The Varied Uses For LNG

/

Wells Fargo describes Liquefied Natural Gas (LNG) as THE theme for midstream energy infrastructure. In a recent series of meetings they found investors were “highly constructive on long-term fundamentals for global LNG…and looking for ways to play the theme.”

One reason is that Europe’s pivot on energy security seems unlikely to change regardless of the outcome in Ukraine. The fact and form of Russia’s invasion are immutable. In a brief moment, Russia has shredded the hopes of those who embraced engagement via trade (see Russia Boosts US Energy Sector).

We were bullish on natural gas before the invasion, because its growth prospects already looked good based on growing Asian demand. The possibility that coal consumers around the world might follow the US lead and start switching to natural gas power plants so as to reduce CO2 emissions remains an upside option.

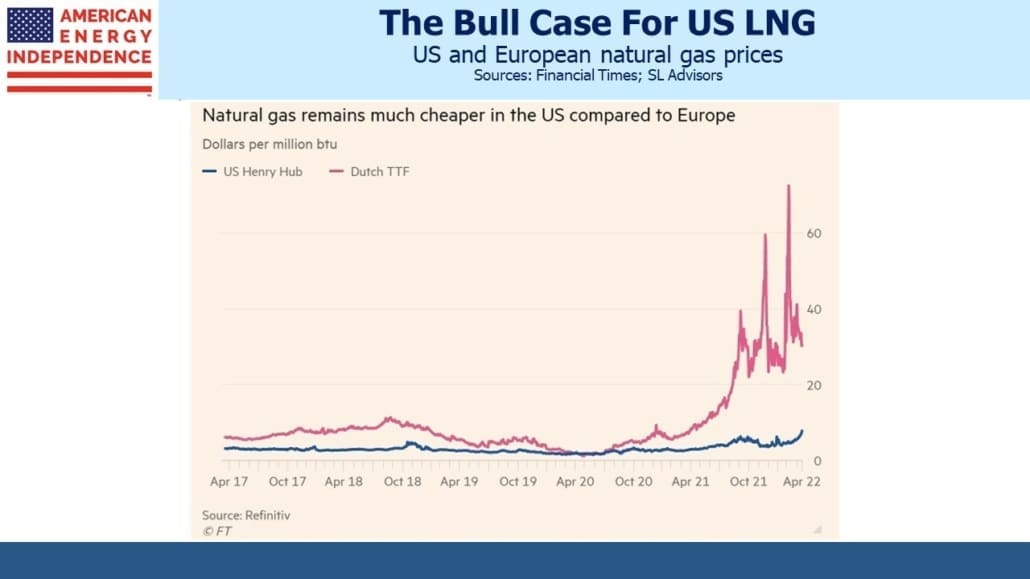

Recent events have drawn more attention to LNG. Spot prices in Europe remain 4X the US and have been double that in recent weeks. The constraint on US exports to Europe isn’t the availability of natural gas, but the export facilities to liquefy it and load it onto LNG tankers. The Financial Times recently warned that building new export infrastructure will take years, meaning price relief won’t come quickly to Europeans.

