Lose Money Fast with Levered ETFs

A few years ago Vanguard invited me to their campus to give a presentation on my just-published book, The Hedge Fund Mirage. Vanguard’s business model is the antithesis of the hedge fund industry, and they were curious to hear from that rare breed, a hedge fund critic. The company’s frugal culture runs deep. As I joked during my presentation, the only German car in the parking lot was mine. Lunch was in the “galley” (cafeteria), where my host reached into his pocket to buy my sandwich and fruit cup. This is a company whose products are usually appropriate ways to access a desired asset class.

So it was in character for Vanguard to recently ban leveraged and inverse ETFs from their brokerage platform. Such products have long been criticized because their only plausible use is for extremely brief holding periods of a few days or less. Because of their daily rebalancing, over time compounding drives their value to zero. To visualize this, imagine if you owned a security which rebalanced its risk daily so as to maintain constant market exposure. A 10% down move followed by a 10% up move would leave you down 1%. Time and volatility work against the holder, except for those able to successfully predict the daily fluctuations and time their trades accordingly. Only those seeking profits in a hurry, or trying to temporarily hedge more risk than they’d like, find them attractive. Neither resembles a long-term investor.

Vanguard’s philosophy prevents creating leveraged or inverse ETFs of their own, but now they’ve taken a logical further step to increase the distance between their clients and long term value-destroyers. They correctly noted that such products are, “generally incompatible with a buy-and-hold strategy.”

This is a popular area, with soaring volumes in recent years. It’s another example of the excessive focus on short term market direction. Consumers of financial news want to know where the market’s going today, and media outlets duly respond. But prospectuses routinely warn that leveraged ETFs will probably decline to zero over time, which means the average holder will lose money. On this basis, one might think the SEC would find banning them easily defensible. So far, while individual commissioners have voiced concern, they haven’t moved further. Finance is not short of regulation, and a philosophy that allows consumers to decide appropriateness for themselves allows innovation, and is more right than wrong. However, it works best when the products financial companies offer to their least sophisticated, retail clients are designed with good intentions. Hedge funds and other sophisticated investors can be expected to properly understand how to use leveraged and inverse ETFs – like prescription medication, their availability should be carefully controlled.

We’ve been critics of these products for years (see Are Leveraged ETFs a Legitimate Investment? from 2014 as well as The Folly of Leveraged ETFs and recently FANG Goes Bang).

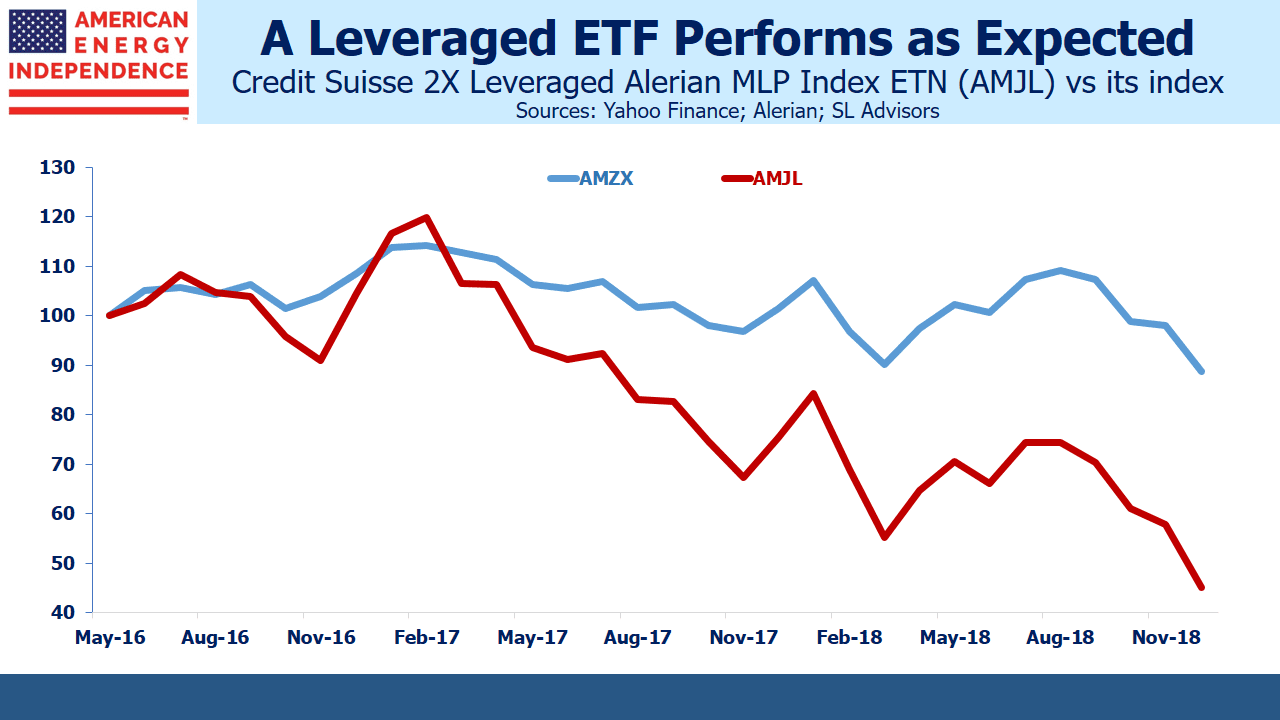

In May 2016 Credit Suisse issued a 2X Leveraged ETN linked to the Alerian index. Since then it’s down 55%, while the index is down 12% (including distributions). Losses are only limited to two times the index over very short periods. This type of long term result is common. It’s unrelated to the index and invariably worse, which Credit Suisse, and Alerian (who allowed their index to be licensed) would have known at the outset. Either name attached to an investment should give the buyer pause. It’s why these products shouldn’t be offered to retail investors.

Energy infrastructure remains one of the most attractively valued sectors around. The American Energy Independence Index yields 6.75%, and we expect dividends to grow 6-7% this year. This is attractive enough for the long-term investor, and isn’t available as a leveraged product.

On Wednesday, January 16th at 1pm Eastern we’ll be hosting a conference call with clients. If you’re interested in joining, please contact your Catalyst wholesaler, or send an e-mail to SL@SL-Advisors.com.

SL Advisors is the sub-advisor to the Catalyst MLP & Infrastructure Fund. To learn more about the Fund, please click here.

SL Advisors is also the advisor to an ETF (USAIETF.com).

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!