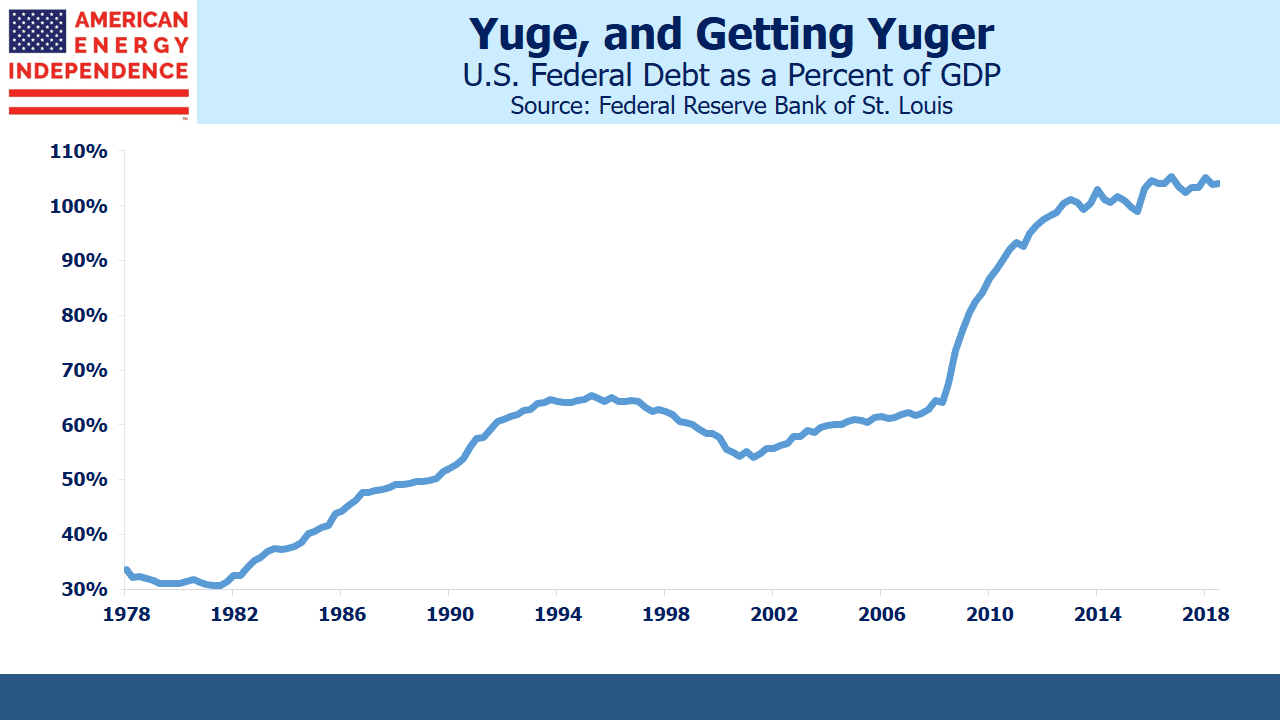

U.S. publicly-held Federal debt to GDP rose sharply following the 2008 financial crisis. Circumstances justified a temporary spike to provide fiscal stimulus, but instead it’s continued to grow. Nonetheless, rates just can’t rise — even though the Fed has stopped buying bonds, others have stepped in. Short term rates might even have peaked, following Fed chairman Jay Powell’s communication missteps in December.

The deficit doesn’t seem to matter. As President Reagan joked, “I am not worried about the deficit. It is big enough to take care of itself.”

This view is easily criticized as needlessly reckless with our country’s future. Markets are forward-looking, and most observers are pessimistic about our long-term fiscal outlook. But yields don’t reflect that. Since our current indebtedness is clearly manageable, it’s worth considering alternative outcomes.

Excessive debt was part of the reason for the 2008 crash. As the economy recovered, the U.S. pursued a stealth devaluation by maintaining negative real interest rates. It’s a well-worn path, and while Ben Bernanke didn’t articulate it as such, treasury yields were so low that buyers suffered a loss of purchasing power after taxes and inflation. Even today there’s hardly any return, although a large proportion of the holders aren’t taxable.

Populism adds an interesting dimension. Let’s suppose that U.S. bond yields rise to more fully reflect the sorry state of fiscal policy. Increased interest expense crowds out other expenditure. The Congressional Budget Office forecasts that net interest expense will double by 2024 and almost triple by 2029. They assume ten year yields rise to around 3.7%. The U.S. Debt Clock has some interesting figures.

If the buyers of our debt demand higher rates as compensation for the outlook, interest expense will rise even more. This will crowd out other priorities and add further to the deficit. Stocks would weaken; growth would slow. We can all imagine how a populist-leaning president, like Trump, would respond. Rather than focus on cutting domestic spending, foreign buyers would be warned to keep investing. The U.S. might threaten a withholding tax on foreign holdings of our debt, effectively lowering the rate. It would constitute a default. Who seriously thinks Trump would blink at the prospect?

It needn’t be a Republican. Early Democrat presidential contenders are similarly populist. How would a president in the mold of AOC (gulp) react to foreign creditors slowing the Green New Deal’s hugely expensive re-engineering of America’s economy?

The moral requirement to repay debt has been steadily weakening for years. Federal debt represents an obligation passed down from one generation to the next. It’s easy to see the political appeal in questioning why the country should repay money that was spent on entitlements by a cohort long gone. The bond buyers should have known better. In 2013, in Bonds Are Not Forever; The Crisis Facing Fixed Income Investors, I expanded on this line of thinking. It’s no less relevant today.

Such problems are in the future, but should be well within the time frame of a thirty year bond investor. Today’s yield curve suggests they’re not worried at the prospect. They should be. Publicly held U.S. Federal debt is $16TN. Another $6TN is owed to other agencies, half of which is Social Security. When you owe $16TN it’s their problem too.

Join us on Friday, February 22nd at 2pm EST for a webinar. We’ll be discussing the outlook for U.S. energy infrastructure. The sector has frustrated investors for the past two years, but there are reasons to believe improved returns are ahead. We’ll explain why. To register please click here.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com)

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The cash flows of Social Security and Medicare start turning really ugly in less than ten years and there is less than zero political will to deal with these programs. Risibly, the left wants to increase these programs exponentially. Credit cards aren’t any harder to use until they reach their limit, then they can’t be used at all.