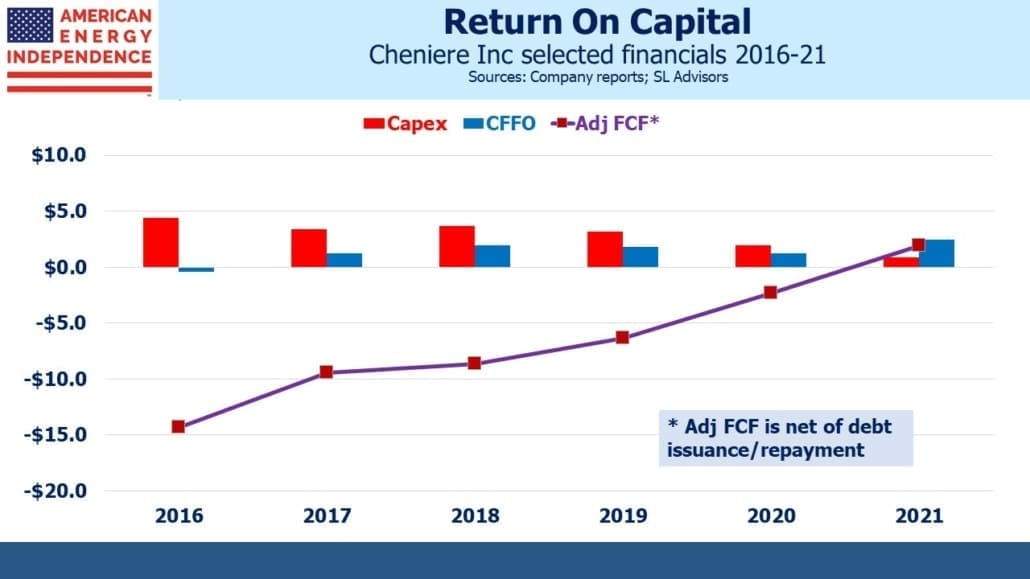

The long lead time on construction provides decent visibility into future export capacity. Because there’s no Plan B for an LNG terminal, twenty year contracts are common to assure an adequate return on investment. Cheniere is the only pure-play publicly-traded US LNG corporation operating, so investors that are bullish on LNG have limited choices. Cheniere is one of the best Free Cash Flow (FCF) story in the midstream sector. Their capex needs have been falling since 2016 while Cash Flow From Operations (CFFO) has been increasing. Their reduced financing needs have allowed them to pay down over $1BN in debt in each of the past two years. This reduced FCF but is a use of cash likely to make most equity investors happy.

Cheniere’s Executive Vice President Anatol Feygin recently described the natural gas market as undergoing a “demand shock” after years of underinvestment. Not surprisingly, he is very bullish on the company’s prospects.

Although Europe’s need for LNG has spurred the sector higher, Asia is the biggest market. Emerging economies are increasing their consumption of all kinds of energy, from coal to renewables, as they strive to raise living standards. When Asian power plants burn natural gas, they are probably substituting for coal. In fact, the single most constructive thing climate extremists can do is encourage coal to gas switching in the developing world, most especially Asia. China plans to invest $130BN in gas projects. Vietnam, Indonesia and India in aggregate are a further $100BN. Asia’s total capex is estimated to be 3X Europe’s, even with their hurried move away from Russian supplies.

Some are concerned that this locks in fossil fuel use beyond the time when the UN would like to it phased out – but solar panels and windmills aren’t a practical substitute for the size of energy needs these countries envisage.

Export contracts to cover long distances is how most people think of LNG. So RBN Energy published a fascinating description of the surprisingly widespread use of small scale LNG plants (see Piece By Piece – Small-Scale LNG Plants In U.S. Find Niche Markets At Home And Abroad). Needs vary from providing extra natural gas to meet peak demand to industrial use where natural gas pipeline capacity isn’t available. New England’s well known opposition to new gas pipelines has made them especially reliant on regasified LNG. There are even trucks which use LNG – they’re more expensive to operate than Compressed Natural Gas (CNG), so tend to be used for longer distances with limited opportunities to refill.

Although purists would like us to give up all fossil fuels, pragmatism is leading to a growing acknowledgment that energy transitions, including this one, take decades to play out. Energy security, historically not a European concern, has catapulted up their priorities.

NextDecade, on which we have written several times recently (see NextDecade Sees A Bright Future), and Tellurian, are among the few LNG stocks available for investors who find Cheniere expensive. Wells Fargo believes what they call the, “highly constructive long-term fundamentals” along with limited choices will keep these names well supported.

Concern about high oil and gas prices has even induced the White House to reverse one of their first steps and permit drilling on Federal land. They’ve managed to offend progressives. But by increasing the royalties by half, to 18.75%, they’re still encouraging caution among energy executives. They know the hand of friendship to traditional energy will be withdrawn as soon as prices drop. But even here, pragmatism is supporting the case for natural gas.

We have three funds that seek to profit from this environment:

Please see important Legal Disclosures.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!